Don't Miss

Global Coin Report: Paymon White Paper Review

Paymon just closed out on the first stage of its initial coin offering (ICO) and has drawn a considerable amount of attention towards its platform and company goals in the process. Potential investors are asking whether there’s real value in this company and, in turn, are trying to figure out how much risk is associated with picking up a position on the back of the ongoing ICO.

In order to serve up a bit of insight into this situation, we asked our review team to take a look at the company.

Here’s what we found.

The whitepaper kicks off with an introduction, so we’ll do the same.

Introduction

This one is all about developing an ecosystem.

The idea is pretty simple in concept.

Paymon acknowledges that the potential implications of blockchain technology are large and the potential for the technology to revolutionize pretty much everything about the way we transact, or the way businesses function and operate, is real and to a large degree inevitable.

The company also acknowledges, however, that this space is very fragmented right now and this fragmentation makes it difficult for new enterprises or new individuals to enter the sector and really leverage the potential of the technology.

According to this white paper, then, Paymon’s answer to these issues is the company’s development of an all encapsulating, 360° ecosystem that can serve as a one-stop shop type application through which individuals, companies, and others can access and leverage the benefits associated with blockchain integration.

So, what is our take on this concept?

Well, at a glance, it looks like a strong project. In this regard, we give the company credit for attempting to do something that really could make a difference as to the rate and scale with which this technology is adopted. Of course, at the same time, and with this being an in-depth review, we can’t really ignore the fact that this is a very large undertaking and that it’s going to require a strong team and solid execution. This is something we will get to in a little more detail shortly.

The Technology

Before getting into how the technology breaks down, it is worth noting that there is an existing MVP available as a mobile application, on both Google Android and iOS, right now.

This is something that is a very strong plus point, as many companies that are conducting ICOs have very little in the way of working, proof of concept technology in place ahead of starting to raise money.

Paymon does, and that gives it a strong lead over some of its competitors in this space.

Outside of this MVP, however, there are also plans for pretty large-scale development across two primary areas. These are:

- The Paymon Platform

- The Paymon Cryptocurrency

Let’s look at these one by one.

First up, then, the platform.

The platform will incorporate a number of things primarily. The first of these is a decentralized token exchange that will allow for and incorporate all types of the blockchain. The second is a system for creating smart contracts with remade and preconfigured contents. Third and fourth are an API for developers and they develop ecosystem through which creators are able to support development on the platform.

In addition, the platform will incorporate the following:

- Security system for both users and developers

- The ability to create your own token or cryptocurrency

- The ability to organize and launch your own Token Sale (ICO)

- Escrow

- Financial transactions and mobile payments

- Confirmation of assets possession

- Voting and rating system

- Authorization and authentication confirmation

As is clear from the above list, then, this really is an all-encompassing platform that aims to bring every aspect of bitcoin and blockchain technology under one roof.

So, we will say it again – if Paymon is able to execute on this vision, it could be a potentially game-changing platform and, in turn, could prove to be the project that every company wants to undertake and that every investor wants to back: the project that bridges the gap between blockchain as a cutting-edge technology and mainstream integration.

So that is the first part of this project, the second, as noted above, is the Paymon cryptocurrency.

Any strong ICO project needs an equally strong token associated with it for a variety of reasons, with the primary of these reasons generally rooted in either the token serving as some sort of fuel type payment that facilitates functionality or as an exposure type token through which early investors can take a position in the company’s future growth.

In this instance, both of these things are true.

The Paymon coin is abbreviated as PMNC and it is designed on the premise that it will, at some point, become as popular if not more so than all of the current existing cryptocurrencies including bitcoin.

That’s a big claim, of course, but if this company can execute on a strategy as outlined above, it’s far from an unreasonable one.

So, PMNC is designed with the following functions in mind:

- Safekeeping of funds

- The possibility of asset growth

- Instant exchange of currency between the network users

- One common interface for investments in classic assets, currencies, and cryptocurrencies

- Forex hedging

And, in addition, the company outlines its belief that an effective and widespread use coin must incorporate the following features:

- Anonymous

- Fast

- No transaction fees

Further, Paymon details in its whitepaper the fact that a blockchain that is able to support a cryptocurrency that displays both the above following functions and the above-outlined features must be:

- Scalable

- Fully decentralized

- Transparent

There are a few things here that we feel are important to highlight as part of this white paper review.

First, that it looks as though Paymon has identified the shortcomings of the current cryptocurrency environment and is attempting to build its own cryptography with a resolution to the shortcomings in mind. For us, that’s an important part of this entire project. To put this another way, Paymon has recognized those reasons behind the current seeming inability of blockchain technology to make the jump between cutting-edge and mainstream and, on the back this recognition, is trying to replace the features that cause this inability so as to enable Intel platform to be the one that eventually does make this jump.

That, in and of itself, is an interesting feature of this white paper.

The Token and the ICO

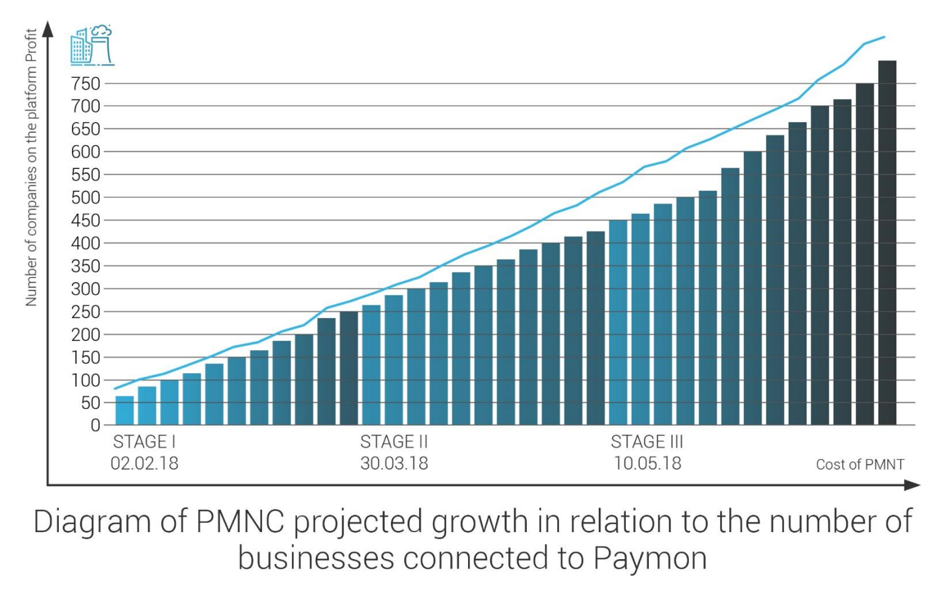

So what about the token? How does that fit into the picture and, more importantly, how is it going to drive value growth for early-stage investors? Well, take a quick look at the chart below. It details the structure of the Paymon ICO and the concurrent price expectations for PMNT as the offering matures:

The idea, then, is that as the ICO matures, and the individual stages of the offering complete, the number of companies that use the platform will also increase. An increased degree of usage will increase demand for PMNC and, as per standard economics, an increased demand when considered against the backdrop of a fixed supply will drive an increase in price.

It is in this price increase that an early investors growth is rooted.

Again, given that this is an objective review, it’s important to note here that for a return to materialize the company needs to draw attention towards its platform, and this is going to be the job of its leadership team.

So what can PMNC holders do with their tokens once they hold them?

This all depends on what their individual goals as token holders are. As is almost certainly going to be the case for early-stage investors, holders can store the tokens in anticipation of long-term growth.

But that’s not all.

Users can also transfer these tokens to their friends across the platform, exchange the tokens for any other cryptocurrency within the system, spend it across the platform on goods and services, store assets in PMNC and, additionally, business owners can even add their company to Paymon.

And of course, finally, they can sell it on the open market to realize a profit subsequent to a shift in token value as the company grows and expands in line with its milestones.

So, this brings us to the final element but probably one of the most important parts of this review – the Roadmap.

The image below details the Pre-ICO stage of the company’s Roadmap, between inception during October 2016 and February 2018, the point at which the ICO initiated with the above-mentioned first stage.

As illustrated, each of these items has been reached and achieved as per expectations, with the MVP in place and some early-stage capital investment also on the balance sheet serving to bolster sentiment.

The reaching of these milestones cannot be understated from an importance perspective.

Not only does this company have a product in place already, it also has some third-party capital lined up supportive of its own expectations.

Very few ICO entities can say this right now ahead of conducting their initial ICOs.

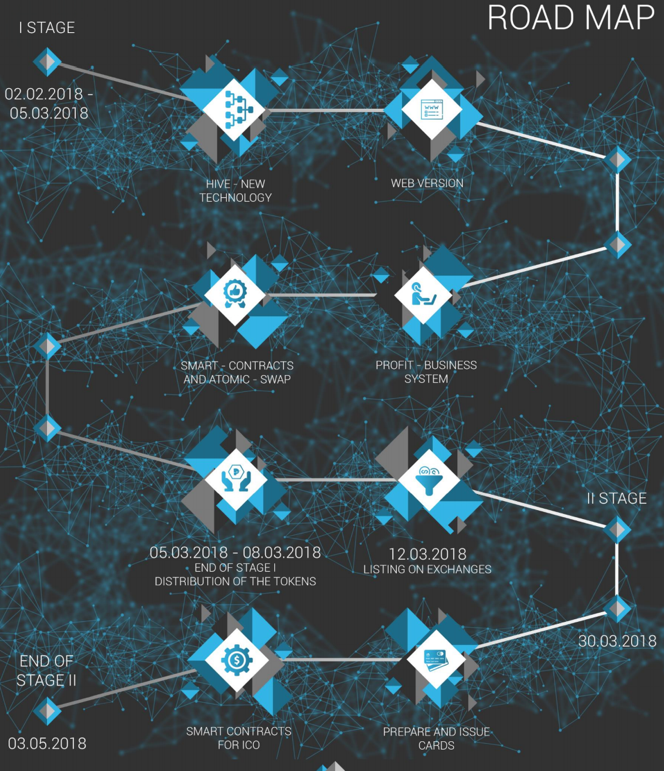

The second roadmap stage is illustrated in the below image:

So, as outlined in the image above, the company is going to spend the period to the middle of March 2018 developing and incorporating features into its platform. By the start of the second stage, expectations are that the token will be listed on exchanges and, by the end of the second stage, that smart contracts for the ICO will be in place and the company will be in a position to prepare and issue physical cards.

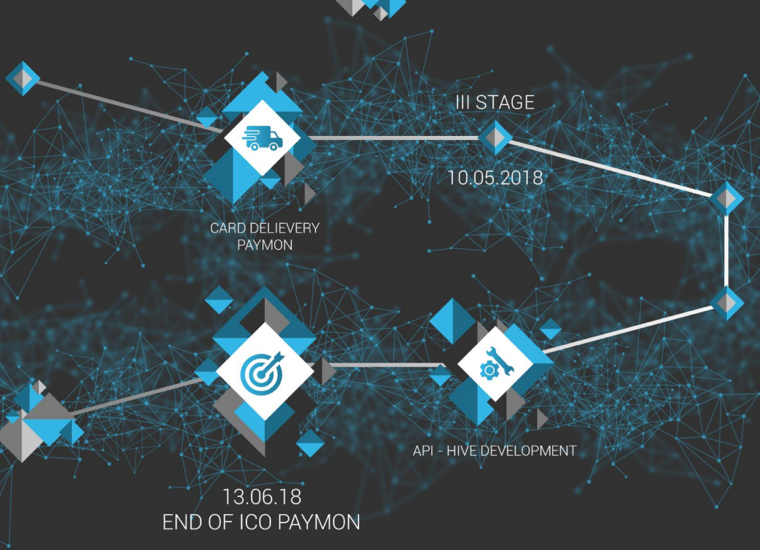

The third and final image outlines the final stage of the ICO roadmap:

during this phase, the company is going to deliver its cards and incorporate the development of its API and Hive system into the platform, before completing the ICO on 13 June 2018.

There are a few things that we like about this roadmap and that we feel set it apart from other companies in the space.

First, that the company expects to have a complete and working product by the end of its ICO phase. That’s rare – normally these companies want to raise money to build a product as opposed to building and growing a product whilst raising money.

Second, that this is an aggressive but justified approach.

By having an MVP in place and having raised outside finance already, Paymon has demonstrated that it is more than capable of executing on an aggressive strategy and, for this reason, we rate this ICO and whitepaper highly.

Conclusion

So, let’s bring this all together into a conclusion.

Paymon is trying to bridge the gap between mainstream and cutting-edge technology with its platform and the company has what looks like a very well thought out and neat strategic approach outlined in its white paper.

It’s far from a simple task to achieve, and with some aggressive milestones in place it’s going to be a push to complete in line with expectations, but taking into consideration the above-mentioned factors we feel that Paymon is more than capable of achieving what it has set out to achieve and, in turn, represents a nice early-stage exposure to a company in the space through its ongoing ICO.

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Don't Miss

A Guide to Exploring the Singaporean ETF market

Singapore’s Exchange Traded Fund (ETF) market has grown, offering investors diverse investment opportunities and access to different asset classes. As the market evolves, investors must navigate these uncharted waters with a clear understanding of Singapore’s ETF landscape. This article explores the trends, challenges and strategies for navigating the Singapore ETF market. To start investing in ETFs, you can visit Saxo Capital Markets PTE.

The Singaporean ETF Market: Exponential Growth

The Singapore ETF market has seen significant growth in recent years, with an increasing number of ETFs covering a wide range of asset classes and holders. different investment topics.

One of the notable trends in the Singapore ETF market is the growing diversity of available options. Investors can now choose from ETFs that track domestic and international stock indexes, bonds, commodities, and specialist sectors or themes. This diverse range of ETFs allows investors to create comprehensive portfolios tailored to their investment goals.

The growth of the ETF market in Singapore is also due to growing investor demand for low-cost, transparent, and accessible investment vehicles. ETFs offer benefits such as intraday liquidity, real-time pricing, and the ability to trade on exchanges. These characteristics have made ETFs attractive to retail and institutional investors who want exposure to different asset classes.

Regulatory Landscape and Investor Protection

The Monetary Authority of Singapore (MAS) is the…

Don't Miss

Property Loans for Foreigners in Singapore That You Must Know About

Intending to invest in a residential or commercial property in Singapore?

When it comes to foreigners applying for a loan in Singapore, things can be pretty hard regardless of the reason whether you need the property for personal or business purposes.

In Singapore, buying a property is challenging, whether you are a foreigner or a native, and sometimes applying for a loan is the only way for you to afford it.

HOW MUCH CAN YOU BORROW FOR A PROPERTY LOAN IN SINGAPORE?

As for the Foreigner Loans, in Singapore, there is an exact amount of money you can borrow to finance the purchase of a property.

In this sense, Singapore has the Loan to Value Ratio (LTV).

The LTV ratio is what determines the exact amount of money you can borrow for a property loan, which changes depending on where you try to obtain the loan:

- If you are applying for a bank loan, you can borrow a maximum of 75% of the value of the property you want to purchase. That means if you are looking for a property that costs $500.000, the maximum amount of money a bank lender can give you like a loan in Singapore is going to be $375.000.

- When you are applying for a loan with a Housing…

Don't Miss

CoinField Launches Sologenic Initial Exchange Offering

CoinField has started its Sologenic IEO, which is the first project to utilize the XRP Ledger for tokenizing stocks and ETFs. The sale will last for one week and will officially end on February 25, 2020, before SOLO trading begins on the platform. Sologenic’s native token SOLO is being offered at 0.25 USDT during the IEO.

Earlier this month, Sologenic released the very first decentralized wallet app for SOLO, XRP, and tokenized assets to support the Sologenic ecosystem. The app is available for mobile and desktop via the Apple Store and Google Play. The desktop version is available for Windows and Mac.

“By connecting the traditional financial markets with crypto, Sologenic will bring a significant volume to the crypto markets. The role of the Sologenic ecosystem is to facilitate the trading of a wide range of asset classes such as stocks, ETFs, and precious metals using blockchain technology. Sologenic is an ecosystem where users can tokenize, trade, and spend these digital assets using SOLO cards in real-time. The ultimate goal is to make Sologenic as decentralized as possible, where CoinField’s role will be only limited to KYC and fiat ON & OFF ramping,” said CoinField’s CEO…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange