Bitcoin

The Bitcoin Meltdown is Chance to Double Your Bitcoin

Most of the cryptocurrency holders have never felt a day so bad.

After a blustering day of trading which saw Bitcoin price drop from $7,950 to $3,800, the massacre caused the worst sell-off to set a new 2020 low which not seen since April 2019.

The history of bitcoin only has a day in 2013 to compare a 40% fall, at that time bitcoin once dropped from $266 to $50, that was also a day when despair defeated the belief of bitcoin and almost no one could foresee bitcoin can recover and prices will reach $10,000 in a few years.

“Be fearful when others are greedy and greedy when others are fearful.” This is what Warren Buffett said about stock market and you can see the stock market never dies, it is just rise and fall happen in a different order at different times.

So it is with bitcoin. The bitcoin meltdown is a chance for a few bitcoin traders while the others are running away.

One typical way is to short bitcoin. Futures trading allows traders to make profits out of the future price difference of the derivatives. However, when during horizontal movement of prices, futures trading may gain you fewer profits to cover the possible loss of the margin.

Is there any trading tool to short bitcoin but you don’t need to lock bitcoin as margin?

Yes, options trading is the tool to gain profits if you can predict the right direction of price movement.

Options Trading: Higher profitability than futures trading

An option is a contract that does not require you to buy or sell an underlying instrument but you have the right to take profits on the change of its value.

For example, if you trade options over BTC and predict its pricing to go down. If it goes down (no matter how big or small the change is), you take the profits. All you need to do is predict the right direction of the market, and open options to automatically sell to other traders who hold the opposite option.

You can buy options of all cryptocurrency including ETH, LTC, EOS, and XRP but don’t need to swap your current currency. Using bitcoin to trade options over all the other kinds of cryptocurrencies saves all the swap fees for you.

How to make profits with options trading? See below how to double your bitcoin every 60 seconds.

IE Option: It is EASY to make options trading to gain up to 91% profitability

IE Option, registered in London, United Kingdom, is an options trading platform operated by a team of blockchain experts and financial professionals. IE Option focuses on cryptocurrency-based financial derivatives including BTC, LTC, ETH, EOS, and XRP.

The profitability is from 60% to 91%, the most popular asset is BTC/USDT which gives 81%. The 91% tier is in a private VIP room which requires you to apply in email.

Profitability means that if you open an option with 1 BTC and predict if the price will go up or go down 60 seconds later, and if the price goes as you predict, you will take 1.91 BTC back. If wrong, you will lose it. If it comes back to the original price where you bid, you will get 1 BTC back.

Simply put, as long as your winning rate is over 52.36%, you will earn more bitcoin than losing.

(If you make it right for the price trends where it will go 60 seconds later, you will take your margin and revenue together immediately.)

Easy Deposit & Quick Withdrawal

How to start your earning journey with IE Option?

Step 1: Create an account. IE Option cares about your privacy and does not ask for personal information, all you need to provide is simply to verify your email. The registration usually takes 30 seconds.

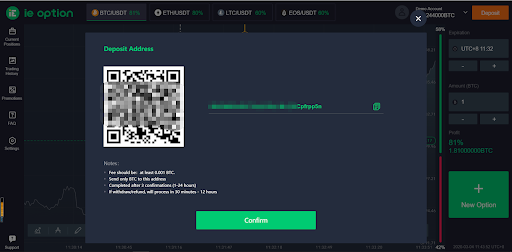

Step 2: Make a deposit. Bitcoin is accepted as the deposit crypto. You will get an exclusive bitcoin address to process your funds. The minimum deposit amount is 0.001 BTC. Once the bitcoin transaction is confirmed by the blockchain, it will be added to your account balance immediately. By the way, you can secure your account by enabling 2FA with your personal Google Authenticator app which will prevent fund theft from third-party devices.

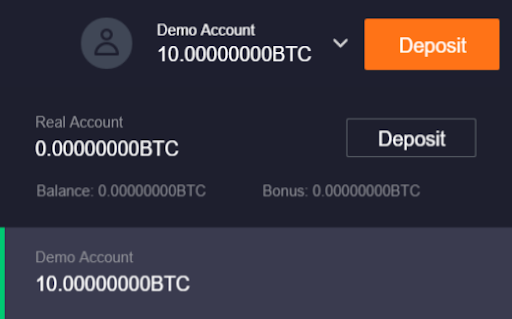

Step 3: Learn and trade. IE Option offers 10 BTC in your demo account for practice use. On you’re prepared, switch to the Real Account, watch the K-line carefully and keep calm, find the right timing to place your first option and wait 30 seconds to show the result. The only goal you need to go for is to reach a satisfying winning rate.

Step 4: Withdraw your profits. IE Option provides a quick liquidation process, your withdrawal request will be handled within 2 hours, and if with your email confirmation, it will be accelerated to take only 30 minutes.

100% First Deposit Bonus

IE Option is giving away a 100% deposit bonus to limited new users. All first deposit will be automatically doubled within 24 hours, if not delivered promptly, please contact the support team in email as all new deposits are qualified. Simply deposit 1 BTC, then get 1 BTC bonus.

The deposit bonus can be traded in the same way as real bitcoin and you can withdraw its profits, more importantly, the amount of the profits is not limited.

Mobile App for Android & iOS

With mobile applications developed by IE Option Ltd., users can take this magical and powerful trading tool to your pocket with the same trading features from the website. Search IE Option trading app or go directly with the official links as follows.

About IE Option

Official Website – https://ieoption.com/

Google Play for Android Phone: https://play.google.com/store/apps/details?id=com.ie.option

Appstore for iPhone: https://apps.apple.com/tt/app/ie-option/id1492021667

Bitcoin

Bitcoin Price Dumps Below $41,000 Amid Uncertainty

Bitcoin price dumped hard on Monday, briefly slipping below $41,000, erasing gains recorded in the previous week. The premier cryptocurrency seems to have exhausted its recent rally propelled by industry vulnerabilities. At the time of writing, the world’s largest cryptocurrency was trading slightly lower at $41,385. Bitcoin’s total market cap has dipped by 2% over the past day, while the total volume of BTC tokens traded over the same period climbed by 58%.

Fundamentals

Bitcoin price has been facing retracements and a rollercoaster over the past few days after recently rocketing to a 20-month peak. On-chain data has suggested that many investors used the opportunity to take some profits, leading to a decline in the asset’s price.

Bitcoin’s price slump is mirrored in the wider crypto market, with the global crypto market cap decreasing by 1.85% over the past 24 hours to $1.55 trillion. The total crypto market volume has increased by 32% over the same period. The Crypto Fear and Greed Index has plunged from a level of extreme greed to a greed level of 70, suggesting a decline in risk appetite.

Ethereum, the largest altcoin by market capitalization, is currently trading at $2,167, down almost 3% for the day. Meme coins have been hit hard by the market slump, with Dogecoin and Shiba Inu down by more than 4% over the last day.

Last week on Thursday, cryptocurrency experts took notice of…

Bitcoin

Bitcoin Price is in Consolidation Mode Despite Market Optimism Post-Fed Decision

Bitcoin price edged lower on Thursday despite optimism in wider markets on the back of the Fed’s interest rate decision. The flagship cryptocurrency has been consolidating above the critical level of $42,000 after briefly topping $44,000, its highest level in 20 months. Bitcoin was trading 0.71% lower at $42,569 at press time. BTC’s total market cap has increased by more than 3% over the last day to $832 billion, while the total volume of the asset traded over the same period jumped by 22%.

Economic Outlook

Bitcoin price has been trading sideways over the past few days, suggesting a pause in its recent rally towards $45,000. The premier cryptocurrency has decreased by 4% in the past week but remains 15.22% higher in the month to date. The digital asset has staged a significant recovery this year after a torrid 2022 in which a string of scandals, including the collapse of FTX, led to a market meltdown, undermining the credibility of the sector.

The crypto market has been buoyed by the Fed’s latest interest rate decision. The US Federal Reserve on Wednesday held its key interest rate unchanged for the third consecutive time, in line with market expectations. With the easing of the inflation rate, members of the Federal Open Market Committee (FOMC) voted to keep the benchmark overnight borrowing rate in a targeted range between 5.25%-5.5%.

Additionally, the central bank indicated that three rate…

Bitcoin

Bitcoin Price Blasts $44K in Spectacular Surge as Spot Bitcoin ETF Approval Looms Large

Bitcoin price has been hovering above the $43,000 psychological level over the past two days amid anticipation about the potential approval of a spot bitcoin ETF. The flagship cryptocurrency has climbed more than 16% in the past week and nearly 170% in the year to date. Bitcoin’s total market cap has increased by nearly 5% over the past 24 hours to $858.9 billion, while the total volume of the token traded rose by 43%. The Bitcoin price was trading at $43,914 at press time.

Fundamentals

Bitcoin price has posted significant gains over the past few days, climbing to its highest level since April 2022, before the crash of a stablecoin that started a litany of company failures, pummeling crypto prices. The world’s largest cryptocurrency briefly topped the crucial level of $44,000 on Wednesday amid rising momentum despite being massively overbought.

According to analysts, with no spot bitcoin ETF approvals yet and the halving event five to six months away, the market is riding on FOMO. Capital has been flowing in the Bitcoin market amid enthusiasm that the launches of spot ETF will bring in billions of dollars of new investment into the crypto sector.

Investors have already started providing capital as seed money for ETF products. Notably, a recent report by CoinDesk showed that the world’s largest fund manager, BlackRock, received $100,000 in capital from a seed investor for its spot bitcoin exchange-traded fund…

-

Blogs7 years ago

Blogs7 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs7 years ago

Blogs7 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs7 years ago

Blogs7 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs7 years ago

Blogs7 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss7 years ago

Don't Miss7 years agoRipple’s five new partnerships are mouthwatering

-

Blogs7 years ago

Blogs7 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs7 years ago

Blogs7 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs7 years ago

Blogs7 years agoIs Litecoin (LTC) Changing Its Game Plan By Going For Mass Adoption?