Trade

Facebook has launched a white paper today for it’s planned cryptocurrency – Libra

11 things you need to know:

- Libra’s mission is to enable a simple global currency and financial infrastructure the empowers billions of people.

- Libra is a stablecoin which will launch in H1 2020. This will be fully backed by a reserve of real assets (a basket of bank deposits and short-term government securities). The balance of the basket can be changed if needed to offset major price fluctuations.

- Facebook won’t control Libra. They get one vote like other founding members of the independent Libra Association headquartered in Switzerland. This provides a level of decentralization and they hope to have 100 well geographically distributed and diverse members by launch. Other founding members include MasterCard, Visa, PayPal and Uber as well as not-for-profits such as Women’s World Banking and academic institutions. They have all invested $10million each.

- It is built on the Libra blockchain which is open-source and any developer can build smart contracts using the Move code language. Move was created to prevent assets from being cloned, to facilitate exchange into fiat and to make it easier to write blockchain code that follows an author’s intention without introducing unintended bugs. The prototype of the blockchain – the testnet – launched today so it’s in beta mode until the launch in H1 2020.

- The Libra blockchain is managed by nodes, which are servers that help operate the blockchain. Each founding member operates a validator node. The blockchain follows a Byzantine Fault Tolerance (BFT) consensus approach which means that only two thirds of the nodes need to come to consensus that the transaction is legitimate and for it to be executed and written in the blockchain. Transactions incur a tiny cost to pay for ‘gas’ that covers the cost of transferring funds – similar to Ethereum.

- Currently, the Libra blockchain is ‘permissioned’ i.e. only entities that fulfil certain requirements can participate in the group that governs the blockchain. The goal is to move to a permission-less system in 5 years based on proof-of-stake. This will protect against attacks by distributing control, facilitating competition and lowering the barrier to entry. The aim is for 20% of votes in the Libra Association to come from node operators based on how much Libra they hold rather than being founding members.

- Facebook has launched a new subsidiary called Calibra. It’s first product will be a digital wallet so people can save, send and spend Libra. The wallet will be available in Messenger, WhatsApp and as a standalone app. It is expected to launch in 2020.

- Facebook has said that they will ensure that Calibra protects users’ privacy by never mingling Libra payments with Facebook data so it cannot be used for ad targeting etc.

- The Libra Association will encourage the listing of Libra on multiple regulated electronic exchanges around the world.

- The Libra Association will also work to sign up businesses to accept Libra for payment and will work on programmes to encourage more developers and merchants to work with them. It plans to use incentives – probably Libra coins – to pay node operators when they sign up people to use Libra. Companies earning these incentives can either keep them or pass them onto their users in the form of free Libra coins or discounts.

- You will spend and own Libra through Libra wallets such as Facebook’s own Calibra wallet, but also we expect others to build compatible wallets including Association members like PayPal or Spotify. Their goal is to make sending or paying money as easy as sending a Facebook message.

eToro’s view:

- This is a seismic moment for global finance.

- It is the first time that we have seen a tech giant and one of the FAANGS make a significant move into finance using crypto by launching a decentralized, blockchain, which will be available to billions of people.

- We are pleased to see that it is open source and decentralized.

- We look forward to listing Libra on eToroX, our crypto exchange, and eToro.com our trading and investment platform with over 11 million registered users across 140 countries.

- We believe that this is just the beginning. We expect other tech giants to follow suit helping to realize the potential for blockchain to disrupt traditional financial services.

- eToro will continue to play a key role in this revolution as we work to open up money to everyone around the world.

- With over 2.5 billion people unbanked in the world, and the majority of the global population using less liquid or inefficient local currencies, there is a great technological opportunity to connect billions of people to one economy through a currency powered by technology.

- With 2 billion users, Facebook has the potential to create one of the largest financial platforms in the world.

- Crypto adoption is about more than money. It’s about global and local politics and the separation of state and money. It can be a powerful tool – hopefully for good.

- Facebook’s Libra could mean greater financial inclusion and greater access to the digital economy.

- Libra’s mission echoes that of eToro’s GoodDollar. The difference is that GoodDollar will distribute money using the principle of universal income (UBI). GoodDollar is 100% not for profit.

- A remaining weakness of the crypto ecosystem is the usability and user experience (UX) which is still quite technical. There are a lot of startups working on creating a better UX for crypto and we expect this to evolve quickly as we move closer to mass adoption.

Altcoins

XNO Token of Xeno NFT Hub listed on Bithumb Korea Exchange

Hong Kong, Hong Kong, 25th January, 2021, // ChainWire //

Xeno Holdings Limited (xno.live ), a blockchain solutions company based in Hong Kong, has announced the listing of its ecosystem utility token XNO on the ‘Bithumb Korea’ cryptocurrency exchange on January 21st 2021.

Xeno NFT Hub (market.xno.live ), developed by Xeno Holdings, enables easy minting of digital items into NFTs while also providing a marketplace where anyone can securely trade NFTs.

The Xeno NFT Hub project team includes former members of the technology project Yosemite X based in San Francisco and professionals such as Gabby Dizon who is a games industry expert and NFT space influencer based in Southeast Asia.

NFT(Non-Fungible Token) technology has recently gained huge focus in the blockchain arena and beyond, making waves in the online gaming sector, the art world, and the digital copyrights industry in recent years. The strongest feature of NFTs is that “NFTs are unique digital assets that cannot be replaced or forged”. Unlike fungible tokens such as Bitcoin or Ether, NFTs are not interchangeable for other tokens of the same type but instead each NFT has a unique value and specific information that cannot be replaced. This fact makes NFTs the perfect solution to record and prove ownership of digital and real-world items like works of art, game items, limited-edition collectibles, and more. One of the ways to have a successful…

Altcoins

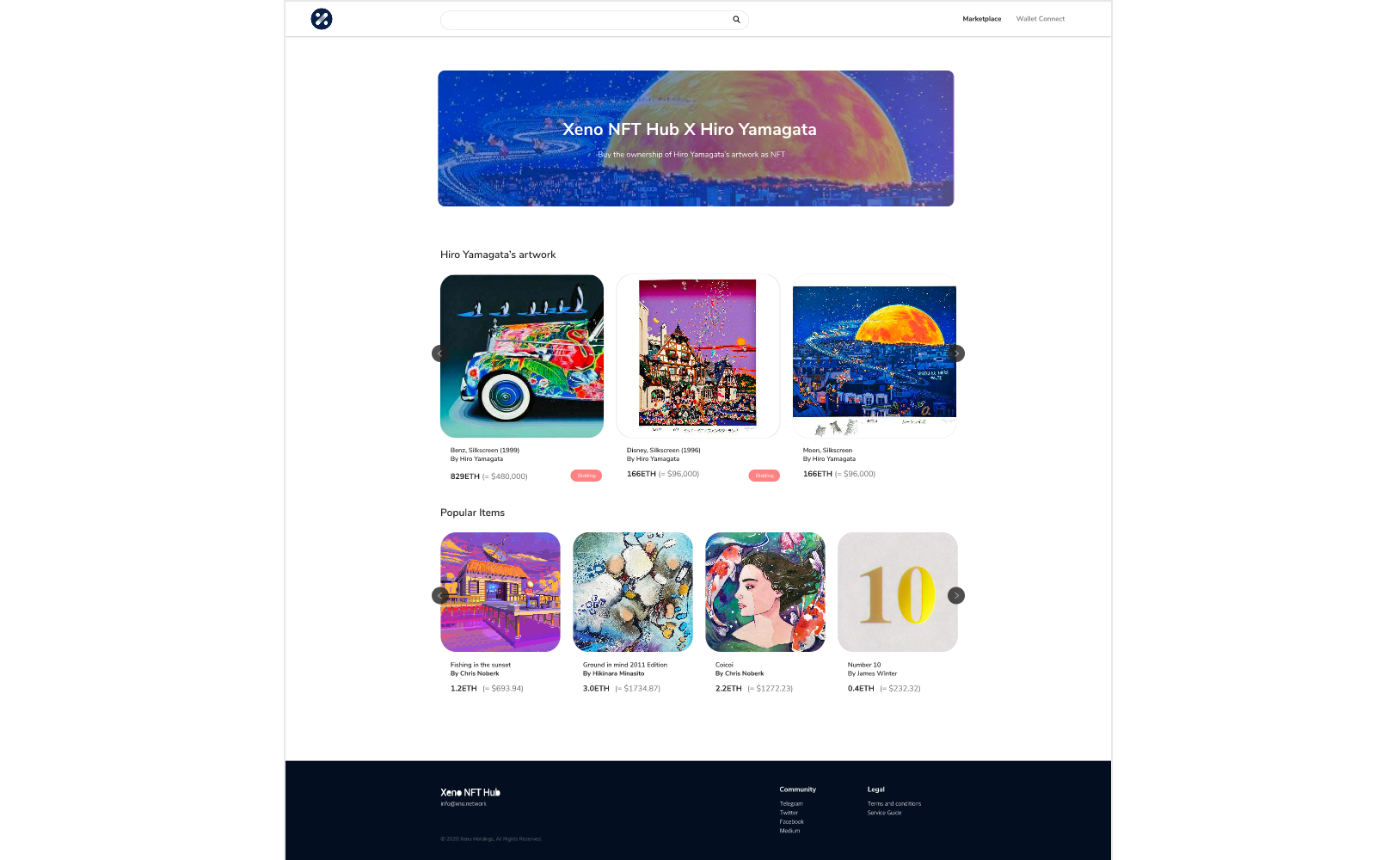

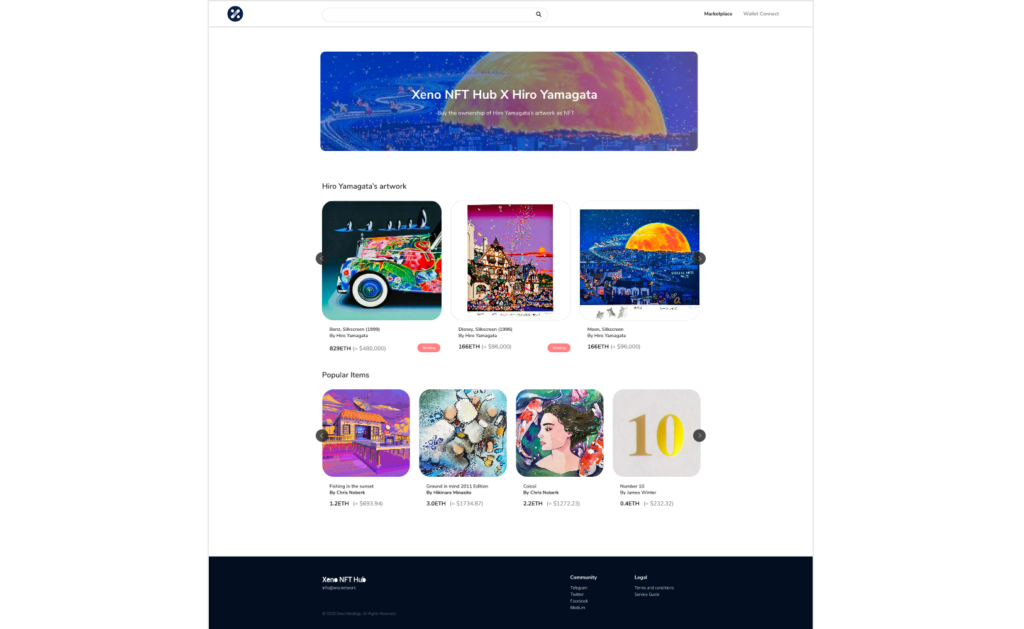

XENO starts VIP NFT trading service and collaborates with contemporary artist Hiro Yamagata

Hong Kong, Hong Kong, 24th December, 2020, // ChainWire //

The XENO NFT Hub (https://xno.live) will provide a crypto-powered digital items and collectables trading platform allowing users to create, buy, and sell NFTs. Additionally it will support auction based listings, governance and voting mechanisms, trade history tracking, user rating and other advanced features.

As a first step towards its fully comprehensive service, XENO NFT Hub launched a recent VIP service to select users and early adopters in December 2020 with plans for a full Public Beta to open in June 2021.

“NFTs are extremely flexible in their usage, from digital event tickets to artwork, and while NFTs have a very wide spectrum of uses and categories XENO will initially focus its partnership efforts and its own item curation on three primary areas: gaming, sports & entertainment, and collectibles.”, said XENO NFT Hub president Anthony Di Franco.

He also added “This does not mean we will prohibit other types of NFTs from our ecosystem However, it simply means that XENO’s efforts as a company will be targeted into these verticals initially as a cohesive business approach.”

Development and Procurement Lead, Gabby Dizon explained, “Despite our initial focus, we found ourselves with a unique opportunity to host some of the works of Mr. Hiro Yamagata. We are collaborating with Japanese artist Hiro Yamagata to enshrine some of his artwork into NFTs.”

Mr. Yamagata has…

Altcoins

My Crypto Heroes Announces Issuance of MCH Governance Token

Tokyo, Japan, 24th November, 2020, // ChainWire //

My Crypto Heroes is happy to announce the issuance of MCH Coin as an incentive to players in the My Crypto Heroes ecosystem, aiming to allow them to craft a “User-oriented world”. The MCH coin is available on Uniswap with a newly created pool with ETH.

My Crypto Heroes is a blockchain-based game for PC and Mobile. It allows users to collect historic heroes and raise them for battle in a Crypto World. Officially released on November 30th, 2018, MCH has recorded the most transactions and daily active users than any other blockchain game in the world.

What is MCH Coin?

MCH Coin is being issued as an ERC-20 Standard Governance Token. The issuance began on November 9th, 2020, with 50 million tokens issued.

Of the funds issued, 40% are allocated to a pay for on-going development and as rewards for advisors and early investors. 10% are allocated to marketing and the growth of the ecosystem, and 50% are allocated to the community. The Distribution Ratio of the MCH Coin is subject to change via a governance decision.

The MCH coin will be used as a voting right as part of the ecosystem’s governance, with 1 coin being 1 vote. It will also be used for in-game utilities and payments. Additional information can be found here:

https://medium.com/mycryptoheroes/new-ecosystem-with-mchcoin-en-a6a82494894f

During December 2020 the first…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoIs Litecoin (LTC) Changing Its Game Plan By Going For Mass Adoption?