featured

A Blockchain Project that is Finally Solving the Issues that Payment Institutions Have Been Hiding for Years

When a buyer makes any type of financial transaction, they are interacting with a complex web of institutions, trusted 3rd parties, and payment gateways in order for their payment to be processed. It may seem like it takes a while for an ACH payment to be processed (3-5 days), but this is nothing compared to the 60-90 days that some businesses must wait in order to get their payments. Aside from the significant wait times of these transactions, these payments face exorbitant transaction fees, which can be upwards of 30% for application developers.

With all of these downsides, it’s a wonder why people still use these systems, and the reality is that 3rd party institutions have an effective monopoly on processing these payments. Only banks and specific payment processing companies like PayPal can deal with these transactions and as such, there’s limited competition leading to our problem: high fees and lengthy payment cycles.

The fees and the time requirement are a result of the complexities present in the status quo, which require large amounts of overhead and a variety of human forms and authentications. While these systems might have been the best alternative a decade ago, now we are equipped with better solutions through decentralized architectures.

Efficiency through Decentralization

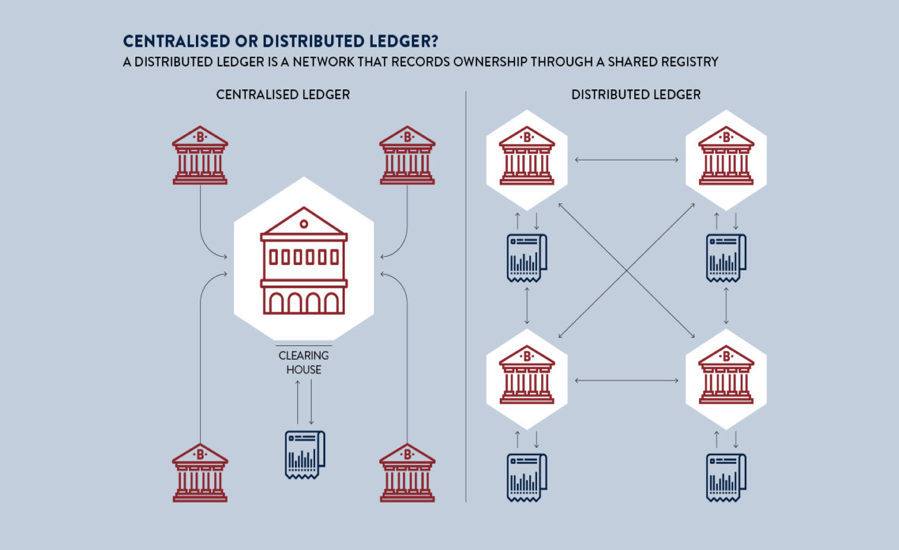

Decentralization delegates the authority to authenticate transactions to the participants. This type of system gives power to the individual actors and creates an infrastructure that requires lower overhead as it grows. Decentralization presents a promising answer to these inefficiencies, however, there still remains an issue with integrating them into the centralized infrastructure we are surrounded with.

Solution

OPEN Platform is a blockchain-agnostic architecture built to put a decentralized form of payment processing in the hands of the applications and developers that need it the most. Unlike the other cryptocurrency payment methods that still rely on centralized payment gateways, OPEN utilizes a payment platform that is completely decentralized.

This provides a more efficient form of interaction, unique from the centralized payment gateways that the majority of other crypto-payment processors use.

The OPEN Solution utilizes a novel architecture that enables developers to set-up decentralized payment gateways for in-app purchases in minutes and takes advantage of the speed and efficiency of a decentralized system. With OPEN Platform, transaction fees are practically eliminated and liquidity is at the hands of the developer.

Targeting Application Developers

Compromised of a team of respected app developers and founders with millions of downloads under their belts, and through their experiences in mobile app development, the OPEN team has seen first hand the high transaction fees and long payment delays that plague the industry.

It is for this reason that the OPEN solution has been targeted for applications, but that is only the start of what this decentralized payment gateway system can do.

Looking to the future

To keep updated on the upcoming OPEN token sale and to discover what the team is up to, visit their website, take a peek at their blog, and chat with them on their Telegram channel!

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency.

Crypto

BNB Price Surges Past $300, Faces Crucial $339 Hurdle: What’s Next?

BNB price has noted significant gains over the past few days, surging past the psychological resistance of $300. The native cryptocurrency of the Binance Exchange has surpassed Solana to regain its position as the fourth-largest cryptocurrency by market cap. The digital currency has been rallying lately with a 7-day profit of more than 15%. Additionally, BNB has clocked a phenomenal gain of 38% in the month to date.

Binance Coin Outlook

BNB price has been on a strong bull run for the past week, breaking out of its consolidation. Even so, the asset has experienced a correction in its uptrend over the past 24 hours but remains above the crucial level of $300. BNB’s total market cap has decreased by 4% over the past day to $48 billion, while the total volume of the asset traded over the same period dipped by about 15%.

Over the past year, Binance Coin has had to cope with Fear, Uncertainty, and Doubt (FUD) on the back of the regulatory troubles of its underlying exchange. Earlier, the BNB price touched a low of $223.50, a few days after its former CEO, Changpeng Zhao, pleaded guilty to money laundering charges. However, the cryptocurrency has managed to rebound 46% in value since then.

The recent price rally has been associated with various positive developments in the Binance ecosystem, including the Introduction of the Isolated Margin Auto-Transfer Mode. This feature enables…

Altcoins

Solana Price Surges Beyond $100, Dethroning Ripple and BNB To Secure Fourth Place

Solana price performance in recent times has been remarkable, surpassing Ripple and Binance Coin to become the fourth-largest cryptocurrency by market cap. The SOL price breached the critical level of $100 for the first time since April 2022 over the weekend to imbue optimism among investors. However, the altcoin has corrected by 7%, suggesting that the market is overheated. At the time of writing, the ‘Ethereum killer’ was trading slightly lower at $111.60.

SOL Outlook

Solana price has made a significant recovery over the past few weeks, climbing above the psychological level of $100. The altcoin has been one of the best-performing assets this year, extending its year-to-date gains to more than 1,025%, with more gains recorded in the past month alone. However, even with such growth, analysts have noted that Solana has a bleak chance of topping its ATH of $260.

The reason behind this is the increase in supply relative to its value. In November 2021, when the Solana price hit its all-time high of $260, its total market capitalization was around $78 billion. Despite the value of the crypto asset being less than half of what it was at the top, its market cap is currently hovering near $50 billion.

This has been brought about by the increase in the Solana supply by more than 100 million SOL over the past two years. According to some analysts, for the altcoin to retest $260, its…

Altcoins

Solana Price Skyrockets to 20-Month Peak Amidst Memecoin Frenzy

Solana price has noted significant gains over the past few weeks, climbing to its highest level since April 2022. The ‘Ethereum Killer’ almost topped the crucial level of $100 on Friday, before pulling back slightly. The asset’s recent surge has catapulted Solana’s total market cap to $39.6 billion, ranking 5th after and above BNB and XRP, respectively. Solana has jumped by more than 22% in the past week and more than 80% in the month to date. At the time of writing, SOL price was trading 0.90% lower at $93.10.

Catalysts Behind SOL’s Rally

Solana price has been on a strong bull run over the past few days, rocketing to its highest level in 20 months as the network benefits from the substantial activity and strong interest in memecoins. The SOL token, the native digital asset of the high-performance blockchain platform Solana, has shown some serious strength over the past few weeks, outperforming all the altcoins in the market.

The recent surge in the Solana price has been linked to heightened on-chain activities on the Solana blockchain. Notably, the ongoing hype for the blockchain’s speedy transactions, cheap fees, and a lottery of meme coin issuances has buoyed SOL’s on-chain activity. Metrics have revealed that Solana has been the strongest draw among on-chain traders, with trading volumes and network fees outperforming Ethereum- the largest altcoin by market cap.

Cited figures provided by DeFi aggregator DeFiLlama…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange