Don't Miss

Global Coin Report: Swapy Network White Paper Review

Blockchain technology has the potential to revolutionize pretty much every aspect of global economic infrastructure but there are a few areas in which it could be more useful than others. These are areas for which the current infrastructure falls short of what we might deem even base-level efficiency; areas that are ripe for an update but for which the currently available technology simply isn’t able to facilitate any sort update (which, in most cases, is the primary cause behind these areas of the economy falling short of others).

One such area is the lending and credit arena and, specifically, the globalization of the existing models in space.

As such, our team has been on the lookout for a company that is trying to bring blockchain technology to the space and, when the Swapy white paper landed in our inboxes, it caught our attention, to say the least.

Of course, just because the company can put together a white paper doesn’t mean that it can solve a global economic issue, so we thought we would take a deep dive into the documents so as to figure out exactly what the team at Swapy is trying to achieve and, more specifically, how it intends to go about it.

Here is what we found.

Introduction

So, let’s kick things off with an introduction to this one given that is where the white paper starts.

As mentioned, the company is trying to shake up the global credit and credit access spaces, and the white paper kicks off with an introduction to the problems that currently exist in the space.

This is relatively par for the course on the sorts of documents, but one thing that stands out right away with Swapy’s approach is that it’s incredibly in-depth. Indeed, this section accounts for pretty much one-quarter of the entire paper – not that this is a bad thing, it simply highlights the scale and scope of this problem that exists in its current format.

So, the company points out the fact that there are currently more than 2 billion people around the world that have no access to financial services and, specifically, that have no access to any sort of credit. Beyond that, Swapy highlights the fact that this issue rests on three primary factors:

- the high cost of capital

- information asymmetry

- the high cost of banking infrastructure

Further, the white paper illustrates, using a selection of global economic data, the disparity between interest rates (both nominal and real) across various global regions. We won’t go into too much detail on the data that the company uses to support its argument that there exists a real problem in the way things are currently set up, because anybody looking to take a real deep dive into these numbers can do so at the white paper (which is available here) and, for the purposes of this discussion, it’s a little out of scope.

What we will say, however, is that a review of the numbers put forward by the company (which are all sourced reliably) really serves to reinforce the suggestion that a solution is very much required here and that any solution needs to count each of the three primary problem factors noted above.

So, as far as putting forward a problem and supporting the existence of this problem with well-sourced and reliable data is concerned, Swapy passes our test on this one.

The Solution

So, with that part of the white paper out of the way, this is where things get pretty interesting for us. Specifically, this is where the company tells us how it’s going to try solving these large and long-term problems with its technology.

Perhaps unsurprisingly, the technology is branded using the Swapy moniker, and is broken down into solutions that aim to connect the following components of the existing financial industry:

- borrowers

- creditors

- insurers

- data producers

- data consumers

- others

Here’s the blurb:

With Swapy Network, individuals and/or companies are able to offer or consume services and collaborate within the ecosystem to decrease the prices of financial services, all the while being more inclusive of new entrants in the financial industry. The fees to operate in Swapy Network will be charged in Swapycryptographic tokens (SWAPY). This way, token holders will have access rights to use the Swapy Network, benefiting from and contributing to it, and receiving tokens in exchange.

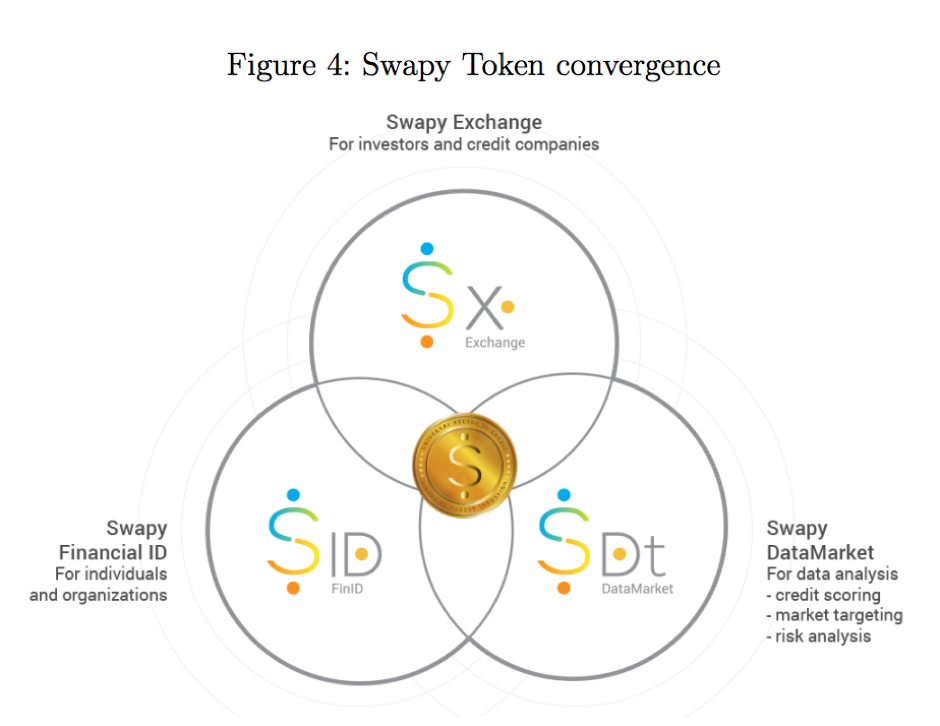

The so-called Swapy Network is further broken down into four primary components, which are the token, the exchange, the financial ID system and a data market. Again, perhaps unsurprisingly, each of these individual components is branded eponymously, so the white paper refers to them as the Swapy Token, the Swapy Exchange, and so on.

For us, each of these components plays a crucial part in solving the above-outlined problems and it’s a strong point of the white paper that Swapy recognizes that each of the problems requires a different solution to provide a 360-overall solution, as opposed to trying to apply a simple one faceted framework to the current existing infrastructure.

So, again, that’s a point in favor of Swapy from our team.

In line with this, the image below illustrates exactly where each of these individual components fits in with one another (we will going to this in a bit more detail once readers have taken a look at the image):

The Token

So, let’s kick things off with the token.

“The Swapy Token (SWAPY) is an ERC2012 token and the basic unit of value in the Swapy Network. One unit will have 18 decimal points, which means that the lowest value one can hold is 0.000000000000000001 SWAPY.”

That’s pulled straight from the paper.

It’s described as a utility token that has three basic functions. The first is for paying for an individual’s data, the second is to pay for services in the Swapy network and the third is to be used as collateral when requesting loans.

Again, as refers to utility, the Swapy team expect that the Swapy Network will achieve sustainability and promote a virtuous cycle surrounding the issuance of a new cryptocurrency, promoting benefits to the peers in the Swapy Network.

Applications

So outside of the token, the above three decentralized open-source applications enter the picture – the exchange, the data market, and the financial ID system.

The Swapy Exchange is a market-based solution for more globalized and more efficient money markets. Basically, it is designed as a sort of arbitrage system through which investors can gain access to higher yield opportunities and through which borrowers can gain access to favorable terms on credit.

The Swapy Financial ID aims to be a digital financial identity valid in any country. Its purpose is to eliminate the information asymmetry, as well as improving the data integrity and privacy. This, more than anything, is a sort of KYC system that allows for the modernizing of the current system (which is offered by entities like Equifax in the US, etc.) and will allow lenders to instantly access the profile of a potential borrower and, not only that but to also trust in the validity on the accuracy of said profile on acquisition.

The data market feeds into both of these applications and allows the aggregation and transfer of data to facilitate the accuracy and availability (and robustness) of the above discussed financial identity, serving to add value to the full scope of this project.

Again, our take on this section is that it is good to see that the team over at Swapy has considered this approach from a few different angles and that the company is willing to build three different decentralized applications, each of which is able to integrate with the other, to complement the overarching concept.

In other words, this is a more complex approach than many other companies might have used but the complexity serves to reinforce the robustness of the problem-solving effort, which, in our eyes, further validates this company as a long-term value prospect for anybody looking to participate in the ICO.

Software Development Roadmap

The company started developing the software back in July 2017 and now has an iterative plan through which it intends to develop the above-described applications towards full functionality.

This plan is as follows:

- 1st quarter after TGE: Swapy Financial ID public alpha on test net providing identification and attestation to Swapy Exchange tokenized assets. Swapy Data Market private alpha on test net operating 1 to 1 data sales.

- 2nd quarter after TGE: Swapy Exchange and Swapy Financial ID private beta on main net transacting real tokens. Each lender or lending company willing to join the Swapy Network will have their own timeline to start using the Swapy Exchange depending on the compliance process.

- 3rd quarter after TGE: Swapy Exchange and Swapy Financial ID public beta on main net. Public ”Connect with Swapy ID” API available. Anyone can use it for any purpose and transact real tokens. Swapy Data Market on private beta transacting real tokens and real data from Swapy Financial ID.

- 4th quarter after TGE Swapy Data Market public beta on main net. Swapy Exchange and Swapy Financial ID improvements. Planning the following year considering the community surveys.

Our take on this is that it is a pretty aggressive plan but one that we feel that this company is almost certainly able to achieve given that development is already well underway. This makes a big difference to our ability to forecast the company’s ability to stick to its roadmap successfully.

The Offering

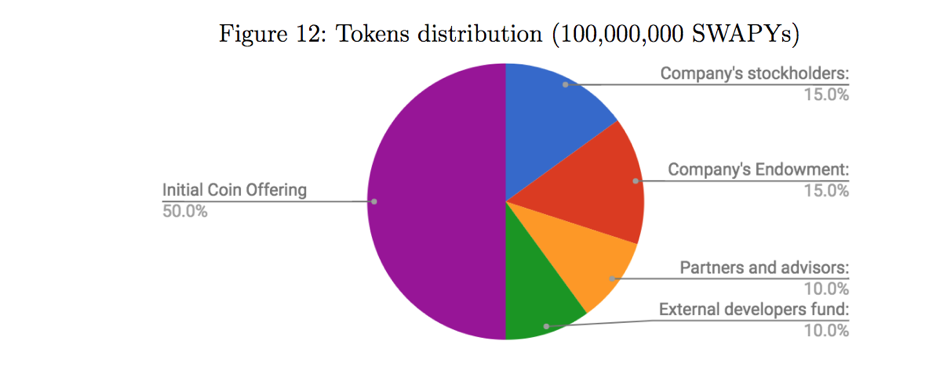

As far as the actual token offering is concerned, things are relatively standard for the Swapy issue. The company is looking to distribute 100 million SWAPY tokens and cap distribution at this number, with no new tokens minted over time.

For any founders or employees, there is a one-year vesting period tied to early issue tokens which, again, is an extremely positive sign for this company, since it aligns the interests of those developing this platform with those of any early-stage token sale participants.

The image below illustrates the breakdown of the issue:

As noted, this is a relatively standard breakdown and seems to fall in line with successful offerings we have seen in the past. This doesn’t confirm success, of course, but it is an important factor nonetheless.

Advisors

We couldn’t get to the conclusion of this one without a brief mention of the advisory team that’s behind Swapy. This isn’t necessarily White Paper material, but from the perspective of a potential token sale participant, it’s well worth touching on.

Specifically, Swapy has one of the strongest advisory boards we’ve seen in this space to date, including:

- Tim Draper,

- Don Tapcostt

- Singularity University

Anyone familiar with the space will certainly be familiar with the names, but for anyone that isn’t, these guys (and Singularity) are well worth checking out.

As far as we are concerned, having someone like Draper behind your efforts is a real strong point for any project and it really sets Swapy aside from some of the other companies we’ve come across in the ICO arena.

Conclusion

So, what’s our final take on this one?

We think Swapy has a great chance of successfully closing out on its ICO and that participants who take part and pick up an early exposure could be rewarded handsomely longer-term for their early-stage acquisitions.

This is a company with a grand vision seeking a solution to a large problem but it’s one with technology already in place and the combination of a strong team and an aggressive growth strategy in its industry.

For us, this combination is one of the best you can get in this space right now.

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Don't Miss

A Guide to Exploring the Singaporean ETF market

Singapore’s Exchange Traded Fund (ETF) market has grown, offering investors diverse investment opportunities and access to different asset classes. As the market evolves, investors must navigate these uncharted waters with a clear understanding of Singapore’s ETF landscape. This article explores the trends, challenges and strategies for navigating the Singapore ETF market. To start investing in ETFs, you can visit Saxo Capital Markets PTE.

The Singaporean ETF Market: Exponential Growth

The Singapore ETF market has seen significant growth in recent years, with an increasing number of ETFs covering a wide range of asset classes and holders. different investment topics.

One of the notable trends in the Singapore ETF market is the growing diversity of available options. Investors can now choose from ETFs that track domestic and international stock indexes, bonds, commodities, and specialist sectors or themes. This diverse range of ETFs allows investors to create comprehensive portfolios tailored to their investment goals.

The growth of the ETF market in Singapore is also due to growing investor demand for low-cost, transparent, and accessible investment vehicles. ETFs offer benefits such as intraday liquidity, real-time pricing, and the ability to trade on exchanges. These characteristics have made ETFs attractive to retail and institutional investors who want exposure to different asset classes.

Regulatory Landscape and Investor Protection

The Monetary Authority of Singapore (MAS) is the…

Don't Miss

Property Loans for Foreigners in Singapore That You Must Know About

Intending to invest in a residential or commercial property in Singapore?

When it comes to foreigners applying for a loan in Singapore, things can be pretty hard regardless of the reason whether you need the property for personal or business purposes.

In Singapore, buying a property is challenging, whether you are a foreigner or a native, and sometimes applying for a loan is the only way for you to afford it.

HOW MUCH CAN YOU BORROW FOR A PROPERTY LOAN IN SINGAPORE?

As for the Foreigner Loans, in Singapore, there is an exact amount of money you can borrow to finance the purchase of a property.

In this sense, Singapore has the Loan to Value Ratio (LTV).

The LTV ratio is what determines the exact amount of money you can borrow for a property loan, which changes depending on where you try to obtain the loan:

- If you are applying for a bank loan, you can borrow a maximum of 75% of the value of the property you want to purchase. That means if you are looking for a property that costs $500.000, the maximum amount of money a bank lender can give you like a loan in Singapore is going to be $375.000.

- When you are applying for a loan with a Housing…

Don't Miss

CoinField Launches Sologenic Initial Exchange Offering

CoinField has started its Sologenic IEO, which is the first project to utilize the XRP Ledger for tokenizing stocks and ETFs. The sale will last for one week and will officially end on February 25, 2020, before SOLO trading begins on the platform. Sologenic’s native token SOLO is being offered at 0.25 USDT during the IEO.

Earlier this month, Sologenic released the very first decentralized wallet app for SOLO, XRP, and tokenized assets to support the Sologenic ecosystem. The app is available for mobile and desktop via the Apple Store and Google Play. The desktop version is available for Windows and Mac.

“By connecting the traditional financial markets with crypto, Sologenic will bring a significant volume to the crypto markets. The role of the Sologenic ecosystem is to facilitate the trading of a wide range of asset classes such as stocks, ETFs, and precious metals using blockchain technology. Sologenic is an ecosystem where users can tokenize, trade, and spend these digital assets using SOLO cards in real-time. The ultimate goal is to make Sologenic as decentralized as possible, where CoinField’s role will be only limited to KYC and fiat ON & OFF ramping,” said CoinField’s CEO…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange