Bitcoin

The Crucial Role of Cryptocurrencies & Blockchain in Modernising The Telco Industry

Blockchain has caused quite a stir in recent years. In fact, there’s a school of thought that firmly believes the digital ledger technology will prove to be the 21st Century’s biggest innovation.

There are a great many industries braced for the disruptive force of blockchain, and the sweeping benefits it can bring to telecommunications can’t be underestimated.

A blockchain is a decentralised, distributed, public digital ledger that’s fundamentally used to record transactions online. Every transaction that takes place is recorded across an extensive array of computers in a way that ensures that any individual record within the chain can’t be tampered with or retroactively modified.

Because of the virtually impregnable security associated with blockchain and the efficiency that comes with a fully decentralised ledger, there’s plenty of potential for the technology within the telco industry in particular – especially given the financial flexibility that comes with cryptocurrency transactions beyond borders.

Let’s take a deeper look at the important role that both blockchain and its associated cryptocurrencies can play in modernising and securing the telco industry:

Unprecedented security

The arrival of blockchain is causing a stir at Deloitte. The professional services giant has contributed tens of thousands of words on blockchain within its ‘insights’ network, and there are few more fascinating than that between the burgeoning digital ledger and the telco industry.

Identity plays a significant role in fostering Deloitte’s excitement over the implementation of blockchain within telecommunications. In the company’s 2018 survey focussing on blockchain, over half of the respondents said that their company is already working on blockchain-based identity solutions.

Because of the unprecedented level of security provided by blockchain, a secure record of identities for users, assets, personal devices and IoT endpoints can be established. The arrival of such powerful measures to ensure our safety will play a significant role in reducing fraud and building trust within the industry.

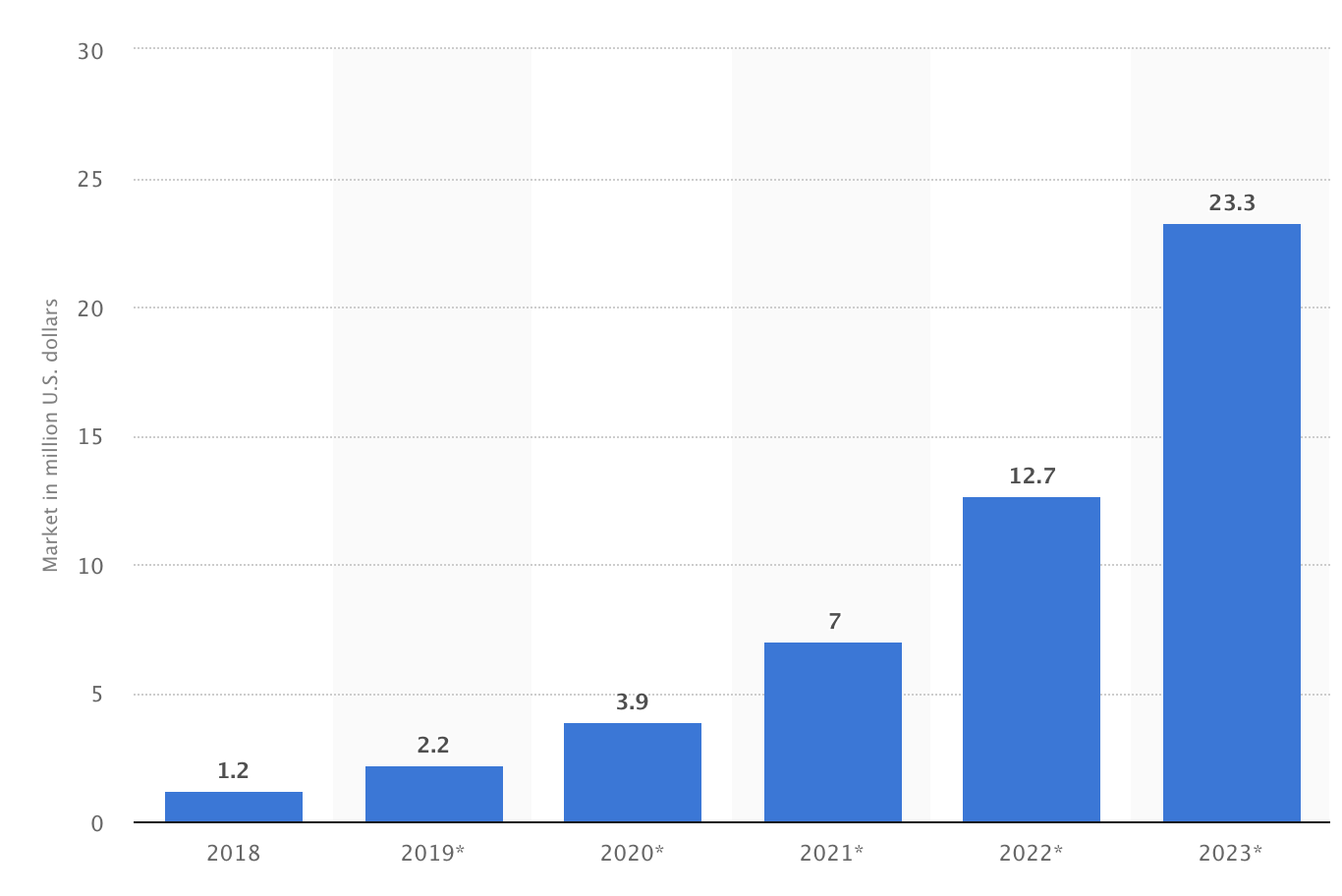

(Chart showing the size of the blockchain market in $ billion. Image Source: Statista)

Deloitte goes further to explain that the security that blockchain will bring won’t be limited to protecting our personal records, but also bring flawless privacy for our devices, content and accounting records. “Transactions stored in a blockchain are encrypted, time-stamped, and synchronized across the entire network. Likewise, the identities of transacting parties and devices are cryptographically unique and registered on the blockchain,” Deloitte’s insights team surmises.

The arrival of blockchain is likely to play a key role in modernising the communication industry that has remained largely unchanged in the 21st Century.

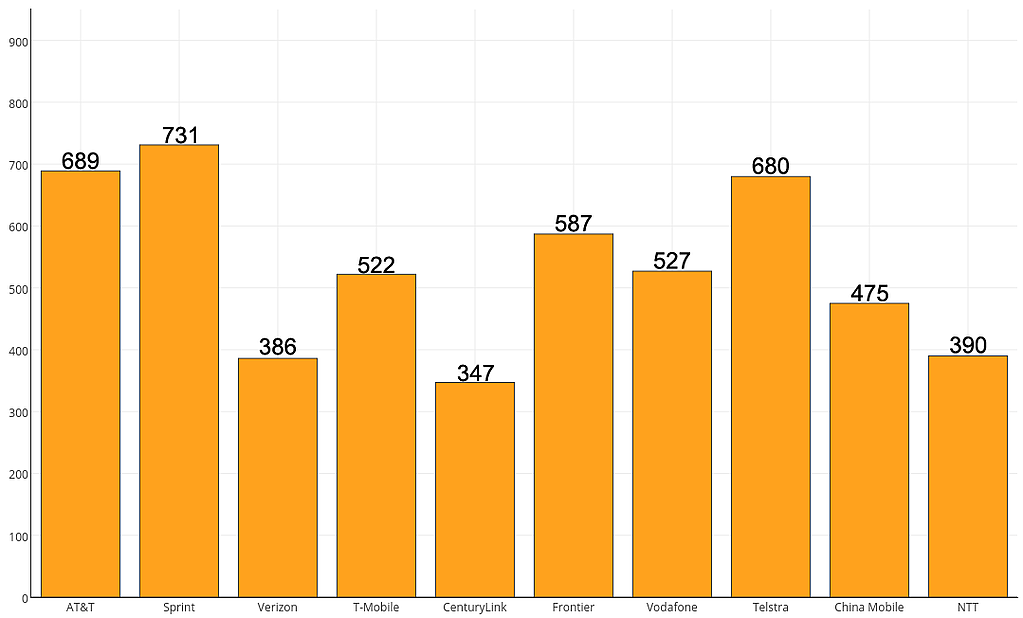

As an example, UpGuard produced a research based on their security tests of major US cell carriers. And, as a matter of fact, the results leave us hoping for the best.

(The higher the score the more secure the network appears to be. Image Source: UpGuard)

As you can see, most carriers have a long way to go to ensure our privacy.

When it comes to the UK, according to Tech Advisor, networks like EE and O2 are among the better-performing ones.

The case for efficiency

There’s also plenty of scope for blockchain actively improving the efficiency within the telecommunications industry. Delta Partnership Group highlights the reduced time of execution needed for information to be stored within a blockchain as a key factor in enhancing performance within telco.

In a published paper entitled ‘Blockchain’s potential for the telecom industry,’ a team of authors explained that “for industries with regular and low-value interactions with their customer base, such as telecom, blockchain can verify and automate transactions, with increased transparency for the end customer. The higher the number of low-value transactions, the greater the potential of blockchain.”

Essentially, the more people involved in a transaction, the better blockchain performs in the face of alternative technologies. For example, in a telecom intercarrier settlement scenario involving three parties, the blockchain will deliver three times the value compared to a two-player scenario.

In addition to this, the efficiency of blockchain will no doubt offer plenty of solutions after the advent of 5G connectivity for mobile phone networks. Given the complexity of such a high-speed and powerful network, a secure digital ledger may ultimately prove essential in dealing with so many different cellular connections and data transactions taking place.

Seamless micropayments

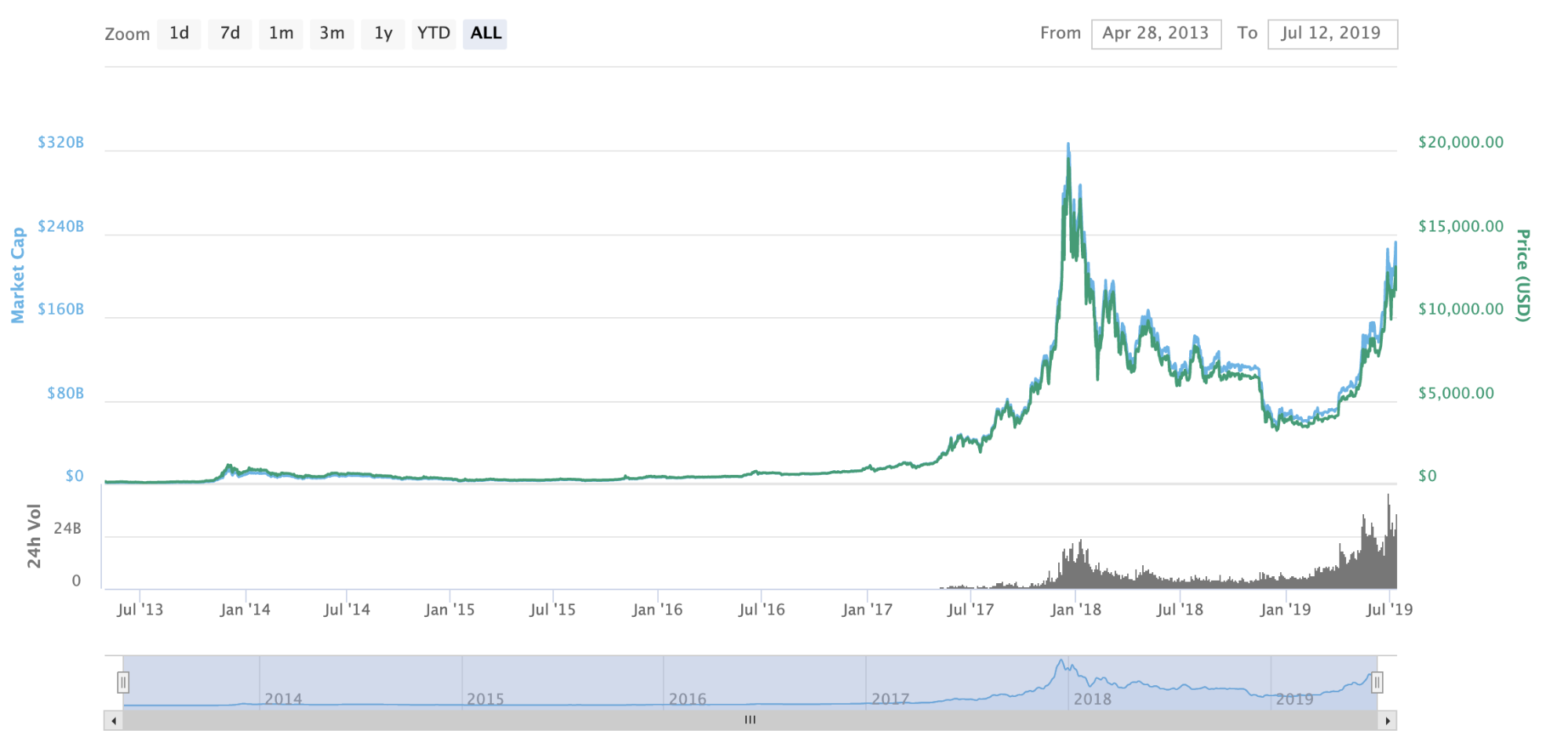

Blockchain was initially conceptualised as a means to support the launch of the cryptocurrency Bitcoin a little over a decade ago. Although the potential of blockchain has caused a massive stir worldwide, it’s Bitcoin that initially took the world by storm after rallying to a value of almost $20,000 USD in December 2017.

Image Source: CoinMarketCap

The telecommunications industry can benefit greatly from the emergence of cryptocurrencies as a means of offering customers the option to make digestible micropayments for both calls and services through the medium of digital currency. Fundamentally, the decentralised nature of cryptocurrencies built on a blockchain network means there’s no more need for middlemen in the industry, and thus no more fees and surcharges to deal with when paying for services. Through the power of blockchain and crypto combined, the intermediary fees of international calling charges and roaming transactions can be assigned to the history books.

Whether you choose to embrace or evade the looming spectre of blockchain, we have to thank it for contributing to making the world that little bit smaller.

Bitcoin

Bitcoin Price Dumps Below $41,000 Amid Uncertainty

Bitcoin price dumped hard on Monday, briefly slipping below $41,000, erasing gains recorded in the previous week. The premier cryptocurrency seems to have exhausted its recent rally propelled by industry vulnerabilities. At the time of writing, the world’s largest cryptocurrency was trading slightly lower at $41,385. Bitcoin’s total market cap has dipped by 2% over the past day, while the total volume of BTC tokens traded over the same period climbed by 58%.

Fundamentals

Bitcoin price has been facing retracements and a rollercoaster over the past few days after recently rocketing to a 20-month peak. On-chain data has suggested that many investors used the opportunity to take some profits, leading to a decline in the asset’s price.

Bitcoin’s price slump is mirrored in the wider crypto market, with the global crypto market cap decreasing by 1.85% over the past 24 hours to $1.55 trillion. The total crypto market volume has increased by 32% over the same period. The Crypto Fear and Greed Index has plunged from a level of extreme greed to a greed level of 70, suggesting a decline in risk appetite.

Ethereum, the largest altcoin by market capitalization, is currently trading at $2,167, down almost 3% for the day. Meme coins have been hit hard by the market slump, with Dogecoin and Shiba Inu down by more than 4% over the last day.

Last week on Thursday, cryptocurrency experts took notice of…

Bitcoin

Bitcoin Price is in Consolidation Mode Despite Market Optimism Post-Fed Decision

Bitcoin price edged lower on Thursday despite optimism in wider markets on the back of the Fed’s interest rate decision. The flagship cryptocurrency has been consolidating above the critical level of $42,000 after briefly topping $44,000, its highest level in 20 months. Bitcoin was trading 0.71% lower at $42,569 at press time. BTC’s total market cap has increased by more than 3% over the last day to $832 billion, while the total volume of the asset traded over the same period jumped by 22%.

Economic Outlook

Bitcoin price has been trading sideways over the past few days, suggesting a pause in its recent rally towards $45,000. The premier cryptocurrency has decreased by 4% in the past week but remains 15.22% higher in the month to date. The digital asset has staged a significant recovery this year after a torrid 2022 in which a string of scandals, including the collapse of FTX, led to a market meltdown, undermining the credibility of the sector.

The crypto market has been buoyed by the Fed’s latest interest rate decision. The US Federal Reserve on Wednesday held its key interest rate unchanged for the third consecutive time, in line with market expectations. With the easing of the inflation rate, members of the Federal Open Market Committee (FOMC) voted to keep the benchmark overnight borrowing rate in a targeted range between 5.25%-5.5%.

Additionally, the central bank indicated that three rate…

Bitcoin

Bitcoin Price Blasts $44K in Spectacular Surge as Spot Bitcoin ETF Approval Looms Large

Bitcoin price has been hovering above the $43,000 psychological level over the past two days amid anticipation about the potential approval of a spot bitcoin ETF. The flagship cryptocurrency has climbed more than 16% in the past week and nearly 170% in the year to date. Bitcoin’s total market cap has increased by nearly 5% over the past 24 hours to $858.9 billion, while the total volume of the token traded rose by 43%. The Bitcoin price was trading at $43,914 at press time.

Fundamentals

Bitcoin price has posted significant gains over the past few days, climbing to its highest level since April 2022, before the crash of a stablecoin that started a litany of company failures, pummeling crypto prices. The world’s largest cryptocurrency briefly topped the crucial level of $44,000 on Wednesday amid rising momentum despite being massively overbought.

According to analysts, with no spot bitcoin ETF approvals yet and the halving event five to six months away, the market is riding on FOMO. Capital has been flowing in the Bitcoin market amid enthusiasm that the launches of spot ETF will bring in billions of dollars of new investment into the crypto sector.

Investors have already started providing capital as seed money for ETF products. Notably, a recent report by CoinDesk showed that the world’s largest fund manager, BlackRock, received $100,000 in capital from a seed investor for its spot bitcoin exchange-traded fund…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange