Bitcoin

Einsteinium (EMC2): What Is Einsteinium And Is It Worth Investing In?

It’s hard to miss a coin boldly named Einsteinium, but is interest in this currency worth the trouble and is Einsteinium potentially good investment? Those are the most significant questions imposing in front of this digital coin cleverly known as EMC2. It is sometimes difficult to determine which digital coin is worthy of attention and which coin is just a “one-hit wonder” doomed to disappear from the map of successful and famous digital currencies that are currently available on the market. To help you follow up with Einsteinium and the way things are with this cryptocurrency, we are analyzing this digital token starting from the basics.

What is Einsteinium?

To determine whether this digital coin represents a good investment or not, we first need to go through its purpose and find out more about this cryptocurrency. Einsteinium’s original intent as you can probably guess is closely related to science. This digital coin is launched and named Einsteinium with the purpose of having philanthropic, scientific and technological projects funded quickly and in a straightforward manner.

As you might guess, Einsteinium, as well as other digital currencies, is based and designed on blockchain technology with the idea of making collecting funds easier and much simpler, focusing on scientific and technological development. Just like some digital coins are created for funding art and artists or are prepared to promote original content and collect funds and organize crowdfunding for different purposes.

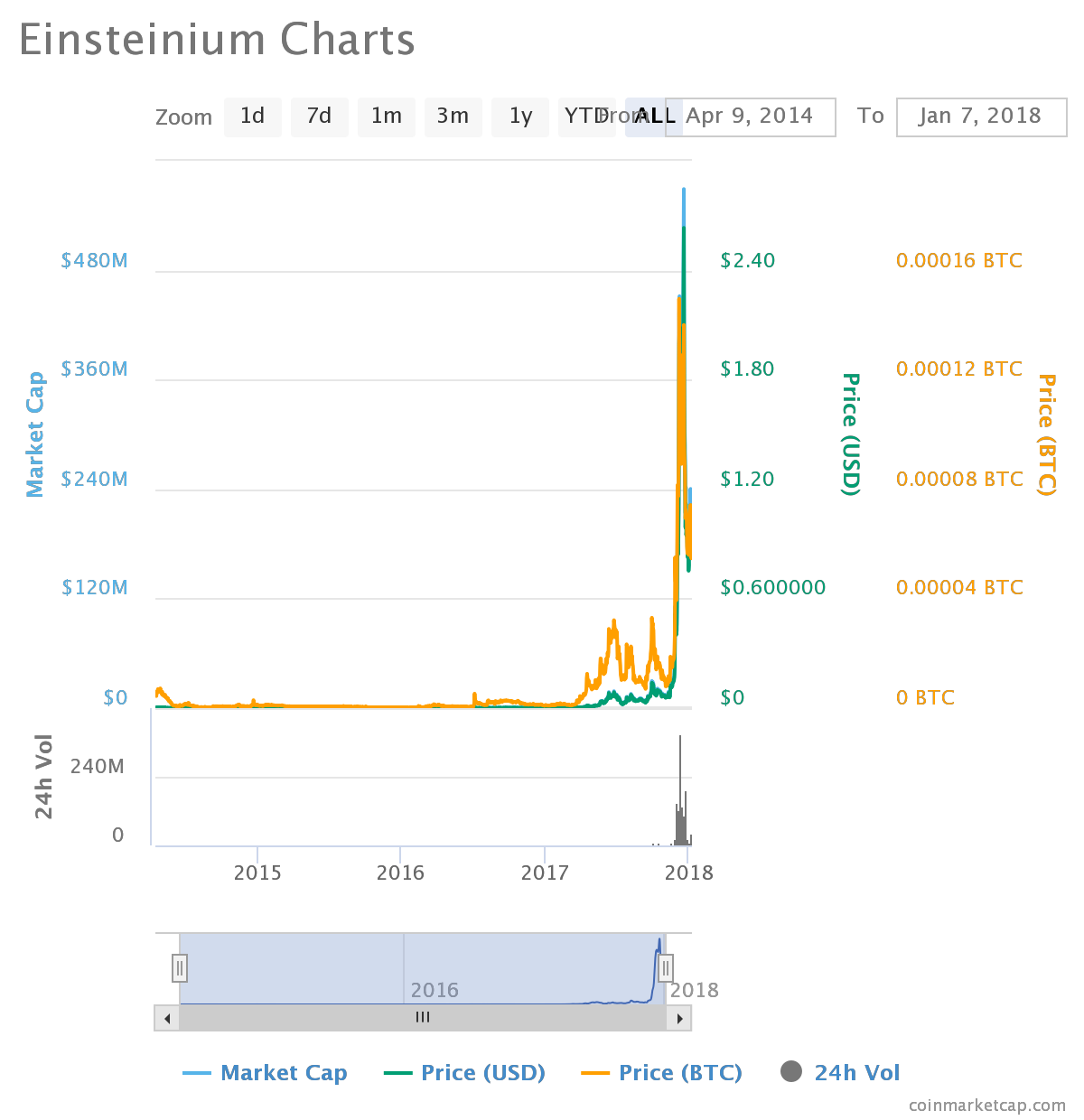

Einsteinium is based in Canada, Montreal where it was launched back in 2014, but Einsteinium didn’t get to see much action till after three years later in 2017 when this digital coin began to experience an increase in value and price.

With being launched three years ago, EMC2 also became the first research-based ecosystem in the community of crypto values and systems, making it one of the coins with hidden potential for investments and direct operations and utilization that can be done with digital currencies. The existence of Einsteinium consequently conditioned the development of Einsteinium foundation, having this platform focused on charitable and crowdfunding donations that are meant for funding different technological and scientific researching.

To make sure that Einsteinium would acquire potential of funding as many types of research as possible, the creators of this digital coin and supporting platform have even arranged that 2.5% of every mined and awarded blockchain is being donated for purposes of funding different researching ventures in areas of philanthropy, science, and technology.

Being the first funding platform for scientific researchers, Einsteinium features crowdfunding organizations, education and represents an open source ecosystem.

Through different crowdfunding actions being organized through this platform, Einsteinium is making collecting funds a lot easier than it would be with popular crowdfunding platforms because all funds being raised for scientific purposes are not mediated by third parties, so there are only two parties involved which are characteristic for blockchain operating platforms. That way, raising funds and transferring funds for researching purposes becomes ever so comfortable and amazingly simple.

Einsteinium also promotes education and is working on spreading knowledge and educating interested people about blockchain technology and latest scientific and technological improvements, valuing learning as much as monetary value.

Along with promoting education, Einsteinium also represents an open source ecosystem that fosters code functionality and open source operations as vital to having a functional blockchain environment.

But, how Einsteinium community decides which projects are being funded first or funded at all? To understand the system of evaluation, we will need to define the term “Epoch.”

What is Epoch and how it relates to EMC2?

Whenever a blockchain is being mined with successful result of solving an equation and completing an entire chain, miners are being rewarded, and 2.5% of that reward goes for charity and funding scientific or technological researches. But how is it decided which project is being funded first?

Epoch represents 25 days, which is the timeline needed for miners to be able to complete 36.000 blocks. After completion of the epoch, the funds raised from the awards earned by having miners working on building blockchains is transferred to Einsteinium Foundation. The next step would be to include the members who are actively working on this platform, whether is it just holding the coins or getting involved in mining, to vote for the project they think is the most important.

The members would be asked to vote to have all projects presented in details so they could easily decide which project has the most potential and which project deserves the funds the most. After the votes are collected and counted, the chosen project with the most votes gets the funds. This process is being repeated after every 36.000 blocks are built by miners, that way creating a never-ending circle of funding projects that are potentially important for scientific and technological development.

Is it Worth It?

Einsteinium Foundation along with its crypto coin EMC2 is the biggest and at the same time, the first blockchain based open source community that is involved in collecting funds for scientific and technological projects that are focused on improving and developing science and technology as we know it. The coin is very functional and mineable as well, and if you add the fact that you are helping different potentially essential science projects, owning EMC2 and working on their platforms sounds pretty promising. Given the fact that EMC2 is currently valued at 0.9$ per one coin with a slight decrease in price over the first couple of days of 2018, regardless the decrease EMC2 probably represents one of the potentially profitable investments with a current market cap of 194.6 million dollars.

We will be updating our subscribers as soon as we know more. For the latest on EMC2, sign up below!

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Please conduct your own thorough research before investing in any cryptocurrency.

Image courtesy of coinmarketcap.com

Bitcoin

Bitcoin Price Dumps Below $41,000 Amid Uncertainty

Bitcoin price dumped hard on Monday, briefly slipping below $41,000, erasing gains recorded in the previous week. The premier cryptocurrency seems to have exhausted its recent rally propelled by industry vulnerabilities. At the time of writing, the world’s largest cryptocurrency was trading slightly lower at $41,385. Bitcoin’s total market cap has dipped by 2% over the past day, while the total volume of BTC tokens traded over the same period climbed by 58%.

Fundamentals

Bitcoin price has been facing retracements and a rollercoaster over the past few days after recently rocketing to a 20-month peak. On-chain data has suggested that many investors used the opportunity to take some profits, leading to a decline in the asset’s price.

Bitcoin’s price slump is mirrored in the wider crypto market, with the global crypto market cap decreasing by 1.85% over the past 24 hours to $1.55 trillion. The total crypto market volume has increased by 32% over the same period. The Crypto Fear and Greed Index has plunged from a level of extreme greed to a greed level of 70, suggesting a decline in risk appetite.

Ethereum, the largest altcoin by market capitalization, is currently trading at $2,167, down almost 3% for the day. Meme coins have been hit hard by the market slump, with Dogecoin and Shiba Inu down by more than 4% over the last day.

Last week on Thursday, cryptocurrency experts took notice of…

Bitcoin

Bitcoin Price is in Consolidation Mode Despite Market Optimism Post-Fed Decision

Bitcoin price edged lower on Thursday despite optimism in wider markets on the back of the Fed’s interest rate decision. The flagship cryptocurrency has been consolidating above the critical level of $42,000 after briefly topping $44,000, its highest level in 20 months. Bitcoin was trading 0.71% lower at $42,569 at press time. BTC’s total market cap has increased by more than 3% over the last day to $832 billion, while the total volume of the asset traded over the same period jumped by 22%.

Economic Outlook

Bitcoin price has been trading sideways over the past few days, suggesting a pause in its recent rally towards $45,000. The premier cryptocurrency has decreased by 4% in the past week but remains 15.22% higher in the month to date. The digital asset has staged a significant recovery this year after a torrid 2022 in which a string of scandals, including the collapse of FTX, led to a market meltdown, undermining the credibility of the sector.

The crypto market has been buoyed by the Fed’s latest interest rate decision. The US Federal Reserve on Wednesday held its key interest rate unchanged for the third consecutive time, in line with market expectations. With the easing of the inflation rate, members of the Federal Open Market Committee (FOMC) voted to keep the benchmark overnight borrowing rate in a targeted range between 5.25%-5.5%.

Additionally, the central bank indicated that three rate…

Bitcoin

Bitcoin Price Blasts $44K in Spectacular Surge as Spot Bitcoin ETF Approval Looms Large

Bitcoin price has been hovering above the $43,000 psychological level over the past two days amid anticipation about the potential approval of a spot bitcoin ETF. The flagship cryptocurrency has climbed more than 16% in the past week and nearly 170% in the year to date. Bitcoin’s total market cap has increased by nearly 5% over the past 24 hours to $858.9 billion, while the total volume of the token traded rose by 43%. The Bitcoin price was trading at $43,914 at press time.

Fundamentals

Bitcoin price has posted significant gains over the past few days, climbing to its highest level since April 2022, before the crash of a stablecoin that started a litany of company failures, pummeling crypto prices. The world’s largest cryptocurrency briefly topped the crucial level of $44,000 on Wednesday amid rising momentum despite being massively overbought.

According to analysts, with no spot bitcoin ETF approvals yet and the halving event five to six months away, the market is riding on FOMO. Capital has been flowing in the Bitcoin market amid enthusiasm that the launches of spot ETF will bring in billions of dollars of new investment into the crypto sector.

Investors have already started providing capital as seed money for ETF products. Notably, a recent report by CoinDesk showed that the world’s largest fund manager, BlackRock, received $100,000 in capital from a seed investor for its spot bitcoin exchange-traded fund…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange