Don't Miss

Billion Reasons to bring Financial Inclusion with a frictionless Ecosystem

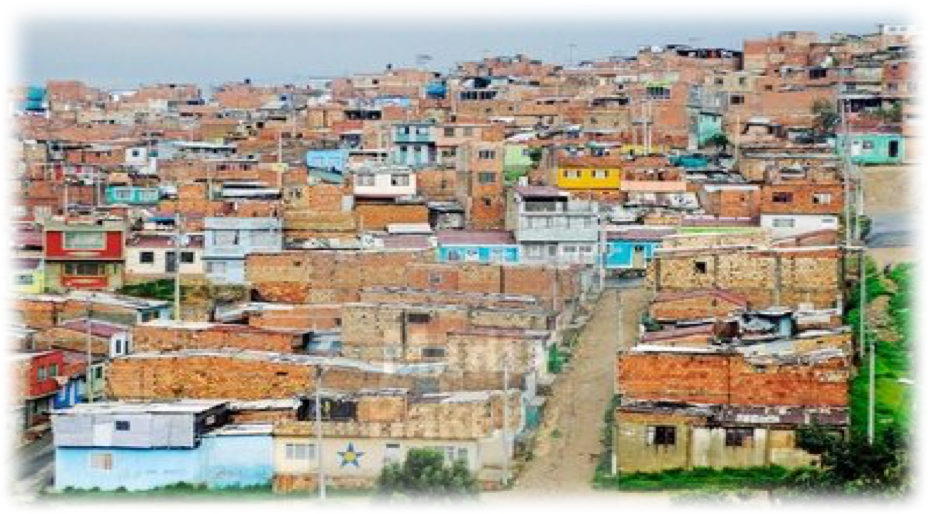

Globally, 1.7 billion adults remain unbanked, which means more than one-third of the world’s population does not have formal financial services. It is believed that bringing unbanked adults and businesses into the formal financial platform could generate about $380 billion in new revenues for banks.

LALA world is hoping to create a financial ecosystem for all, where services including low-cost remittances, cashless payments, peer-to-peer lending, fiat lending, etc.prevail under one umbrella. It is opening the door to regulated financial services stating that it has great potential to protect up to $42 billion from what it calls “the grey market.”

LALA world has the vision to reach people with limited resources through blockchain, without needing to understand the underlying technology.

LALA World argues that, currently, international transactions in developing countries are extremely inefficient — a problem that is aggravated by many migrants who work in various parts of the world. According to UN DESA, 3.4% of the world’s inhabitants today are international migrants. The number of migrants residing in high-income countries rose from 9.6% in 2000 to 14% in 2017.

It says that payments through its ecosystem would be borderless and considerably inexpensive. Payments would also be processed speedily as no intermediates are delaying the transaction. All the transactions handled through its ecosystem are immutably recorded on a Blockchain, making them unalterable.

The company has scheduled to offer different services and products in upcoming months, some of which are already up and running. Each product is the stepping milestone for this network to take shape and become a sustainable financial ecosystem.

LALA Pay, the payment services have been successfully launched in India earlier this month via LALA World App with features of bill payment services through which the user can pay their Telephone, Gas, Broadband, Electricity and Post-paid mobile bills of more than 25 different utility service providers in India.

Another LALA offering, LALA Lending went live in India earlier this week as their first loan got disbursed successfully through its acquired Non-Banking Financial Company (NBFC) in India, whose application for the change of board is submitted with the Reserve Bank of India, the governing authority. With collateral free, fiat Lending and LALA Pay the LALA World’s frictionless financial ecosystem dreams to touch numerous lives with their generous offers and services.

LALA, to begin with, will be offering loans in two segments in its first phase:

1) Micro and Nano Credit (MANC) for individuals. 2) MSME Loans: for Micro, Small and Medium Enterprises.

India is a huge market for both these offerings. As according to World Bank, Indian MSME has employed more than 50 million people, scaling manufacturing capabilities, curtailing regional disparities, balancing the distribution of wealth, and contributing to the GDP-MSME sector forms 8% of GDP. With Nano Credit, it can empower youth to become successful entrepreneurs with financial support which cannot be secured from traditional banking.

LALA world is exploring multiple angles to reach maximum people through their socio-business platforms.

By 23rd July 2018, they have planned to launch Recharge Services via LALA World App from UAE utilizing their partnership with ManGo Point Payment Services L.L.C which is a company registered in Dubai, UAE under the Dubai Economic Department for accepting and processing payments in the UAE. Post-launch, any migrant in UAE would be able to top-up his/her LALA World App account through ManGo kiosks present at 450 locations across UAE. After a successful top-up, users can do top-up of their own mobile number or any other mobile number belonging to 10 different countries outside UAE, saving them from frequent visits to the kiosks.

By 2020, they want to make a difference in 100 million lives and build the acceptability of LALA, making these individual launches as stepping stones towards the mega-vision!

In future, LALA World would be able to enable crypto-to-crypto lending among peers (peer-to-peer). This would be the fastest form of lending and would empower migrants in urgent need of credit, who would be able to borrow from their near and dear ones.

With growing income levels, financial inclusion is now one of the top agendas for public and private financial institutions. The time is right for all financial institutes to take into account the unbanked and underbanked market. It can be done by changing their current operating model to serve this fast-growing profitable market effectively. Challenges of current banking and loaning services need to have a common base of a solution to bring all on the same platform, and it seems LALA World holds a strong potential to achieve it.

Organizations like LALA World can improve annual revenues of nations significantly by:

- Closing the small business credit gap at average lending spreads and provide conservative fee-based services.

- Including unbanked adults in the formal financial system, and raising their formal financial services spending levels.

Resources:

(Accenture: https://www.accenture.com/us-en/insight-billion-reasons-bank-inclusively)

(http://www.iamwire.com/2017/09/importance-of-msme-sector-in-india/166912).

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Don't Miss

A Guide to Exploring the Singaporean ETF market

Singapore’s Exchange Traded Fund (ETF) market has grown, offering investors diverse investment opportunities and access to different asset classes. As the market evolves, investors must navigate these uncharted waters with a clear understanding of Singapore’s ETF landscape. This article explores the trends, challenges and strategies for navigating the Singapore ETF market. To start investing in ETFs, you can visit Saxo Capital Markets PTE.

The Singaporean ETF Market: Exponential Growth

The Singapore ETF market has seen significant growth in recent years, with an increasing number of ETFs covering a wide range of asset classes and holders. different investment topics.

One of the notable trends in the Singapore ETF market is the growing diversity of available options. Investors can now choose from ETFs that track domestic and international stock indexes, bonds, commodities, and specialist sectors or themes. This diverse range of ETFs allows investors to create comprehensive portfolios tailored to their investment goals.

The growth of the ETF market in Singapore is also due to growing investor demand for low-cost, transparent, and accessible investment vehicles. ETFs offer benefits such as intraday liquidity, real-time pricing, and the ability to trade on exchanges. These characteristics have made ETFs attractive to retail and institutional investors who want exposure to different asset classes.

Regulatory Landscape and Investor Protection

The Monetary Authority of Singapore (MAS) is the…

Don't Miss

Property Loans for Foreigners in Singapore That You Must Know About

Intending to invest in a residential or commercial property in Singapore?

When it comes to foreigners applying for a loan in Singapore, things can be pretty hard regardless of the reason whether you need the property for personal or business purposes.

In Singapore, buying a property is challenging, whether you are a foreigner or a native, and sometimes applying for a loan is the only way for you to afford it.

HOW MUCH CAN YOU BORROW FOR A PROPERTY LOAN IN SINGAPORE?

As for the Foreigner Loans, in Singapore, there is an exact amount of money you can borrow to finance the purchase of a property.

In this sense, Singapore has the Loan to Value Ratio (LTV).

The LTV ratio is what determines the exact amount of money you can borrow for a property loan, which changes depending on where you try to obtain the loan:

- If you are applying for a bank loan, you can borrow a maximum of 75% of the value of the property you want to purchase. That means if you are looking for a property that costs $500.000, the maximum amount of money a bank lender can give you like a loan in Singapore is going to be $375.000.

- When you are applying for a loan with a Housing…

Don't Miss

CoinField Launches Sologenic Initial Exchange Offering

CoinField has started its Sologenic IEO, which is the first project to utilize the XRP Ledger for tokenizing stocks and ETFs. The sale will last for one week and will officially end on February 25, 2020, before SOLO trading begins on the platform. Sologenic’s native token SOLO is being offered at 0.25 USDT during the IEO.

Earlier this month, Sologenic released the very first decentralized wallet app for SOLO, XRP, and tokenized assets to support the Sologenic ecosystem. The app is available for mobile and desktop via the Apple Store and Google Play. The desktop version is available for Windows and Mac.

“By connecting the traditional financial markets with crypto, Sologenic will bring a significant volume to the crypto markets. The role of the Sologenic ecosystem is to facilitate the trading of a wide range of asset classes such as stocks, ETFs, and precious metals using blockchain technology. Sologenic is an ecosystem where users can tokenize, trade, and spend these digital assets using SOLO cards in real-time. The ultimate goal is to make Sologenic as decentralized as possible, where CoinField’s role will be only limited to KYC and fiat ON & OFF ramping,” said CoinField’s CEO…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange