Bitcoin

Should your business accept cryptocurrency?

Along with Brexit, Bitcoin was one of the biggest news stories of 2017. The value of this previously low-profile phenomenon brought it very much into the public eye. It’s amazing that it had taken almost a whole decade for something that was first launched in 2009 to reach the public consciousness – and it took its meteoric rise in value to help it break through as big news.

First of all – what is cryptocurrency? Well, it’s a digital currency that uses encryption to regulate its use and generate its release. Cryptocurrency uses a technology called blockchain to keep a log of every transaction – and this prevents the same coin being spent twice by the same person. However, at heart, it is also a currency just like the pound, dollar or euro – it’s just not regulated by any bank, government or financial authority.

Bitcoin is the leading brand of cryptocurrency. It operates by using peer-to-peer exchanges which match buyers with sellers, who set their own price and methods of payment. If you want to buy Bitcoin, you must first own a digital wallet. Then you’ll need to find a recommended exchange platform, such as Coinbase, before choosing the right Bitcoin trader based on the kind of deals they’re offering. Due to the value of Bitcoin skyrocketing in 2018, even just 0.01 of a Bitcoin will set you back hundreds, if not thousands of pounds.

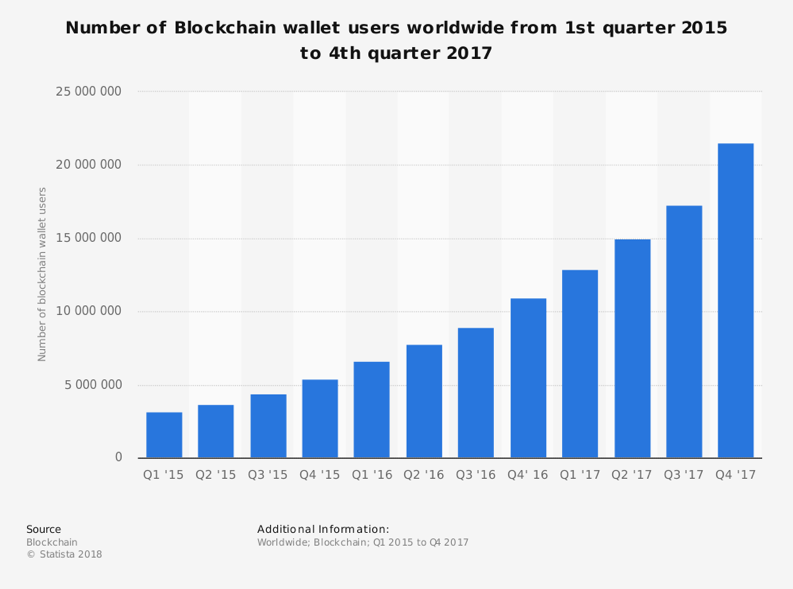

In fact, the original aim was to create a payment method that would be free of all government or financial authority regulation bringing with it a whole number of advantages that fiat currencies simply couldn’t offer. That’s been attractive to many – therefore the number of wallet users has grown exponentially.

Naturally, as cryptocurrencies start to gain more traction they are also starting to attract the big financial institutions who they were originally designed to side-track. For most, it’s the blockchain technology that interests them most and it’s likely that many will be incorporating this into their own systems in years to come.

While Bitcoin is the leader of the cryptocurrency pack, it’s by no means the only player. For example, Ethereum is seen as a platform which has a wider range of applications than Bitcoin, compared to just financial ones. Then there’s Ripple, which was started back in 2004 as a way for users to get around the immense amount of computer power needed to complete Bitcoin transactions. Another alternative to Bitcoin is Petro, which was created in Venezuela. Unlike Bitcoin, Petro is a sovereign currency backed by oil prices and can be exchanged for its equivalent in other cryptocurrencies.

Which businesses are using bitcoin?

Gradually, more businesses have started to come on board by accepting mainly Bitcoin, but other cryptocurrencies as well. For example, giants like Microsoft, Expedia and Paypal already accept it and so do many smaller places, particularly ones whose prime customers are the millennials – who are the perfect demographic to embrace the new currency. Bitcoin can also be exchanged for Nike, Amazon and Walmart vouchers shopping app Gyft.

Gradually, more businesses have started to come on board by accepting mainly Bitcoin, but other cryptocurrencies as well. For example, giants like Microsoft, Expedia and Paypal already accept it and so do many smaller places, particularly ones whose prime customers are the millennials – who are the perfect demographic to embrace the new currency. Bitcoin can also be exchanged for Nike, Amazon and Walmart vouchers shopping app Gyft.

But retailers aside, Bitcoin has been seen as attractive to many types of businesses and industries. Some banks are known to be experimenting with blockchain, which holds the infrastructure of cryptocurrency together. These include the likes of HSBC and Goldman Sachs, which operate all over the world, as well as the national banks of Canada, Australia, and India.

Blockchain has also been used by companies in the hotel industry, as a way to refine their internal processes and revenue management. Industry giant TUI Group is one of the companies known to be experimenting in this way.

Finally, some healthcare providers are looking into how blockchain can support the security of supply chain management – cutting down time delays and human errors, as well as helping providers share data more effectively.

So in this context of a world that is gradually embracing cryptocurrencies, should you too?

There are a number of arguments for and against which we’ll go through here.

Advantages

- More choice for your customers

We all know the expression the ‘customer is king’ and this has never been truer than today when consumer demands for personalization and immediacy are at an all-time high. So the more payment options that you can offer, the better for you both. With an estimated 300,000 new bitcoin wallets being opened each month it’s certainly a trend that’s worth looking into for your business too. Because it could be that, before you know it, businesses that don’t accept cryptocurrencies could soon be the exception rather than the rule.

- Lower costs

For many businesses, the charges made by their banks are an appreciable overhead and one which they could well do without, especially when they can be as high as 5% on some transactions. But one of the many advantages of cryptocurrencies is that this figure is generally far lower and sometimes there are no charges at all. That’s because there’s no intermediary to pay.

- Faster transactions

Another bugbear of many businesses is just how long it can take for transactions to go through. Because even though we’re living in a 24/7 age many banks and financial organizations still stick to a fixed number of working days for payments to be made. But the blockchain technology behind cryptocurrencies means that they can be made in minutes instead. Admittedly, some currencies can take longer than others but even the slowest is far faster than most banks.

- Greater security

The nature of the blockchain means that all transactions are verified, secure and nonreversible. So if you’ve ever had a cheque bounce or a transaction fails to go through because of lack of funds this will never be a problem with a cryptocurrency. This could make a big difference to, for example, online casinos. At one point, online betting site SatoshiDice comprised half of all transactions on the Bitcoin network – and it made sense because it represented a much more secure way for winners to collect their jackpots than carrying cash.

- Ideal for cross-border payments

If you do business with other countries, then using a cryptocurrency will solve all of the issues you may face with exchange rates and bank fees for converting one fiat currency into another. Much like the advantage in terms of cutting costs, this has to be good news.

Disadvantages

So those are all the good things about going cryptocurrency, but there certainly are some disadvantages too. This is why even forward-thinking and innovative businesses like online casinos do not, by and large, accept them as a form of payment. Here’s why.

- Fluctuation in value

As we’ve seen, the value of cryptocurrencies can rise and fall rapidly so there’s always the danger that you can be caught on the wrong side of one of these dramatic drops. In fact, Bitcoin has dropped as much as 40% in a single day on previous occasions. Due to this unpredictable, uncontrollable nature, for customers, it’s a case of either hanging on until the value rises again or simply biting the bullet and accepting that you’re going to make a loss. Attracting customers with an unreliable income may one day have a negative impact on your business.

- The threat of regulation

At the moment, there are few regulations surrounding cryptocurrencies. But as they become more widely used, many governments are suggesting that regulations will need to be introduced. Until we know what these are likely to be it’s impossible to predict what this will mean for businesses. But the threat of them could be enough to make you think twice.

- The anonymity of your customers

For some, the anonymity of using cryptocurrencies is a large part of the appeal. But this can create an issue for businesses who need to know exactly who they’re dealing with. It’s this anonymity that has also led to cryptocurrencies gaining an unwanted reputation for being used for all kinds of shady or criminal activity online.

Taking the example of online casinos again, all gambling operators in the UK need to have a certain level of data on their customers – such as their age, email address, and occupation – to allow them to gamble. The players also have to prove they have sufficient funds, according to UK Gambling Commission regulation. Cryptocurrency, by contrast, offers no transparency, which puts online casinos off.

That’s why when you look at the payment options offered here by leading online casino 888casino, you’ll find that it allows a range of payment options – but not cryptocurrency.

- More complex accounting needs

While transactions in cryptocurrencies can be treated just like any cash exchange it will undoubtedly make accounting a more complex process, just as dealing in different currencies would. So this is another consideration that you will have to bear in mind.

So hopefully this has given you plenty to consider when you’re thinking about whether to start accepting cryptocurrencies. But one thing is definitely true and that is the more businesses that do start, the greater the momentum will be. And if a huge multi-billion sector like online casinos came on board it would certainly serve to catapult cryptocurrencies into the mainstream. Whether they will remains to be seen – but it’s safe to say that we can expect to see many more headlines about Bitcoin and the thousand other alt-coins in the months and years to come.

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Bitcoin

Bitcoin Price Dumps Below $41,000 Amid Uncertainty

Bitcoin price dumped hard on Monday, briefly slipping below $41,000, erasing gains recorded in the previous week. The premier cryptocurrency seems to have exhausted its recent rally propelled by industry vulnerabilities. At the time of writing, the world’s largest cryptocurrency was trading slightly lower at $41,385. Bitcoin’s total market cap has dipped by 2% over the past day, while the total volume of BTC tokens traded over the same period climbed by 58%.

Fundamentals

Bitcoin price has been facing retracements and a rollercoaster over the past few days after recently rocketing to a 20-month peak. On-chain data has suggested that many investors used the opportunity to take some profits, leading to a decline in the asset’s price.

Bitcoin’s price slump is mirrored in the wider crypto market, with the global crypto market cap decreasing by 1.85% over the past 24 hours to $1.55 trillion. The total crypto market volume has increased by 32% over the same period. The Crypto Fear and Greed Index has plunged from a level of extreme greed to a greed level of 70, suggesting a decline in risk appetite.

Ethereum, the largest altcoin by market capitalization, is currently trading at $2,167, down almost 3% for the day. Meme coins have been hit hard by the market slump, with Dogecoin and Shiba Inu down by more than 4% over the last day.

Last week on Thursday, cryptocurrency experts took notice of…

Bitcoin

Bitcoin Price is in Consolidation Mode Despite Market Optimism Post-Fed Decision

Bitcoin price edged lower on Thursday despite optimism in wider markets on the back of the Fed’s interest rate decision. The flagship cryptocurrency has been consolidating above the critical level of $42,000 after briefly topping $44,000, its highest level in 20 months. Bitcoin was trading 0.71% lower at $42,569 at press time. BTC’s total market cap has increased by more than 3% over the last day to $832 billion, while the total volume of the asset traded over the same period jumped by 22%.

Economic Outlook

Bitcoin price has been trading sideways over the past few days, suggesting a pause in its recent rally towards $45,000. The premier cryptocurrency has decreased by 4% in the past week but remains 15.22% higher in the month to date. The digital asset has staged a significant recovery this year after a torrid 2022 in which a string of scandals, including the collapse of FTX, led to a market meltdown, undermining the credibility of the sector.

The crypto market has been buoyed by the Fed’s latest interest rate decision. The US Federal Reserve on Wednesday held its key interest rate unchanged for the third consecutive time, in line with market expectations. With the easing of the inflation rate, members of the Federal Open Market Committee (FOMC) voted to keep the benchmark overnight borrowing rate in a targeted range between 5.25%-5.5%.

Additionally, the central bank indicated that three rate…

Bitcoin

Bitcoin Price Blasts $44K in Spectacular Surge as Spot Bitcoin ETF Approval Looms Large

Bitcoin price has been hovering above the $43,000 psychological level over the past two days amid anticipation about the potential approval of a spot bitcoin ETF. The flagship cryptocurrency has climbed more than 16% in the past week and nearly 170% in the year to date. Bitcoin’s total market cap has increased by nearly 5% over the past 24 hours to $858.9 billion, while the total volume of the token traded rose by 43%. The Bitcoin price was trading at $43,914 at press time.

Fundamentals

Bitcoin price has posted significant gains over the past few days, climbing to its highest level since April 2022, before the crash of a stablecoin that started a litany of company failures, pummeling crypto prices. The world’s largest cryptocurrency briefly topped the crucial level of $44,000 on Wednesday amid rising momentum despite being massively overbought.

According to analysts, with no spot bitcoin ETF approvals yet and the halving event five to six months away, the market is riding on FOMO. Capital has been flowing in the Bitcoin market amid enthusiasm that the launches of spot ETF will bring in billions of dollars of new investment into the crypto sector.

Investors have already started providing capital as seed money for ETF products. Notably, a recent report by CoinDesk showed that the world’s largest fund manager, BlackRock, received $100,000 in capital from a seed investor for its spot bitcoin exchange-traded fund…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange