Ethereum

Ethereum Price Dips Below $1.8K Amid Macroeconomic Headwinds

Ethereum price was in the red on Friday, shedding some of the gains made in the past week. At the time of writing, Ethereum was trading 2.24% lower at $1,763.05. The lead altcoin has added more than 12% in the past week and 47.40% in the year to date. Its total market cap remains 1.60% higher for the day at $212 billion.

Fundamentals

Ethereum price has recorded significant gains over the past week on the back of positive market sentiment and Bitcoin’s brief interaction with the important level of $35,000. The crypto market has been bullish over the past week amid BlackRock’s EFT buzz and an increase in risk appetite. The Crypto Fear and Greed Index, which measures the key emotions driving the crypto market, is at a Greed level of 71, suggesting an increase in buying pressure.

The crypto market has been on a bullish rally in the past week as BlackRock’s closely watched spot bitcoin EFT appeared on a list maintained by a Nasdaq-operated clearing house for EFTs, the Depository Trust and Clearing Corporation. The move by the DTCC raised hopes that the US Securities and Exchange Commission (SEC) will approve the trading of the highly anticipated bitcoin EFT. BlackRock’s EFT application filed earlier in June is still pending approval from the SEC.

Bitcoin, the largest cryptocurrency by market cap, briefly topped $35,000, its highest level since May 2022, on the back of BlackRock’s EFT listing. BTC’s jump to this level pushed crypto prices of most altcoins, including Ethereum, Solana, Cardano, and Dogecoin, higher.

Even so, macroeconomic headwinds have continued to weigh on cryptocurrency prices. The US dollar rose to a near 1-week high on Friday against several major currencies as investors’ appetite for risk assets faded following a series of lackluster corporate results that raised worries about the economic outlook.

Additionally, investors have been digesting the latest personal consumption expenditures data for September. Core PCE, the Fed’s favorite inflation gauge, inched 0.3% higher in September and 3.7% year on year, in line with analysts’ estimates. While markets are widely anticipating a pause in interest rates in November, investors are closely watching for hints from the US Federal Reserve about the monetary policy path.

Ethereum Price Outlook

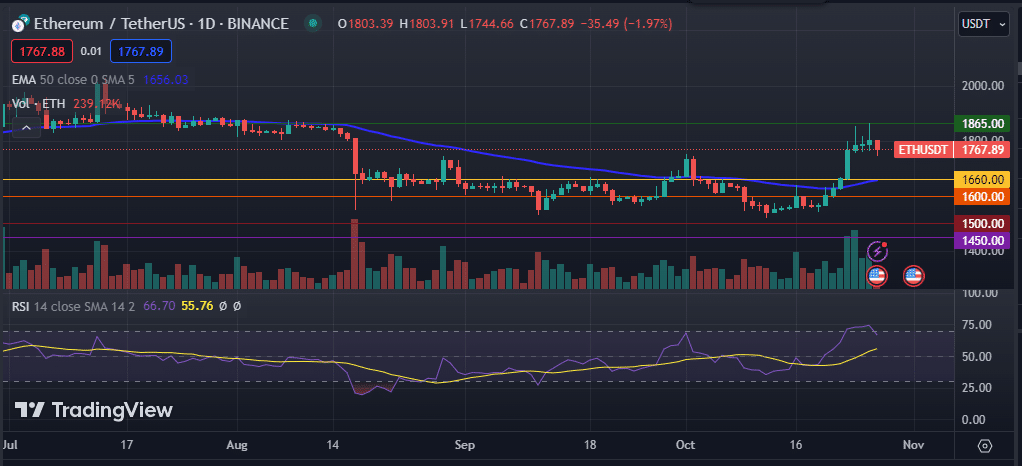

The daily chart hints at exhaustion in Ethereum ‘s price recent rally past $1,800. The altcoin briefly jumped to $1,865 earlier in the week, its highest level since August. Ethereum remains above the 50-day and 200-day exponential moving averages. Its Relative Strength Index, as well as the Moving Average Convergence Divergence Indicator, signal a bullish outlook.

As such, the Ethereum price is likely to continue trading above the $1,700 level in the ensuing sessions as it struggles to recover above the important resistance level of $1,800. A breach above this level might lead to subsequent gains towards $1,865 and $1,900. However, a drop below $1,700 will push the price lower to the immediate support at the 50-day EMA, invalidating the bullish thesis.

Ethereum

Ethereum Price Hovers Around $2,190: A Delicate Balance Between Profit-Taking and Bullish Sentiment

Ethereum price has been struggling to hold above the crucial support of $2,190 for the past few days amid profit-taking by investors. At the time of writing, the second-largest cryptocurrency by market cap was trading slightly higher at $2,216.20. Even so, Ethereum’s total market cap remains 1.33% lower for the day at $266 billion, while the total volume of the asset traded over the same period declined by 2.56%.

Fundamental Analysis

Ethereum price has been trading sideways for the past few days amid profit-taking by whales, triggering an increase in selling pressure. The Ethereum price has been positively impacted for the past two months by the recent bullish momentum in global crypto markets, fueled by Bitcoin’s surge to $44,000.

Over the years, ETH has maintained a distinctive market position attributed to its extensive developer community, widespread adoption, and pivotal role in decentralized finance (DeFi) and various blockchain applications. However, the impact of significant holders selling could continue driving the ETH price lower in the ensuing sessions. Despite these concerns, the overall market sentiment remains cautiously optimistic, leaving room for potential further growth in the asset’s price.

According to CoinMarketCap, the global crypto market cap has increased to $1.61 trillion, over the past few days. The Crypto Fear and Greed Index, which measures the key emotions driving the market, has improved slightly over the past day, highlighting an increase in risk appetite.

The recent decline in the greenback…

Ethereum

Ethereum Price Sails Past $2,300 with Bulls at the Helm

Ethereum price has been on a tear, blasting past the psychological level of $2,300 amid speculation of spot Ether exchange-traded funds (ETF) launching in the markets and broader market cues. The largest altcoin by market cap has climbed by nearly 15% in the past week and more than 96% in the year to date. ETH’s total market cap has increased to $282 billion over the past 24 hours, while the total volume of the asset traded over the same period increased by more than 14%.

Behind ETH’s Rally

Ethereum price has recorded significant gains over the past few weeks, consolidating within a bullish ascending parallel channel since the broader market turned bullish earlier in October. Data by Santiment has revealed that corporate entities and high net-worth investors have continued to double down on their ETH positions.

According to the prominent on-chain tracker, the top 20,000 Ethereum wallets have ramped up their buying spree this week. An increase in the supply held by top addresses is often interpreted as a strong bullish signal. This highlights a buying trend among the largest stakeholders within Ethereum’s ecosystem.

One of the key catalysts behind Ethereum’s price rally is the anticipation of the approval of a spot Ether ETF, which has increased demand and market optimism. On November 30, the US Securities and Exchange Commission (SEC) initiated the review process for Fidelity’s spot Ether ETF proposal filed earlier on November 17. This…

Ethereum

Ethereum Price Reclaims $2,000 on the Back of Crypto Market Renaissance

Ethereum price edged higher on Friday, reclaiming the critical psychological level of $2,000 after hitting an intraday high of $2,129.29. Ethereum, the second largest token by total market capitalization, has been outperforming the crypto market this week and is on pace to end the week 8% higher. ETH’s total market cap jumped by 4% over the last day to $255 billion, while the total volume of the asset traded over the same period declined by nearly 10%.

ETH Price Outlook

Ethereum price is back to trading above the important level of $2,000 amid positive on-chain data and bullish crypto market sentiment. Data by IntoTheBlock shows that more than 500,000 ETH tokens have left exchanges for non-custodial wallets this month, the highest amount in three months. As such, total outflows increased to $1 billion in three weeks. This suggests that traders and investors have taken advantage of ETH’s recent dip, which has proven profitable.

The crypto market sentiment has also buoyed the Ethereum price rally this week. The global crypto market cap has increased by more than 2% over the past 24 hours to $1.44 trillion, while the total crypto market volume inched slightly lower over the same period. The Crypto Fear and Greed Index has increased to a Greed level of 72, up from 67, hinting at an increase in demand for the risk assets.

Additionally, Bitcoin’s brief…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange