Bitcoin

BitBay (BAY) Is Reaching Critical Mass – Here’s What’s Next

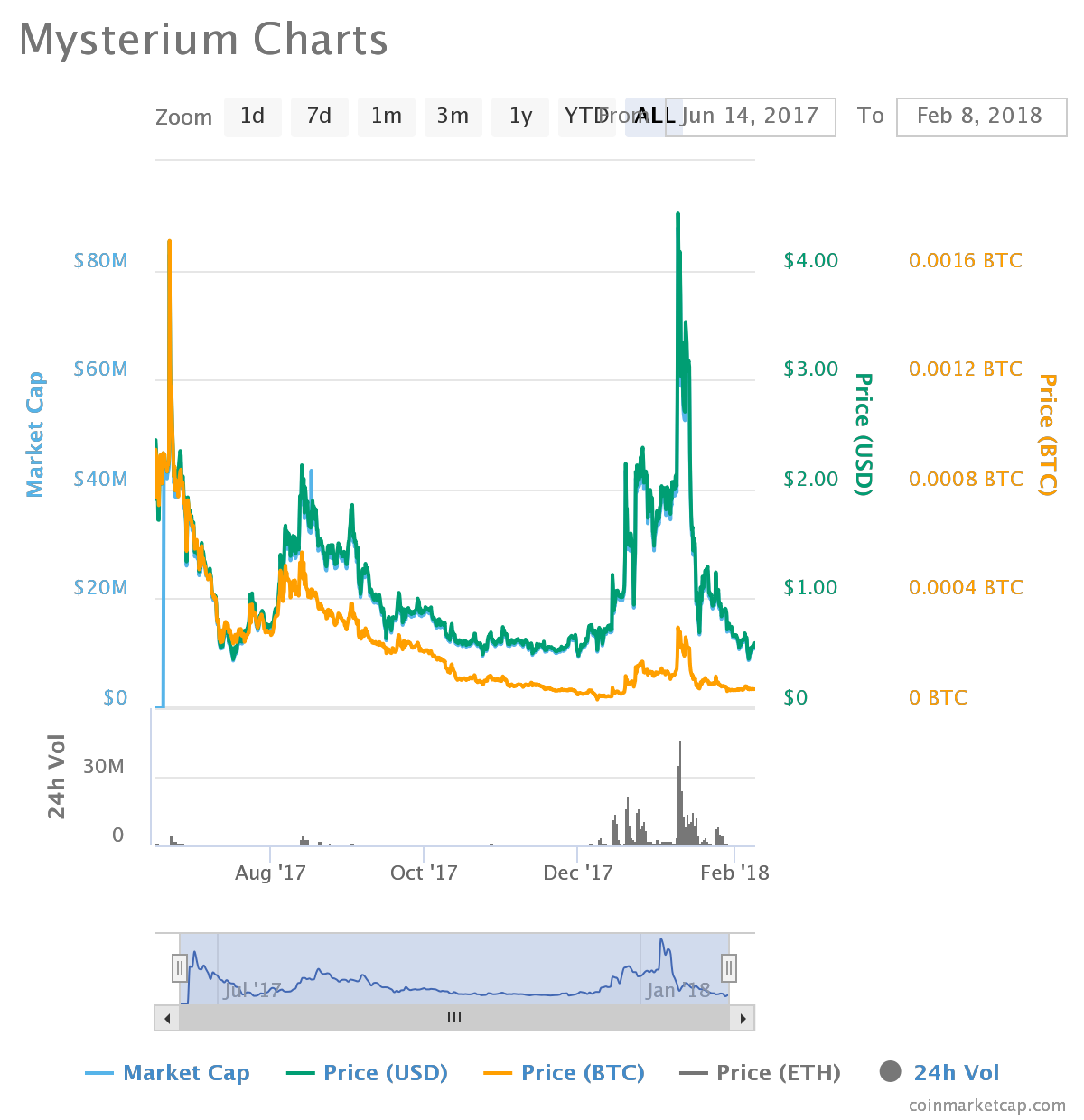

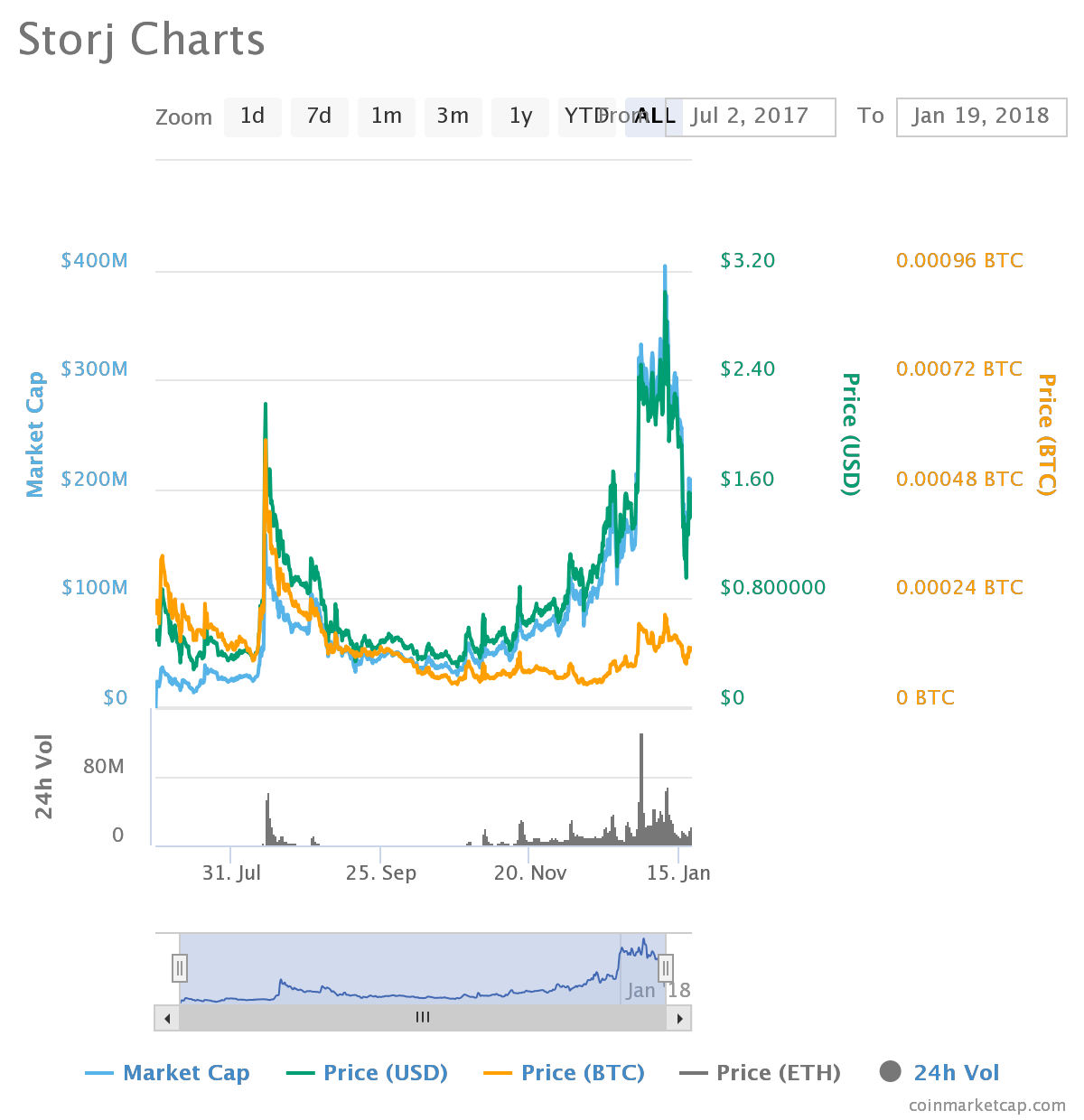

BitBay (BAY) is one of the companies and accompanying cryptocurrencies that we feel is and has been the most overlooked in the market over the last 12 months and more. That is a big statement but it is not one we make lightly. And over the last few weeks, our expectations for BAY have been validated – to a degree.

The coin currently trades for just shy of $0.37 apiece, up from $0.07 apiece on December 6. This gives the overall BAY ecosystem a market capitalization of $368 million and, over the last 24 hours, we saw volume hit more than $18 million – meaning a little over 25% of the total outstanding coins changed hands.

And for BitBay, and BAY, this is far from unusual. Indeed, changing hands is the primary use case for BAY, as compared to some of the more speculative assets or the more functional ones in this market.

So what is BAY and why do we like it so much?

BitBay is a decentralized transaction marketplace that is set up in a similar fashion to what we might refer to as its namesake – eBay. However, there are a number of key and pivotal differences which ensure that, other than the fact that people are buying and selling across the company’s platform and that the final three letters of the platforms name match those of eBay, the ecosystems are entirely different.

BAY Daily Chart

It’s built using smart contracts, meaning much of the bureaucracy and the process complexities associated with buying and selling goods and services across pretty much any other platform (be that virtual or real world) are removed.

The company has used what it calls a double deposit escrow system so as to pretty much entirely remove the incentive from either buyer or seller to act maliciously when conducting a transaction. Basically, both users contribute deposit ahead of the transaction and if one or the other act maliciously, both deposits are burnt, meaning both parties lose money.

The platform also allows for custom smart contract templates which means a seller can structure the transaction pretty much exactly how he or she wishes, with pretty much any currency available for use, any deal structure (auction, barter, exchange, or something) available, and many more options that basically blow all of the other online exchange platforms out of the water in terms of seller functionality.

So why is this one running now?

Well, the platform is reaching a critical mass of users and is about to release a brand-new client GUI this quarter. Alongside this GUI, we will see the release of a mobile wallet and the release of the final smart contract templates, which should facilitate increased quality of seller experience (and, in turn, translate to user growth).

Additionally, next quarter, the company is set to implement what’s called a dynamic peg, which essentially allows for pegging of BAY to USD (or another fiat) at the time of a deal closing so as to ensure that the buyer and seller don’t have to be concerned with fluctuating rates while the deal matures to completion.

This is a big deal as it will likely translate to a much higher proportion of transactions being carried out in BAY (as well as the increased BAY deposit count that comes with an increased user base), which, in turn, will translate to an increase in demand and (by proxy) an increase in price of the underlying asset.

That’s why we’re excited about this one and that’s why we think there’s a lot of run room left on current prices – this company is just getting started and we expect it to grow far and fast during 2018.

We will be updating our subscribers as soon as we know more. For the latest on BAY, sign up below!

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Please conduct your own thorough research before investing in any cryptocurrency.

Image courtesy of BitBay

Bitcoin

Bitcoin Price Dumps Below $41,000 Amid Uncertainty

Bitcoin price dumped hard on Monday, briefly slipping below $41,000, erasing gains recorded in the previous week. The premier cryptocurrency seems to have exhausted its recent rally propelled by industry vulnerabilities. At the time of writing, the world’s largest cryptocurrency was trading slightly lower at $41,385. Bitcoin’s total market cap has dipped by 2% over the past day, while the total volume of BTC tokens traded over the same period climbed by 58%.

Fundamentals

Bitcoin price has been facing retracements and a rollercoaster over the past few days after recently rocketing to a 20-month peak. On-chain data has suggested that many investors used the opportunity to take some profits, leading to a decline in the asset’s price.

Bitcoin’s price slump is mirrored in the wider crypto market, with the global crypto market cap decreasing by 1.85% over the past 24 hours to $1.55 trillion. The total crypto market volume has increased by 32% over the same period. The Crypto Fear and Greed Index has plunged from a level of extreme greed to a greed level of 70, suggesting a decline in risk appetite.

Ethereum, the largest altcoin by market capitalization, is currently trading at $2,167, down almost 3% for the day. Meme coins have been hit hard by the market slump, with Dogecoin and Shiba Inu down by more than 4% over the last day.

Last week on Thursday, cryptocurrency experts took notice of…

Bitcoin

Bitcoin Price is in Consolidation Mode Despite Market Optimism Post-Fed Decision

Bitcoin price edged lower on Thursday despite optimism in wider markets on the back of the Fed’s interest rate decision. The flagship cryptocurrency has been consolidating above the critical level of $42,000 after briefly topping $44,000, its highest level in 20 months. Bitcoin was trading 0.71% lower at $42,569 at press time. BTC’s total market cap has increased by more than 3% over the last day to $832 billion, while the total volume of the asset traded over the same period jumped by 22%.

Economic Outlook

Bitcoin price has been trading sideways over the past few days, suggesting a pause in its recent rally towards $45,000. The premier cryptocurrency has decreased by 4% in the past week but remains 15.22% higher in the month to date. The digital asset has staged a significant recovery this year after a torrid 2022 in which a string of scandals, including the collapse of FTX, led to a market meltdown, undermining the credibility of the sector.

The crypto market has been buoyed by the Fed’s latest interest rate decision. The US Federal Reserve on Wednesday held its key interest rate unchanged for the third consecutive time, in line with market expectations. With the easing of the inflation rate, members of the Federal Open Market Committee (FOMC) voted to keep the benchmark overnight borrowing rate in a targeted range between 5.25%-5.5%.

Additionally, the central bank indicated that three rate…

Bitcoin

Bitcoin Price Blasts $44K in Spectacular Surge as Spot Bitcoin ETF Approval Looms Large

Bitcoin price has been hovering above the $43,000 psychological level over the past two days amid anticipation about the potential approval of a spot bitcoin ETF. The flagship cryptocurrency has climbed more than 16% in the past week and nearly 170% in the year to date. Bitcoin’s total market cap has increased by nearly 5% over the past 24 hours to $858.9 billion, while the total volume of the token traded rose by 43%. The Bitcoin price was trading at $43,914 at press time.

Fundamentals

Bitcoin price has posted significant gains over the past few days, climbing to its highest level since April 2022, before the crash of a stablecoin that started a litany of company failures, pummeling crypto prices. The world’s largest cryptocurrency briefly topped the crucial level of $44,000 on Wednesday amid rising momentum despite being massively overbought.

According to analysts, with no spot bitcoin ETF approvals yet and the halving event five to six months away, the market is riding on FOMO. Capital has been flowing in the Bitcoin market amid enthusiasm that the launches of spot ETF will bring in billions of dollars of new investment into the crypto sector.

Investors have already started providing capital as seed money for ETF products. Notably, a recent report by CoinDesk showed that the world’s largest fund manager, BlackRock, received $100,000 in capital from a seed investor for its spot bitcoin exchange-traded fund…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange