Bitcoin

Stepping off the rollercoaster: Why I’ve fallen out of love with Bitcoin

The very word Bitcoin has almost become synonymous with that of cryptocurrency. It’s basically just a medium of conducting digital transactions – it’s a virtual currency and one of many. So how has it taken on a definition of its own and asserted itself as a leader in the digital financial ecosystem?

Bitcoin has been crowned king of altcoins, probably because it was one of the earliest and most successful of its kind. The trendsetter has ushered in a wave of cryptocurrencies built on decentralised P2P networks and has inspired a growing number of followers and spinoffs. But is Bitcoin struggling to keep up with the newcomers who have made considerable developments to the stability, security, and usability of the crypto world?

The supporting case for Bitcoin has been a clear one. Its pioneering infrastructure has situated it in a position of dominance in the altcoin realm. Bitcoin has a proven usage case as a store of value. Having existed over 8 years without failure, it has a large lead over most altcoins and has withstood the test of time as younger counterparts join the market. However, it seems to be on a downward slope, or at the very least, not progressing at the speed of the market.

In May this year, investors saw a $1,000 decline in the price of Bitcoin (CoinDesk). Notorious for its unpredictable highs and lows, it was unsurprising to many; as Bitcoin has always been the joy and bane of crypto-investors.

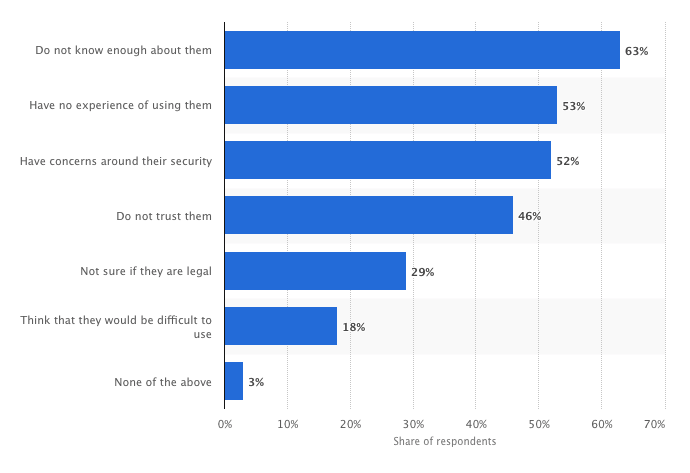

Image Source: Statista

The data here shows the reasons respondents gave for not wanting to use Bitcoin in GB. Clearly, 63% reported not wanting to use Bitcoin because they “don’t know enough about them”. Bitcoin has disregarded the general public and has arguably made little effort to provide understandable and accurate information on the ins and outs of the cryptocurrency.

Existing in a time of inspired and improved mediums of digital transactions, Bitcoin faces better-equipt rivals. Aggressive volatility in the market, lack of trust and few regulations have caused relentless problems in the crypto market, and Bitcoin has offered very few solutions.

One of the main attributes that give rise to the extreme volatility we see is speculation. The demand spikes for cryptocurrencies are fuelled by trading and speculation rather than through the adoption of the real world. This is abundantly clear when we consider that in 2018 the market capitalisation of cryptocurrencies hit an all-time high of over $800 billion but is currently at its all-time low at $200 billion (CNBC).

What’s been done to improve the conditions of the crypto market?

Here, enters Stablecoin, a cryptocurrency that has revolutionised the crypto revolution itself. It has been created primarily to tackle the harsh volatility and unpredictability that characterises the crypto market. They aim to stabilise prices by pegging them to some other ‘stable’ asset. These can include a cryptocurrency, fiat money or to exchange-traded commodities- like gold.

Instability makes for unfavourable market conditions that generate erratic investor behaviour and sell-offs that further weaken the money-earning opportunities in this niche market. Timvi (TMV), the secured algorithmic Stablecoin, has entered the market to tackle this precise problem and allow users to make money during both bull and bear market conditions.

The stabilising functions of Stablecoins are twofold. Asset-backed Stablecoins, such as Digix Gold Token (DGX), aim to reduce price volatility backed by exchange-traded commodities, or by using fiat currencies like the US dollar. Algorithmic Stablecoins rely on computing logic to monitor the supply of currency to achieve stability by mimicking the mechanisms of central banks.

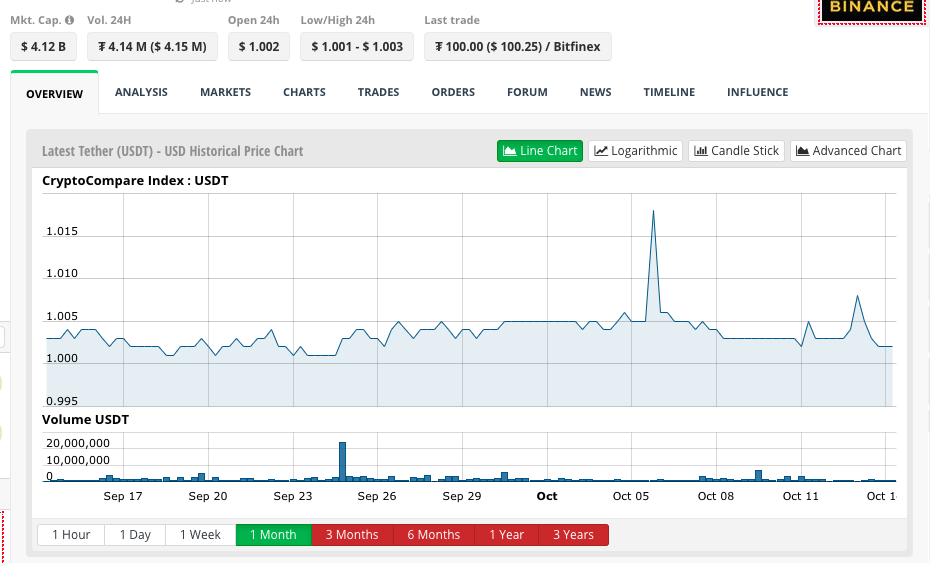

Stablecoins are gaining increasing traction around the world. According to CryptoCompare, the market cap of the biggest Stablecoin is roughly $4 billion.

Image Source: CryptoCompare

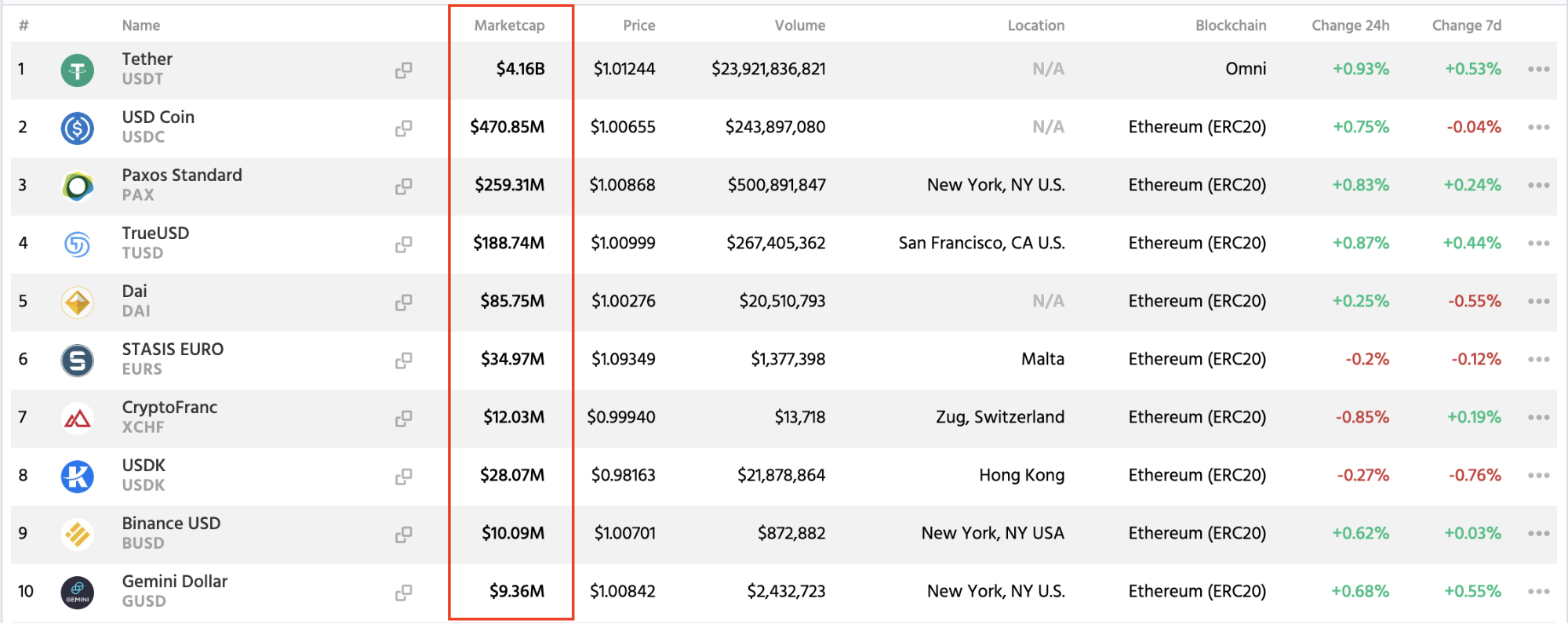

The market cap of all Stablecoins now exceeds $5 billion.

Image Source: CryptoSlate

In the same report, Bitcoin has claimed that they aim to develop their Stablecoin solution within the next few years. But this may prove to be too little too late and could be the turning point where Bitcoin loses its crown for innovation.

Some Stablecoins such as Tether (USDT), a US dollar-pegged unit, are commonly used to trade bitcoins. One unit of Tether is intended to equate to one US dollar and has thus far proven to be generally reliable on delivering this.

So, Stablecoins are more complementary than they are competitive with Bitcoin. Indeed, they are a form of infrastructure provided by cryptocurrencies. It is disappointing that Bitcoin is yet to have secured its place as the Stablecoin leader, but the emerging alternatives do well to console this.

These developments are important for the future of the crypto market. Given that a currency is ultimately a store of value, it should not be speculative, but rather predictive and stable in order to grow the user confidence needed for cryptocurrency to go mainstream. The total Stablecoin market value share has more than doubled in the past 12 months and its continued growth may well suggest a fall in Bitcoin’s reign.

For the latest cryptocurrency news, join our Telegram!

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Bitcoin

Bitcoin Price Dumps Below $41,000 Amid Uncertainty

Bitcoin price dumped hard on Monday, briefly slipping below $41,000, erasing gains recorded in the previous week. The premier cryptocurrency seems to have exhausted its recent rally propelled by industry vulnerabilities. At the time of writing, the world’s largest cryptocurrency was trading slightly lower at $41,385. Bitcoin’s total market cap has dipped by 2% over the past day, while the total volume of BTC tokens traded over the same period climbed by 58%.

Fundamentals

Bitcoin price has been facing retracements and a rollercoaster over the past few days after recently rocketing to a 20-month peak. On-chain data has suggested that many investors used the opportunity to take some profits, leading to a decline in the asset’s price.

Bitcoin’s price slump is mirrored in the wider crypto market, with the global crypto market cap decreasing by 1.85% over the past 24 hours to $1.55 trillion. The total crypto market volume has increased by 32% over the same period. The Crypto Fear and Greed Index has plunged from a level of extreme greed to a greed level of 70, suggesting a decline in risk appetite.

Ethereum, the largest altcoin by market capitalization, is currently trading at $2,167, down almost 3% for the day. Meme coins have been hit hard by the market slump, with Dogecoin and Shiba Inu down by more than 4% over the last day.

Last week on Thursday, cryptocurrency experts took notice of…

Bitcoin

Bitcoin Price is in Consolidation Mode Despite Market Optimism Post-Fed Decision

Bitcoin price edged lower on Thursday despite optimism in wider markets on the back of the Fed’s interest rate decision. The flagship cryptocurrency has been consolidating above the critical level of $42,000 after briefly topping $44,000, its highest level in 20 months. Bitcoin was trading 0.71% lower at $42,569 at press time. BTC’s total market cap has increased by more than 3% over the last day to $832 billion, while the total volume of the asset traded over the same period jumped by 22%.

Economic Outlook

Bitcoin price has been trading sideways over the past few days, suggesting a pause in its recent rally towards $45,000. The premier cryptocurrency has decreased by 4% in the past week but remains 15.22% higher in the month to date. The digital asset has staged a significant recovery this year after a torrid 2022 in which a string of scandals, including the collapse of FTX, led to a market meltdown, undermining the credibility of the sector.

The crypto market has been buoyed by the Fed’s latest interest rate decision. The US Federal Reserve on Wednesday held its key interest rate unchanged for the third consecutive time, in line with market expectations. With the easing of the inflation rate, members of the Federal Open Market Committee (FOMC) voted to keep the benchmark overnight borrowing rate in a targeted range between 5.25%-5.5%.

Additionally, the central bank indicated that three rate…

Bitcoin

Bitcoin Price Blasts $44K in Spectacular Surge as Spot Bitcoin ETF Approval Looms Large

Bitcoin price has been hovering above the $43,000 psychological level over the past two days amid anticipation about the potential approval of a spot bitcoin ETF. The flagship cryptocurrency has climbed more than 16% in the past week and nearly 170% in the year to date. Bitcoin’s total market cap has increased by nearly 5% over the past 24 hours to $858.9 billion, while the total volume of the token traded rose by 43%. The Bitcoin price was trading at $43,914 at press time.

Fundamentals

Bitcoin price has posted significant gains over the past few days, climbing to its highest level since April 2022, before the crash of a stablecoin that started a litany of company failures, pummeling crypto prices. The world’s largest cryptocurrency briefly topped the crucial level of $44,000 on Wednesday amid rising momentum despite being massively overbought.

According to analysts, with no spot bitcoin ETF approvals yet and the halving event five to six months away, the market is riding on FOMO. Capital has been flowing in the Bitcoin market amid enthusiasm that the launches of spot ETF will bring in billions of dollars of new investment into the crypto sector.

Investors have already started providing capital as seed money for ETF products. Notably, a recent report by CoinDesk showed that the world’s largest fund manager, BlackRock, received $100,000 in capital from a seed investor for its spot bitcoin exchange-traded fund…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange