Trade

Popular Investor Sergejs Kovalonoks talks about his methodical investment habits

Sergejs (@BalanceAM) from Latvia is a Popular Investor who likes to keep his Risk Score low. He has been with eToro since late 2017, and if you check out his stats, you’ll see he says he has 8 years of trading experience. His strategy involves rotating his portfolio at the end of each quarter, and he often uses short positions as a diversification tool. We asked him a few questions about his trading habits on eToro:

65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. This is not investment advice.

1. Tell us a little bit about yourself

I’m 30 years old, living in Riga, Latvia. My passion for markets emerged when I first saw an ad of a brokerage firm on a billboard in my university, on the Economics and Business Administration building, which stated “start trading FX and become financially independent.” A couple of days later I found myself in the library surrounded by a pile of books about forex trading. These were ancient books, with too many charts and indicators, and I had no idea what it all was about (though I still enjoyed to read them), and it was the only occasion in which I was reading books at university during the evening. Cutting a long story short, after finishing my studies, I quickly entered the asset management industry where I continue to study and work as a financial analyst for almost 9 years now.

2. Did you have previous experience with financial investments before joining eToro?

Before joining eToro, I already had plenty of experience in managing money and a necessary fundamental knowledge of working with various financial instruments. However, eToro’s social component was something entirely new to me, and in the beginning, it was difficult to figure out what people value the most and what they want to see from an adequate Popular Investor. I’m still in the process of adjusting the way I present the data and explain my decisions so that everybody knows exactly what’s going on. Sometimes it feels like an unending process.

3. Why did you choose to join eToro?

Honestly, I think it is the by far the best option at the moment to bring institutional management expertise into the broader retail market. eToro offers not only a reliable and easy-to-use platform, but also the support of a highly dedicated team that responds with interest and enthusiasm on any new ideas brought forth by the wide range of traders/investors globally. Also, the compensation structure was attractive too, and I really liked that it is linked to the quality of a Popular Investor’s decisions and performance. Lastly, the fact that the whole environment is so transparent gives assurance that your skills and values will not be missed.

4. What are the three key benefits of using eToro?

In my view, the primary advantage of the eToro platform is its simplicity, and that it does not limit portfolio managers in complexity. The way things are organised gives many people an easy way to connect with markets and asset managers around the world. The second component is undoubtedly the possibility always to have an open line of communication. Here you can get feedback from investors almost instantly, especially if you did something wrong, which helps to correct the decision-making process and learn much quicker. The third element is the fact that the company is run by a CEO who has a clear vision of the future of the finance industry and an obsession with making it more accessible to those who need it the most.

5. How has eToro changed the way you trade?

Everything changes us in some way, and the investment process is not isolated from things surrounding us. By having exposure to eToro, I think I became even more dedicated to making the investment process more agile and plausible for a wide range of audience.

6. What is your type of trading strategy and what is it focused on?

To navigate through the different type of cycles, whether it is credit, business or economic, investors should have an attitude of “I know nothing about the future, but I will do my best to navigate through anything that comes”. My investment process is straightforward and based on the fact that companies with a higher spread between returns and the cost of capital, in the long-term, are rewarded the most. I cannot give you specific criteria and measurements, but I can say that every potential investment should survive my four different layers of screening before it can get into the portfolio.

The first layer is based on volume and price analysis. The second one is purely fundamental analysis driven, with criteria being automatically adjusted based on the incoming data. The third one helps to make a vital allocation decision. Finally, the last step involves finding the evidence that your initial case is wrong. This is probably one of the most important ones, and I spend most of the time finding factors that could significantly deteriorate the prime case scenario.

I also deploy the concept that things should be in balance and not overstretch in any direction for an extended period of time. It means that I don’t want to have exposure to growth, value, core, longs or shorts in a way that limits my ability to respond to growing risk in various pockets of the financial markets. The balance means finding a point in which you bear a risk that is more than compensated in a scenario that is most likely to happen. It’s never the same thing, but the principles that move you closer to the balance are always reliable and rarely change.

7. What are the benefits of being a Popular Investor and what is your long-term goal as one?

Being a Popular Investor creates a deep sense of responsibility and care for the people who decided to stick with you. My goal is to continuously improve my strategy so that it can withstand multiple cycles and make people a little bit happier financially.

8. Do you have any advice for your copiers/users considering copying you?

I wrote a post once for helping people decide who to copy. It included many things, but I will say the most important one: You are the king when it comes to rewarding/punishing investor for great efforts or negligence, and all that you need to do is to start or stop copy. Period. For your financial well-being, it’s essential to have exposure to the stock market, to make sacrifices regarding short-term pleasures which in turn saves you more money that you can put to work. Never save money that you can spend now and upgrade your performance in the markets. Be highly attentive to these things. Maybe a new iPhone is not really necessary for you right now; maybe your old TV is still ok – don’t throw money left and right just for the sake of 1-5 days pleasure. If you decided to copy me, don’t fall into the trap that I will be able to make you rich. Yes, I will do the best I can, but you should also make a lot of efforts both emotionally and physically to stick to the plan and fight for your financial independence.

9. What are your hobbies?

Apart from being overly engaged with the markets, sometimes I enjoy playing tennis with my friends, having a simple walk in nature with my dog and family, playing the guitar or reading a good book. You also need to challenge yourself constantly, so sometimes I also enjoy risky activities such as snowboarding, climbing or dirt bike riding.

65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. This is not investment advice.

Altcoins

XNO Token of Xeno NFT Hub listed on Bithumb Korea Exchange

Hong Kong, Hong Kong, 25th January, 2021, // ChainWire //

Xeno Holdings Limited (xno.live ), a blockchain solutions company based in Hong Kong, has announced the listing of its ecosystem utility token XNO on the ‘Bithumb Korea’ cryptocurrency exchange on January 21st 2021.

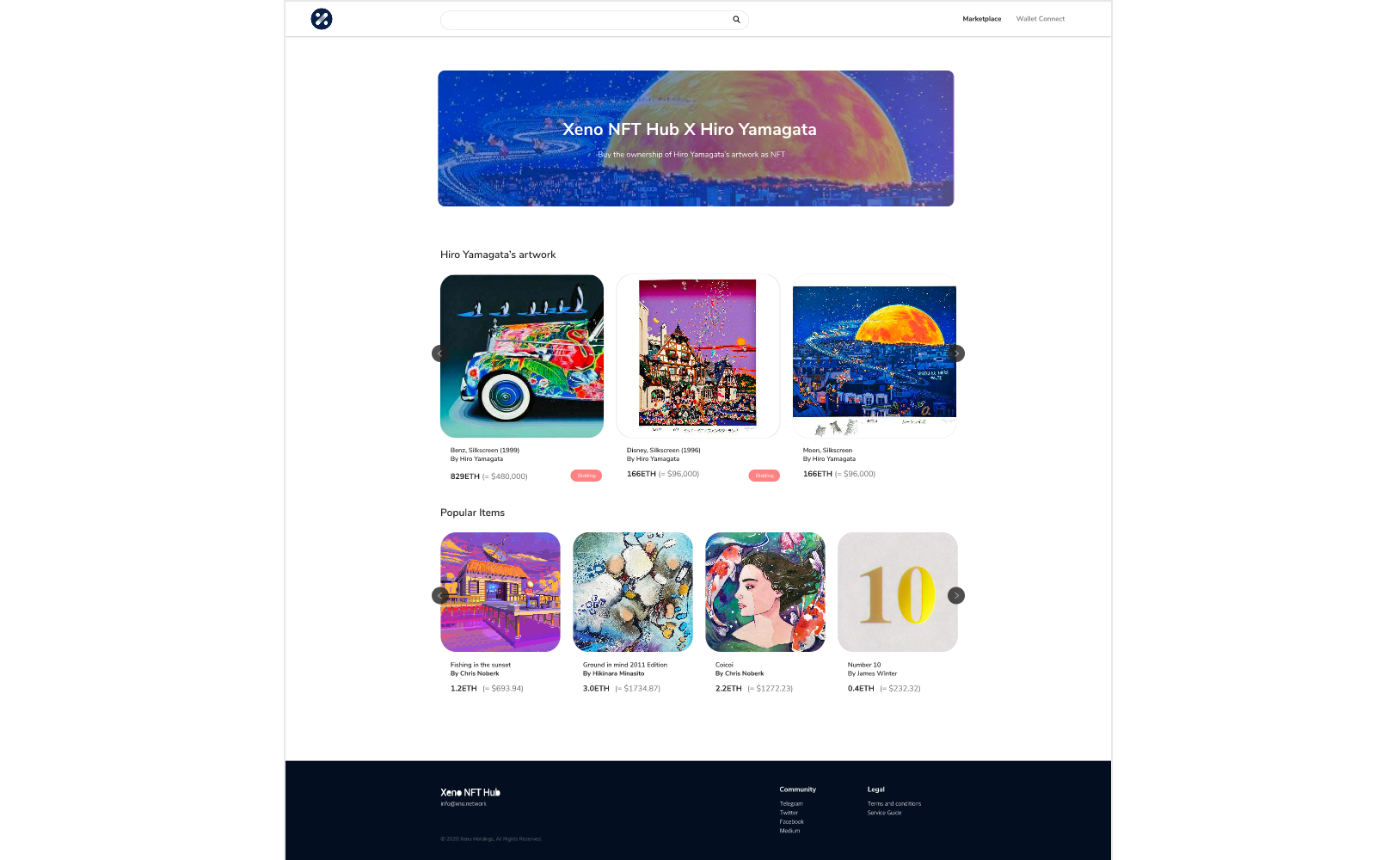

Xeno NFT Hub (market.xno.live ), developed by Xeno Holdings, enables easy minting of digital items into NFTs while also providing a marketplace where anyone can securely trade NFTs.

The Xeno NFT Hub project team includes former members of the technology project Yosemite X based in San Francisco and professionals such as Gabby Dizon who is a games industry expert and NFT space influencer based in Southeast Asia.

NFT(Non-Fungible Token) technology has recently gained huge focus in the blockchain arena and beyond, making waves in the online gaming sector, the art world, and the digital copyrights industry in recent years. The strongest feature of NFTs is that “NFTs are unique digital assets that cannot be replaced or forged”. Unlike fungible tokens such as Bitcoin or Ether, NFTs are not interchangeable for other tokens of the same type but instead each NFT has a unique value and specific information that cannot be replaced. This fact makes NFTs the perfect solution to record and prove ownership of digital and real-world items like works of art, game items, limited-edition collectibles, and more. One of the ways to have a successful…

Altcoins

XENO starts VIP NFT trading service and collaborates with contemporary artist Hiro Yamagata

Hong Kong, Hong Kong, 24th December, 2020, // ChainWire //

The XENO NFT Hub (https://xno.live) will provide a crypto-powered digital items and collectables trading platform allowing users to create, buy, and sell NFTs. Additionally it will support auction based listings, governance and voting mechanisms, trade history tracking, user rating and other advanced features.

As a first step towards its fully comprehensive service, XENO NFT Hub launched a recent VIP service to select users and early adopters in December 2020 with plans for a full Public Beta to open in June 2021.

“NFTs are extremely flexible in their usage, from digital event tickets to artwork, and while NFTs have a very wide spectrum of uses and categories XENO will initially focus its partnership efforts and its own item curation on three primary areas: gaming, sports & entertainment, and collectibles.”, said XENO NFT Hub president Anthony Di Franco.

He also added “This does not mean we will prohibit other types of NFTs from our ecosystem However, it simply means that XENO’s efforts as a company will be targeted into these verticals initially as a cohesive business approach.”

Development and Procurement Lead, Gabby Dizon explained, “Despite our initial focus, we found ourselves with a unique opportunity to host some of the works of Mr. Hiro Yamagata. We are collaborating with Japanese artist Hiro Yamagata to enshrine some of his artwork into NFTs.”

Mr. Yamagata has…

Altcoins

My Crypto Heroes Announces Issuance of MCH Governance Token

Tokyo, Japan, 24th November, 2020, // ChainWire //

My Crypto Heroes is happy to announce the issuance of MCH Coin as an incentive to players in the My Crypto Heroes ecosystem, aiming to allow them to craft a “User-oriented world”. The MCH coin is available on Uniswap with a newly created pool with ETH.

My Crypto Heroes is a blockchain-based game for PC and Mobile. It allows users to collect historic heroes and raise them for battle in a Crypto World. Officially released on November 30th, 2018, MCH has recorded the most transactions and daily active users than any other blockchain game in the world.

What is MCH Coin?

MCH Coin is being issued as an ERC-20 Standard Governance Token. The issuance began on November 9th, 2020, with 50 million tokens issued.

Of the funds issued, 40% are allocated to a pay for on-going development and as rewards for advisors and early investors. 10% are allocated to marketing and the growth of the ecosystem, and 50% are allocated to the community. The Distribution Ratio of the MCH Coin is subject to change via a governance decision.

The MCH coin will be used as a voting right as part of the ecosystem’s governance, with 1 coin being 1 vote. It will also be used for in-game utilities and payments. Additional information can be found here:

https://medium.com/mycryptoheroes/new-ecosystem-with-mchcoin-en-a6a82494894f

During December 2020 the first…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange