Hot Updates

Why Cloud Mining when investing in Bitcoin?

–-Miningzoo.com a perfect cloud mining solution just for you!

With the trading war causing all the anxiety leading to stock price plummeting and bitcoin price skyrocketing, large institutions start to pour their funds into bitcoin investment gradually to diversify their investment portfolio.

Even if you do not long Bitcoin or consider it digitized gold, like Tim Draper and other investment gurus do, you might want to buy some bitcoin for diversification, an investment strategy taught in Yale’s Financial Markets class by Nobel laureate, Robert Schiller.

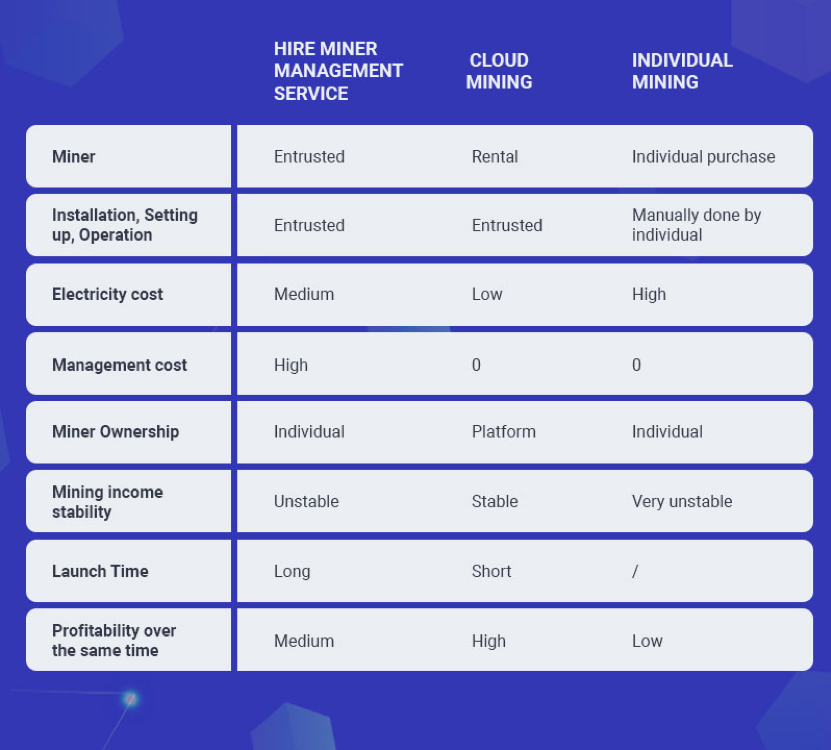

You can always buy bitcoin with cash, but if you hate to withstand its rollercoaster price but want to produce bitcoin yourself, what are the options?

First, you need to buy miners, which are costly. Second, you need to be able to operate the miners. This requires a lot of time, energy and of course know-how in technical set-up and assembling. How and where to set those miners up? And on top of these, various risks like technical failures and electricity blackout.

MiningZoo’s cloud mining is an optimal alternative choice if you find the previous two ways too much trouble.

The advantages of cloud mining compared to buy and run mining machine yourself are obvious: it is noise-free, and saves you from personal maintenance and transportation troubles. The most important thing is that cloud mining revenue is more stable than investing and buying your own miners’ mining revenue. Of course, Cloud mining depends on which mining platform you choose. Choose a cloud mining platform with good reputation like MiningZoo. Then you can rest to collect bitcoin income every day! Leave all these to the professional staff with MiningZoo!

This is a quality cloud mining platform designed for your. The contract price for the same amount of mining power is the most value for money if you compare across all different cloud mining platforms.

Price Comparison Table:

With MiningZoo, the daily cost per T mining power is as low as $0.076, and the electricity bill is as low as $0.0769 per day. Your annualized income will be over 200% if bitcoin price and bitcoins generation maintain the current status.

Once you place an order you can start mining right away. MiningZoo guarantees 100% uptime and cover system downtimes by using the most efficient and secure miners. You never suffer the loss of mining time due to system downtimes. MiningZoo is heavily investing in the best available hardware to stay at the edge of technology. For you, it is the easiest way of mining: no need to assemble rigs or to have hot, loud miners in your home.

MiningZoo, your premium bitcoin investment choice!

Altcoins

Ethereum Price Outlook as the DXY Index Crash Continues

Cryptocurrency prices remained in an upbeat tone on Thursday as the US dollar index continued its bearish move. Bitcoin, the biggest cryptocurrency in the world, rose to $23,165, the highest level in months. Similarly, Ethereum has risen by more than 4% in the past 24 hours while BNB Coin and XRP surged to $307 and $0.41, respectively.

US dollar index retreats

Cryptocurrencies have an inverse relationship with the US dollar index. For example, the DXY, which looks at the performance of the greenback vs other currencies, soared to a 20-year high of $115 in 2022. As that happened, cryptocurrencies like Bitcoin plunged during the year.

The foundation of this relationship is the Federal Reserve. In most periods, the US dollar index tends to rise when the Fed is extremely hawkish and vice versa. And it was extremely hawkish in 2022 as it hiked interest rates by more than 400 basis points.

Therefore, while the Fed has remained hawkish recently, the US dollar has dropped because of what the data is saying. Data published recently showed that America’s inflation is easing. The closely watched consumer price index dropped to 6.5% in December while core inflation fell to 5.7%.

At the same time, other parts of the economy are showing that the American economy is indeed recoiling. Retail sales dropped sharply in December while many…

Altcoins

XNO Token of Xeno NFT Hub listed on Bithumb Korea Exchange

Hong Kong, Hong Kong, 25th January, 2021, // ChainWire //

Xeno Holdings Limited (xno.live ), a blockchain solutions company based in Hong Kong, has announced the listing of its ecosystem utility token XNO on the ‘Bithumb Korea’ cryptocurrency exchange on January 21st 2021.

Xeno NFT Hub (market.xno.live ), developed by Xeno Holdings, enables easy minting of digital items into NFTs while also providing a marketplace where anyone can securely trade NFTs.

The Xeno NFT Hub project team includes former members of the technology project Yosemite X based in San Francisco and professionals such as Gabby Dizon who is a games industry expert and NFT space influencer based in Southeast Asia.

NFT(Non-Fungible Token) technology has recently gained huge focus in the blockchain arena and beyond, making waves in the online gaming sector, the art world, and the digital copyrights industry in recent years. The strongest feature of NFTs is that “NFTs are unique digital assets that cannot be replaced or forged”. Unlike fungible tokens such as Bitcoin or Ether, NFTs are not interchangeable for other tokens of the same type but instead each NFT has a unique value and specific information that cannot be replaced. This fact makes NFTs the perfect solution to record and prove ownership of digital and real-world items like works of art, game items, limited-edition collectibles, and more. One of the ways to have a successful…

Hot Updates

Campden Wealth Partners with GDA Group to Enter Digital Asset Markets

Blockchain conglomerate GDA Group joins as Campden Wealth’s newest Corporate Partner for 2021. Based in Toronto, GDA group provides access to all verticals of the crypto capital markets to institutions and private investors. The two institutions once operated on different verticals, so the partnership indicates a new era of portfolio allocation and asset diversification. Digital assets, including bitcoin, are becoming a vital component of modern investment strategies. GDA Group provides multiple avenues for digital asset exposure, including trading services through their institutional trading desk Secure Digital Markets, including non-recourse lending up to $100M through GDA Lending, and private placements through their capital markets arm GDA Capital.

“Institutions have spent a decade on the sidelines, evaluating the risks of this burgeoning sector. Now, in less than 6 months we have seen billions in institutional and private capital enter the space,” says James Godfrey, FX and International Banking Advisor to GDA Group. “Our relationship with Campden will illustrate the maturation of this industry and where we are headed next. New stakeholders will need experience, resources and insights to navigate this new market and evaluate upcoming opportunities.”

“The Campden Community is constantly balancing the needs of wealth creation for the future, with wealth preservation…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange