Don't Miss

ODUWA: Protecting cryptocurrency investments from Volatility and securing a decentralized global economy

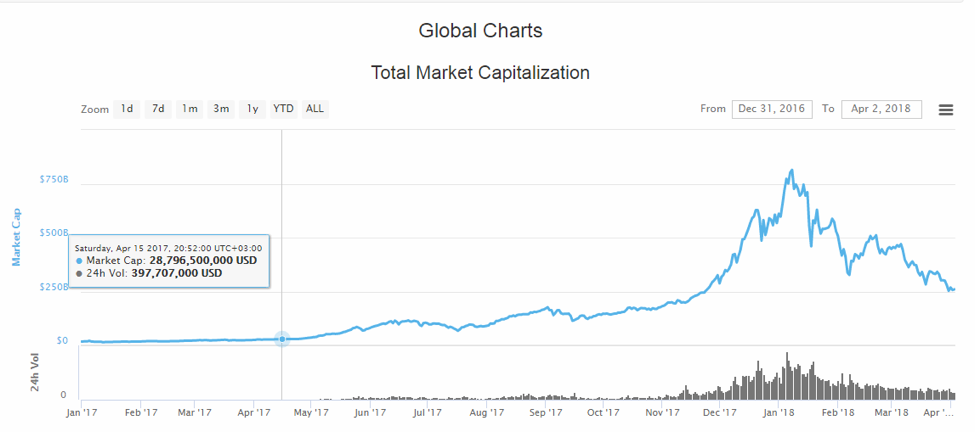

It’s common knowledge in business to have high risks whenever there are high returns. In fact, the past year in the cryptocurrency world has been a complete replica of a high risk, high yield market with the overall market capitalization going from a low of 20 billion at the start of the year to a high of over 750 billion in January 2018 only to drop back down to the 250 billion region at the time of this writing.

Obviously, there is a lot of money to be made with such violent swings in the market. Bitcoin for instance quadrupled in price in 2017 and Ripple gained 30,000 percent of its initial price at the end of 2016. By the end of 2017, it was pretty clear for most investors that the spread in the cryptocurrency market was unlike any other investment vehicle in the financial world.

The Underlying Problem

However, considering the earlier statement on risk and reward, there is no denying that there are bound to be many casualties along the way in cases where cryptocurrencies drop in price drastically sometimes in a matter of days or hours. Whenever the cryptocurrency market takes on a bearish trend, many conventional investors are bound to make losses while experienced and savvy investors with market analysis skills, get to cushion themselves from loses. In fact, with enough experience and the right tools, savvy investors have been known to make money in the cryptocurrency market even in a bearish market.

Sadly, most conventional investors not only lack the experience that can offer indemnity but also lack the right tools to help protect their investments from depreciation in the market. For conventional investors, ODUWA Coin (OWC) is offering a first of its kind cryptocurrency insurance that will enable investors to protect their portfolios from a violently volatile market.

What is ODUWA Coin (OWC)?

To put it simply, ODUWA is an up and coming project set to be the world’s first exchange and trading platform that offers investors protection from volatility and overall market depreciation. Basically, ODUWA Coin is looking to be the cryptocurrency for cryptocurrencies and will facilitate a Blockchain that will offer a solution to investors of the Bitcoin and crypto world.

By creating a Blockchain based insurance system; the ODUWA team will also offer a host of other products with the aim of realizing a truly decentralized economy that would see investors protect their digital assets from future depreciation.

How ODUWA insurance works

Having identified that volatility investment risk is the biggest challenge faced by investors in the cryptocurrency world, the ODUWA team is looking to build an open source platform that will soon be available on Github once the product launches whereby users of the platform get to make risk free deposits on the ODUWA wallet while buying crypto coins.

Basically, ODUWA will cover the downside risk of depreciating assets thanks to the use of smart contracts and a smart wallet that is set to be compatible with the top cryptocurrencies. This will encourage more investors to dip their toes into the crypto space thanks to the zero risk incentive and as a return, ODUWA will make a profit from appreciating assets at the end of the contract while absorbing the depreciated assets according to the smart contract.

By charging a fee for the appreciated assets, ODUWA will enable buyers an opportunity to buy a select number of reliable cryptocurrencies risk-free with indemnity covering a period of 90 to 180 days depending on the various tiers of the agreed terms.

What is ODUWA’s Team and Vision?

The main goal of ODUWA Coin is to build a decentralized Blockchain infrastructure that ensures leading coins in the market while providing asset protection to encourage more investors to come into the cryptocurrency market. Ultimately, OWC will be used in various industries for payments and settling of transactions on the internet. By bridging the gap between Blockchain and insurance, ODUWA Coin will go as far as creating a secure, open and reliable means of communication thanks to its application of smart contracts.

To push for this vision, ODUWA is backed by a strong team of experts including Bright Enabulele who is a Blockchain development coordinator, Charles Anchang who is the vise president liaison at ODUWA and Michael Vernon who is a sales developer. Furthermore, ODUWA also has an able team of advisors including Dylan Kamoka, George Titan, and Dr.Jay Potter.

Other products from ODUWA

Apart from offering insurance for digital assets, ODUWA is also looking to offers users a reliable trading platform with zero fees on trading ODUWA Coins. The platform will also provide an e-wallet for safe storage of tokens and cryptocurrencies supported by ODUWA. Furthermore, ODUWA will also be looking to develop an encrypted telecommunications system that will enable users to connect easily while making VoIP calls with any device including desktops, Android SIP, X-Lite, 3CX phone and Zoiper among others.

ODUWA Coin ICO details

According to ODUWA’s roadmap, the 1st 2nd and 3rd OWC ICO stage is set for the 1st quarter of 2018. There are 21million OWC tokens set aside for distribution on ODUWA Coin’s currently ongoing token sale. Interested participants can use ETH, USD or BTC to purchase the tokens that are currently priced at $0.21 with a minimum transaction amount of 0.10ETH. With funding underway, ODUWA Coin will use the funds for marketing and product development and later on launch its exchange platform live in May this year with a bonus token delivery for purchases of over $50,000 priced at 15 cents.

HardCap: 21,000,000

Token Symbol: OWC

Reserved: 3,150,000

The beginning of ICO: 4th January 2018

End of ICO: 3rd April 2018

Conclusion

In conclusion, ODUWA is a pretty exciting project at this time in the cryptocurrency world given that there is a prevailing bearish market trend in the crypto space. With the growing Blockchain and cryptocurrency industry, there is no denying that more and more investors will develop an appetite for this budding industry. After all, the cryptocurrency market has been on a steady growth over the years despite the violent volatility. With ODUWA’s insurance, Exchange platform, and encrypted telecommunication services, cryptocurrency enthusiasts can finally breathe a sigh of relief as these products are set to facilitate a decentralized economy for the future global industries. Eventually, ODUWA will enable absolute decentralization while protecting investors from market volatility, which is revolutionary.

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Image courtesy of Gil Valentine via Flickr

Don't Miss

A Guide to Exploring the Singaporean ETF market

Singapore’s Exchange Traded Fund (ETF) market has grown, offering investors diverse investment opportunities and access to different asset classes. As the market evolves, investors must navigate these uncharted waters with a clear understanding of Singapore’s ETF landscape. This article explores the trends, challenges and strategies for navigating the Singapore ETF market. To start investing in ETFs, you can visit Saxo Capital Markets PTE.

The Singaporean ETF Market: Exponential Growth

The Singapore ETF market has seen significant growth in recent years, with an increasing number of ETFs covering a wide range of asset classes and holders. different investment topics.

One of the notable trends in the Singapore ETF market is the growing diversity of available options. Investors can now choose from ETFs that track domestic and international stock indexes, bonds, commodities, and specialist sectors or themes. This diverse range of ETFs allows investors to create comprehensive portfolios tailored to their investment goals.

The growth of the ETF market in Singapore is also due to growing investor demand for low-cost, transparent, and accessible investment vehicles. ETFs offer benefits such as intraday liquidity, real-time pricing, and the ability to trade on exchanges. These characteristics have made ETFs attractive to retail and institutional investors who want exposure to different asset classes.

Regulatory Landscape and Investor Protection

The Monetary Authority of Singapore (MAS) is the…

Don't Miss

Property Loans for Foreigners in Singapore That You Must Know About

Intending to invest in a residential or commercial property in Singapore?

When it comes to foreigners applying for a loan in Singapore, things can be pretty hard regardless of the reason whether you need the property for personal or business purposes.

In Singapore, buying a property is challenging, whether you are a foreigner or a native, and sometimes applying for a loan is the only way for you to afford it.

HOW MUCH CAN YOU BORROW FOR A PROPERTY LOAN IN SINGAPORE?

As for the Foreigner Loans, in Singapore, there is an exact amount of money you can borrow to finance the purchase of a property.

In this sense, Singapore has the Loan to Value Ratio (LTV).

The LTV ratio is what determines the exact amount of money you can borrow for a property loan, which changes depending on where you try to obtain the loan:

- If you are applying for a bank loan, you can borrow a maximum of 75% of the value of the property you want to purchase. That means if you are looking for a property that costs $500.000, the maximum amount of money a bank lender can give you like a loan in Singapore is going to be $375.000.

- When you are applying for a loan with a Housing…

Don't Miss

CoinField Launches Sologenic Initial Exchange Offering

CoinField has started its Sologenic IEO, which is the first project to utilize the XRP Ledger for tokenizing stocks and ETFs. The sale will last for one week and will officially end on February 25, 2020, before SOLO trading begins on the platform. Sologenic’s native token SOLO is being offered at 0.25 USDT during the IEO.

Earlier this month, Sologenic released the very first decentralized wallet app for SOLO, XRP, and tokenized assets to support the Sologenic ecosystem. The app is available for mobile and desktop via the Apple Store and Google Play. The desktop version is available for Windows and Mac.

“By connecting the traditional financial markets with crypto, Sologenic will bring a significant volume to the crypto markets. The role of the Sologenic ecosystem is to facilitate the trading of a wide range of asset classes such as stocks, ETFs, and precious metals using blockchain technology. Sologenic is an ecosystem where users can tokenize, trade, and spend these digital assets using SOLO cards in real-time. The ultimate goal is to make Sologenic as decentralized as possible, where CoinField’s role will be only limited to KYC and fiat ON & OFF ramping,” said CoinField’s CEO…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange