featured

How 3D-Token Could Revolutionize the Manufacturing Space

One of the key arguments used in opposition to cryptocurrency is the lack of real-world value. The makers of the upcoming 3D-Token have completely sidestepped that argument, augmenting their existing business structure with a cryptocurrency that effectively fuels their 3D printing network. Politronica is an offshoot of the well regarded Italian Institute of Technology in Turin, Italy. Throughout the past decade, the Institute has received multiple grants from the Italian government to fund experimentation in the field of 3D printing – something that the Institute has since excelled at.

Over the course of the past year, they have started prototyping their “Just In Time” factory model. This proof of concept model contained one hundred 3D printing units and had 50 members within the network to stress test the system. The prototype was a complete success, and Politronica is ready to start deploying their “Network Robots’ Workforce’ at production scale. They are expecting to increase the number of printers by a factor of 30, and increase the network member size accordingly. To do this, they will use the 3D-Token blockchain as a facilitator. They are hoping to see over 20 million hours of effective production per year, once the workforce is fully up and running.

The 4pointzero.net Factory

Politronica envisions a centralized factory space where customers can pay for production time through their Network Robots’ Workforce. They’ve titled this factory 4pointzero.net, and it will exist as a means to easily lease 3D printers. The leases are by necessity short term and would be used to produce a limited run of products. This, in turn, allows the customer to produce items on an as-needed basis, avoiding inventory costs while still providing products to the end consumer promptly. While they have proven that the technology is functional, they have yet to fully integrate the blockchain network into the system. That’s the next hurdle they have to cross, but their academic pedigree suggests they will succeed.

3D Printing is an explosive emerging technology and has finally reached a level of public acceptance and mass adoption. The cheapest 3D printers are now becoming comparable in price point to higher-end traditional printers. Industries are looking at the myriad ways they can incorporate 3D Printers into their production processes, with some specialty manufacturers converting entirely to a printer based business model. Even assuming that demand remains where it is today, rather than rises as predicted, leased 3D printing time would come at a stiff premium.

Integration of the 3D-Token

To help combat this inevitable traffic jam of consumers looking for 3D printing solutions, Politronica has developed the 3D-Token, or 3DT, cryptocurrency for use within their factory. The ERC20 smart contract capable token exists as a digital stake in production time at the 4pointzero.net Factory. Holders can spend the token to reserve production time within the Network Robot’s Workforce, and ensure that their inventory arrives promptly. The customer can stockpile an amount of 3DT necessary to ensure that they can always provide the inventory that they will require, while not having to spend the money to keep the inventory in stock.

As with any cryptocurrency, it can also be traded person-to-person on an exchange or through Politronica’s own 3Dwix.com network, ensuring a consistent value against the Ethereum standard. The token can also always be sold back to Politronica, should the customer decide that they will no longer require that reserved production time. There is also an intention to create 3D-crowd.com, a form of crowdfunding site where users can donate 3DT to start-ups seeking to fund their 3D printing based projects, efficiently crowdsourcing the leased printer time itself.

Blockchain Technology in Parallel with Bleeding Edge Manufacturing

3D-Token shows a complete synergy between two emerging technologies; Blockchain networking and 3D printer manufacturing. Both industries are seeing almost unprecedented growth, and Politronica has managed to combine the two in a way that legitimately uses the strengths of both. Their token generation event sold out in only ten days of the expected two-month pre-sale period. This suggests the cryptocurrency investing public at large has confidence in both the existing Politronica infrastructure, and their intended final product.

You can watch the ICO live here.

You can also scroll through the whitepaper here.

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Please conduct your own thorough research before investing in any cryptocurrency.

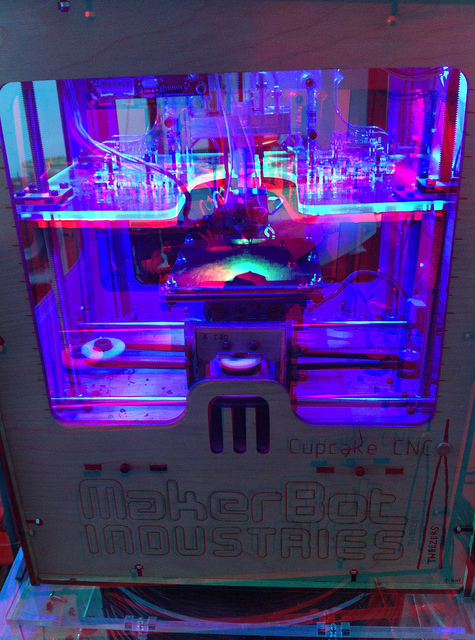

Image courtesy of Jenna Fox via Flickr

Crypto

BNB Price Surges Past $300, Faces Crucial $339 Hurdle: What’s Next?

BNB price has noted significant gains over the past few days, surging past the psychological resistance of $300. The native cryptocurrency of the Binance Exchange has surpassed Solana to regain its position as the fourth-largest cryptocurrency by market cap. The digital currency has been rallying lately with a 7-day profit of more than 15%. Additionally, BNB has clocked a phenomenal gain of 38% in the month to date.

Binance Coin Outlook

BNB price has been on a strong bull run for the past week, breaking out of its consolidation. Even so, the asset has experienced a correction in its uptrend over the past 24 hours but remains above the crucial level of $300. BNB’s total market cap has decreased by 4% over the past day to $48 billion, while the total volume of the asset traded over the same period dipped by about 15%.

Over the past year, Binance Coin has had to cope with Fear, Uncertainty, and Doubt (FUD) on the back of the regulatory troubles of its underlying exchange. Earlier, the BNB price touched a low of $223.50, a few days after its former CEO, Changpeng Zhao, pleaded guilty to money laundering charges. However, the cryptocurrency has managed to rebound 46% in value since then.

The recent price rally has been associated with various positive developments in the Binance ecosystem, including the Introduction of the Isolated Margin Auto-Transfer Mode. This feature enables…

Altcoins

Solana Price Surges Beyond $100, Dethroning Ripple and BNB To Secure Fourth Place

Solana price performance in recent times has been remarkable, surpassing Ripple and Binance Coin to become the fourth-largest cryptocurrency by market cap. The SOL price breached the critical level of $100 for the first time since April 2022 over the weekend to imbue optimism among investors. However, the altcoin has corrected by 7%, suggesting that the market is overheated. At the time of writing, the ‘Ethereum killer’ was trading slightly lower at $111.60.

SOL Outlook

Solana price has made a significant recovery over the past few weeks, climbing above the psychological level of $100. The altcoin has been one of the best-performing assets this year, extending its year-to-date gains to more than 1,025%, with more gains recorded in the past month alone. However, even with such growth, analysts have noted that Solana has a bleak chance of topping its ATH of $260.

The reason behind this is the increase in supply relative to its value. In November 2021, when the Solana price hit its all-time high of $260, its total market capitalization was around $78 billion. Despite the value of the crypto asset being less than half of what it was at the top, its market cap is currently hovering near $50 billion.

This has been brought about by the increase in the Solana supply by more than 100 million SOL over the past two years. According to some analysts, for the altcoin to retest $260, its…

Altcoins

Solana Price Skyrockets to 20-Month Peak Amidst Memecoin Frenzy

Solana price has noted significant gains over the past few weeks, climbing to its highest level since April 2022. The ‘Ethereum Killer’ almost topped the crucial level of $100 on Friday, before pulling back slightly. The asset’s recent surge has catapulted Solana’s total market cap to $39.6 billion, ranking 5th after and above BNB and XRP, respectively. Solana has jumped by more than 22% in the past week and more than 80% in the month to date. At the time of writing, SOL price was trading 0.90% lower at $93.10.

Catalysts Behind SOL’s Rally

Solana price has been on a strong bull run over the past few days, rocketing to its highest level in 20 months as the network benefits from the substantial activity and strong interest in memecoins. The SOL token, the native digital asset of the high-performance blockchain platform Solana, has shown some serious strength over the past few weeks, outperforming all the altcoins in the market.

The recent surge in the Solana price has been linked to heightened on-chain activities on the Solana blockchain. Notably, the ongoing hype for the blockchain’s speedy transactions, cheap fees, and a lottery of meme coin issuances has buoyed SOL’s on-chain activity. Metrics have revealed that Solana has been the strongest draw among on-chain traders, with trading volumes and network fees outperforming Ethereum- the largest altcoin by market cap.

Cited figures provided by DeFi aggregator DeFiLlama…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange