Hot Updates

NEXO Token Holders Receive US$2,409,574.87 in Dividends

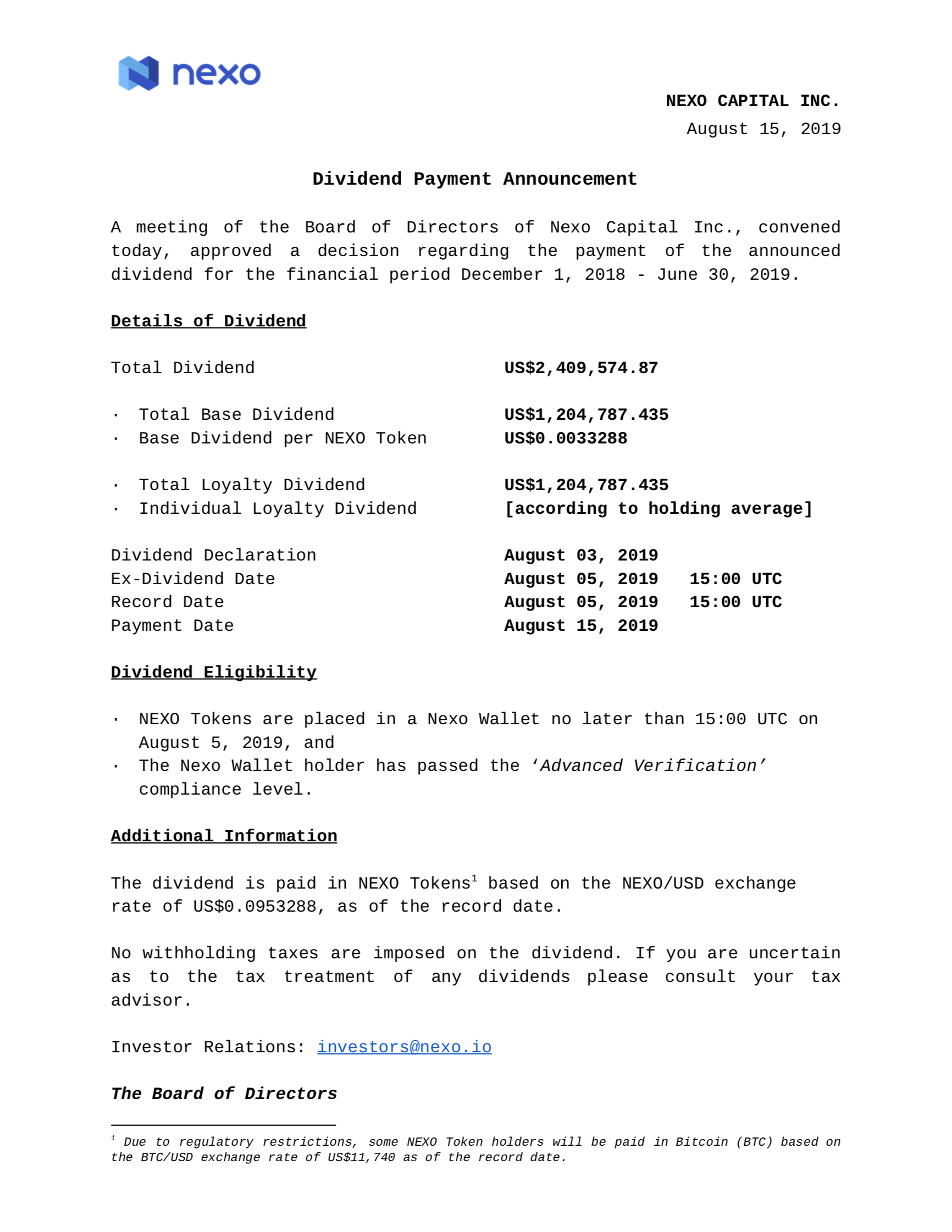

Nexo is delighted to announce that the Dividend Payment of US$2,409,574.87 to NEXO Token Holders scheduled for August 15, 2019, is now complete.

NEXO Token Holders can simply log in to the Nexo Mobile App to view the dividend that has been credited to their wallets.

The annualized dividend yield is an impressive 12.73%, which surpasses all of the highest dividend-paying stocks in the S&P 500.

Nexo’s innovative dividend-distribution methodology rewards long-term investor confidence and also decreases market volatility around ex-dividend dates. It consists of two parts – the Nexo Base Dividend and the Nexo Loyalty Dividend, each making up 50% of the total amount in the current distribution.

Since the April 2018 launch, Nexo has seen exorbitant growth of the registered user base to 250,000+ and has gained significant market share, making Nexo the market leader in Crypto FinTech.

Since the April 2018 launch, Nexo has seen exorbitant growth of the registered user base to 250,000+ and has gained significant market share, making Nexo the market leader in Crypto FinTech.

Nexo’s impeccable and innovative marketing strategies, unrivaled customer support, combined with a substantial upswing in crypto asset prices across the board has ensured unprecedented demand for Nexo’s signature Instant Crypto Credit Lines™.

This has given us the means to further give back to the community, by allowing investors from around the world to generate 8% with Nexo’s high-yielding ‘Earn Interest’ product.

The launch of the Nexo Mastercard, the acquisition of commercial banking capabilities and bridging the gap between traditional and decentralized finance all ensure Nexo’s lead in the market and the sustainability of our long-term growth rates.

The entire Nexo Team is dedicated to making sure that our savvy investors earn ever-larger returns on their investment.

In addition to regular and growing dividend payouts, the team is working on the NEXO Token Utilities 2.0 that will bring a plethora of new amazing utility features, including, but not limited to:

- Better interest rates on all Nexo products

- Premium features and functionalities

- Higher Nexo Card Cashback

- Exclusive Nexo Card designs

- Affiliate commissions

- Invite-only access to products and events

This Utilities 2.0 overhaul ensures a continuously growing demand and appreciation of the NEXO Token.

To participate in Nexo’s financial success, make sure to purchase NEXO Tokens on Huobi, the community’s most preferred cryptocurrency exchange.

Thank everyone for their ongoing trust and support!

Altcoins

Ethereum Price Outlook as the DXY Index Crash Continues

Cryptocurrency prices remained in an upbeat tone on Thursday as the US dollar index continued its bearish move. Bitcoin, the biggest cryptocurrency in the world, rose to $23,165, the highest level in months. Similarly, Ethereum has risen by more than 4% in the past 24 hours while BNB Coin and XRP surged to $307 and $0.41, respectively.

US dollar index retreats

Cryptocurrencies have an inverse relationship with the US dollar index. For example, the DXY, which looks at the performance of the greenback vs other currencies, soared to a 20-year high of $115 in 2022. As that happened, cryptocurrencies like Bitcoin plunged during the year.

The foundation of this relationship is the Federal Reserve. In most periods, the US dollar index tends to rise when the Fed is extremely hawkish and vice versa. And it was extremely hawkish in 2022 as it hiked interest rates by more than 400 basis points.

Therefore, while the Fed has remained hawkish recently, the US dollar has dropped because of what the data is saying. Data published recently showed that America’s inflation is easing. The closely watched consumer price index dropped to 6.5% in December while core inflation fell to 5.7%.

At the same time, other parts of the economy are showing that the American economy is indeed recoiling. Retail sales dropped sharply in December while many…

Altcoins

XNO Token of Xeno NFT Hub listed on Bithumb Korea Exchange

Hong Kong, Hong Kong, 25th January, 2021, // ChainWire //

Xeno Holdings Limited (xno.live ), a blockchain solutions company based in Hong Kong, has announced the listing of its ecosystem utility token XNO on the ‘Bithumb Korea’ cryptocurrency exchange on January 21st 2021.

Xeno NFT Hub (market.xno.live ), developed by Xeno Holdings, enables easy minting of digital items into NFTs while also providing a marketplace where anyone can securely trade NFTs.

The Xeno NFT Hub project team includes former members of the technology project Yosemite X based in San Francisco and professionals such as Gabby Dizon who is a games industry expert and NFT space influencer based in Southeast Asia.

NFT(Non-Fungible Token) technology has recently gained huge focus in the blockchain arena and beyond, making waves in the online gaming sector, the art world, and the digital copyrights industry in recent years. The strongest feature of NFTs is that “NFTs are unique digital assets that cannot be replaced or forged”. Unlike fungible tokens such as Bitcoin or Ether, NFTs are not interchangeable for other tokens of the same type but instead each NFT has a unique value and specific information that cannot be replaced. This fact makes NFTs the perfect solution to record and prove ownership of digital and real-world items like works of art, game items, limited-edition collectibles, and more. One of the ways to have a successful…

Hot Updates

Campden Wealth Partners with GDA Group to Enter Digital Asset Markets

Blockchain conglomerate GDA Group joins as Campden Wealth’s newest Corporate Partner for 2021. Based in Toronto, GDA group provides access to all verticals of the crypto capital markets to institutions and private investors. The two institutions once operated on different verticals, so the partnership indicates a new era of portfolio allocation and asset diversification. Digital assets, including bitcoin, are becoming a vital component of modern investment strategies. GDA Group provides multiple avenues for digital asset exposure, including trading services through their institutional trading desk Secure Digital Markets, including non-recourse lending up to $100M through GDA Lending, and private placements through their capital markets arm GDA Capital.

“Institutions have spent a decade on the sidelines, evaluating the risks of this burgeoning sector. Now, in less than 6 months we have seen billions in institutional and private capital enter the space,” says James Godfrey, FX and International Banking Advisor to GDA Group. “Our relationship with Campden will illustrate the maturation of this industry and where we are headed next. New stakeholders will need experience, resources and insights to navigate this new market and evaluate upcoming opportunities.”

“The Campden Community is constantly balancing the needs of wealth creation for the future, with wealth preservation…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange