Bitcoin

As Global Tensions Grow, Bitcoin Price May Go Higher

BTC Surged Again as A Safe Haven Asset During Global Tensions

- India – China Border Conflict

After weeks of squabbling and brawling along their long-disputed border, hundreds of Indian and Chinese soldiers engaged in a deadly clash Monday in a river valley that’s part of the region of Ladakh last week. Troops had massed on both sides of the border in recent months in the northern India region of Ladakh and the southwestern Chinese region of Aksai Chin, causing global concerns of a potential escalation between the two.

- North and South Korea Clash

Last Tuesday, North Korea destroyed the liaison office it jointly operates with South Korea in the city of Kaesong, just north of the demilitarized zone that separates the two countries.

North Korea also said it would send troops to now-shuttered joint cooperation sites on its territory, reinstall guard posts and resume military drills at front-line areas in a violation of separate 2018 deals with South Korea. Jeong said South Korea will take “immediate, swift and corresponding” steps to any North Korean provocation.

The tensions grown in Asia and the potential “second wave” of coronavirus in the United States may add more difficulties to the global economic recovery. Thus, Bitcoin, as a safe haven asset, attracts more investors to buy and hold.

Due to the uncertainty of the global economy, Bitcoin performed a strong upward movement from $9,400 to $9,700 on Monday, appreciating 3% in past 2 days. Though it declined sharply to as low as $9,000 early today, the daily chart also highlights that BTC may soon manage to break above the $10,500 area. This could propel the cryptocurrency into a major new bullish trend.

Grasp the BTC Fluctuations and Get Bigger Gains

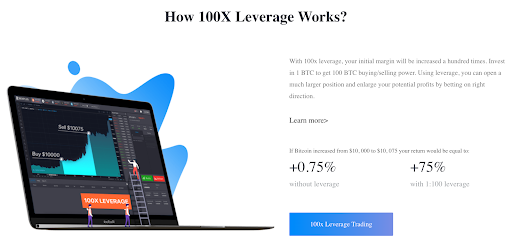

For investors who have a lot of funds to invest in the Bitcoin market, buying a great number of BTC at a low price and selling it at higher price might be the most secure yet profitable trading method. However, for most of us, we don’t have not so much money for investment, we can trade BTC futures contracts with 100x leverage. A small capital investment may lead to greater gains.

As an example, opening a position with an initial margin of 0.1 BTC with 100x leverage is essentially equivalent to controlling a position size of 10 BTC. If Bitcoin gains in value by 10 percent during this time period, you would have a profit of $10,000 — all while only risking your initial 0.1 BTC margin. Besides, it allows traders to short the market — allowing them to profit even when the market is down. With BTC being such a volatile trading product, margin trading essentially provides much more opportunities to profit compared to one-directional BTC spot trade.

Bexplus is one of the most popular futures exchanges in the cryptocurrency market. It provides a variety of trading pairs including BTC/USDT, ETH/USDT, EOS/USDT, LTC/USDT and XRP/USDT with 100x leverage. By using leverage, cryptocurrency traders can increase their exposure to price movements and turn what would otherwise be small gains when spot trading into extraordinary profits.

Why Choose Bexplus?

- NO KYC

Bexplus allows users to register an account with No KYC required. Users can start trading after easy registration with email without completing any sort of AML/KYC

- Mobile Support

Users can trade futures contracts on both computers and mobile phones, including iOS and Android. Download the Bexplus app from App stores or Google Play and trade on the go.

- Ultra-fast Deposit & Withdrawal

Deposit and withdrawal are processed at a fast speed. No service charge for the deposit. To withdraw bitcoin, you just need to submit the withdrawal request form and the money will be soon credited in your wallet. No maximum amount limited.

- Fair Quote of Price

Bexplus quote index is weighted average of those from top 5 exchanges, including Bitfines, Binance, Poloniex, Huobi Global and ZB. It also equipped with anti-manipulation mechanism and it can execute 30,000 orders/TPS without latency even during strong market fluctuations

- Trading simulator

Bexplus provides the trading simulator with 10 free BTC If you are a beginner or inexperienced in crypto futures trading, you can practice trading without losing a penny. You can also use P/L calculator to estimate the profit/loss before entering the trade at a precise price point.

- 100% deposit bonus

To deposit BTC in the real account, you can earn 100% BTC bonus, which can also be used to trade futures contracts. The more deposit, the more bonus you will get. You can get up to 10 FREE BTC as bonus!

Trade BTC futures contracts with 100x leverage in Bexplus, you will have more chances to make a fortune during the coming bull market.

Bitcoin

Bitcoin Price Dumps Below $41,000 Amid Uncertainty

Bitcoin price dumped hard on Monday, briefly slipping below $41,000, erasing gains recorded in the previous week. The premier cryptocurrency seems to have exhausted its recent rally propelled by industry vulnerabilities. At the time of writing, the world’s largest cryptocurrency was trading slightly lower at $41,385. Bitcoin’s total market cap has dipped by 2% over the past day, while the total volume of BTC tokens traded over the same period climbed by 58%.

Fundamentals

Bitcoin price has been facing retracements and a rollercoaster over the past few days after recently rocketing to a 20-month peak. On-chain data has suggested that many investors used the opportunity to take some profits, leading to a decline in the asset’s price.

Bitcoin’s price slump is mirrored in the wider crypto market, with the global crypto market cap decreasing by 1.85% over the past 24 hours to $1.55 trillion. The total crypto market volume has increased by 32% over the same period. The Crypto Fear and Greed Index has plunged from a level of extreme greed to a greed level of 70, suggesting a decline in risk appetite.

Ethereum, the largest altcoin by market capitalization, is currently trading at $2,167, down almost 3% for the day. Meme coins have been hit hard by the market slump, with Dogecoin and Shiba Inu down by more than 4% over the last day.

Last week on Thursday, cryptocurrency experts took notice of…

Bitcoin

Bitcoin Price is in Consolidation Mode Despite Market Optimism Post-Fed Decision

Bitcoin price edged lower on Thursday despite optimism in wider markets on the back of the Fed’s interest rate decision. The flagship cryptocurrency has been consolidating above the critical level of $42,000 after briefly topping $44,000, its highest level in 20 months. Bitcoin was trading 0.71% lower at $42,569 at press time. BTC’s total market cap has increased by more than 3% over the last day to $832 billion, while the total volume of the asset traded over the same period jumped by 22%.

Economic Outlook

Bitcoin price has been trading sideways over the past few days, suggesting a pause in its recent rally towards $45,000. The premier cryptocurrency has decreased by 4% in the past week but remains 15.22% higher in the month to date. The digital asset has staged a significant recovery this year after a torrid 2022 in which a string of scandals, including the collapse of FTX, led to a market meltdown, undermining the credibility of the sector.

The crypto market has been buoyed by the Fed’s latest interest rate decision. The US Federal Reserve on Wednesday held its key interest rate unchanged for the third consecutive time, in line with market expectations. With the easing of the inflation rate, members of the Federal Open Market Committee (FOMC) voted to keep the benchmark overnight borrowing rate in a targeted range between 5.25%-5.5%.

Additionally, the central bank indicated that three rate…

Bitcoin

Bitcoin Price Blasts $44K in Spectacular Surge as Spot Bitcoin ETF Approval Looms Large

Bitcoin price has been hovering above the $43,000 psychological level over the past two days amid anticipation about the potential approval of a spot bitcoin ETF. The flagship cryptocurrency has climbed more than 16% in the past week and nearly 170% in the year to date. Bitcoin’s total market cap has increased by nearly 5% over the past 24 hours to $858.9 billion, while the total volume of the token traded rose by 43%. The Bitcoin price was trading at $43,914 at press time.

Fundamentals

Bitcoin price has posted significant gains over the past few days, climbing to its highest level since April 2022, before the crash of a stablecoin that started a litany of company failures, pummeling crypto prices. The world’s largest cryptocurrency briefly topped the crucial level of $44,000 on Wednesday amid rising momentum despite being massively overbought.

According to analysts, with no spot bitcoin ETF approvals yet and the halving event five to six months away, the market is riding on FOMO. Capital has been flowing in the Bitcoin market amid enthusiasm that the launches of spot ETF will bring in billions of dollars of new investment into the crypto sector.

Investors have already started providing capital as seed money for ETF products. Notably, a recent report by CoinDesk showed that the world’s largest fund manager, BlackRock, received $100,000 in capital from a seed investor for its spot bitcoin exchange-traded fund…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange