Altcoins

Litecoin Price Multi-Timeframe Analysis Points to More Gains

Litecoin price moved sideways on Monday as investors embraced a risk-off sentiment. The coin was trading at $97.24, which was a few points below the year-to-date high of $102. Litecoin has been one of the best-performing big-cap cryptocurrencies in the world. Unlike most coins, its rally started in June last year when it dropped to a low of $47.85.

Litecoin price analysis (1D chart)

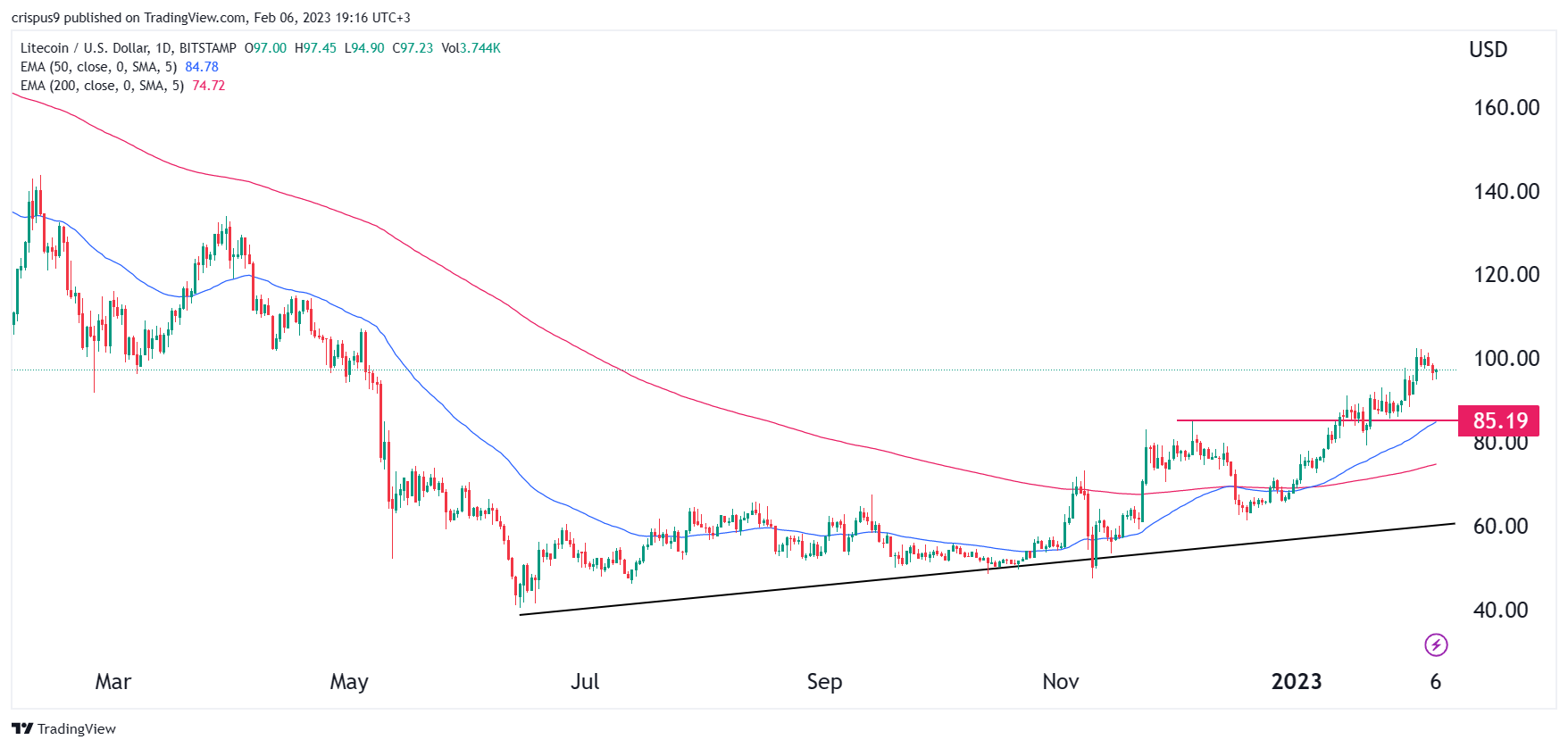

The LTC/USD price has been in a strong rally in the past few months. This rally was validated when the coin moved formed a golden cross pattern. In financial trading, this pattern forms when the 50-day and 200-day moving averages makes a bullish crossover. The cross happened on December 16.

In the past few months, Litecoin has moved above several important resistance levels. The most recent was when it moved above the key level at $85.20, the highest point on December 6. It also moved above the psychological level of $100.

The coin has also jumped above the ascending trendline shown in black. Therefore, I suspect that the bullish trend will continue as Litecoin’s hash rate continues rising. It has jumped to an all-time high, signaling that the network remains significantly healthy.

If this trend continues, Litecoin will likely continue rising as buyers target the key resistance point at $120, which is about 23% above the current level.

LTC/USD price 4H analysis

Turning to the 4H chart, we see that the LTC/USD price has formed an ascending channel shown in black. The price has moved slightly below the middle line of this channel. It is also consolidating at the 25-day moving averages. Therefore, while the coin has made a slight pullback, I suspect that the bullish trend will continue in the coming days.

If this is accurate, the coin will likely retest the important resistance level at $102.16, the highest point this year. A move above that resistance point will see the Litecoin price continue soaring, with the key level to watch being at $120. This view is in line with that on the daily chart.

Altcoins

Solana Price Surges Beyond $100, Dethroning Ripple and BNB To Secure Fourth Place

Solana price performance in recent times has been remarkable, surpassing Ripple and Binance Coin to become the fourth-largest cryptocurrency by market cap. The SOL price breached the critical level of $100 for the first time since April 2022 over the weekend to imbue optimism among investors. However, the altcoin has corrected by 7%, suggesting that the market is overheated. At the time of writing, the ‘Ethereum killer’ was trading slightly lower at $111.60.

SOL Outlook

Solana price has made a significant recovery over the past few weeks, climbing above the psychological level of $100. The altcoin has been one of the best-performing assets this year, extending its year-to-date gains to more than 1,025%, with more gains recorded in the past month alone. However, even with such growth, analysts have noted that Solana has a bleak chance of topping its ATH of $260.

The reason behind this is the increase in supply relative to its value. In November 2021, when the Solana price hit its all-time high of $260, its total market capitalization was around $78 billion. Despite the value of the crypto asset being less than half of what it was at the top, its market cap is currently hovering near $50 billion.

This has been brought about by the increase in the Solana supply by more than 100 million SOL over the past two years. According to some analysts, for the altcoin to retest $260, its…

Altcoins

Solana Price Skyrockets to 20-Month Peak Amidst Memecoin Frenzy

Solana price has noted significant gains over the past few weeks, climbing to its highest level since April 2022. The ‘Ethereum Killer’ almost topped the crucial level of $100 on Friday, before pulling back slightly. The asset’s recent surge has catapulted Solana’s total market cap to $39.6 billion, ranking 5th after and above BNB and XRP, respectively. Solana has jumped by more than 22% in the past week and more than 80% in the month to date. At the time of writing, SOL price was trading 0.90% lower at $93.10.

Catalysts Behind SOL’s Rally

Solana price has been on a strong bull run over the past few days, rocketing to its highest level in 20 months as the network benefits from the substantial activity and strong interest in memecoins. The SOL token, the native digital asset of the high-performance blockchain platform Solana, has shown some serious strength over the past few weeks, outperforming all the altcoins in the market.

The recent surge in the Solana price has been linked to heightened on-chain activities on the Solana blockchain. Notably, the ongoing hype for the blockchain’s speedy transactions, cheap fees, and a lottery of meme coin issuances has buoyed SOL’s on-chain activity. Metrics have revealed that Solana has been the strongest draw among on-chain traders, with trading volumes and network fees outperforming Ethereum- the largest altcoin by market cap.

Cited figures provided by DeFi aggregator DeFiLlama…

Altcoins

Solana Price Breaches $60 Amid a Symphony of Bullish Indicators

Solana price has jumped more than 8% over the past week, breaching the important level of $60. At the time of writing, Solana was trading 3% higher at $61.07. The asset’s total market cap has climbed to $25.9 billion over the past week, ranking it the 6th largest cryptocurrency after XRP. The total volume of SOL traded over the last day has declined by 8%.

SOL’s Bullish Cues

Solana’s price has been among the best-performing cryptocurrencies this year amid continuous growth. The “Ethereum killer” has consistently impressed investors throughout the year on the back of a resurgence in bullishness, which saw SOL’s price climb more than 513% in the year to date. Institutional investors have also shared the bullish sentiment, making Solana their most preferred altcoin.

In the week ending November 24, Solana recorded inflows worth nearly $3.5 million, significantly more than the other altcoins’ inflows combined. The asset’s monthly inflows were higher at $40.2 million, lower than Ethereum’s $99.6 million inflows in the same period. Other altcoins, including Litecoin and Ethereum, noted significant outflows, making Solana nearly half of the home for DeFi. This implies that when it comes to institutions, Solana is currently the best-performing altcoin with the potential of a long-term rally much higher than other digital assets.

Notably, the Solana DeFi ecosystem accomplished a significant milestone earlier this week. Its Total Value Locked (TVL) hit a new yearly peak of over $655 million,…

-

Blogs7 years ago

Blogs7 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs7 years ago

Blogs7 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs7 years ago

Blogs7 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs7 years ago

Blogs7 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss7 years ago

Don't Miss7 years agoRipple’s five new partnerships are mouthwatering

-

Blogs7 years ago

Blogs7 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs7 years ago

Blogs7 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs7 years ago

Blogs7 years agoIs Litecoin (LTC) Changing Its Game Plan By Going For Mass Adoption?