Trade

Big banks, big opportunity? Earnings season kicks off

Each quarter, publicly listed companies share their earnings reports with their investors and the general public. These reports provide insights into each company’s performance and more often than not, impact their stock prices. Over the next six weeks, companies will be sharing their reports for the fourth quarter of 2018 (Q4), with major banks kicking off the earnings season.

Reporting earnings in a challenging market

This earnings season has a very meaningful backdrop, as Wall Street has been heavily impacted by external forces recently. Firstly, the Fed’s drive to hike rates over the past year, with four rate hikes in 2018, has put pressure on the market.

Perhaps the most important factor causing Wall Street to struggle recently has been the rising yield of 10-year bonds. These bonds, issued by the US Treasury, present a relatively low-risk investment option and produce steady returns twice a year. When the interest produced by these bonds is high, it could push investors away from the stock market, as the safer option is now also high yielding. Recently, 10-year bond yields have been giving investors interest rates of 2.73%.

Entering this earnings season, many companies face the challenge of remaining a lucrative investment option for their shareholders. For some companies in the financial sector, this season might be especially crucial, as they have to recover from less-than-impressive results last quarter.

Banking on earnings

The last time around, several large financial institutions disappointed their investors by displaying subpar performance. Wells Fargo is one of the companies that is hoping for a turnaround. The financial powerhouse has been in a slump over the past several quarters, still trying to recover from a scandal of two years ago, in which it was revealed that its employees created fake accounts for clients, in order to meet sales targets. Last July, the company experienced a 1.3 % increase in its stock price, following the Q3 earnings report that exceeded expectations.

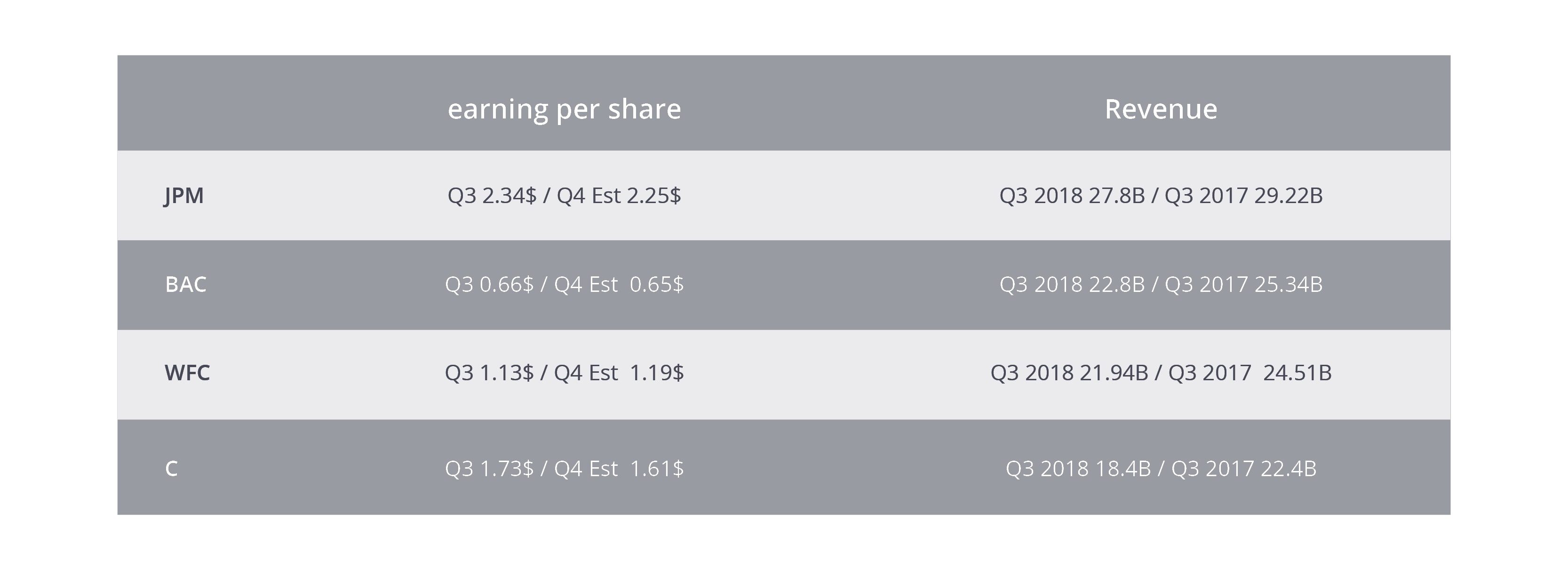

Indicative prices for illustration purposes

Another financial institution that is looking to make a comeback is Citigroup, which experienced a 2.5% increase in stock price following its Q3 earnings report. However, the financial sector was not all negative last quarter. Morgan Stanley was able to beat market expectations and its share price spiked 5% following better-than-expected results. These financial institutions, alongside other major players, such as JPMorgan Chase and Bank of America, have a lot to prove this quarter.

Investing in the financial sector on eToro

TheBigBanks CopyPortfolio is one of eToro’s first Market CopyPortfolios, offering investors a thematic investment opportunity in a fully allocated portfolio comprised of leading banks and financial institutions. Like all CopyPortfolios, TheBigBanks was created and is managed by eToro’s Investment Committee. The Portfolio is rebalanced periodically by the committee in an attempt to optimise performance.

The upcoming earnings season will no doubt impact markets, and since the financial sector is the first major segment to report, investors will be watching it closely over the coming weeks. To stay posted on recent and upcoming earnings reports, follow the eToro Earnings Reports Calendar.

Past performance is not an indication of future results. Data presented is less than 5 years old and may not suffice as a basis for investment decisions. This is not investment advice. Your capital is at risk.

Altcoins

XNO Token of Xeno NFT Hub listed on Bithumb Korea Exchange

Hong Kong, Hong Kong, 25th January, 2021, // ChainWire //

Xeno Holdings Limited (xno.live ), a blockchain solutions company based in Hong Kong, has announced the listing of its ecosystem utility token XNO on the ‘Bithumb Korea’ cryptocurrency exchange on January 21st 2021.

Xeno NFT Hub (market.xno.live ), developed by Xeno Holdings, enables easy minting of digital items into NFTs while also providing a marketplace where anyone can securely trade NFTs.

The Xeno NFT Hub project team includes former members of the technology project Yosemite X based in San Francisco and professionals such as Gabby Dizon who is a games industry expert and NFT space influencer based in Southeast Asia.

NFT(Non-Fungible Token) technology has recently gained huge focus in the blockchain arena and beyond, making waves in the online gaming sector, the art world, and the digital copyrights industry in recent years. The strongest feature of NFTs is that “NFTs are unique digital assets that cannot be replaced or forged”. Unlike fungible tokens such as Bitcoin or Ether, NFTs are not interchangeable for other tokens of the same type but instead each NFT has a unique value and specific information that cannot be replaced. This fact makes NFTs the perfect solution to record and prove ownership of digital and real-world items like works of art, game items, limited-edition collectibles, and more. One of the ways to have a successful…

Altcoins

XENO starts VIP NFT trading service and collaborates with contemporary artist Hiro Yamagata

Hong Kong, Hong Kong, 24th December, 2020, // ChainWire //

The XENO NFT Hub (https://xno.live) will provide a crypto-powered digital items and collectables trading platform allowing users to create, buy, and sell NFTs. Additionally it will support auction based listings, governance and voting mechanisms, trade history tracking, user rating and other advanced features.

As a first step towards its fully comprehensive service, XENO NFT Hub launched a recent VIP service to select users and early adopters in December 2020 with plans for a full Public Beta to open in June 2021.

“NFTs are extremely flexible in their usage, from digital event tickets to artwork, and while NFTs have a very wide spectrum of uses and categories XENO will initially focus its partnership efforts and its own item curation on three primary areas: gaming, sports & entertainment, and collectibles.”, said XENO NFT Hub president Anthony Di Franco.

He also added “This does not mean we will prohibit other types of NFTs from our ecosystem However, it simply means that XENO’s efforts as a company will be targeted into these verticals initially as a cohesive business approach.”

Development and Procurement Lead, Gabby Dizon explained, “Despite our initial focus, we found ourselves with a unique opportunity to host some of the works of Mr. Hiro Yamagata. We are collaborating with Japanese artist Hiro Yamagata to enshrine some of his artwork into NFTs.”

Mr. Yamagata has…

Altcoins

My Crypto Heroes Announces Issuance of MCH Governance Token

Tokyo, Japan, 24th November, 2020, // ChainWire //

My Crypto Heroes is happy to announce the issuance of MCH Coin as an incentive to players in the My Crypto Heroes ecosystem, aiming to allow them to craft a “User-oriented world”. The MCH coin is available on Uniswap with a newly created pool with ETH.

My Crypto Heroes is a blockchain-based game for PC and Mobile. It allows users to collect historic heroes and raise them for battle in a Crypto World. Officially released on November 30th, 2018, MCH has recorded the most transactions and daily active users than any other blockchain game in the world.

What is MCH Coin?

MCH Coin is being issued as an ERC-20 Standard Governance Token. The issuance began on November 9th, 2020, with 50 million tokens issued.

Of the funds issued, 40% are allocated to a pay for on-going development and as rewards for advisors and early investors. 10% are allocated to marketing and the growth of the ecosystem, and 50% are allocated to the community. The Distribution Ratio of the MCH Coin is subject to change via a governance decision.

The MCH coin will be used as a voting right as part of the ecosystem’s governance, with 1 coin being 1 vote. It will also be used for in-game utilities and payments. Additional information can be found here:

https://medium.com/mycryptoheroes/new-ecosystem-with-mchcoin-en-a6a82494894f

During December 2020 the first…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange