Trade

Cryptocurrency Bear Market: Four Options – Choose Wisely

In the decade since the introduction of bitcoin, it has been a rollercoaster of a ride for cryptocurrency investors – especially after the start of the bull run late in 2017. There have been thrills and spills, and more ups than downs across the 10 years. Certainly, those who were clever – or lucky – enough to invest in the early days will be very pleased with their yield.

Much like a rollercoaster, following a steep ascent comes an exhilarating – sometimes scary – drop, and that has been the case for bitcoin and the other major cryptos in 2018.

There is talk of another bull run on the horizon, though whether it will happen is anyone’s guess. So what strategies do crypto investors employ in a bear market? Basically, you have four options – as listed below. Choose wisely.

- Short sell

“Shorting” is when a trader backs a certain market to decline. If their hunch is correct, then they will benefit. Arguably the most famous example of short selling happened in September 1992, when Hungarian-American investor George Soros netted approximately $1 billion after correctly predicting the British pound would drop when it was forced out of the European Exchange Rate Mechanism.

Shorting is made possible through Contracts For Difference (CFDs), or derivatives, as they allow the trader to sell assets he or she doesn’t actually own. Simply put, a short trade is executed when a borrowed asset, or instrument, is sold at the current market price. If the market moves the trader’s way thereafter, and the price of the asset declines, the value of their position increases. From there the trader can choose to buy back the now-cheaper asset and make a tidy profit.

The 1,200 instruments offered by leading global social trading and investing platform eToro to its 10 million+ members have the option to short, including within the cryptocurrency and stock markets. Never has the adage “one man’s loss is another man’s gain” been so apt.

- HODL

The first time you see “HODL” when someone is discussing cryptocurrencies the word causes you to stop reading. You think: “Is it a misspelling?” Well, yes it is – at least it was mistyped originally. Now, rather amusingly, HODL has spawned a life of its own. It has evolved to represent a long-term trading strategy and philosophy for crypto investors.

HODL has become an acronym (or even backronym) for “hold on for dear life”, meaning that even when investors are in the deep red with their cryptos they should not buckle under pressure and sell, driven by the belief that they will, ultimately, reap great rewards, once mass adoption has been achieved.

Quartz heralded HODL as one of the most important terms in crypto culture in 2017, describing it as a determination to “stay invested in bitcoin and not to capitulate in the face of plunging prices”.

There is certainly great potential of HODLing as an investment strategy, and not selling while under pressure, as history shows us – and not just in the cryptocurrency world.

One of the most notorious examples of failing to HODL happened in the mid 1970s when Ronald Wayne, Apple’s third co-founder – alongside Steve Jobs and Steve Wozniak – sold his 10 per cent stake in the then-start-up back to the other two co-founders for $800.

In August 2018, Apple achieved the historic milestone of reaching a market capitalisation of $1 trillion. Had Wayne adopted a HODL mentality his Apple stake would be worth around $100 billion today.

It is impossible to predict the future, but Jay Smith, one of eToro’s most recognisable Popular Investors (whose trades can be copied by others – as can anyone’s on the platform), believes staying strong will reap the biggest rewards. Full-time trader Smith – a.k.a. jaynemesis on eToro– describes his trading style as “fundamentals, future and HODLing”.

“I firmly believe that cryptos will change the world, replacing stock markets, most currencies and powering everything from machine-to-machine payments and the Internet of Things through to streaming media, prediction markets, governance systems, voting systems, even potentially the internet,” he continues. “That being said, there is a long way to go, we are in the very early stages for most of these areas.”

- Keep investing

When the value of cryptos falls, many investors double down – effectively strengthening their commitment to a course of action that is potentially risky – because the prices are so low. As with HODLers, those who keep investing see the long-term benefits of cryptos.

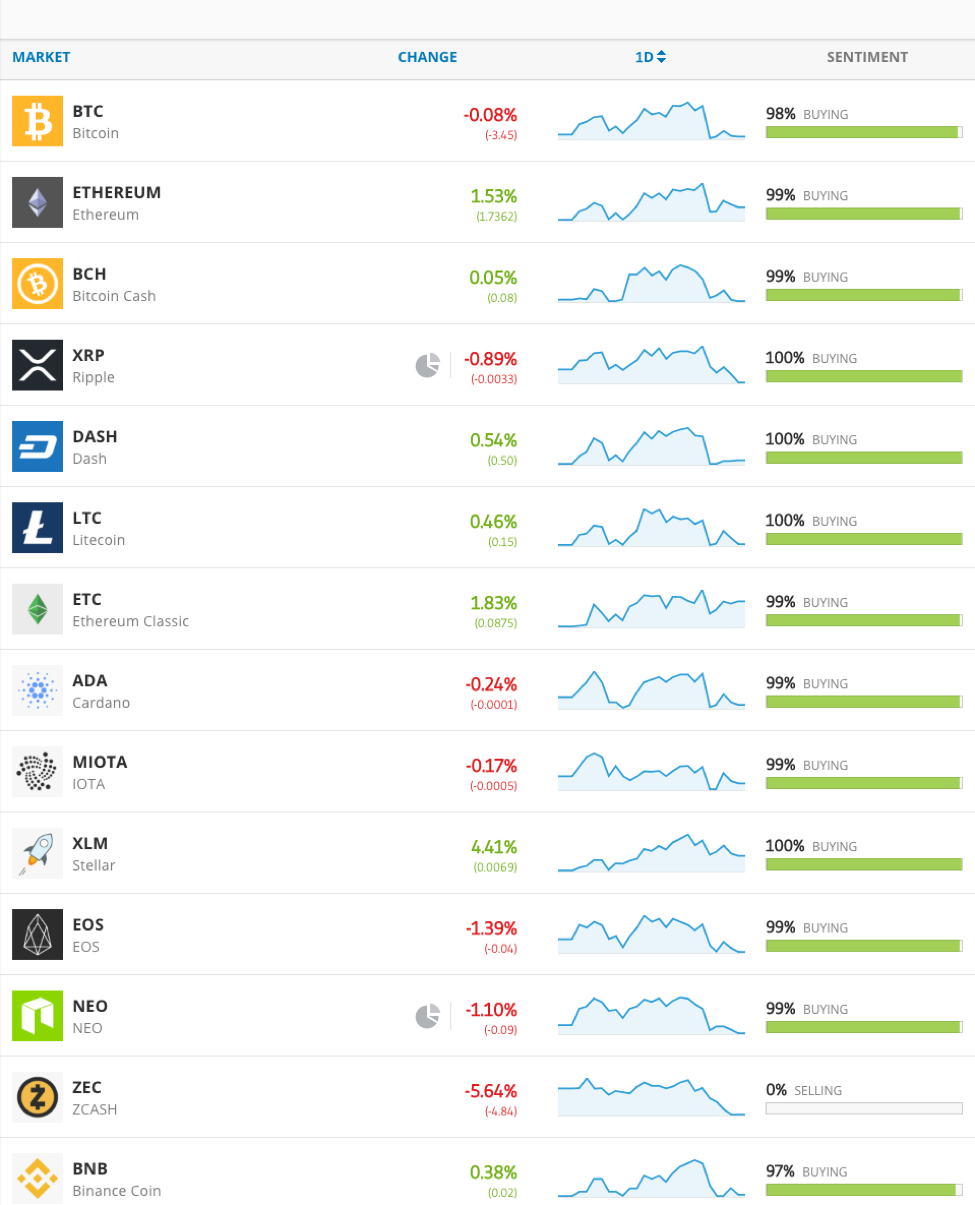

Despite the bear market of 2018, many eToro users have invested more in bitcoin, XRP, and a range of other cryptos available on the platform – just see the market sentiment (image taken on November 30, 2018).

This is not investment advice or an investment recommendation.

- Diversify

If you have gone all in on cryptos and are waiting for the arrows to turn green, rather than red, it might be a good idea, during a bear market, to consider investing in other asset classes. By diversifying your portfolio this approach will spread your overall risk.

On eToro there are over 1,200 financial instruments, across six asset classes, on offer: cryptocurrencies; exchange-traded funds (ETFs); stocks; indices; commodities; and currencies. There are other ways for users to invest with eToro, in addition to manual trading. The innovative CopyTrader tool allows clients to copy the trades of top investors automatically. Users can view and copy anyone with a profile in a straightforward way, and expand their portfolio using CopyTrader while still using an individual strategy.

Another option is CopyPortfolios™: eToro offer various portfolios including in cryptos, technology, and the best-performing traders. These allow users to invest in multiple markets or traders based on predetermined investment strategies.

The award-winning platform truly is a one-stop shop for all your trading needs in a crypto bear market.

eToro is a multi-asset platform which offers both investing in stocks and cryptocurrencies, as well as trading CFD assets.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Cryptoassets are unregulated and can fluctuate widely in price and are, therefore, not appropriate for all investors. Trading cryptoassets is not supervised by any EU regulatory framework. Past performance is not an indication of future results. Your capital is at risk.

This content is intended for information and educational purposes only and should not be considered investment advice or investment recommendation.

Altcoins

XNO Token of Xeno NFT Hub listed on Bithumb Korea Exchange

Hong Kong, Hong Kong, 25th January, 2021, // ChainWire //

Xeno Holdings Limited (xno.live ), a blockchain solutions company based in Hong Kong, has announced the listing of its ecosystem utility token XNO on the ‘Bithumb Korea’ cryptocurrency exchange on January 21st 2021.

Xeno NFT Hub (market.xno.live ), developed by Xeno Holdings, enables easy minting of digital items into NFTs while also providing a marketplace where anyone can securely trade NFTs.

The Xeno NFT Hub project team includes former members of the technology project Yosemite X based in San Francisco and professionals such as Gabby Dizon who is a games industry expert and NFT space influencer based in Southeast Asia.

NFT(Non-Fungible Token) technology has recently gained huge focus in the blockchain arena and beyond, making waves in the online gaming sector, the art world, and the digital copyrights industry in recent years. The strongest feature of NFTs is that “NFTs are unique digital assets that cannot be replaced or forged”. Unlike fungible tokens such as Bitcoin or Ether, NFTs are not interchangeable for other tokens of the same type but instead each NFT has a unique value and specific information that cannot be replaced. This fact makes NFTs the perfect solution to record and prove ownership of digital and real-world items like works of art, game items, limited-edition collectibles, and more. One of the ways to have a successful…

Altcoins

XENO starts VIP NFT trading service and collaborates with contemporary artist Hiro Yamagata

Hong Kong, Hong Kong, 24th December, 2020, // ChainWire //

The XENO NFT Hub (https://xno.live) will provide a crypto-powered digital items and collectables trading platform allowing users to create, buy, and sell NFTs. Additionally it will support auction based listings, governance and voting mechanisms, trade history tracking, user rating and other advanced features.

As a first step towards its fully comprehensive service, XENO NFT Hub launched a recent VIP service to select users and early adopters in December 2020 with plans for a full Public Beta to open in June 2021.

“NFTs are extremely flexible in their usage, from digital event tickets to artwork, and while NFTs have a very wide spectrum of uses and categories XENO will initially focus its partnership efforts and its own item curation on three primary areas: gaming, sports & entertainment, and collectibles.”, said XENO NFT Hub president Anthony Di Franco.

He also added “This does not mean we will prohibit other types of NFTs from our ecosystem However, it simply means that XENO’s efforts as a company will be targeted into these verticals initially as a cohesive business approach.”

Development and Procurement Lead, Gabby Dizon explained, “Despite our initial focus, we found ourselves with a unique opportunity to host some of the works of Mr. Hiro Yamagata. We are collaborating with Japanese artist Hiro Yamagata to enshrine some of his artwork into NFTs.”

Mr. Yamagata has…

Altcoins

My Crypto Heroes Announces Issuance of MCH Governance Token

Tokyo, Japan, 24th November, 2020, // ChainWire //

My Crypto Heroes is happy to announce the issuance of MCH Coin as an incentive to players in the My Crypto Heroes ecosystem, aiming to allow them to craft a “User-oriented world”. The MCH coin is available on Uniswap with a newly created pool with ETH.

My Crypto Heroes is a blockchain-based game for PC and Mobile. It allows users to collect historic heroes and raise them for battle in a Crypto World. Officially released on November 30th, 2018, MCH has recorded the most transactions and daily active users than any other blockchain game in the world.

What is MCH Coin?

MCH Coin is being issued as an ERC-20 Standard Governance Token. The issuance began on November 9th, 2020, with 50 million tokens issued.

Of the funds issued, 40% are allocated to a pay for on-going development and as rewards for advisors and early investors. 10% are allocated to marketing and the growth of the ecosystem, and 50% are allocated to the community. The Distribution Ratio of the MCH Coin is subject to change via a governance decision.

The MCH coin will be used as a voting right as part of the ecosystem’s governance, with 1 coin being 1 vote. It will also be used for in-game utilities and payments. Additional information can be found here:

https://medium.com/mycryptoheroes/new-ecosystem-with-mchcoin-en-a6a82494894f

During December 2020 the first…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange