Stocks

Rainy Day Saving: How Will COVID-19 Affect Micro-investing?

Micro-investing has developed into a considerably popular market for younger investors. With the increasing pace of life coupled with rising living costs, the arrival of platforms and apps that automatically collect the spare change of users and place it into stocks, bonds and even real estate has helped millions to build savings.

The arrival of COVID-19, however, has plunged the micro-investing landscape into extremely choppy waters. With the vast majority of FinTech businesses arriving in the years that followed the major financial crash of 2008, the inevitable recession prompted by the pandemic will be their first experience of adversity. Will the financial constraints prompted by Coronavirus cause the micro-investing bubble to burst? Or will its user base continue to entrust their savings in FinTech?

The Component Parts of Micro-Investing

If you’ve ever owned a piggy bank, it’s easy to see the similarities between old fashioned saving and its digital incarnation. Fundamentally, micro-investing platforms are designed to act as a somewhat more omnipresent piggy bank.

Whenever you decide to make a purchase on a registered card, whether it’s a morning coffee or a lunchtime sandwich, your designated micro-investing app will recognise the purchase and round the fee up to the nearest whole unit and invest the difference itself.

For instance, if you purchase a mocha at Starbucks for £3.50, a micro-investing app would round the fee up to £4 and invest the 50p.

The grand idea behind this form of investment is that money is being saved in an extremely discreet way. Users are unlikely to notice an extra 50p missing from their account, but over a period of months and years, the loose change will develop into a significant saving. If the same Starbucks mocha is purchased, say, 20 times a month, that would amount to £10 saved on hot drinks alone in – amounting to £120 by the end of the year. The money saved is automatically invested in selected markets in a bid to help savings grow over time.

Micro-investing platforms such as Wealthsimple, Moneybox and Nutmeg offer a wide range of different ISAs that are optimised towards customers buying their first homes, floating savings on stock market shares, or simply storing loose change in a single place.

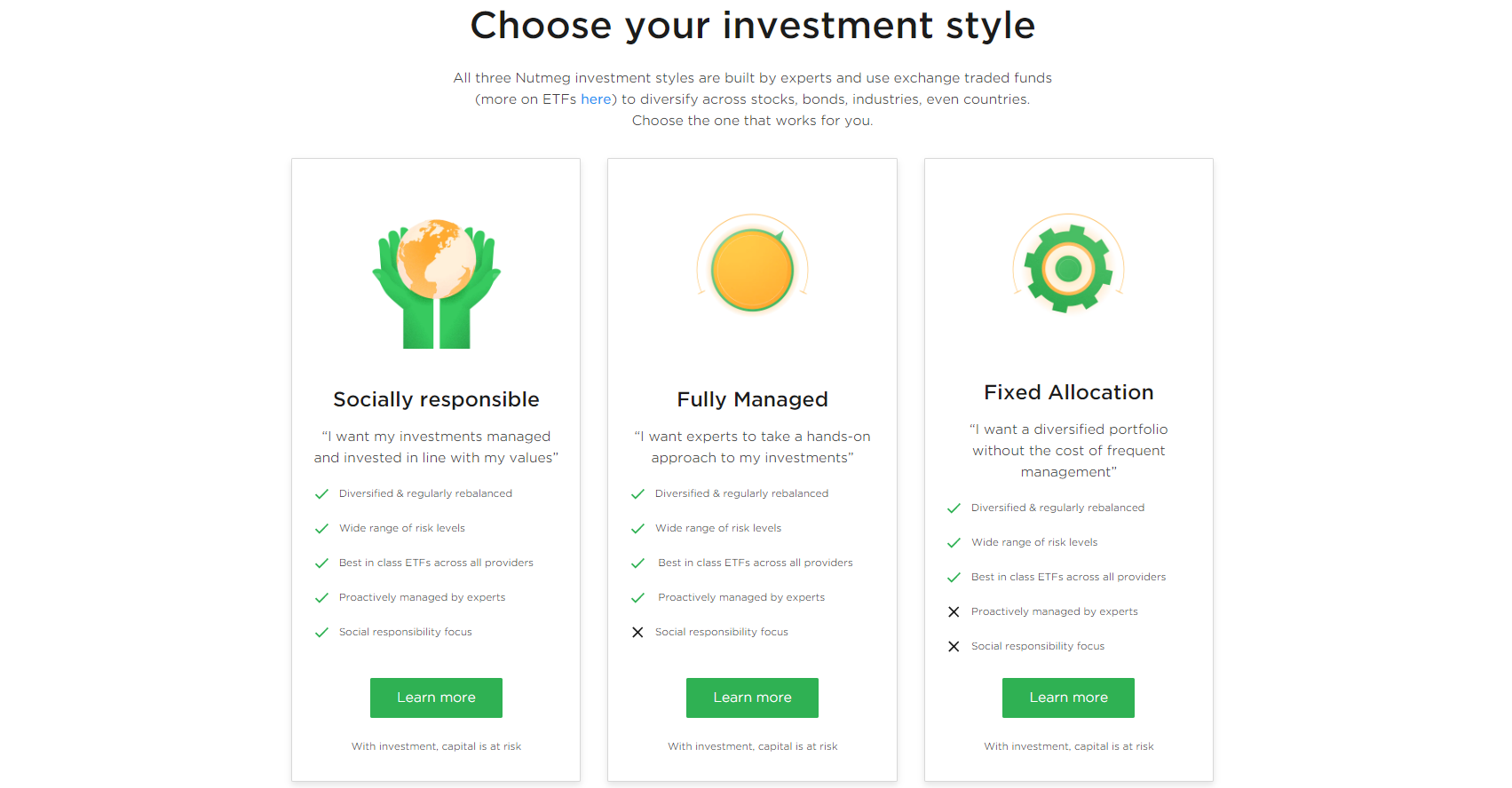

(Image: Nutmeg)

Micro-investing platforms stand as one of the most popular developments from the growing FinTech industry, which is ever-evolving to help users better manage their money. The majority of apps also let users decide their level of risk in terms of where their money is invested. Some platforms like Nutmeg allow users to pick the type of investments that they want to make – including more socially responsible, sustainable markets.

Investment in The Face of Recession

FinTech has aided users to invest their money and organically grow their wealth in a discreet manner. Its popularity among younger consumers cannot be underestimated, but 2020’s Coronavirus pandemic has caused widespread damage to economies on a global scale.

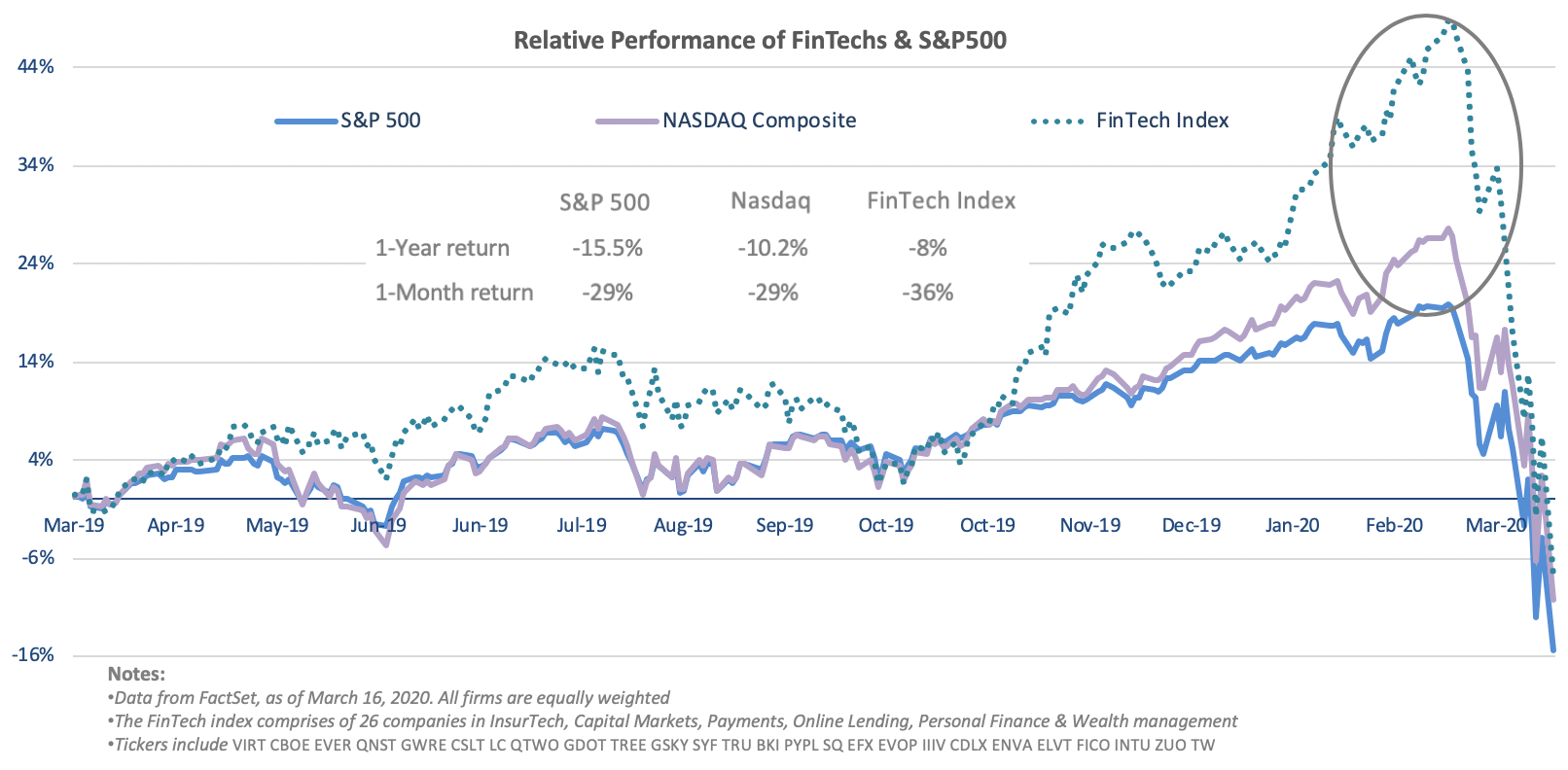

(Image: Payments Cards & Mobile)

As the chart above shows, the impact of COVID-19 has hit FinTech businesses harder than other markets. Widespread uncertainty left many micro-investors looking at losses on the money they’d saved throughout March and April. With the prospect of a global recession looking like an inevitability, will micro-investing suffer further as users begin to withdraw their savings?

Is it Wise to Micro-Invest With Increased Market Volatility?

Naturally, there’s no one-size-fits-all answer to this question. In times of financial hardship, money can become more scarce and some individuals could be harder hit than others during these times.

It’s also worth noting that many micro-investment platforms are somewhat restrictive for users who require easy access to their funds. Apps like Wealthsimple require up to five working days for investments to be transferred to user bank accounts while Moneybox asks for as much as two-to-three weeks for their Stocks & Shares ISA to be withdrawn. Some Moneybox accounts require 95 days’ notice before a withdrawal can take place.

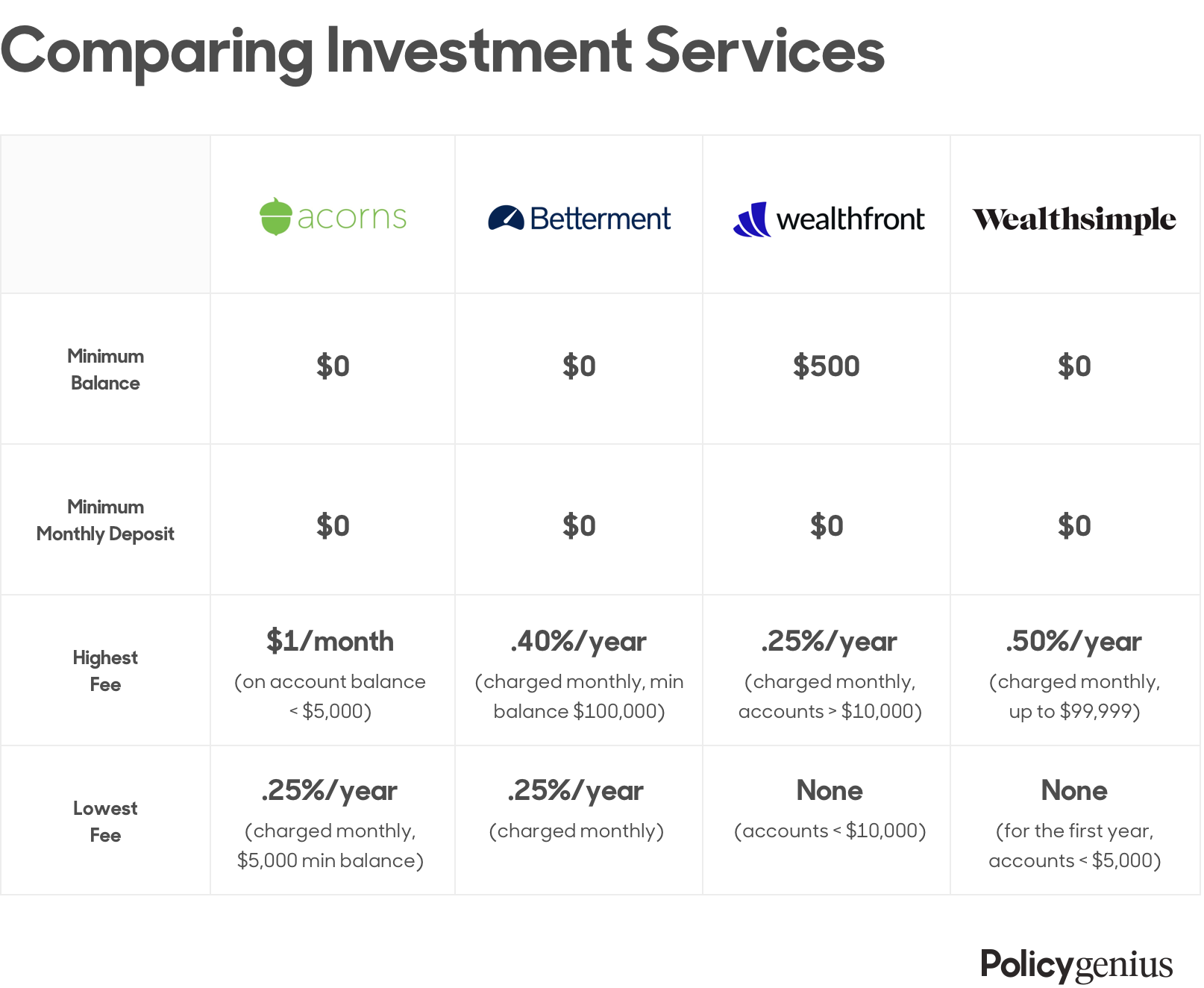

There are also an array of fees to pay for some micro-investment services as charted below:

(Image: Policy Genius)

The necessity of having finance closer to hand could be too important for some investors, who would seek to cash in on their funds, or pause their deposits. However, The Daily Telegraph’s Investment Editor, Taha Lokhandwala, believes that micro-investing is, in fact, one of the smartest platforms to place your trust as Coronavirus uncertainty rumbles on.

“The best way to invest in a falling market is by dripping money in, because you pick up shares at cheaper prices but without risking a lot of money. If markets fall again, it’s unfortunate, but also means you can just buy more at an even lower price. This will mean losing some money in the short term but at the benefit of buying shares at low prices in the long term,” Lokhandwala explains.

The State of Play For Micro-Investing in a Post-COVID Landscape

Will COVID-19 burst the micro-investing bubble? While some investors may need to leave the platform to access money due to a loss of wealth or unemployment, those are financially able to continue consuming could reap the rewards of an eventual market recovery by depositing microscopic levels of money into their portfolios.

Despite the FinTech industry being hit hard by market downturns, it’s highly unlikely that enough abandonment will occur to keep the prosperous businesses of 2019 down. However, given that we’re living in an unprecedented time of unpredictability and market volatility, the future of micro-investing may feature a few bumps in the road.

Altcoins

XNO Token of Xeno NFT Hub listed on Bithumb Korea Exchange

Hong Kong, Hong Kong, 25th January, 2021, // ChainWire //

Xeno Holdings Limited (xno.live ), a blockchain solutions company based in Hong Kong, has announced the listing of its ecosystem utility token XNO on the ‘Bithumb Korea’ cryptocurrency exchange on January 21st 2021.

Xeno NFT Hub (market.xno.live ), developed by Xeno Holdings, enables easy minting of digital items into NFTs while also providing a marketplace where anyone can securely trade NFTs.

The Xeno NFT Hub project team includes former members of the technology project Yosemite X based in San Francisco and professionals such as Gabby Dizon who is a games industry expert and NFT space influencer based in Southeast Asia.

NFT(Non-Fungible Token) technology has recently gained huge focus in the blockchain arena and beyond, making waves in the online gaming sector, the art world, and the digital copyrights industry in recent years. The strongest feature of NFTs is that “NFTs are unique digital assets that cannot be replaced or forged”. Unlike fungible tokens such as Bitcoin or Ether, NFTs are not interchangeable for other tokens of the same type but instead each NFT has a unique value and specific information that cannot be replaced. This fact makes NFTs the perfect solution to record and prove ownership of digital and real-world items like works of art, game items, limited-edition collectibles, and more. One of the ways to have a successful…

Altcoins

XENO starts VIP NFT trading service and collaborates with contemporary artist Hiro Yamagata

Hong Kong, Hong Kong, 24th December, 2020, // ChainWire //

The XENO NFT Hub (https://xno.live) will provide a crypto-powered digital items and collectables trading platform allowing users to create, buy, and sell NFTs. Additionally it will support auction based listings, governance and voting mechanisms, trade history tracking, user rating and other advanced features.

As a first step towards its fully comprehensive service, XENO NFT Hub launched a recent VIP service to select users and early adopters in December 2020 with plans for a full Public Beta to open in June 2021.

“NFTs are extremely flexible in their usage, from digital event tickets to artwork, and while NFTs have a very wide spectrum of uses and categories XENO will initially focus its partnership efforts and its own item curation on three primary areas: gaming, sports & entertainment, and collectibles.”, said XENO NFT Hub president Anthony Di Franco.

He also added “This does not mean we will prohibit other types of NFTs from our ecosystem However, it simply means that XENO’s efforts as a company will be targeted into these verticals initially as a cohesive business approach.”

Development and Procurement Lead, Gabby Dizon explained, “Despite our initial focus, we found ourselves with a unique opportunity to host some of the works of Mr. Hiro Yamagata. We are collaborating with Japanese artist Hiro Yamagata to enshrine some of his artwork into NFTs.”

Mr. Yamagata has…

Altcoins

My Crypto Heroes Announces Issuance of MCH Governance Token

Tokyo, Japan, 24th November, 2020, // ChainWire //

My Crypto Heroes is happy to announce the issuance of MCH Coin as an incentive to players in the My Crypto Heroes ecosystem, aiming to allow them to craft a “User-oriented world”. The MCH coin is available on Uniswap with a newly created pool with ETH.

My Crypto Heroes is a blockchain-based game for PC and Mobile. It allows users to collect historic heroes and raise them for battle in a Crypto World. Officially released on November 30th, 2018, MCH has recorded the most transactions and daily active users than any other blockchain game in the world.

What is MCH Coin?

MCH Coin is being issued as an ERC-20 Standard Governance Token. The issuance began on November 9th, 2020, with 50 million tokens issued.

Of the funds issued, 40% are allocated to a pay for on-going development and as rewards for advisors and early investors. 10% are allocated to marketing and the growth of the ecosystem, and 50% are allocated to the community. The Distribution Ratio of the MCH Coin is subject to change via a governance decision.

The MCH coin will be used as a voting right as part of the ecosystem’s governance, with 1 coin being 1 vote. It will also be used for in-game utilities and payments. Additional information can be found here:

https://medium.com/mycryptoheroes/new-ecosystem-with-mchcoin-en-a6a82494894f

During December 2020 the first…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange