Altcoins

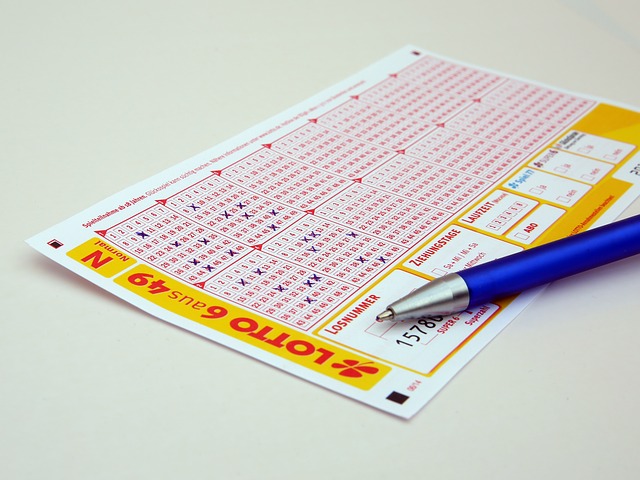

Lotto Nation is Revolutionizing the Traditional Lottery Industry

As the global economy continues to deal with the economic fallout due to the ongoing pandemic, companies are coming to terms with the fact that normalcy may not return for quite a while. Many economists are wondering how the business landscape will look a year or more from now. It’s certainly possible that many businesses, such as retailers and restaurants, may be unable to survive the current downturn. But while some businesses will falter, others will emerge stronger than ever.

Traditionally, when economies go through a severe downturn, companies adapt. Those that maintain the status quo usually have great difficulty while those that adapt prosper and conquer. One possible example of this is Lotto Nation. Thanks to the entrepreneurial skills of Nils Thomson, the Founder and CEO of Lotto Nation, the company is attempting to completely modernize the traditional lottery industry.

Current Lottery Model is Severely Outdated

It’s safe to say that nearly every human that has ever walked the earth has fantasized about winning the massive jackpot that would completely change their life. These dreams have turned the global lottery industry into a $302 billion market that is expected to reach $380 billion by 2025. Despite this predicted growth, the industry suffers from a variety of problems that are preventing it from really exploding.

Perhaps the biggest problem is that traditional lotteries are centralized. Because of this, there is essentially no oversight on what a lottery provider may or may not do. This lack of transparency leads to high levels of fraud and hidden costs that cause a great deal of trust issues among the lottery participants. In addition, players often have to deal with highly restrictive limits on withdrawals that can be burdensome to deal with.

Businesses and charities have their own hurdles to deal with. Problems for these participants include the following:

- Large entry fees

- High costs of running an online lottery

- Large jackpots cannot be offered

- Long and expensive licensing processes involved

- No support for blockchain protocols

The last issue is extremely important especially as it relates to this article. One of the best aspects of blockchain technology is efficiency and transparency. In this case, the use of blockchain technology would result in eliminating the middleman which will lead to better results (including fairness) for all those involved. Additionally, blockchain technology is borderless which will truly help to capture a global audience.

The Rise of Lotto Nation

Lotto Nation is a first-of-its-kind, decentralized lottery platform run on the blockchain and powered by artificial intelligence that allows companies, charities, and individuals to set up their own lottery and connect with players through the most reputable and advanced technology.

The platform’s mission is to become the best fully licensed blockchain lottery in the world. Lotto Nation allows any person or business to create and run their own lottery and invite friends and family members to become part of a syndicate (a group of participants). The biggest advantage of this revolutionary platform is that it utilized a social aspect. By digitalizing and introducing a social aspect into the platform, Lotto Nation is creating a transparent ecosystem with the use of smart contracts and a random number generator built on blockchain to guarantee full fairness in the drawing process. This will remove the high levels of distrust associated with traditional and centralized lottery operators.

There are 5 critical aspects which make Lotto Nation unique compared to the traditional lottery providers as well as blockchain competitors. Those aspects are:

Strong Track Record – The company behind Lotto Nation, Winners Group, has a strong track record in building and running successful B2C lottery sites for over 20 years.

Disruptive Microservices Platform – The platform offers a disruptive agile online lottery turnkey solution built on microservices.

Massive Product Offering – Players have an opportunity to play 26 national lotteries with the highest global jackpots. In addition, players are kept busy through multiple daily drawings as opposed to just once or twice a week which is what traditional providers offer.

Unique Insurance Model – The platform’s insurance partner, Lloyds of London, allows Lotto Nation to insure and offer high jackpots for its B2B clients.

Social Interaction – As previously mentioned, the social aspect employed by Lotto Nation will result in a significant increase in customer loyalty.

Conclusion

There is absolutely no doubt that blockchain technology is going to have a monumental impact over the coming years. This will be seen across a variety of industries and implemented by most the aggressive companies. One industry that is in dire need of modernization is the lottery market and thanks to the revolutionary platform, Lotto Nation, the modernization will be coming a lot sooner than many expected.

Image by Hermann Traub from Pixabay

Altcoins

Solana Price Surges Beyond $100, Dethroning Ripple and BNB To Secure Fourth Place

Solana price performance in recent times has been remarkable, surpassing Ripple and Binance Coin to become the fourth-largest cryptocurrency by market cap. The SOL price breached the critical level of $100 for the first time since April 2022 over the weekend to imbue optimism among investors. However, the altcoin has corrected by 7%, suggesting that the market is overheated. At the time of writing, the ‘Ethereum killer’ was trading slightly lower at $111.60.

SOL Outlook

Solana price has made a significant recovery over the past few weeks, climbing above the psychological level of $100. The altcoin has been one of the best-performing assets this year, extending its year-to-date gains to more than 1,025%, with more gains recorded in the past month alone. However, even with such growth, analysts have noted that Solana has a bleak chance of topping its ATH of $260.

The reason behind this is the increase in supply relative to its value. In November 2021, when the Solana price hit its all-time high of $260, its total market capitalization was around $78 billion. Despite the value of the crypto asset being less than half of what it was at the top, its market cap is currently hovering near $50 billion.

This has been brought about by the increase in the Solana supply by more than 100 million SOL over the past two years. According to some analysts, for the altcoin to retest $260, its…

Altcoins

Solana Price Skyrockets to 20-Month Peak Amidst Memecoin Frenzy

Solana price has noted significant gains over the past few weeks, climbing to its highest level since April 2022. The ‘Ethereum Killer’ almost topped the crucial level of $100 on Friday, before pulling back slightly. The asset’s recent surge has catapulted Solana’s total market cap to $39.6 billion, ranking 5th after and above BNB and XRP, respectively. Solana has jumped by more than 22% in the past week and more than 80% in the month to date. At the time of writing, SOL price was trading 0.90% lower at $93.10.

Catalysts Behind SOL’s Rally

Solana price has been on a strong bull run over the past few days, rocketing to its highest level in 20 months as the network benefits from the substantial activity and strong interest in memecoins. The SOL token, the native digital asset of the high-performance blockchain platform Solana, has shown some serious strength over the past few weeks, outperforming all the altcoins in the market.

The recent surge in the Solana price has been linked to heightened on-chain activities on the Solana blockchain. Notably, the ongoing hype for the blockchain’s speedy transactions, cheap fees, and a lottery of meme coin issuances has buoyed SOL’s on-chain activity. Metrics have revealed that Solana has been the strongest draw among on-chain traders, with trading volumes and network fees outperforming Ethereum- the largest altcoin by market cap.

Cited figures provided by DeFi aggregator DeFiLlama…

Altcoins

Solana Price Breaches $60 Amid a Symphony of Bullish Indicators

Solana price has jumped more than 8% over the past week, breaching the important level of $60. At the time of writing, Solana was trading 3% higher at $61.07. The asset’s total market cap has climbed to $25.9 billion over the past week, ranking it the 6th largest cryptocurrency after XRP. The total volume of SOL traded over the last day has declined by 8%.

SOL’s Bullish Cues

Solana’s price has been among the best-performing cryptocurrencies this year amid continuous growth. The “Ethereum killer” has consistently impressed investors throughout the year on the back of a resurgence in bullishness, which saw SOL’s price climb more than 513% in the year to date. Institutional investors have also shared the bullish sentiment, making Solana their most preferred altcoin.

In the week ending November 24, Solana recorded inflows worth nearly $3.5 million, significantly more than the other altcoins’ inflows combined. The asset’s monthly inflows were higher at $40.2 million, lower than Ethereum’s $99.6 million inflows in the same period. Other altcoins, including Litecoin and Ethereum, noted significant outflows, making Solana nearly half of the home for DeFi. This implies that when it comes to institutions, Solana is currently the best-performing altcoin with the potential of a long-term rally much higher than other digital assets.

Notably, the Solana DeFi ecosystem accomplished a significant milestone earlier this week. Its Total Value Locked (TVL) hit a new yearly peak of over $655 million,…

-

Blogs7 years ago

Blogs7 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs7 years ago

Blogs7 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs7 years ago

Blogs7 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs7 years ago

Blogs7 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss7 years ago

Don't Miss7 years agoRipple’s five new partnerships are mouthwatering

-

Blogs7 years ago

Blogs7 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs7 years ago

Blogs7 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs7 years ago

Blogs7 years agoIs Litecoin (LTC) Changing Its Game Plan By Going For Mass Adoption?