Trade

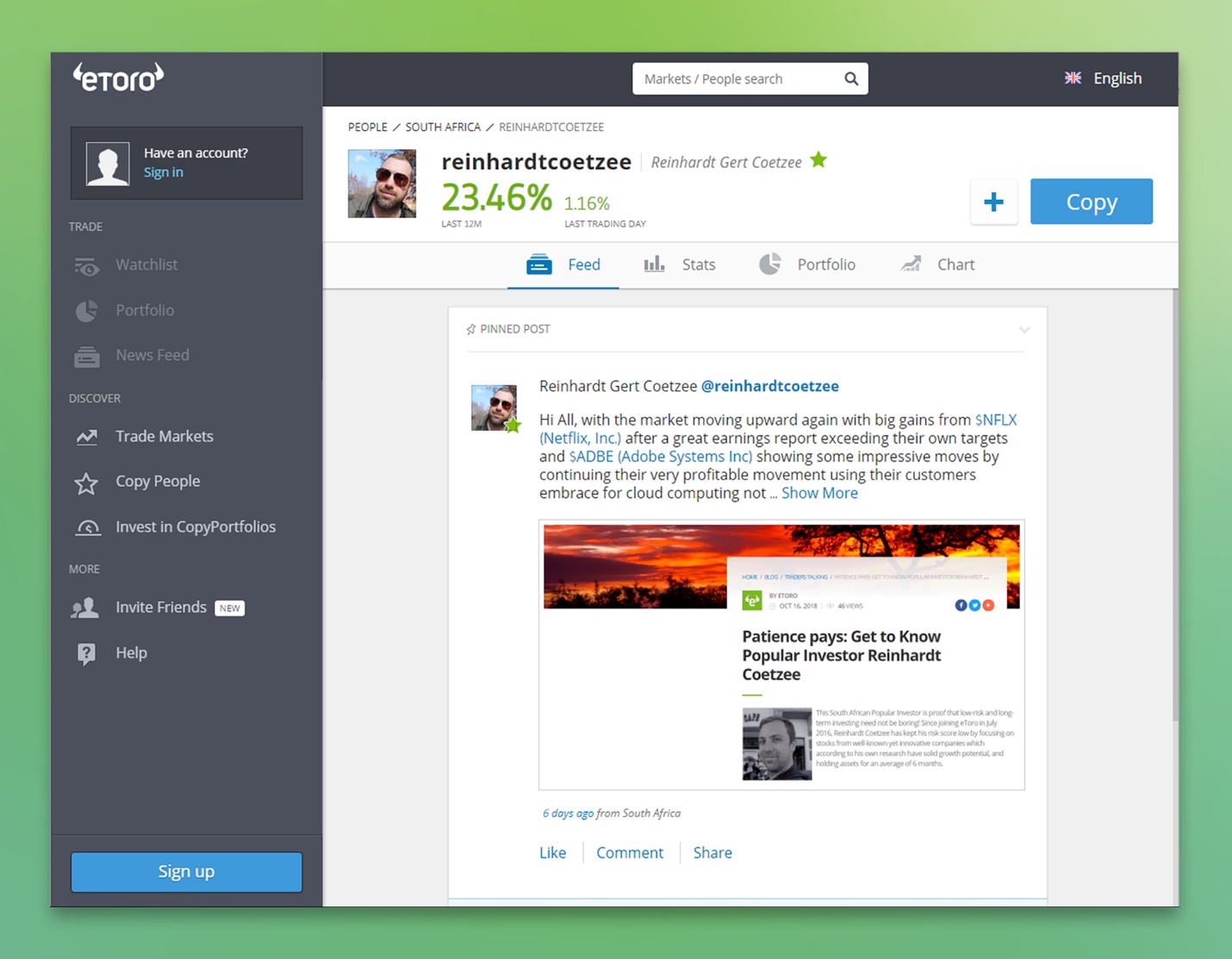

Patience pays: Get to Know Popular Investor Reinhardt Coetzee

Ask any trader and they’ll tell you: diversifying your portfolio is one of the best ways to reduce risk. If you’re curious about branching out to other assets, definitely check out Reinhardt Coetzee — this South African Popular Investor is proof that low-risk, long-term investing can really pay off!

Since joining eToro in July 2016, Reinhardt has kept his risk score low by focusing on stocks from well-known yet innovative companies which according to his own research have solid growth potential, and holding assets for an average of 6 months.

Read more about Reinhardt’s investment s1trategy and see his trading activity here:

View Reinhardt’s profile

This is not investment advice. Past performance is not an indication of future results. Your capital is at risk.

Hi, Reinhardt! Thanks for chatting with us today. Can you tell us a bit about yourself?

I’m 35 years old and live in Johannesburg, South Africa. I work in the industrial automation industry and specialise in the fields of software engineering, business intelligence & data analytics. Investing is an avocational passion of mine. I’m a technology enthusiast — or nerd for short — and I love playing around with and following the latest technological trends that are changing the way we live.

Did you have previous experience with financial investments before joining eToro?

I’ve been investing in equity funds like unit trusts and ETF’s ever since I started my first ‘real’ job and could afford to put some money away. Being a bit of an obsessive when it comes to investing my money, I would research how a particular fund was performing over time and look into things like the underlying asset allocation and detailed stats. Did I mention I’m into analytics? I soon started share trading online, investing in stocks directly and building my own portfolio and have become further involved in the world of investing ever since. I joined eToro in mid-2016 and quickly climbed the ranks to reach Elite Popular Investor status.

Why did you choose to join eToro?

I was looking online for an affordable and accessible way to get more direct exposure to US stocks. Trading international markets using traditional investment brokers can be complicated, non-transparent, and expensive. eToro just made it easy and accessible. I immediately loved using the platform, as it’s very easy to use. The interface design and user experience are great and then there is the whole social aspect to it — having the ability to interact with, and see what other traders all over the world are investing in, is quite amazing.

What are the three key benefits of using eToro?

There are many, and I think it will differ from person to person depending on their trading strategy. For me, the three key benefits have been:

1. Easy and simple-to-use platform with full transparency and statistics. I love stats.

2. Social interaction with a like-minded community of traders and investors — the power of the crowd.

3. Friendly and professional communication. When it comes to support issues and how those are communicated, or speaking with an account manager, I’ve only seen and had good experiences.

That last one might be more of a company culture thing rather than a feature of the platform, but for me, trust in the company you use to invest your money is just as important.

How has eToro changed the way you trade?

Having the ability to trade stock CFD’s, and more recently, directly in the underlying asset, while still being able to trade shares with fractional ownership means I can build out a well-positioned, diversified portfolio. This market-maker model eToro uses, allows me to continually reinvest in my portfolio, adding to existing positions and taking advantage of good buying opportunities such as during market dips.

What is your type of trading strategy and what is it focused on?

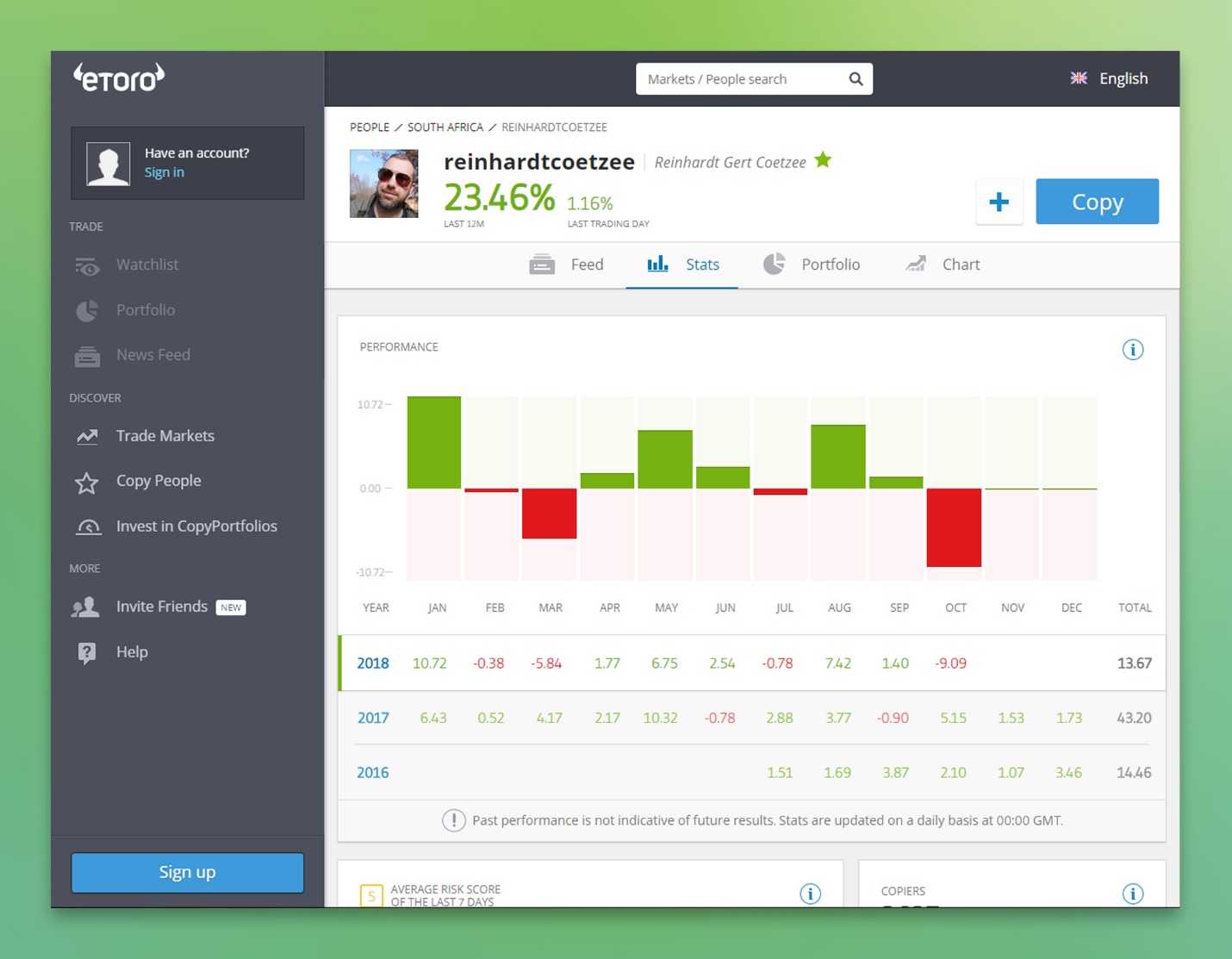

My portfolio is focused on maximum long-term growth. I’m not a day trader. I do a lot of research and reading up on each of the companies in which I invest, fundamental analysis, studying earnings reports etc. I’m also big on thematic investing — researching the technology themes, like AI, shaping our future and what that might look like in the next 5, 10 or 20 years and invest in the companies that stand to benefit the most. You also have to have a benchmark. I invest mainly in tech stocks so I use the Nasdaq100 index (NSDQ100) which historically has been one of the best-performing industry indices over any long-term period, which gives me and my copiers a good benchmark against which to compare my performance.

What are the benefits of being a Popular Investor and what is your long-term goal?

There is obviously the monetary reward for being a Popular Investor, receiving a percentage of my assets under management, which is a great incentive from eToro to be part of the program. Being a Popular Investor means I have a responsibility toward the people who have invested their money with me and I believe this has benefitted me personally by motivating me to do even more research and due diligence when comes to managing the portfolio. Also, I love the social interaction, and playing a bigger part in this awesome community has been great. My main focus and long-term goal at eToro is still to grow the portfolio, keep getting the best possible return, and to be profitable on a consistent basis for myself and my copiers. Hopefully, by doing that, I can keep attracting people to invest with me and remain a top-performing Popular Investor on eToro.

Do you have any advice for your copiers/users considering copying you?

Keep a long-term goal in mind. Equities, and technology stocks in particular, are one of the most profitable investment categories, but they can also be volatile in the short-term. The important thing is to stay calm and have patience. If the market suddenly drops, it can be difficult to stay calm, but just open up a chart and zoom out a bit — most times it will make the drop look like a small blip in the overall performance. History shows that even if you start investing at a really bad time, if you stick with your investment choices, you will be far better off than selling and investing in something else every time. This is how many people lose money in the stock market, which remains one of the best places to put your money.

What are your hobbies?

Then: Braaing (barbequing) with friends, traveling, gaming, and snowboarding when we get the occasional snow in Lesotho.

Now: Spending time with my wife and adorable daughter ???? When I get the time, slowly converting my home into a ‘smart’ IOT home.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

This is not investment advice. Past performance is not an indication of future results.

Altcoins

XNO Token of Xeno NFT Hub listed on Bithumb Korea Exchange

Hong Kong, Hong Kong, 25th January, 2021, // ChainWire //

Xeno Holdings Limited (xno.live ), a blockchain solutions company based in Hong Kong, has announced the listing of its ecosystem utility token XNO on the ‘Bithumb Korea’ cryptocurrency exchange on January 21st 2021.

Xeno NFT Hub (market.xno.live ), developed by Xeno Holdings, enables easy minting of digital items into NFTs while also providing a marketplace where anyone can securely trade NFTs.

The Xeno NFT Hub project team includes former members of the technology project Yosemite X based in San Francisco and professionals such as Gabby Dizon who is a games industry expert and NFT space influencer based in Southeast Asia.

NFT(Non-Fungible Token) technology has recently gained huge focus in the blockchain arena and beyond, making waves in the online gaming sector, the art world, and the digital copyrights industry in recent years. The strongest feature of NFTs is that “NFTs are unique digital assets that cannot be replaced or forged”. Unlike fungible tokens such as Bitcoin or Ether, NFTs are not interchangeable for other tokens of the same type but instead each NFT has a unique value and specific information that cannot be replaced. This fact makes NFTs the perfect solution to record and prove ownership of digital and real-world items like works of art, game items, limited-edition collectibles, and more. One of the ways to have a successful…

Altcoins

XENO starts VIP NFT trading service and collaborates with contemporary artist Hiro Yamagata

Hong Kong, Hong Kong, 24th December, 2020, // ChainWire //

The XENO NFT Hub (https://xno.live) will provide a crypto-powered digital items and collectables trading platform allowing users to create, buy, and sell NFTs. Additionally it will support auction based listings, governance and voting mechanisms, trade history tracking, user rating and other advanced features.

As a first step towards its fully comprehensive service, XENO NFT Hub launched a recent VIP service to select users and early adopters in December 2020 with plans for a full Public Beta to open in June 2021.

“NFTs are extremely flexible in their usage, from digital event tickets to artwork, and while NFTs have a very wide spectrum of uses and categories XENO will initially focus its partnership efforts and its own item curation on three primary areas: gaming, sports & entertainment, and collectibles.”, said XENO NFT Hub president Anthony Di Franco.

He also added “This does not mean we will prohibit other types of NFTs from our ecosystem However, it simply means that XENO’s efforts as a company will be targeted into these verticals initially as a cohesive business approach.”

Development and Procurement Lead, Gabby Dizon explained, “Despite our initial focus, we found ourselves with a unique opportunity to host some of the works of Mr. Hiro Yamagata. We are collaborating with Japanese artist Hiro Yamagata to enshrine some of his artwork into NFTs.”

Mr. Yamagata has…

Altcoins

My Crypto Heroes Announces Issuance of MCH Governance Token

Tokyo, Japan, 24th November, 2020, // ChainWire //

My Crypto Heroes is happy to announce the issuance of MCH Coin as an incentive to players in the My Crypto Heroes ecosystem, aiming to allow them to craft a “User-oriented world”. The MCH coin is available on Uniswap with a newly created pool with ETH.

My Crypto Heroes is a blockchain-based game for PC and Mobile. It allows users to collect historic heroes and raise them for battle in a Crypto World. Officially released on November 30th, 2018, MCH has recorded the most transactions and daily active users than any other blockchain game in the world.

What is MCH Coin?

MCH Coin is being issued as an ERC-20 Standard Governance Token. The issuance began on November 9th, 2020, with 50 million tokens issued.

Of the funds issued, 40% are allocated to a pay for on-going development and as rewards for advisors and early investors. 10% are allocated to marketing and the growth of the ecosystem, and 50% are allocated to the community. The Distribution Ratio of the MCH Coin is subject to change via a governance decision.

The MCH coin will be used as a voting right as part of the ecosystem’s governance, with 1 coin being 1 vote. It will also be used for in-game utilities and payments. Additional information can be found here:

https://medium.com/mycryptoheroes/new-ecosystem-with-mchcoin-en-a6a82494894f

During December 2020 the first…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange