Trade

The Power of HODL

The first time you see “HODL” when someone is discussing cryptocurrencies, the word causes you to stop reading. You think: “Is it a misspelling?” Well, yes it is – at least it was mistyped originally. Now, rather amusingly, HODL has spawned a life of its own. It has evolved to represent a long-term trading strategy and philosophy for crypto investors.

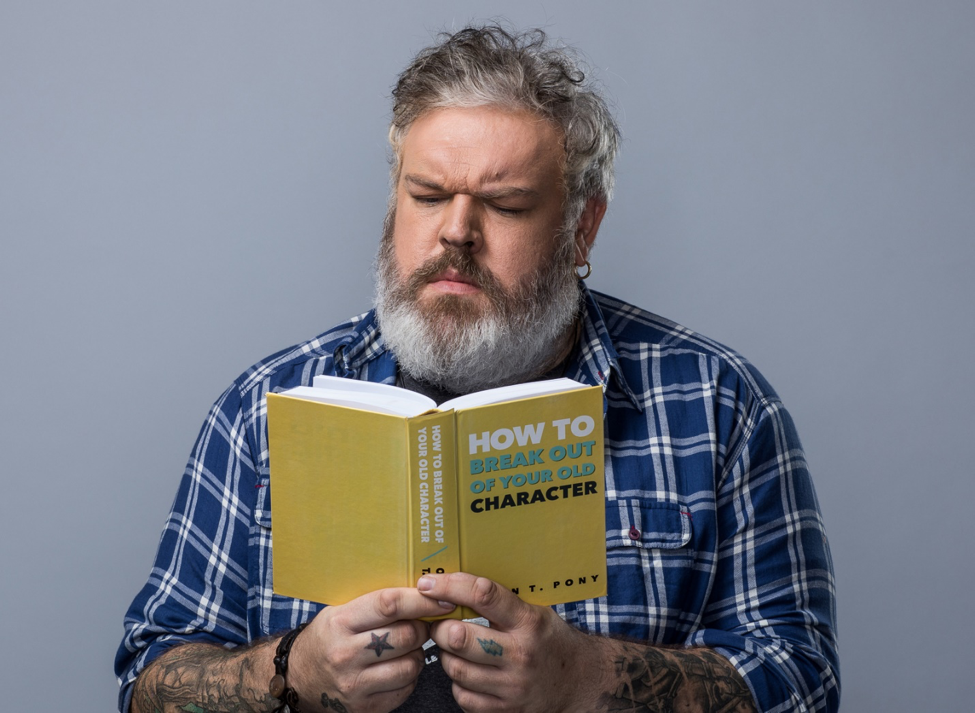

With the launch of our latest campaign – HODL, featuring Kristian Nairn – we thought it would be a good idea to explain in detail what this unusual slang term really means. Better yet, here is Kristian with the explanation:

History of HODL

HODL has become an acronym (or even backronym) for “hold on for dear life”, meaning that even when investors are in the deep red with their cryptos, they should not buckle under pressure and sell, driven by the belief that they will, ultimately, reap great rewards, once mass adoption has been achieved.

The origin of HODL can be traced back to December 18, 2013, and a legendary, whiskey-fuelled rant on Bitcoin Forum by someone calling themselves GameKyuubi.

To provide context, just before the series of poorly written posts were typed – or mistyped – the price of bitcoin had fallen almost 40 percent, from $716 to $438 in 24 hours, according to CoinDesk. The pullback was likely to have been triggered by reports of a crackdown on the original crypto in China. GameKyuubi made clear his or her intentions.

“I AM HODLING,” GameKyuubi wrote, before going on to explain a fair amount of whiskey had been consumed and the reason for “HODLING”. Almost immediately, the funny series of Bitcoin Forum posts were transformed into internet memes, with references to fighting films 300 and Braveheart being especially popular.

More than a Meme: HODL as a Strategy

The memes helped lift HODL from a mistyped “hold” to a widely adopted slang term and trading strategy used in the cryptocurrency community. Quartz heralded it as one of the most important terms in crypto culture in 2017, describing it as a determination to “stay invested in bitcoin and not to capitulate in the face of plunging prices”.

Famous Examples Where HODL Should have been Adopted

There is certainly great potential for HODLing as an investment strategy, and not buckling under pressure, as history shows us – and not just in the cryptocurrency world. One of the most notorious examples of failing to “HODL” happened in the mid-1970’s when Ronald Wayne, Apple’s third co-founder – alongside Steve Jobs and Steve Wozniak – sold his 10 percent stake in the then-start-up back to the other two co-founders for $800.

In August 2018, Apple achieved the historic milestone of reaching a market capitalisation of $1 trillion. Had Wayne adopted a HODL mentality, his Apple stake would be worth around $100 billion today.

Similarly, when another tech giant, e-commerce titan, Amazon first floated, it was worth $18. It dropped to just $1.5, leading many early investors to sell their assets. Now, however, a single stock is worth around $1,700. There are numerous other instances of where a HODL philosophy would have proved the right course of action (or inaction) in other investment spheres – including real estate and especially in cryptos.

HODLing Cryptocurrency Positions

Of course, it is impossible to predict the future, but Jay Smith, one of leading global social trading and investing platform eToro’s most recognisable traders, believes staying strong will reap the biggest rewards. Full-time trader Smith – a.k.a.jaynemesis on eToro– describes his trading style as “fundamentals, future and HODLing”.

Of the potential of cryptos, he continues: “I’ve always been a fan of automation, futurology and transhumanism. On top of that, I am interested in politics, ideology and economics. Cryptocurrencies are a melting pot for all of these things, experimenting with new economic models, governance models, moral and ideological models and offer massive advantages over the systems they aim to replace.”

Smith adds: “I firmly believe that cryptos will change the world, replacing stock markets, most currencies and powering everything from machine-to-machine payments and the Internet of Things through to streaming media, prediction markets, governance systems, voting systems, even potentially the internet. That being said, there is a long way to go, we are in the very early stages for most of these areas.”

About eToro

eToro is a regulated multi-asset investment platform that has been offering investors access to cryptoassets since 2014. The platform now offers 12 cryptoassets (Bitcoin, Ethereum, Bitcoin Cash, XRP, Litecoin, Ethereum Classic, Dash, Stellar, NEO, EOS, Cardano and IOTA) as well as crypto/crypto pairs and crypto/fiat pairs. eToro acts as a bridge between the old world of investing and the new, helping investors navigate and benefit from the transition of assets to the blockchain. eToro is the only place where investors can hold traditional assets such as stocks or commodities alongside ‘new’ assets such as bitcoin.

Original Article – eToro blog

eToro is a multi-asset platform which offers both investing in stocks and cryptocurrencies, as well as trading CFD assets.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider.You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Cryptocurrencies can fluctuate widely in price and are, therefore, not appropriate for all investors. Trading cryptocurrencies are not supervised by any EU regulatory framework.

Past performance is not an indication of future results. HODL is not investment advice. Your capital is at risk.

Altcoins

XNO Token of Xeno NFT Hub listed on Bithumb Korea Exchange

Hong Kong, Hong Kong, 25th January, 2021, // ChainWire //

Xeno Holdings Limited (xno.live ), a blockchain solutions company based in Hong Kong, has announced the listing of its ecosystem utility token XNO on the ‘Bithumb Korea’ cryptocurrency exchange on January 21st 2021.

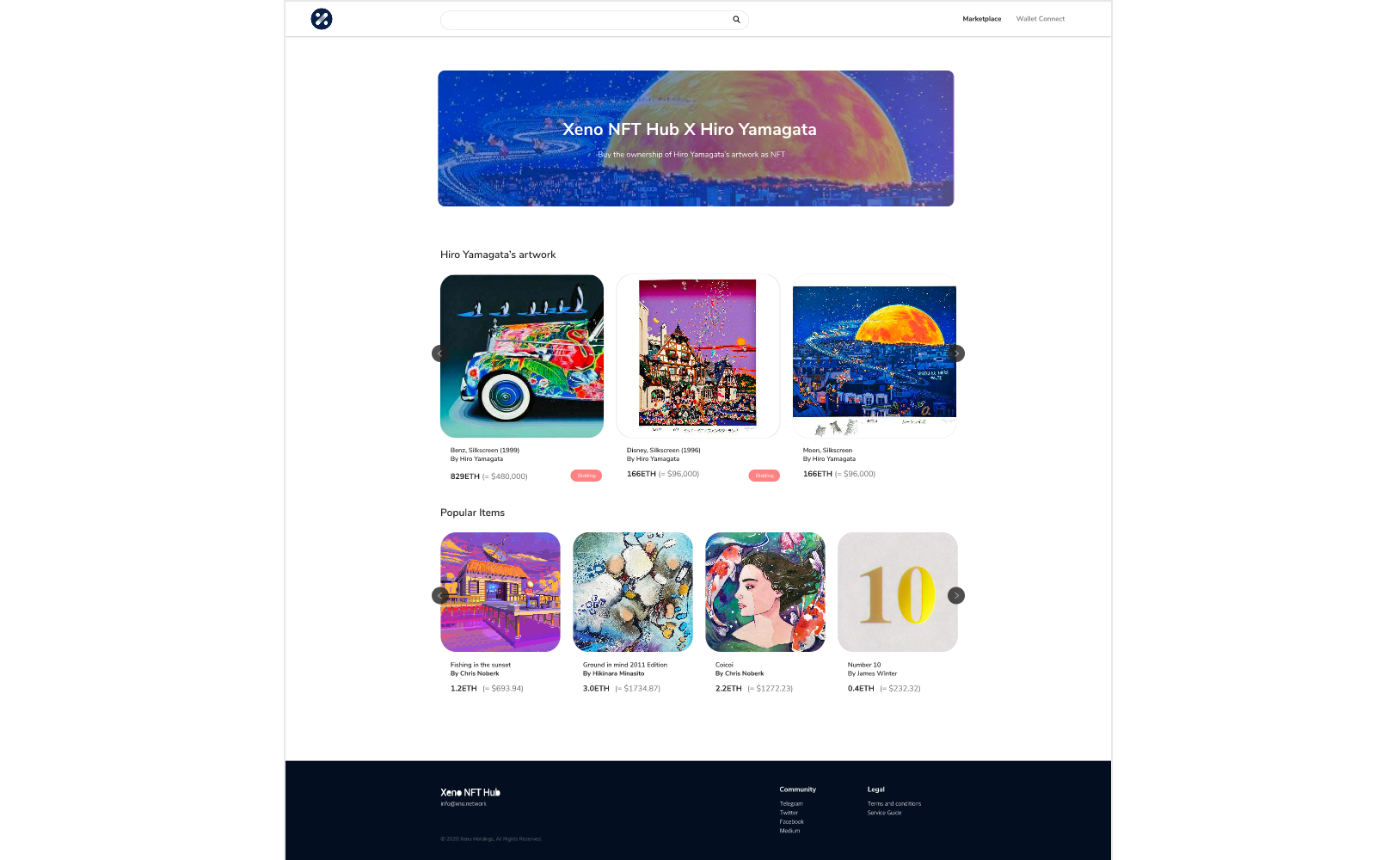

Xeno NFT Hub (market.xno.live ), developed by Xeno Holdings, enables easy minting of digital items into NFTs while also providing a marketplace where anyone can securely trade NFTs.

The Xeno NFT Hub project team includes former members of the technology project Yosemite X based in San Francisco and professionals such as Gabby Dizon who is a games industry expert and NFT space influencer based in Southeast Asia.

NFT(Non-Fungible Token) technology has recently gained huge focus in the blockchain arena and beyond, making waves in the online gaming sector, the art world, and the digital copyrights industry in recent years. The strongest feature of NFTs is that “NFTs are unique digital assets that cannot be replaced or forged”. Unlike fungible tokens such as Bitcoin or Ether, NFTs are not interchangeable for other tokens of the same type but instead each NFT has a unique value and specific information that cannot be replaced. This fact makes NFTs the perfect solution to record and prove ownership of digital and real-world items like works of art, game items, limited-edition collectibles, and more. One of the ways to have a successful…

Altcoins

XENO starts VIP NFT trading service and collaborates with contemporary artist Hiro Yamagata

Hong Kong, Hong Kong, 24th December, 2020, // ChainWire //

The XENO NFT Hub (https://xno.live) will provide a crypto-powered digital items and collectables trading platform allowing users to create, buy, and sell NFTs. Additionally it will support auction based listings, governance and voting mechanisms, trade history tracking, user rating and other advanced features.

As a first step towards its fully comprehensive service, XENO NFT Hub launched a recent VIP service to select users and early adopters in December 2020 with plans for a full Public Beta to open in June 2021.

“NFTs are extremely flexible in their usage, from digital event tickets to artwork, and while NFTs have a very wide spectrum of uses and categories XENO will initially focus its partnership efforts and its own item curation on three primary areas: gaming, sports & entertainment, and collectibles.”, said XENO NFT Hub president Anthony Di Franco.

He also added “This does not mean we will prohibit other types of NFTs from our ecosystem However, it simply means that XENO’s efforts as a company will be targeted into these verticals initially as a cohesive business approach.”

Development and Procurement Lead, Gabby Dizon explained, “Despite our initial focus, we found ourselves with a unique opportunity to host some of the works of Mr. Hiro Yamagata. We are collaborating with Japanese artist Hiro Yamagata to enshrine some of his artwork into NFTs.”

Mr. Yamagata has…

Altcoins

My Crypto Heroes Announces Issuance of MCH Governance Token

Tokyo, Japan, 24th November, 2020, // ChainWire //

My Crypto Heroes is happy to announce the issuance of MCH Coin as an incentive to players in the My Crypto Heroes ecosystem, aiming to allow them to craft a “User-oriented world”. The MCH coin is available on Uniswap with a newly created pool with ETH.

My Crypto Heroes is a blockchain-based game for PC and Mobile. It allows users to collect historic heroes and raise them for battle in a Crypto World. Officially released on November 30th, 2018, MCH has recorded the most transactions and daily active users than any other blockchain game in the world.

What is MCH Coin?

MCH Coin is being issued as an ERC-20 Standard Governance Token. The issuance began on November 9th, 2020, with 50 million tokens issued.

Of the funds issued, 40% are allocated to a pay for on-going development and as rewards for advisors and early investors. 10% are allocated to marketing and the growth of the ecosystem, and 50% are allocated to the community. The Distribution Ratio of the MCH Coin is subject to change via a governance decision.

The MCH coin will be used as a voting right as part of the ecosystem’s governance, with 1 coin being 1 vote. It will also be used for in-game utilities and payments. Additional information can be found here:

https://medium.com/mycryptoheroes/new-ecosystem-with-mchcoin-en-a6a82494894f

During December 2020 the first…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange