Bitcoin

Bitcoin (BTC) Ethereum (ETH) LiteCoin (LTC) Bitcoin Cash (BCH) Technical Analysis – Bear Market Conditions Persist

For the past six (6) months it’s been no secret that Bitcoin HODLers have found the environment both challenging as well as the footing slippery as prices throughout have continued to slide the slope lower.

This past weekend, both investors/traders were treated to yet another leg lower on large volume, which produced a sharp and violent move to the south-side and in the process, taking-out/breaching some very important short-term support levels across the board.

While recent price action has produced short-term oversold conditions and we can perhaps anticipate some pause as well as some price relief in the days ahead, we must remember that oversold conditions can and often do, become more oversold just as overbought conditions can often lead to further price appreciation beyond what many investors/traders expect/anticipate.

Thus, while we certainly suspect that both investors/traders within the crypto sphere will be treated to some pause and or short-term price relief in the days ahead, we must always defer our opinions and biases to the action of the market as Price is the only thing that Pays.

That being said, let’s take a look at the charts to see what may be in store moving forward as well as some levels to monitor in order to navigate the landscape without detonating the triplines that litter the field.

After touching down at the 7K level a couple of weeks ago and subsequently grinding higher, Bitcoin (BTC) was unable to clear our previously noted 7730 level and ‘stick’. Once that became apparent, and it was rather quite obvious as BTC attempted to clear the hurdle on multiple occasions only to fail, such was the signal that the likelihood of lower prices were in the offing, which has now played-out.

Moving forward, both investors/traders may want to monitor the following levels for further clues/evidence with respect to direction.

If, at any time in the days ahead, BTC can go top-side of the 7040-7060 zone and perhaps, more importantly, can clear the noted 7260 figure (former support now turned resistance), such development/s, should they materialize, would release some short-term pressure. On the opposite side of the ledger, potential short-term support can be found at the 6425 level and should such level ‘give-way’ at any time in the days/weeks ahead, a date with the February lows at 6K would certainly be in the cards.

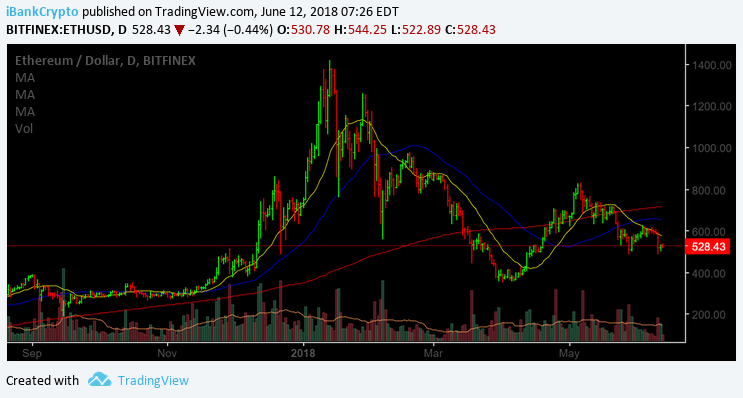

Much like BTC, Ethereum (ETH) found itself having trouble with our noted 615-630 zone and was unable to jump the creek, which promptly turned the tables southbound as we can witness from the Chart below:

As we can observe above, despite several attempts at clearing the 615-630 zone and incapable of holding, proved too much for ETH as it promptly reversed course for lower depths.

Moving forward, short-term potential resistance can be found at the 538 as well as the 575-600 zone, while potential support resides at 480-500 area. Should the 480-500 area ‘give-way’ at any point in the days/weeks ahead, the probability of a move into the 350-400 zone becomes a viable possibility.

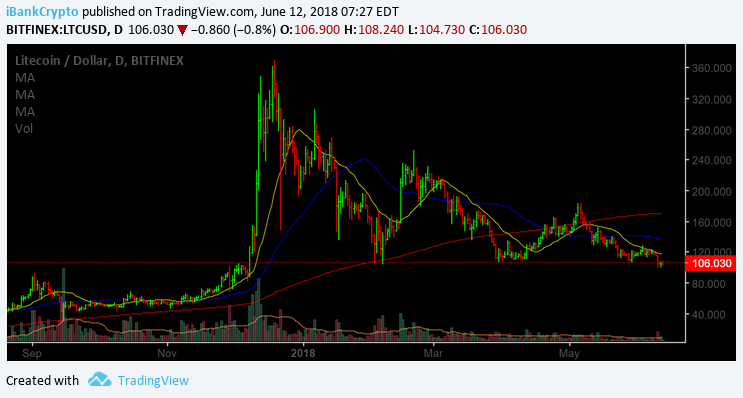

Moving on to LiteCoin, despite its short-term oversold posture, LTC remains extremely vulnerable as it has violated all of its potential short-term support levels and is hanging by a thread. While a bounce may be forthcoming in the days ahead, it appears that a date with the 80-85 zone is indeed its ultimate destination down the road.

As we can witness above, LTC has taken-out our noted 109-112 zone and now finds itself with little support or net beneath its feet. While a bounce into the 115-120 zone may relieve some short-term pressure, we suspect that the 80-85 zone may provide its best line of defense (potential support) moving forward.

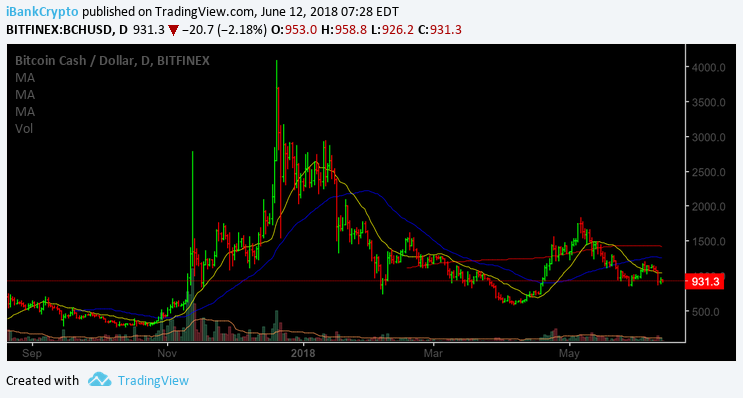

Last but not least, let’s take a look at Bitcoin Cash below to see what it may have in store for both investors/traders moving forward.

As we can observe from the chart above, while the recent move lower in BCH was sharp and deep accompanied with volume, it did not hit nor violate the May lows located at the 868-870 level.

Thus, moving forward, both investors/traders may want to pay particular attention to the 840-870 zone as well as the February low 750 area for potential support, while the 1000-1035, as well as the 1075-1085 zone, provide likely headwinds/resistance above.

While market participants may enjoy some price relief from short-term oversold conditions in the days ahead, we must remember that bear market conditions persist throughout the entire cryptocurrency universe and as investors/traders, we have to leave our opinions/biases at the door and take our cues from the action.

If one is trading this environment, be sure to keep positions on a tight leash and honor Your Stops as risk management is priority number one, as always. For those longer-term investors, patience and discipline are in order and you may want to continue to monitor your favorites for suitable entry and or adding to existing positions.

Happy Trading!!

For the latest cryptocurrency news, join our Telegram!

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Image courtesy of Pexels

Charts courtesy of tradingview.com

Bitcoin

Bitcoin Price Dumps Below $41,000 Amid Uncertainty

Bitcoin price dumped hard on Monday, briefly slipping below $41,000, erasing gains recorded in the previous week. The premier cryptocurrency seems to have exhausted its recent rally propelled by industry vulnerabilities. At the time of writing, the world’s largest cryptocurrency was trading slightly lower at $41,385. Bitcoin’s total market cap has dipped by 2% over the past day, while the total volume of BTC tokens traded over the same period climbed by 58%.

Fundamentals

Bitcoin price has been facing retracements and a rollercoaster over the past few days after recently rocketing to a 20-month peak. On-chain data has suggested that many investors used the opportunity to take some profits, leading to a decline in the asset’s price.

Bitcoin’s price slump is mirrored in the wider crypto market, with the global crypto market cap decreasing by 1.85% over the past 24 hours to $1.55 trillion. The total crypto market volume has increased by 32% over the same period. The Crypto Fear and Greed Index has plunged from a level of extreme greed to a greed level of 70, suggesting a decline in risk appetite.

Ethereum, the largest altcoin by market capitalization, is currently trading at $2,167, down almost 3% for the day. Meme coins have been hit hard by the market slump, with Dogecoin and Shiba Inu down by more than 4% over the last day.

Last week on Thursday, cryptocurrency experts took notice of…

Bitcoin

Bitcoin Price is in Consolidation Mode Despite Market Optimism Post-Fed Decision

Bitcoin price edged lower on Thursday despite optimism in wider markets on the back of the Fed’s interest rate decision. The flagship cryptocurrency has been consolidating above the critical level of $42,000 after briefly topping $44,000, its highest level in 20 months. Bitcoin was trading 0.71% lower at $42,569 at press time. BTC’s total market cap has increased by more than 3% over the last day to $832 billion, while the total volume of the asset traded over the same period jumped by 22%.

Economic Outlook

Bitcoin price has been trading sideways over the past few days, suggesting a pause in its recent rally towards $45,000. The premier cryptocurrency has decreased by 4% in the past week but remains 15.22% higher in the month to date. The digital asset has staged a significant recovery this year after a torrid 2022 in which a string of scandals, including the collapse of FTX, led to a market meltdown, undermining the credibility of the sector.

The crypto market has been buoyed by the Fed’s latest interest rate decision. The US Federal Reserve on Wednesday held its key interest rate unchanged for the third consecutive time, in line with market expectations. With the easing of the inflation rate, members of the Federal Open Market Committee (FOMC) voted to keep the benchmark overnight borrowing rate in a targeted range between 5.25%-5.5%.

Additionally, the central bank indicated that three rate…

Bitcoin

Bitcoin Price Blasts $44K in Spectacular Surge as Spot Bitcoin ETF Approval Looms Large

Bitcoin price has been hovering above the $43,000 psychological level over the past two days amid anticipation about the potential approval of a spot bitcoin ETF. The flagship cryptocurrency has climbed more than 16% in the past week and nearly 170% in the year to date. Bitcoin’s total market cap has increased by nearly 5% over the past 24 hours to $858.9 billion, while the total volume of the token traded rose by 43%. The Bitcoin price was trading at $43,914 at press time.

Fundamentals

Bitcoin price has posted significant gains over the past few days, climbing to its highest level since April 2022, before the crash of a stablecoin that started a litany of company failures, pummeling crypto prices. The world’s largest cryptocurrency briefly topped the crucial level of $44,000 on Wednesday amid rising momentum despite being massively overbought.

According to analysts, with no spot bitcoin ETF approvals yet and the halving event five to six months away, the market is riding on FOMO. Capital has been flowing in the Bitcoin market amid enthusiasm that the launches of spot ETF will bring in billions of dollars of new investment into the crypto sector.

Investors have already started providing capital as seed money for ETF products. Notably, a recent report by CoinDesk showed that the world’s largest fund manager, BlackRock, received $100,000 in capital from a seed investor for its spot bitcoin exchange-traded fund…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange