Don't Miss

Blockchain Startup Incubator Blockhive Proposes ICO Alternative

Blockchain has made the headlines for the past few months, but the technology is still at its nascent stage and has to go through many steps to reach a complete maturity level. To accelerate adoption, Blockhive, a startup headquartered in Estonia, intends to create an incubator platform to help startups and established companies implement projects related to the distributed ledger technology (DLT), as blockchain is also called. As you’ll read below, the company applies a revolutionary form of fundraising that is different from initial coin offerings (ICOs).

Blockhive has created a platform that encourages collaboration between parties to allow startups to implement their roadmaps more efficiently and help them succeed in a digital ecosystem. Blockhive’s blockchain-oriented business models and solutions are ideal for companies in various industries.

Within its newly formed ecosystem, the startup wants to permit the tokenization of properties, money, and assets. Also, to ensure transparency and trust, Blockhive is relying on the use of digital identity, and choosing Estonia to host its headquarters was not done by coincidence.

What Does Estonia Have to Offer?

After winning its independence more than 25 years ago, Estonia turned into a modern and progressive nation with lots of opportunities for fintechs and IT companies. The government has endorsed futuristic projects like e-residency, e-government, and digital signature. It seems that the authorities had some plans to launch a national cryptocurrency called Estcoin, but it gave back amid an intense pressure from the European Union, which doesn’t accept other legal means of payments besides euro. Thus, Estcoin remains to be a potential crypto project within the e-residency program.

The country’s advancement in the blockchain space was regarded as a strong reason by Blockhive to base its project development there. Besides, Estonia guarantees a business-friendly environment after several regulatory reforms that revolve around transparency and openness.

The e-residency program is the first one of its kind. Under the program, the Estonian government is providing a digital form of ID to anyone in the world. Thus, citizens and businesses can become members of a new concept of a global digital nation with no borders. Blockchive integrates the e-residency’s features into its platform.

Blockhive’s Revolutionary Fundraising Method

ICOs have become a trend in the blockchain space, as most of the startups choose this form of fundraising to make their jump-start. However, there has been registered many scams that compromised this approach, even though there is nothing fundamentally wrong with it. Some startups decided to change the name and present their fundraising event as a “token sale event,” “token generation event” or some other alternative.

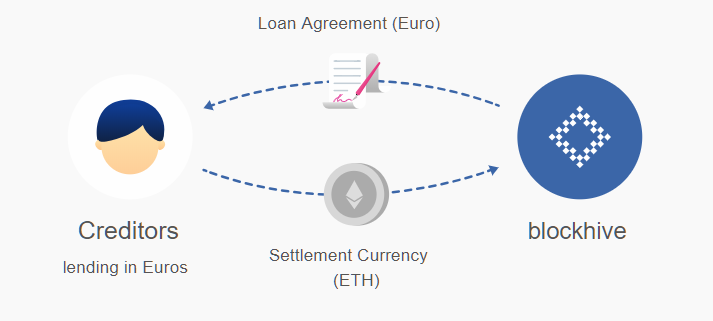

Blockhivealso endorses a standard in fundraising, but it doesn’t want to change the name of the process but to revolutionize the whole concept. Currently, Blockhive conducts a so-called Initial Loan Procurement (ILP). You can call it an ICO’s twin, but it’s different.

FLATs are given to creditors after a loan agreement is completed (signed and loaned). In addition, investors can buy these tokens in the secondary after HIVE tokens are listed. In other words, you can invest in a bond-like token and earn an interest, which in this case is the equivalent of 20% of Blockhive’s profits. Thus, investors are actually becoming creditors.

The company’s public ILP is conducted in two rounds, releasing a total of 30% of Hive tokens. The first round was successfully completed on February 9, 2018, while the second round is currently live until June 30, 2018.

The total supply of Hive tokens is 1 billion, and the company is aiming to raise 45 million euro (around $52 million).

Investors are motivated to buy these credit tokens given the company’s potential to generate profits from revenue streams. However, it’s worth mentioning that residents of Japan and the US cannot take part in the ILP event.

For the ILP, Blockhive is betting on the Ethereum platform to create loan agreements based on smart contracts. Thus, HIVE is an ERC20-based token.

To participate in the ILP event, you can follow these simple steps:

- Create an account by using your e-mail and choosing a secure

- Submit your personal information and ETH address used to send ETH to Blockchive.

- Pass ID verification with the smartphone app “Agrello KYC.”

- Submit your residential info and then sign a digital form of loan agreement.

- Send ETH to Blockhive’s ETH address.

Blockhive’s Ecosystem

Blockhive has a complex ecosystem that is centered on blockchain projects. It currently includes the following:

- Blockhive’s core projects built in-house;

- Joint projects developed with Blockhive’s partners;

- Consulting and incubation services.

Blockhive’s core projects are:

- Eesti Mining – a mining project using renewable energy at an Estonian facility.

- e-Best Ventures – a government-approved VC firm investing in privateICO stages.

- Tokenote– this platform allows blockchain startups raise funds by conducting ILP events, as Blockchive does today.

- Eesty– a digital wallet where you can hold cryptocurrencies and earn ESTY tokens from transactions.

Besides its own projects, Blockhive has partnered with several entities to implement blockchain solutions in various sectors. Some of the partners are Agrello, PayBe, Oblicity, Pakri, Fintech Global, Fujinet Systems, IMAY, Icefire, and NordCoin Mining among others.

Blockhive has a professional team and is supported by state-backed organizations in Estonia, so the project has some great potential. If you want to become a creditor buy investing in HIVE tokens, you can take part in the ILP by registering here.

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Image courtesy of Stefan Fischer via Flickr

Don't Miss

A Guide to Exploring the Singaporean ETF market

Singapore’s Exchange Traded Fund (ETF) market has grown, offering investors diverse investment opportunities and access to different asset classes. As the market evolves, investors must navigate these uncharted waters with a clear understanding of Singapore’s ETF landscape. This article explores the trends, challenges and strategies for navigating the Singapore ETF market. To start investing in ETFs, you can visit Saxo Capital Markets PTE.

The Singaporean ETF Market: Exponential Growth

The Singapore ETF market has seen significant growth in recent years, with an increasing number of ETFs covering a wide range of asset classes and holders. different investment topics.

One of the notable trends in the Singapore ETF market is the growing diversity of available options. Investors can now choose from ETFs that track domestic and international stock indexes, bonds, commodities, and specialist sectors or themes. This diverse range of ETFs allows investors to create comprehensive portfolios tailored to their investment goals.

The growth of the ETF market in Singapore is also due to growing investor demand for low-cost, transparent, and accessible investment vehicles. ETFs offer benefits such as intraday liquidity, real-time pricing, and the ability to trade on exchanges. These characteristics have made ETFs attractive to retail and institutional investors who want exposure to different asset classes.

Regulatory Landscape and Investor Protection

The Monetary Authority of Singapore (MAS) is the…

Don't Miss

Property Loans for Foreigners in Singapore That You Must Know About

Intending to invest in a residential or commercial property in Singapore?

When it comes to foreigners applying for a loan in Singapore, things can be pretty hard regardless of the reason whether you need the property for personal or business purposes.

In Singapore, buying a property is challenging, whether you are a foreigner or a native, and sometimes applying for a loan is the only way for you to afford it.

HOW MUCH CAN YOU BORROW FOR A PROPERTY LOAN IN SINGAPORE?

As for the Foreigner Loans, in Singapore, there is an exact amount of money you can borrow to finance the purchase of a property.

In this sense, Singapore has the Loan to Value Ratio (LTV).

The LTV ratio is what determines the exact amount of money you can borrow for a property loan, which changes depending on where you try to obtain the loan:

- If you are applying for a bank loan, you can borrow a maximum of 75% of the value of the property you want to purchase. That means if you are looking for a property that costs $500.000, the maximum amount of money a bank lender can give you like a loan in Singapore is going to be $375.000.

- When you are applying for a loan with a Housing…

Don't Miss

CoinField Launches Sologenic Initial Exchange Offering

CoinField has started its Sologenic IEO, which is the first project to utilize the XRP Ledger for tokenizing stocks and ETFs. The sale will last for one week and will officially end on February 25, 2020, before SOLO trading begins on the platform. Sologenic’s native token SOLO is being offered at 0.25 USDT during the IEO.

Earlier this month, Sologenic released the very first decentralized wallet app for SOLO, XRP, and tokenized assets to support the Sologenic ecosystem. The app is available for mobile and desktop via the Apple Store and Google Play. The desktop version is available for Windows and Mac.

“By connecting the traditional financial markets with crypto, Sologenic will bring a significant volume to the crypto markets. The role of the Sologenic ecosystem is to facilitate the trading of a wide range of asset classes such as stocks, ETFs, and precious metals using blockchain technology. Sologenic is an ecosystem where users can tokenize, trade, and spend these digital assets using SOLO cards in real-time. The ultimate goal is to make Sologenic as decentralized as possible, where CoinField’s role will be only limited to KYC and fiat ON & OFF ramping,” said CoinField’s CEO…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange