Altcoins

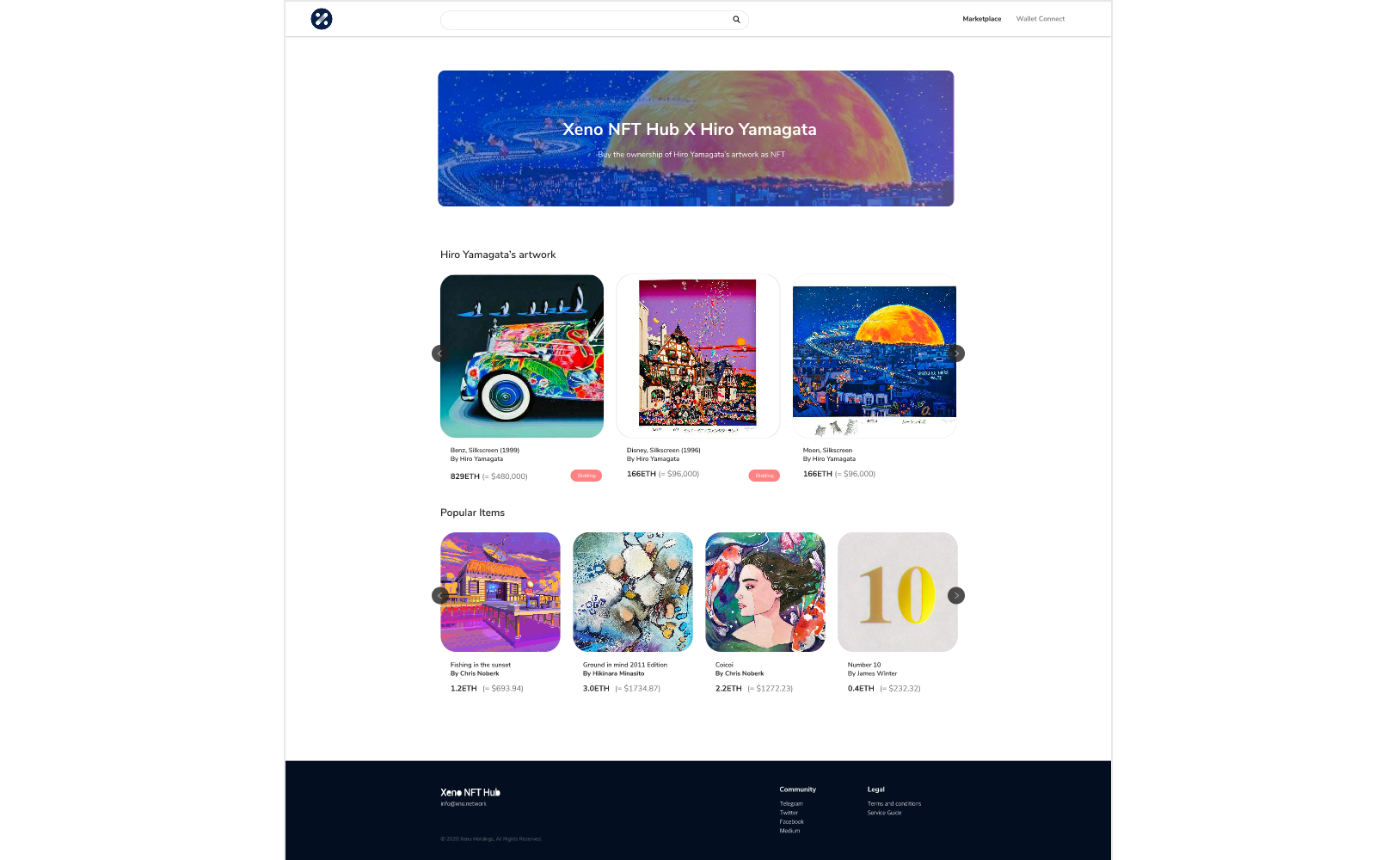

XENO starts VIP NFT trading service and collaborates with contemporary artist Hiro Yamagata

Hong Kong, Hong Kong, 24th December, 2020, // ChainWire //

The XENO NFT Hub (https://xno.live) will provide a crypto-powered digital items and collectables trading platform allowing users to create, buy, and sell NFTs. Additionally it will support auction based listings, governance and voting mechanisms, trade history tracking, user rating and other advanced features.

As a first step towards its fully comprehensive service, XENO NFT Hub launched a recent VIP service to select users and early adopters in December 2020 with plans for a full Public Beta to open in June 2021.

“NFTs are extremely flexible in their usage, from digital event tickets to artwork, and while NFTs have a very wide spectrum of uses and categories XENO will initially focus its partnership efforts and its own item curation on three primary areas: gaming, sports & entertainment, and collectibles.”, said XENO NFT Hub president Anthony Di Franco.

He also added “This does not mean we will prohibit other types of NFTs from our ecosystem However, it simply means that XENO’s efforts as a company will be targeted into these verticals initially as a cohesive business approach.”

Development and Procurement Lead, Gabby Dizon explained, “Despite our initial focus, we found ourselves with a unique opportunity to host some of the works of Mr. Hiro Yamagata. We are collaborating with Japanese artist Hiro Yamagata to enshrine some of his artwork into NFTs.”

Mr. Yamagata has been considered by many as one of the most famous silkscreen artists because of the use of vivid colors in his pieces. However, he has also been known more recently for his contemporary works using laser and hologram technology. He is recognized as a pioneer of contemporary laser art. Some of his most famous works include, ‘Dreams of Disney’ and ‘Restoring of Mercedes-Benz’.

“Now through the power of blockchain and its application in NFT technology, Mr. Yamagata’s works are immortalized into an immutable public ledger. That is a very powerful thing for both artists and art collectors alike”, Mr. Di Franco added.

One of the most important factors in the art world is provenance and the history and context of both the artist and the artwork itself. Now through the use of blockchain, there is a complete and fully transparent history of the artwork’s lifespan starting at the artist and ending at current owner. NFTs bring unprecedented ownership and historical accuracy with guarantees that cannot be provided elsewhere.

“The NFT market is still young, but many like Mr. Yamagata, have expressed interest in using this new medium to reach a new market and bring value to their existing clients. There is a growing movement of individuals and businesses that have a purchasing appetite for these unique digital assets”, continued Mr Dizon.

XENO’s VIP service commenced with Mr Yamagata’s (and other digital items) listed in auction and direct sale formats with great success and positive feedback from users. It is looking to roll out a wider Closed Beta in the near future while ramping up for a full Public Beta launch on its own network in June 2021.

Contacts

Head of Promotion

- Kate Wilson

- XENO Holdings Limited

- [email protected]

Altcoins

Solana Price Surges Beyond $100, Dethroning Ripple and BNB To Secure Fourth Place

Solana price performance in recent times has been remarkable, surpassing Ripple and Binance Coin to become the fourth-largest cryptocurrency by market cap. The SOL price breached the critical level of $100 for the first time since April 2022 over the weekend to imbue optimism among investors. However, the altcoin has corrected by 7%, suggesting that the market is overheated. At the time of writing, the ‘Ethereum killer’ was trading slightly lower at $111.60.

SOL Outlook

Solana price has made a significant recovery over the past few weeks, climbing above the psychological level of $100. The altcoin has been one of the best-performing assets this year, extending its year-to-date gains to more than 1,025%, with more gains recorded in the past month alone. However, even with such growth, analysts have noted that Solana has a bleak chance of topping its ATH of $260.

The reason behind this is the increase in supply relative to its value. In November 2021, when the Solana price hit its all-time high of $260, its total market capitalization was around $78 billion. Despite the value of the crypto asset being less than half of what it was at the top, its market cap is currently hovering near $50 billion.

This has been brought about by the increase in the Solana supply by more than 100 million SOL over the past two years. According to some analysts, for the altcoin to retest $260, its…

Altcoins

Solana Price Skyrockets to 20-Month Peak Amidst Memecoin Frenzy

Solana price has noted significant gains over the past few weeks, climbing to its highest level since April 2022. The ‘Ethereum Killer’ almost topped the crucial level of $100 on Friday, before pulling back slightly. The asset’s recent surge has catapulted Solana’s total market cap to $39.6 billion, ranking 5th after and above BNB and XRP, respectively. Solana has jumped by more than 22% in the past week and more than 80% in the month to date. At the time of writing, SOL price was trading 0.90% lower at $93.10.

Catalysts Behind SOL’s Rally

Solana price has been on a strong bull run over the past few days, rocketing to its highest level in 20 months as the network benefits from the substantial activity and strong interest in memecoins. The SOL token, the native digital asset of the high-performance blockchain platform Solana, has shown some serious strength over the past few weeks, outperforming all the altcoins in the market.

The recent surge in the Solana price has been linked to heightened on-chain activities on the Solana blockchain. Notably, the ongoing hype for the blockchain’s speedy transactions, cheap fees, and a lottery of meme coin issuances has buoyed SOL’s on-chain activity. Metrics have revealed that Solana has been the strongest draw among on-chain traders, with trading volumes and network fees outperforming Ethereum- the largest altcoin by market cap.

Cited figures provided by DeFi aggregator DeFiLlama…

Altcoins

Solana Price Breaches $60 Amid a Symphony of Bullish Indicators

Solana price has jumped more than 8% over the past week, breaching the important level of $60. At the time of writing, Solana was trading 3% higher at $61.07. The asset’s total market cap has climbed to $25.9 billion over the past week, ranking it the 6th largest cryptocurrency after XRP. The total volume of SOL traded over the last day has declined by 8%.

SOL’s Bullish Cues

Solana’s price has been among the best-performing cryptocurrencies this year amid continuous growth. The “Ethereum killer” has consistently impressed investors throughout the year on the back of a resurgence in bullishness, which saw SOL’s price climb more than 513% in the year to date. Institutional investors have also shared the bullish sentiment, making Solana their most preferred altcoin.

In the week ending November 24, Solana recorded inflows worth nearly $3.5 million, significantly more than the other altcoins’ inflows combined. The asset’s monthly inflows were higher at $40.2 million, lower than Ethereum’s $99.6 million inflows in the same period. Other altcoins, including Litecoin and Ethereum, noted significant outflows, making Solana nearly half of the home for DeFi. This implies that when it comes to institutions, Solana is currently the best-performing altcoin with the potential of a long-term rally much higher than other digital assets.

Notably, the Solana DeFi ecosystem accomplished a significant milestone earlier this week. Its Total Value Locked (TVL) hit a new yearly peak of over $655 million,…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange