Trade

When buying bitcoin turns you into a trader

For most of us, the image of a trader is someone sitting in a busy stock exchange, looking stressed out and sweaty or with their head in their hands as the market crashes.

Or, they could be pacing up and down your high street bellowing “Buy! Buy!” or “Sell! Sell!” into a mobile phone, making sure everyone hears them.

But have you considered that you could also be a trader? If you have been buying Bitcoin, Litecoin or any of the others with the specific intent of selling when it rises, only to buy it again when it falls, in the eyes of some fairly important people, you might be classed as a trader.

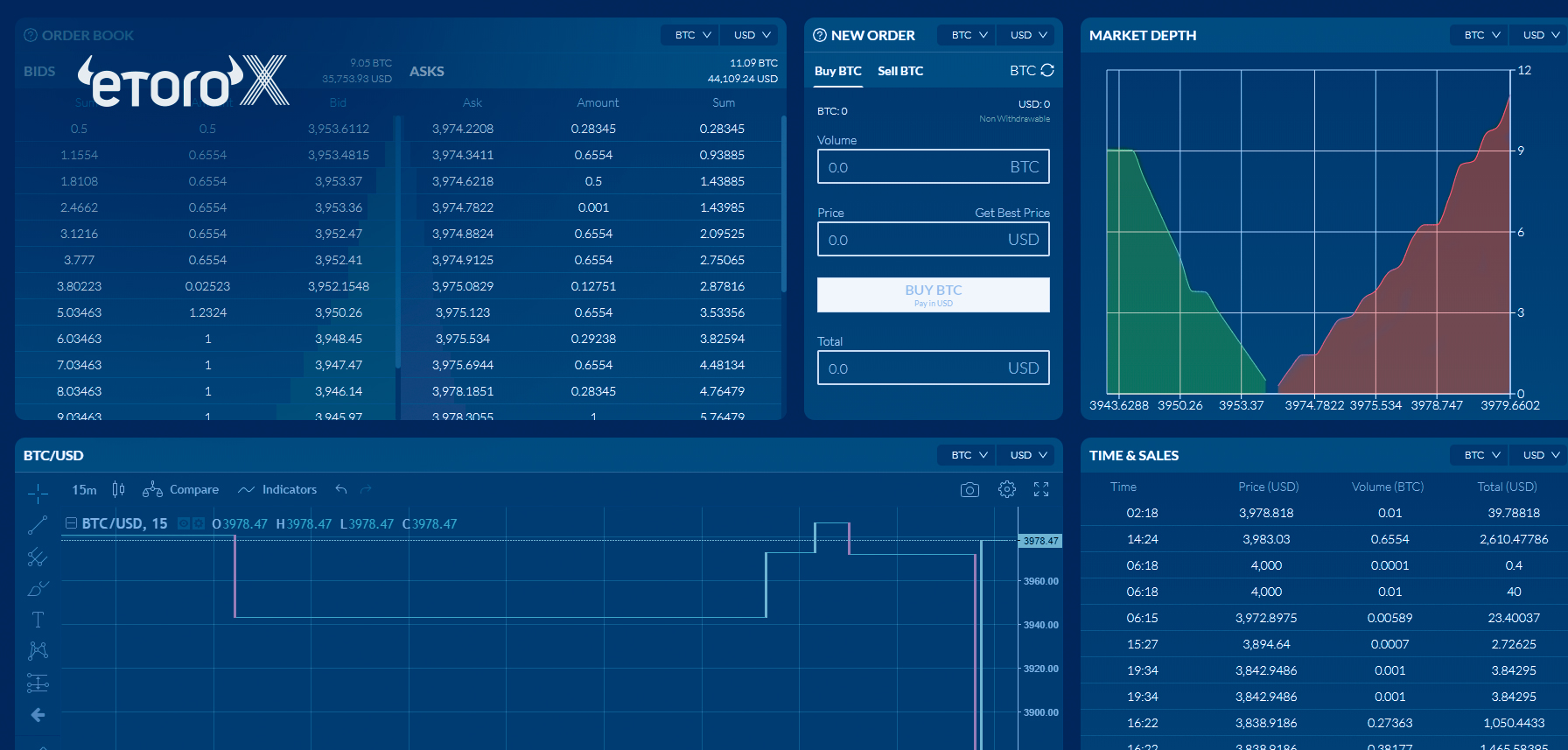

USE ETORO’S CRYPTO TAX CALCULATOR

These fairly important people are Her Majesty’s Revenue and Customs, and if they suspect you are trading cryptoassets, there might be taxes to pay (if you are a UK resident).

Unlike long-term investments, which the government actually likes as it ties in capital into supporting companies, currencies and other projects it doesn’t want to spend the money to do, trading is treated differently.

FIND OUT IF YOU OWE CRYPTO TAX

Trading attracts Income Tax, which is additional to what you pay on your regular earnings. HMRC doesn’t like people earning extra cash – digital, traditional or otherwise – and not telling it, so it could be worth checking up before you file your tax return. Just like your regular income tax though, you are able to offset it against some losses.

READ ETORO’S CRYPTOASSET TAX REPORT

The good news is that HMRC has set the bar quite high. You would have to make lots of trades every day for the authorities to think you’re setting up shop as the next Barclays or Goldman Sachs.

However, if HMRC deems you to not be a trader, you don’t get off the hook for your dues. Applicable to UK taxpayers, Capital Gains Tax is due on all profit made from investments and assets that grow in value, is still due to be paid… and no, the Exchequer does not accept Bitcoin.

As cryptos are fairly new – to the powers that be, at least – there are few rules and regulations so far set in place. But it is important to note that these will be tightened up over the coming years and months as they become more mainstream, so keep an eye out for updates.

To help you understand how this new tax regime might affect you, eToro has created a crypto tax calculator, infographic and crypto tax guide.

You can also listen to eToro, HMRC and ICAEW explore the cryptoasset landscape, the future of crypto, the tax levy and dispel common misconceptions in our webinar here.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk CFDs work, and whether you can afford to take the high risk of losing your money.

Applies to UK taxpayers only.

The information above does not constitute financial advice, always speak to a tax professional to ensure it is right for your specific circumstances.

eToro does not represent any government entity. You should check with a tax professional or HMRC if you are paying the right amount of tax.

Altcoins

XNO Token of Xeno NFT Hub listed on Bithumb Korea Exchange

Hong Kong, Hong Kong, 25th January, 2021, // ChainWire //

Xeno Holdings Limited (xno.live ), a blockchain solutions company based in Hong Kong, has announced the listing of its ecosystem utility token XNO on the ‘Bithumb Korea’ cryptocurrency exchange on January 21st 2021.

Xeno NFT Hub (market.xno.live ), developed by Xeno Holdings, enables easy minting of digital items into NFTs while also providing a marketplace where anyone can securely trade NFTs.

The Xeno NFT Hub project team includes former members of the technology project Yosemite X based in San Francisco and professionals such as Gabby Dizon who is a games industry expert and NFT space influencer based in Southeast Asia.

NFT(Non-Fungible Token) technology has recently gained huge focus in the blockchain arena and beyond, making waves in the online gaming sector, the art world, and the digital copyrights industry in recent years. The strongest feature of NFTs is that “NFTs are unique digital assets that cannot be replaced or forged”. Unlike fungible tokens such as Bitcoin or Ether, NFTs are not interchangeable for other tokens of the same type but instead each NFT has a unique value and specific information that cannot be replaced. This fact makes NFTs the perfect solution to record and prove ownership of digital and real-world items like works of art, game items, limited-edition collectibles, and more. One of the ways to have a successful…

Altcoins

XENO starts VIP NFT trading service and collaborates with contemporary artist Hiro Yamagata

Hong Kong, Hong Kong, 24th December, 2020, // ChainWire //

The XENO NFT Hub (https://xno.live) will provide a crypto-powered digital items and collectables trading platform allowing users to create, buy, and sell NFTs. Additionally it will support auction based listings, governance and voting mechanisms, trade history tracking, user rating and other advanced features.

As a first step towards its fully comprehensive service, XENO NFT Hub launched a recent VIP service to select users and early adopters in December 2020 with plans for a full Public Beta to open in June 2021.

“NFTs are extremely flexible in their usage, from digital event tickets to artwork, and while NFTs have a very wide spectrum of uses and categories XENO will initially focus its partnership efforts and its own item curation on three primary areas: gaming, sports & entertainment, and collectibles.”, said XENO NFT Hub president Anthony Di Franco.

He also added “This does not mean we will prohibit other types of NFTs from our ecosystem However, it simply means that XENO’s efforts as a company will be targeted into these verticals initially as a cohesive business approach.”

Development and Procurement Lead, Gabby Dizon explained, “Despite our initial focus, we found ourselves with a unique opportunity to host some of the works of Mr. Hiro Yamagata. We are collaborating with Japanese artist Hiro Yamagata to enshrine some of his artwork into NFTs.”

Mr. Yamagata has…

Altcoins

My Crypto Heroes Announces Issuance of MCH Governance Token

Tokyo, Japan, 24th November, 2020, // ChainWire //

My Crypto Heroes is happy to announce the issuance of MCH Coin as an incentive to players in the My Crypto Heroes ecosystem, aiming to allow them to craft a “User-oriented world”. The MCH coin is available on Uniswap with a newly created pool with ETH.

My Crypto Heroes is a blockchain-based game for PC and Mobile. It allows users to collect historic heroes and raise them for battle in a Crypto World. Officially released on November 30th, 2018, MCH has recorded the most transactions and daily active users than any other blockchain game in the world.

What is MCH Coin?

MCH Coin is being issued as an ERC-20 Standard Governance Token. The issuance began on November 9th, 2020, with 50 million tokens issued.

Of the funds issued, 40% are allocated to a pay for on-going development and as rewards for advisors and early investors. 10% are allocated to marketing and the growth of the ecosystem, and 50% are allocated to the community. The Distribution Ratio of the MCH Coin is subject to change via a governance decision.

The MCH coin will be used as a voting right as part of the ecosystem’s governance, with 1 coin being 1 vote. It will also be used for in-game utilities and payments. Additional information can be found here:

https://medium.com/mycryptoheroes/new-ecosystem-with-mchcoin-en-a6a82494894f

During December 2020 the first…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange