Don't Miss

Bitlumens: An Energy Miracle Powered by IoT and Blockchain Technology

Energy for all is a global priority. An estimated 1.2 billion people lack access to electricity or roughly 17% of the world’s population. There needs to be a cheap and clean option. One which is affordable and one that does not increase the carbon footprint.

One solution powered by Blockchain and the Internet of Things (IoT) has been developed by Bitlumens.

Bitlumens

Bitlumens is building a decentralized, blockchain-based micro power-grid for the 1.2 billion people without access to electricity and banking. Bitlumens brings electricity from renewable sources using IoT and the Blockchain. Thanks to solar energy and Bitlumens technology, people can use electricity, charge their electrical appliances and even water their crops.

Off grid communities lease Bitlumens hardware and pay in installments denominated in BLS tokens. This allows them to build a credit score leading to financial inclusion and get access to microloans backed by BLS.

Solar Home System (SHS)

The Bitlumens Solar Home System (SHS) will initially use a 15/20/50W solar panel and 3000 mAh, Lithium Ferro-Phosphate (LFP) Battery. Bitlumens will sell 3 systems coming with different appliances, i.e. two USB charging ports; integrated dimmable LED lights; LED Backlit LCD TV; Radio and TV. The battery should last for 5 years and the system has a minimum 2-year warranty.

The system must provide to the final user: available credit, battery availability, electricity consumed, lighting duration, daily cost, and energy output. The data will be sent to the network on a daily basis between 7-10pm.

Bitlumens will provide cooperative banks with key pieces of information they require to open an account or facilitate financial services. Each user will be able to have their own ID and credit history. This information can be shared with third parties offering microlending solutions, governments and development banks. Users can get access to microcredits backed by BLS by paying a specific interest rate.

The system will be comprised (at minimum) of the following components:

- A token creation smart contract (Ethereum)

- A utility billing system contract (Ethereum)

- IPFS (hash-based decentralized file storage)

- A centralized server to hold fingerprint data and notarize identity

- requests (approve/refuse)

- smart meter

BLS Tokens

To access and use Bitlumens software, BLS tokens are needed. The tokens serve multiple purposes: villagers need them to pay the installments of their solar power device, banks need them to access the Bitlumens SaaS (Software as a Service), and family members use the tokens to send remittances.

Since most villagers do not have Internet access to pay digitally their Solar Home Systems, Bitlumens employs agents who will collect the payments in cash and buy a corresponding amount of BLS tokens from the open market. The BLS will then be uniquely associated with the solar power device.

The BLS token is an ERC20 token based on the Ethereum blockchain. It does not represent equity in the company. Since every participant in Bitlumens ecosystem will need to buy BLS from the open market, the demand for BLS will increase as the business scales.

Typical Transaction

To assess the risk of each household, Bitlumens’ agents collect KYC information from each customer and feed the risk model with that data. The agents distribute and install the machines at the client’s house. The machines are leased for a period a period of 12 to 24 months. The client makes the lease payments in BLS tokens. If needed, the client can purchase the BLS tokens for the lease payment from the agent. If lease payments are not made when due, the machine is locked until the payment is made. If users receive remittances from family members to cover a lease payment, Bitlumens charges a 1% transaction fee.

Bitlumens registers the load profile of each machine that is in use. Token holders can monitor these profiles on the blockchain. Thus, they can see the evolution of the project and its environmental and social benefits.

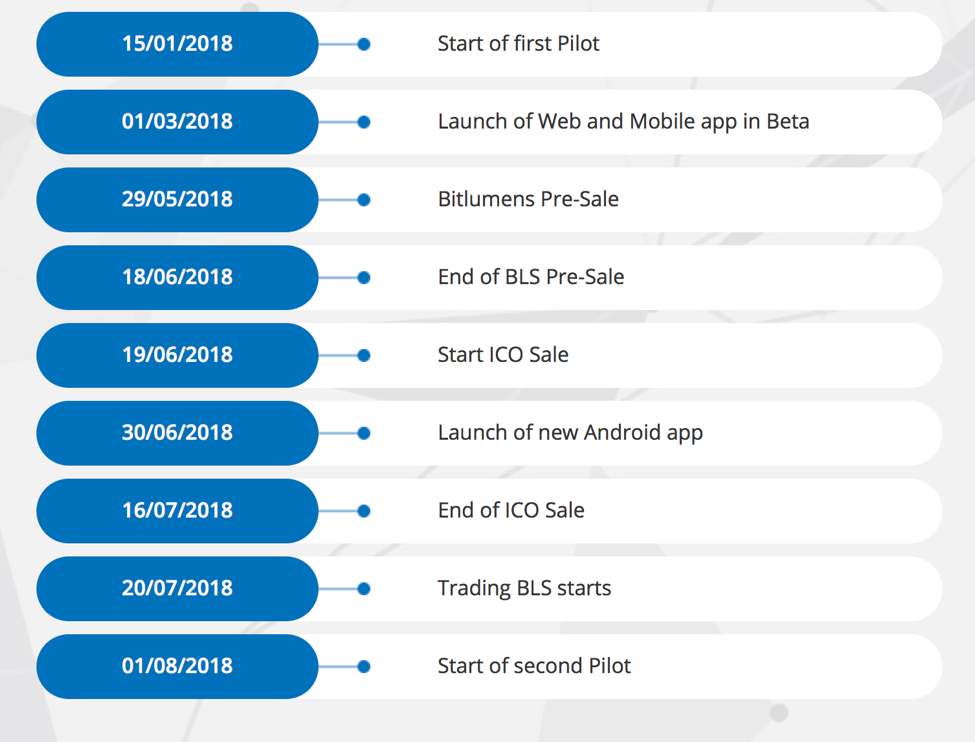

Timeline

Token Sale

Token: BLS

Platform: Ethereum

Type: ERC20

Pre-ICO Price: 1 BLS = 0.0007 ETH

ICO Price: 1 BLS = 0.001 ETH

Total Supply: 50,000,000 BLS

Soft Cap: $1,000,000

Hard Cap: $25,000,000

The Pre-ICO ends at midnight CET on June 18. The ICO starts on June 19 at midnight CET and goes on for 28 days. On the first day of the ICO BLS tokens are priced at 1.5 BLS/USD. Between the 2nd and the 7th day, the price is 1.4 BLS/USD and between the 8th and the 14th day the price increases to 1.3 BLS /USD. Finally, during the last 14 days of the ICO, the price is 1.2 BLS/USD. The ICO will terminate early if an equivalent USD 25 million is raised.

Bottom line

Bitlumens is indeed one of the most ambitious blockchain projects we have seen and one with enormous potential. Considering the strong need for a clean and affordable energy option for the 1.2 billion people without electricity, Bitlumens could be the energy miracle that so many are looking for. For more information, check out the Bitlumens website, white paper, and Telegram.

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Image courtesy of Pexels

Don't Miss

A Guide to Exploring the Singaporean ETF market

Singapore’s Exchange Traded Fund (ETF) market has grown, offering investors diverse investment opportunities and access to different asset classes. As the market evolves, investors must navigate these uncharted waters with a clear understanding of Singapore’s ETF landscape. This article explores the trends, challenges and strategies for navigating the Singapore ETF market. To start investing in ETFs, you can visit Saxo Capital Markets PTE.

The Singaporean ETF Market: Exponential Growth

The Singapore ETF market has seen significant growth in recent years, with an increasing number of ETFs covering a wide range of asset classes and holders. different investment topics.

One of the notable trends in the Singapore ETF market is the growing diversity of available options. Investors can now choose from ETFs that track domestic and international stock indexes, bonds, commodities, and specialist sectors or themes. This diverse range of ETFs allows investors to create comprehensive portfolios tailored to their investment goals.

The growth of the ETF market in Singapore is also due to growing investor demand for low-cost, transparent, and accessible investment vehicles. ETFs offer benefits such as intraday liquidity, real-time pricing, and the ability to trade on exchanges. These characteristics have made ETFs attractive to retail and institutional investors who want exposure to different asset classes.

Regulatory Landscape and Investor Protection

The Monetary Authority of Singapore (MAS) is the…

Don't Miss

Property Loans for Foreigners in Singapore That You Must Know About

Intending to invest in a residential or commercial property in Singapore?

When it comes to foreigners applying for a loan in Singapore, things can be pretty hard regardless of the reason whether you need the property for personal or business purposes.

In Singapore, buying a property is challenging, whether you are a foreigner or a native, and sometimes applying for a loan is the only way for you to afford it.

HOW MUCH CAN YOU BORROW FOR A PROPERTY LOAN IN SINGAPORE?

As for the Foreigner Loans, in Singapore, there is an exact amount of money you can borrow to finance the purchase of a property.

In this sense, Singapore has the Loan to Value Ratio (LTV).

The LTV ratio is what determines the exact amount of money you can borrow for a property loan, which changes depending on where you try to obtain the loan:

- If you are applying for a bank loan, you can borrow a maximum of 75% of the value of the property you want to purchase. That means if you are looking for a property that costs $500.000, the maximum amount of money a bank lender can give you like a loan in Singapore is going to be $375.000.

- When you are applying for a loan with a Housing…

Don't Miss

CoinField Launches Sologenic Initial Exchange Offering

CoinField has started its Sologenic IEO, which is the first project to utilize the XRP Ledger for tokenizing stocks and ETFs. The sale will last for one week and will officially end on February 25, 2020, before SOLO trading begins on the platform. Sologenic’s native token SOLO is being offered at 0.25 USDT during the IEO.

Earlier this month, Sologenic released the very first decentralized wallet app for SOLO, XRP, and tokenized assets to support the Sologenic ecosystem. The app is available for mobile and desktop via the Apple Store and Google Play. The desktop version is available for Windows and Mac.

“By connecting the traditional financial markets with crypto, Sologenic will bring a significant volume to the crypto markets. The role of the Sologenic ecosystem is to facilitate the trading of a wide range of asset classes such as stocks, ETFs, and precious metals using blockchain technology. Sologenic is an ecosystem where users can tokenize, trade, and spend these digital assets using SOLO cards in real-time. The ultimate goal is to make Sologenic as decentralized as possible, where CoinField’s role will be only limited to KYC and fiat ON & OFF ramping,” said CoinField’s CEO…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange