Hot Updates

Bitcoin Plunging… but Possibilities for Investors Still Available

Bitcoin (BTC-USD) and most of the other cryptocurrencies are under pressure this week, continuing the multi-day downward trend. The leading cryptocurrency has lost 14% of its value on Tuesday over the 24-hour period and around 30% from the recent high. During 18th July Asia Session bitcoin is trading 23% lower than it was a week ago, around $9,700.

According to Coindesk’s Omar Godbole, if the events of 2016 would repeat, $7,500 could become a new support price. Bitcoin dropping to $6,100 while still maintaining its parabolic formation is also possible.

As one would expect, Bitcoin-related, altcoins, which are dependent on Bitcoin, also have a drop in price.

Ether (ETH) fell slightly less than BTC, shedding 10.4% to hit $203, while Litecoin (LTC) and Binance Coin (BNB) mirrored the behavior.

Bitcoin currently accounts for just over 66% of the total cryptocurrency market cap, a near two-year high.

There could be several major factors standing behind bitcoin’s current volatility: International Exchange’s new futures exchange Bakkt is about to start its beta-testing, and Fidelity Digital Assets, the crypto-focused branch of a major asset manager, will offer crypto trading to soon.

Various industry experts state that recent U.S. officials comments regarding bitcoin could have contributed to the price fall. Generally speaking, governments still view cryptocurrencies as a realm for money laundering and other illegal activities.

What more has added to investors skepticism is that now it’s obvious it’s not just the Trump administration and congressional Republicans who express concerns about cryptocurrencies.

No one knows what will be the consequences of US officials stating their position, but for sure uncertainty about industry doesn’t make investors confident.

Some industry executives, like Digital Currency Group CEO Barry Silbert and Ikigai Fund founder Travis Kling, have said that the remarks on Bitcoin by President Trump and Secretary Mnuchin can be acknowledged as a bullish sign in long-term perspective: Silbert said that Trump’s and Mnichin’s comments were “complete and total validation of bitcoin.”

To bitcoin price growth could contribute oncoming bitcoin halving. Many major miners have secured sufficient capital to sustain their operations for an extra 12 months. When demand hits short supply, price rises.

During the period of volatility many investors choose margin trading, the essence of which is a possibility to gain profits not only when BTC price grows, but also when it falls. To make a good trade, you just need to properly predict price direction.

Bexplus Grants Each User a 10% Cashback

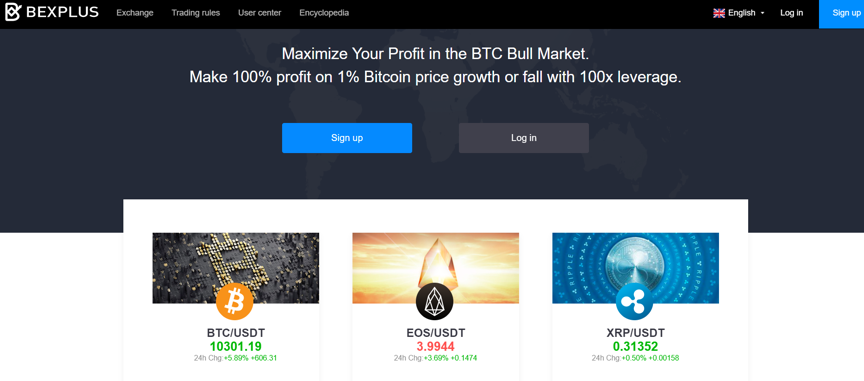

Bexplus is a fast-growing crypto exchange with 100x leverage. On Bexplus investors gain profits by trading BTC, ETH, LTC, and other crypto futures. Our advantages are simplicity, lack of spread, availability of simulation mode, security, quick and simple withdrawals, as well as additional activities (for example, we offer an annual interest rate for a deposit) and responsive 24-hour tech support.

This July Bexplus grants every user deposited more than 0.05 BTC with 10% withdrawable cashback. Amount of cashback for each user is unlimited!

Make a deposit on Bexplus and win iPhone XS Max

This July, Bexplus users can get a valuable gift by making deposits: gifts vary from Amazon Gift Cards to iPhone XS Max!

Start gain profits with Bexplus today!

Follow Bexplus on:

Website: www.bexplus.com

Facebook: https://www.facebook.com/Bexplusglobal/

Telegram: https://t.me/bexplusexchange

Twitter: https://twitter.com/BexplusExchange

Altcoins

Ethereum Price Outlook as the DXY Index Crash Continues

Cryptocurrency prices remained in an upbeat tone on Thursday as the US dollar index continued its bearish move. Bitcoin, the biggest cryptocurrency in the world, rose to $23,165, the highest level in months. Similarly, Ethereum has risen by more than 4% in the past 24 hours while BNB Coin and XRP surged to $307 and $0.41, respectively.

US dollar index retreats

Cryptocurrencies have an inverse relationship with the US dollar index. For example, the DXY, which looks at the performance of the greenback vs other currencies, soared to a 20-year high of $115 in 2022. As that happened, cryptocurrencies like Bitcoin plunged during the year.

The foundation of this relationship is the Federal Reserve. In most periods, the US dollar index tends to rise when the Fed is extremely hawkish and vice versa. And it was extremely hawkish in 2022 as it hiked interest rates by more than 400 basis points.

Therefore, while the Fed has remained hawkish recently, the US dollar has dropped because of what the data is saying. Data published recently showed that America’s inflation is easing. The closely watched consumer price index dropped to 6.5% in December while core inflation fell to 5.7%.

At the same time, other parts of the economy are showing that the American economy is indeed recoiling. Retail sales dropped sharply in December while many…

Altcoins

XNO Token of Xeno NFT Hub listed on Bithumb Korea Exchange

Hong Kong, Hong Kong, 25th January, 2021, // ChainWire //

Xeno Holdings Limited (xno.live ), a blockchain solutions company based in Hong Kong, has announced the listing of its ecosystem utility token XNO on the ‘Bithumb Korea’ cryptocurrency exchange on January 21st 2021.

Xeno NFT Hub (market.xno.live ), developed by Xeno Holdings, enables easy minting of digital items into NFTs while also providing a marketplace where anyone can securely trade NFTs.

The Xeno NFT Hub project team includes former members of the technology project Yosemite X based in San Francisco and professionals such as Gabby Dizon who is a games industry expert and NFT space influencer based in Southeast Asia.

NFT(Non-Fungible Token) technology has recently gained huge focus in the blockchain arena and beyond, making waves in the online gaming sector, the art world, and the digital copyrights industry in recent years. The strongest feature of NFTs is that “NFTs are unique digital assets that cannot be replaced or forged”. Unlike fungible tokens such as Bitcoin or Ether, NFTs are not interchangeable for other tokens of the same type but instead each NFT has a unique value and specific information that cannot be replaced. This fact makes NFTs the perfect solution to record and prove ownership of digital and real-world items like works of art, game items, limited-edition collectibles, and more. One of the ways to have a successful…

Hot Updates

Campden Wealth Partners with GDA Group to Enter Digital Asset Markets

Blockchain conglomerate GDA Group joins as Campden Wealth’s newest Corporate Partner for 2021. Based in Toronto, GDA group provides access to all verticals of the crypto capital markets to institutions and private investors. The two institutions once operated on different verticals, so the partnership indicates a new era of portfolio allocation and asset diversification. Digital assets, including bitcoin, are becoming a vital component of modern investment strategies. GDA Group provides multiple avenues for digital asset exposure, including trading services through their institutional trading desk Secure Digital Markets, including non-recourse lending up to $100M through GDA Lending, and private placements through their capital markets arm GDA Capital.

“Institutions have spent a decade on the sidelines, evaluating the risks of this burgeoning sector. Now, in less than 6 months we have seen billions in institutional and private capital enter the space,” says James Godfrey, FX and International Banking Advisor to GDA Group. “Our relationship with Campden will illustrate the maturation of this industry and where we are headed next. New stakeholders will need experience, resources and insights to navigate this new market and evaluate upcoming opportunities.”

“The Campden Community is constantly balancing the needs of wealth creation for the future, with wealth preservation…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange