Featured news

Fear & Greed Index Suggests A Bull in the Bitcoin Market?

As indicated by Justin Kwo, an analyst director from Bexplus, Cryptocurrency trading is a game of nerves and it cannot withstand the emotional behavior. Traders keep on changing their minds with the sudden and strong market fluctuations. This behavior reflects their psychological instability and prevailing sentiment in a particular time zone. However, in the Bitcoin market, traders’ emotions will determine their trading behaviors, which, therefore, affects the future trend of Bitcoin.

So, what is Fear and Greed Index?

Alternative.me has the most well-known and respected Bitcoin fear and greed index.

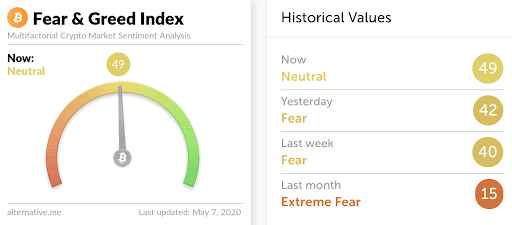

- Extreme fear can be a sign that investors are too worried. That could be a buying opportunity.

- When Investors are getting too greedy, that means the market is due for a correction.

To make it precise:

- When the index drops below 20 it indicates extreme fear.

- When the index rises above 60, it indicates extreme greed.

The result of Fear and Greed Index is calculated from the following aspects:

Volatility: the program marks wider fluctuations as a sign of fear

Market volume: if buying volumes increase significantly, the greed levels rise, too

Social media: the client monitors, gathers and counts posts on various hashtags, to see how many interactions they receive over certain time-frames

Dominance: when Bitcoin dominance rises, it indicates an increasing level of greed, and vice versa, when the dominance shrinks, it means that people get scared to invest in BTC.

Trends: the program pulls Google Trends data for various Bitcoin-related search queries and crunches those numbers, especially the change of search volumes.

Fear and Greed Index Signals A Bull Recently

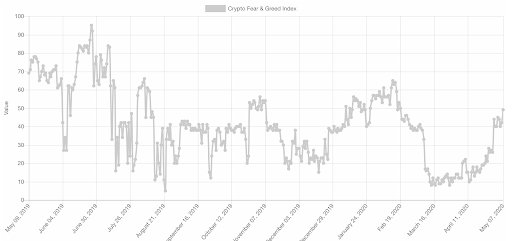

From the picture below, we can see that in the past 2 months approximately, the crypto Fear and Greed Index has been between “Extreme Fear” and “Fear” degrees. Amid the coming halving as well as Bitcoin has nearly doubled since the extreme low set back in mid-March, showing that this very well could be the disbelief rally is coming which may surges to new highs.

Take Advantage of Market Fluctuation and Double Profits

Though the Fear and Greed Index may indicate a bullish trend, there will be a lot of fluctuations. Make profits on these fluctuations, you can make great fortune before BTC skyrockets to $20,000 again.

Bexplus is one of the world-leading futures exchanges in the cryptocurrency area. It’s registered in Saint Vincent and the Grenadines, in late 2017. Bexplus offers 100x leverage perpetual contracts across all major trading pairs including BTC/USDT, ETH/USDT, LTC/USDT, XRP/USDT and EOS/USDT. With 100x leverage, traders can open a “short” or a “long” position of 100 BTC with only 1 BTC used as margin. If BTC price increases or decreases 10%, the profit would be 10 BTC, whereas without leverage, the profit would just be 0.1 BTC.

Win Up to 10 BTC in Bexplus

Up to 100% FREE BTC bonus will be sent to clients who deposit and trade futures contracts in Bexplus.

For example, deposit 10 BTC, you will get 20 BTC credited in your account.

For more details: https://www.bexplus.com/activity/cash_back

One of the richest traders on the planet Warren Buffet said, “Investors should remember that excitement and expenses are their enemies. And if they insist on trying to time their participation in equities, they should try to be fearful when others are greedy and greedy only when others are fearful.”

Remember the quote, you can make successful trades in Bexplus easily!

Crypto

BNB Price Surges Past $300, Faces Crucial $339 Hurdle: What’s Next?

BNB price has noted significant gains over the past few days, surging past the psychological resistance of $300. The native cryptocurrency of the Binance Exchange has surpassed Solana to regain its position as the fourth-largest cryptocurrency by market cap. The digital currency has been rallying lately with a 7-day profit of more than 15%. Additionally, BNB has clocked a phenomenal gain of 38% in the month to date.

Binance Coin Outlook

BNB price has been on a strong bull run for the past week, breaking out of its consolidation. Even so, the asset has experienced a correction in its uptrend over the past 24 hours but remains above the crucial level of $300. BNB’s total market cap has decreased by 4% over the past day to $48 billion, while the total volume of the asset traded over the same period dipped by about 15%.

Over the past year, Binance Coin has had to cope with Fear, Uncertainty, and Doubt (FUD) on the back of the regulatory troubles of its underlying exchange. Earlier, the BNB price touched a low of $223.50, a few days after its former CEO, Changpeng Zhao, pleaded guilty to money laundering charges. However, the cryptocurrency has managed to rebound 46% in value since then.

The recent price rally has been associated with various positive developments in the Binance ecosystem, including the Introduction of the Isolated Margin Auto-Transfer Mode. This feature enables…

Altcoins

Solana Price Surges Beyond $100, Dethroning Ripple and BNB To Secure Fourth Place

Solana price performance in recent times has been remarkable, surpassing Ripple and Binance Coin to become the fourth-largest cryptocurrency by market cap. The SOL price breached the critical level of $100 for the first time since April 2022 over the weekend to imbue optimism among investors. However, the altcoin has corrected by 7%, suggesting that the market is overheated. At the time of writing, the ‘Ethereum killer’ was trading slightly lower at $111.60.

SOL Outlook

Solana price has made a significant recovery over the past few weeks, climbing above the psychological level of $100. The altcoin has been one of the best-performing assets this year, extending its year-to-date gains to more than 1,025%, with more gains recorded in the past month alone. However, even with such growth, analysts have noted that Solana has a bleak chance of topping its ATH of $260.

The reason behind this is the increase in supply relative to its value. In November 2021, when the Solana price hit its all-time high of $260, its total market capitalization was around $78 billion. Despite the value of the crypto asset being less than half of what it was at the top, its market cap is currently hovering near $50 billion.

This has been brought about by the increase in the Solana supply by more than 100 million SOL over the past two years. According to some analysts, for the altcoin to retest $260, its…

Altcoins

Solana Price Skyrockets to 20-Month Peak Amidst Memecoin Frenzy

Solana price has noted significant gains over the past few weeks, climbing to its highest level since April 2022. The ‘Ethereum Killer’ almost topped the crucial level of $100 on Friday, before pulling back slightly. The asset’s recent surge has catapulted Solana’s total market cap to $39.6 billion, ranking 5th after and above BNB and XRP, respectively. Solana has jumped by more than 22% in the past week and more than 80% in the month to date. At the time of writing, SOL price was trading 0.90% lower at $93.10.

Catalysts Behind SOL’s Rally

Solana price has been on a strong bull run over the past few days, rocketing to its highest level in 20 months as the network benefits from the substantial activity and strong interest in memecoins. The SOL token, the native digital asset of the high-performance blockchain platform Solana, has shown some serious strength over the past few weeks, outperforming all the altcoins in the market.

The recent surge in the Solana price has been linked to heightened on-chain activities on the Solana blockchain. Notably, the ongoing hype for the blockchain’s speedy transactions, cheap fees, and a lottery of meme coin issuances has buoyed SOL’s on-chain activity. Metrics have revealed that Solana has been the strongest draw among on-chain traders, with trading volumes and network fees outperforming Ethereum- the largest altcoin by market cap.

Cited figures provided by DeFi aggregator DeFiLlama…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoIs Litecoin (LTC) Changing Its Game Plan By Going For Mass Adoption?