Bitcoin

Is Bex500 an alternative to BitMEX?

An all around review of Bex500

Bex500 is a young but rapid-growing exchange, less adversarial than BitMEX, but with higher leverage than Binance, Bex500 has enough strings to attract many crypto traders.

Those dissatisfied with the old exchange, may find Bex500 exchange with a stable system with no manipulation or “overload”, pleasant UX, user-friendly tool kits, and around-clock customer service.

Bex500 says they are making crypto margin trading “easier” and giving you a better return.

Can they really achieve that? We conduct a comprehensive review as below to see if it is a trustworthy exchange

Question 1. What features does Bex500 have?

Bex500 offers perpetual BTC futures as well as three other cryptos including ETH, XRP and LTC, all paired against USDT. You may find Bex500 doing a good job aggregating most important features traders need for a robust trading experience with better return.

-A fair trade with no overload

Many traders are familiar with “overload” problem, which disables placing orders in peak trading times. It is suspected to be insider manipulations by exchanges which can cost users entire portfolios.

Bex500, with its unmatched TPS (claimed to be over 10,000 orders per second), ensures that the trading machines will not overload, even during peak hours. As a result, all traders can close their positions as intended despite volatility. There is no use of systematic problem as an excuse.

-Trading toolkits

You will find an extremely concise trading interface, however after first try, you will realize their trading toolkits are even more comprehensive and useful than others.

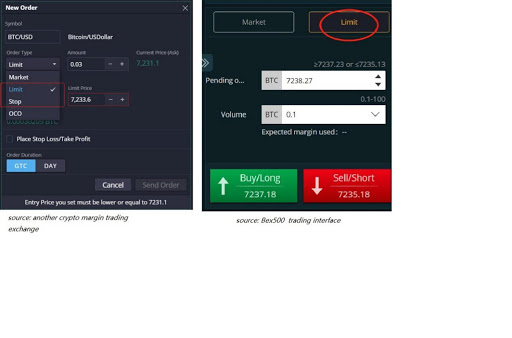

- Intelligent limit order

Most crypto exchanges separate limit orders to “buy/sell limit” and “buy/sell stop” for traders to place the order triggered in expected prices.

In Bex500, it is far easier. Just input the price you wish to buy or sell; the system will automatically trigger the buy/sell order at the price you want. For example, btc current price is at $7,000, but you think if will go down to $6,000 and then go up, you can just input $6,000 in limit order, then click “buy”. The order will be triggered at $6,000 automatically.

- Stop-Loss/Take-Profit Follow-Up Orders.

This is my favorite feature. Traders can set up a maximum loss or an awaited profit in numbers in the order you set, so you don’t have to later set up numerous additional trades just to act as take profit and stop loss.

- Expected Margin Calculation.

Traders can see how much he/she would earn at any time using a simple calculation tool.

Seems like, crypto trading has been easier in Bex500, they did not reinvent the wheel here, but they create an exchange with every tool you need to optimize the trading at fingertips. It saves you from unnecessary time wasted in other exchanges to achieve the same function.

-Advanced risk management tool

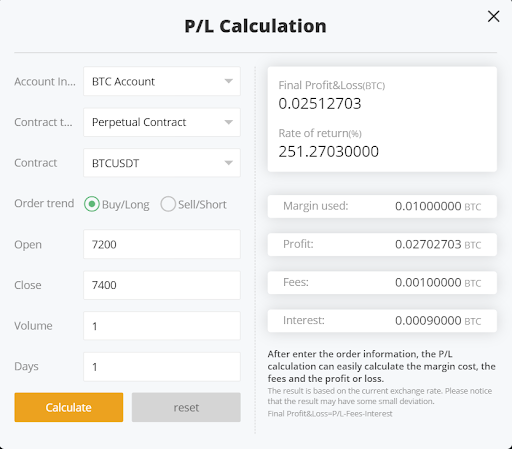

- Profit calculator.

This is a handy tool for risk management, and first of its kind.

Before placing orders, traders can use the calculator to have a clear picture about his costs and gains. It is helpful in position control and risk management.

For newbies, you can use the calculator to make sure you have a clear understanding of trading rules.

- Locked Position. Traders can set up positions of equal size on the same account and on the same instrument, but in opposite directions. Bex500 seems to be the only crypto exchange with a “locked position” feature available.

- EA trading for professionals

For professionals, the Bex500 Crypto Exchange offers MT5 trading through both web interface and mobile applications on iOS and Android. The MetaQuotes trading system is frequently used by the banks and futures brokers in high-frequency trading applications. Advanced traders also have the option of applying EA trading or program trading to Bex500.

-Only crypto exchange with real-world commodities

In the crypto exchange sphere, Bex500 offers trades with USDT, BTC, ETH, LTC, and XRP. For the commodity traders, the positions in silver (XAG/USD), gold (XAU/USD), and oil (WTI and BRN) are available.

For at-risk traders, Double Contracts on BTC, ETH, LTC, and XRP are available in a one-click mode. The leverage can be up to 200x in double contract.

Question 2. Is it safe? Can it be trusted?

Futures trading is the best way of engaging the Bitcoin markets without having to acknowledge the ownership and storage responsibilities.

We are interested in this question most and examine BEX500 in every security-related policies and infrastructure.

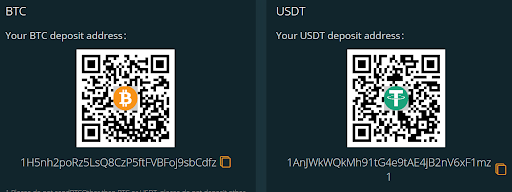

-Segregated Client Account & Cold-wallet Storage

In BEX500, the deposits and Bitcoin futures are held in a segregated customer account.

Each client receives their unique address for BTC & USDT, deposits into the platform will be secured in cold-wallet storage, where they can secure all the Bitcoin keys off from any known server and computers and store them physically on the device which is not connected to the internet.

BEX500 applies “multi-signature encryption” & “manual review” over transfer and withdrawal.

“multi-signature encryption” prevents any individual from transferring the crypto assets without permission; “manual review” applies to large amount withdrawal to protect client’s funds.

-SSL Encryption

SSL provides a secure channel between two machines or devices operating over the internet or an internal network.

SSL protects data transmissions, and prevents phishing attack; they ensure the server you’re connected to is actually the correct server. With SSL, it can assure you with data integrity, which means that the data that is requested or submitted is what is actually delivered.

You can know that BEX500 is secured with SSL encryption when a padlock is displayed.

Therefore, it is completely safe to visit, and trade on the platform.

-Information Encrypted and Stored on Server

Confidential information about trading data and personal information, in BEX500 is all encrypted and stored on the server.

Access to the server is restricted and regulated by specific executives to ensure security.

-Firewall to prevent visits from suspicious ports and network protocols

BEX500 sets up firewall to prevent suspicious visits from risky ports and network, which fences the site off from cyber criminals in the first place.

AWS WAF seem to be used to block common attack patterns, such as SQL injection or cross-site scripting.

– DDOS Protection

Bex500‘s detailed approach to security issues makes it look extremely attractive. High-level DDoS-protection, as well as 2FA-authorization (via mobile phone and e-mail), are implemented on this platform.

Their network capacity is 15x bigger than the largest DDoS attack ever recorded. With 30 Tbps of capacity, they can defend traders from any modern distributed attack, including those targeting DNS infrastructure.

Question 3. Areas for improvements?

No exchange is perfect, we find a few things we think that warrant improvements

- Poor translation

- Only 4 types of bitcoin trading pairs supported

- APP under development

- No fiat currency gateway

The lack of mobile app is especially frustrating for those traders who can not be behind PC the whole day. The good news is, Bex500 plans on releasing app within December. We will update on it later.

Conclusions

Should you use Bex500? We encourage you to give it a try starting with small amount.

We have found Bex500 to be secured, and user-friendly. Most importantly, they revolutionized the derivative industry with easier trading interface, a fair mechanism with no price manipulation and more advanced professional risk management tools. They also have other highlights including

- Multiple bonus programs

- No KYC

- No withdrawal fees

- Very low service (transactional) fees

- Helpful tutorials

They are prepared to offer an alternative to other leading exchanges in crypto derivatives market.

Warning ⚡️: Trading leveraged futures products is incredibly risky. Make sure that you practice adequate risk management

Bitcoin

Bitcoin Price Dumps Below $41,000 Amid Uncertainty

Bitcoin price dumped hard on Monday, briefly slipping below $41,000, erasing gains recorded in the previous week. The premier cryptocurrency seems to have exhausted its recent rally propelled by industry vulnerabilities. At the time of writing, the world’s largest cryptocurrency was trading slightly lower at $41,385. Bitcoin’s total market cap has dipped by 2% over the past day, while the total volume of BTC tokens traded over the same period climbed by 58%.

Fundamentals

Bitcoin price has been facing retracements and a rollercoaster over the past few days after recently rocketing to a 20-month peak. On-chain data has suggested that many investors used the opportunity to take some profits, leading to a decline in the asset’s price.

Bitcoin’s price slump is mirrored in the wider crypto market, with the global crypto market cap decreasing by 1.85% over the past 24 hours to $1.55 trillion. The total crypto market volume has increased by 32% over the same period. The Crypto Fear and Greed Index has plunged from a level of extreme greed to a greed level of 70, suggesting a decline in risk appetite.

Ethereum, the largest altcoin by market capitalization, is currently trading at $2,167, down almost 3% for the day. Meme coins have been hit hard by the market slump, with Dogecoin and Shiba Inu down by more than 4% over the last day.

Last week on Thursday, cryptocurrency experts took notice of…

Bitcoin

Bitcoin Price is in Consolidation Mode Despite Market Optimism Post-Fed Decision

Bitcoin price edged lower on Thursday despite optimism in wider markets on the back of the Fed’s interest rate decision. The flagship cryptocurrency has been consolidating above the critical level of $42,000 after briefly topping $44,000, its highest level in 20 months. Bitcoin was trading 0.71% lower at $42,569 at press time. BTC’s total market cap has increased by more than 3% over the last day to $832 billion, while the total volume of the asset traded over the same period jumped by 22%.

Economic Outlook

Bitcoin price has been trading sideways over the past few days, suggesting a pause in its recent rally towards $45,000. The premier cryptocurrency has decreased by 4% in the past week but remains 15.22% higher in the month to date. The digital asset has staged a significant recovery this year after a torrid 2022 in which a string of scandals, including the collapse of FTX, led to a market meltdown, undermining the credibility of the sector.

The crypto market has been buoyed by the Fed’s latest interest rate decision. The US Federal Reserve on Wednesday held its key interest rate unchanged for the third consecutive time, in line with market expectations. With the easing of the inflation rate, members of the Federal Open Market Committee (FOMC) voted to keep the benchmark overnight borrowing rate in a targeted range between 5.25%-5.5%.

Additionally, the central bank indicated that three rate…

Bitcoin

Bitcoin Price Blasts $44K in Spectacular Surge as Spot Bitcoin ETF Approval Looms Large

Bitcoin price has been hovering above the $43,000 psychological level over the past two days amid anticipation about the potential approval of a spot bitcoin ETF. The flagship cryptocurrency has climbed more than 16% in the past week and nearly 170% in the year to date. Bitcoin’s total market cap has increased by nearly 5% over the past 24 hours to $858.9 billion, while the total volume of the token traded rose by 43%. The Bitcoin price was trading at $43,914 at press time.

Fundamentals

Bitcoin price has posted significant gains over the past few days, climbing to its highest level since April 2022, before the crash of a stablecoin that started a litany of company failures, pummeling crypto prices. The world’s largest cryptocurrency briefly topped the crucial level of $44,000 on Wednesday amid rising momentum despite being massively overbought.

According to analysts, with no spot bitcoin ETF approvals yet and the halving event five to six months away, the market is riding on FOMO. Capital has been flowing in the Bitcoin market amid enthusiasm that the launches of spot ETF will bring in billions of dollars of new investment into the crypto sector.

Investors have already started providing capital as seed money for ETF products. Notably, a recent report by CoinDesk showed that the world’s largest fund manager, BlackRock, received $100,000 in capital from a seed investor for its spot bitcoin exchange-traded fund…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoIs Litecoin (LTC) Changing Its Game Plan By Going For Mass Adoption?