Don't Miss

LAPO Coin (LAX) – a Swiss Stable Cryptocurrency for Market Growth

It’s almost been ten years since Bitcoin, the pioneer of cryptocurrencies, was first introduced to the world in 2009.

And, what a ride it’s been. While someone in 2010 bought 2 pizzas with 10,000 bitcoins, today, that amount of Bitcoin is worth an absolute fortune!

The same, explosive growth, also catapulted Ethereum, which followed the pioneer in later years, into the stratosphere. And, Ripple & many of the other cryptocurrencies, of which, today, there are more than 1,600 to choose from in a global market valued close to $400 billion.

While, during this decade the world has gone gaga over crypto; and, governments & regulators across the planet are doing their best, as we speak, to find suitable frameworks for the incorporation thereof, it is clear that digital money is busy gaining wide popularity as preferred method for the exchanging of value, in this, the Digital Age.

However, one of the major hurdles that still needs to be overcome is volatility.

Please continue reading to see how price instability is holding back the market growth of crypto.

And, how Lapo has stepped in with a solution that curbs volatility, thereby making its LAX Coin perfect for everyday use.

Also, how you can participate in this lucrative opportunity by becoming a proud owner of LAX today; thereby, benefitting from an early-mover advantage before the Coin begins trading in the open market at rising values.

Skyrocketing and fluctuating crypto prices cause severe market turbulence

In recent years, the mainstream media has been doing a good job and continues to do so, of keeping us informed on the countless, new millionaires, or even billionaires, that are being created ever so often, thanks to the world’s snowballing interest in cryptocurrency.

Of course, we all know a good thing when we see one; and, global citizens everywhere are increasingly becoming aware that it’s simply a matter of time until digital currencies become the everyday norm.

Therefore, while just about everyone and anyone’s getting on board, the unprecedented demand for crypto has seen the prices of the more popular currencies appreciate tenfold, hundredfold and even more, over recent years.

While, surely, nobody is complaining in a rising market, all the frantic crypto buying & selling activity leaves huge waves of volatility in its wake.

So much so, that the instability is severely hampering the outlook for crypto to reach its next level, as far as the big picture for the overall market is concerned, i.e. the rapid adoption of digital currencies for everyday use, in our normal lives, when we go shopping, or make regular payments for goods & services.

For instance, it is not uncommon to see the prices of popular digital currencies, such as Ethereum and Bitcoin, to fluctuate between 10-15% in a single day. Everyday payers and payees are therefore reluctant, to say the least, to part with, or receive, crypto that can be worth much more tomorrow, or much less.

In January, the popular British newspaper, The Telegraph, published an article titled, “Can Bitcoin or any other cryptocurrency actually work as money?”

In the article, The Telegraph wrote, “Most buyers of cryptocurrency are betting that the price of whichever ‘coin’ they buy will increase in value dramatically. However, the ultimate aim of many digital currencies is not to remain a highly volatile asset for speculative investors but to offer a viable decentralized alternative to the current system of money.”

The article further quoted Garrick Hileman, who holds positions at the London School of Economics and University of Cambridge and specializes in monetary systems, as saying, “Cryptocurrencies such as Bitcoin and Litecoin do function as a medium of exchange, as you can buy things with them. They do store value from day to day, although they are very volatile and the fact that they can lose value so rapidly is a major question mark.”

“Volatility is also a significant barrier to a cryptocurrency achieving widespread adoption. Buyers don’t want to hold currency ahead of a purchase when it could lose 90pc of its value tomorrow and don’t want to spend currency that could gain 50pc in hours. Similarly, sellers don’t want to accept a form of payment that could fall in value dramatically once they receive it”, The Telegraph concluded.

The LAPO (LAX) Coin protects users against artificial volatility

Lapo believes that stability is a key requirement of any currency that aims to create a favorable economic environment where activity & growth are the desired outcomes.

And, to cultivate & achieve the aforementioned objectives, Lapo is rendering its LAX cryptocurrency perfect for everyday use, by combining its monetary policy with Artificial Intelligence (AI) into a holistic solution, called “The Stability Fund”.

The AI algorithm for Lapo’s Stability Fund has been programmed with one, overriding global mandate in mind, i.e. the stability and long-term growth of the value of its LAX coin.

The Lapo algorithm detects artificial price volatility in terms of LAX, such as “pump and dump” schemes, often perpetrated by opportunistic crypto traders seeking to manipulate markets for their own gain.

And, where such unusual price spikes or troughs are detected by the AI algorithm,

then it automatically purchases or sells LAX in the open market, to the extent that is necessary to return the LAX price to the levels supported by natural market activity, in contrast with the manipulated spikes and troughs.

The Stability Fund is the mechanism that is employed by Lapo to ensure that the LAX price reflects a true representation of normal market activity, by equalizing or smoothing out the effects of artificial volatility.

The Lapo AI algorithm operates according to the principles of the “Seigniorage Shares” concept, which is further explained under How the Stability Fund Works, in the Lapo whitepaper.

As a non-collateralized coin, the value of Lapo’s LAX is independent of other currencies, such as the US Dollar, Bitcoin or Ethereum. Because Lapo’s Stability Fund removes any & all incentives for potential market manipulators to try and control the price of LAX, the coin outperforms the others as a stable store of value.

The LAPO Coin (LAX) & Initial Coin Offering (ICO)

The LAX Coin is the core currency of the LAPO ePlatform and can be easily converted at any time to other cryptocurrencies or traditional (“fiat”) monies.

The LAX Coin is required for all exchanges of value on Lapo’s decentralized, blockchain, payment ecosystem.

The Lapo ICO is currently underway and you may Register online to get 50 LAX for free!

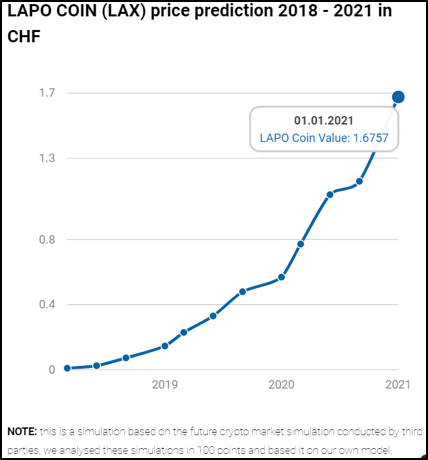

Because, there is a limited supply of the LAX Coin available, its value is expected to rise in the open cryptocurrency market as demand grows over time.

More information on the Lapo ICO, the token sale terms, coin distribution & fund distribution is available on the Lapo website.

While a detailed summary of the Financial and Presale Information may also be viewed in Lapo’s whitepaper.

Management, Milestones & Roadmap

LAPO Blockchain is a Swiss-based project in Zug and Zürich, under the capable leadership of ten skilled and experienced Members, also a board of five Advisors.

Please Meet the Team on the Lapo website.

The exciting journey of Lapo started in 2017. While several Development Milestones have already been achieved to date, many more are in the pipeline for the years & decades to come.

Also, please view the detailed, Lapo Roadmap online.

Conclusion

We all love crypto. But, after years of severe volatility, we are now looking forward to enjoying the stability that is required for digital currency to take its rightful place as the world’s favorite medium for the exchanging of value.

Enters Lapo and the LAX coin, the perfect crypto solution for normal, everyday payments of goods & services right across the planet.

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Image courtesy of Pexels

Don't Miss

A Guide to Exploring the Singaporean ETF market

Singapore’s Exchange Traded Fund (ETF) market has grown, offering investors diverse investment opportunities and access to different asset classes. As the market evolves, investors must navigate these uncharted waters with a clear understanding of Singapore’s ETF landscape. This article explores the trends, challenges and strategies for navigating the Singapore ETF market. To start investing in ETFs, you can visit Saxo Capital Markets PTE.

The Singaporean ETF Market: Exponential Growth

The Singapore ETF market has seen significant growth in recent years, with an increasing number of ETFs covering a wide range of asset classes and holders. different investment topics.

One of the notable trends in the Singapore ETF market is the growing diversity of available options. Investors can now choose from ETFs that track domestic and international stock indexes, bonds, commodities, and specialist sectors or themes. This diverse range of ETFs allows investors to create comprehensive portfolios tailored to their investment goals.

The growth of the ETF market in Singapore is also due to growing investor demand for low-cost, transparent, and accessible investment vehicles. ETFs offer benefits such as intraday liquidity, real-time pricing, and the ability to trade on exchanges. These characteristics have made ETFs attractive to retail and institutional investors who want exposure to different asset classes.

Regulatory Landscape and Investor Protection

The Monetary Authority of Singapore (MAS) is the…

Don't Miss

Property Loans for Foreigners in Singapore That You Must Know About

Intending to invest in a residential or commercial property in Singapore?

When it comes to foreigners applying for a loan in Singapore, things can be pretty hard regardless of the reason whether you need the property for personal or business purposes.

In Singapore, buying a property is challenging, whether you are a foreigner or a native, and sometimes applying for a loan is the only way for you to afford it.

HOW MUCH CAN YOU BORROW FOR A PROPERTY LOAN IN SINGAPORE?

As for the Foreigner Loans, in Singapore, there is an exact amount of money you can borrow to finance the purchase of a property.

In this sense, Singapore has the Loan to Value Ratio (LTV).

The LTV ratio is what determines the exact amount of money you can borrow for a property loan, which changes depending on where you try to obtain the loan:

- If you are applying for a bank loan, you can borrow a maximum of 75% of the value of the property you want to purchase. That means if you are looking for a property that costs $500.000, the maximum amount of money a bank lender can give you like a loan in Singapore is going to be $375.000.

- When you are applying for a loan with a Housing…

Don't Miss

CoinField Launches Sologenic Initial Exchange Offering

CoinField has started its Sologenic IEO, which is the first project to utilize the XRP Ledger for tokenizing stocks and ETFs. The sale will last for one week and will officially end on February 25, 2020, before SOLO trading begins on the platform. Sologenic’s native token SOLO is being offered at 0.25 USDT during the IEO.

Earlier this month, Sologenic released the very first decentralized wallet app for SOLO, XRP, and tokenized assets to support the Sologenic ecosystem. The app is available for mobile and desktop via the Apple Store and Google Play. The desktop version is available for Windows and Mac.

“By connecting the traditional financial markets with crypto, Sologenic will bring a significant volume to the crypto markets. The role of the Sologenic ecosystem is to facilitate the trading of a wide range of asset classes such as stocks, ETFs, and precious metals using blockchain technology. Sologenic is an ecosystem where users can tokenize, trade, and spend these digital assets using SOLO cards in real-time. The ultimate goal is to make Sologenic as decentralized as possible, where CoinField’s role will be only limited to KYC and fiat ON & OFF ramping,” said CoinField’s CEO…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange