Crypto Queen

The Top 5 Barriers to Mass Adoption – And How to Overcome Them

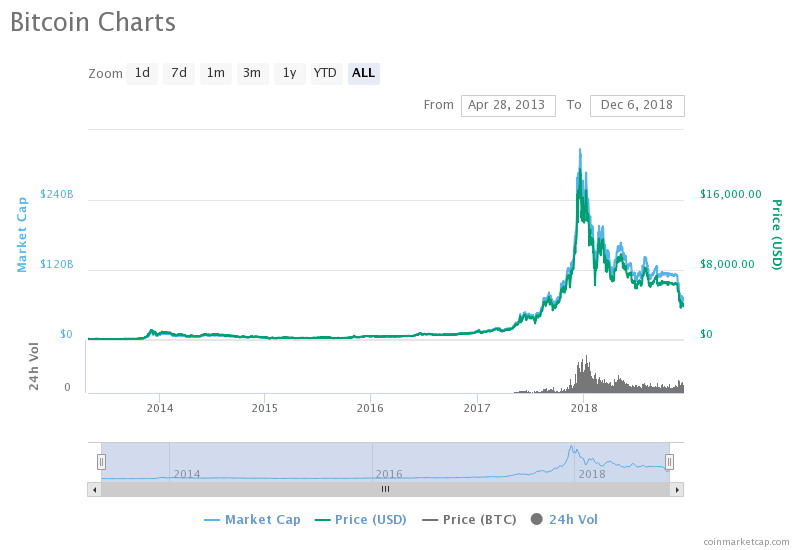

You can’t write an article about crypto without mentioning the latest market massacre. That would be like not talking about the elephant in the room. Many people in the industry are still too new to remember Bitcoin’s many bubbles. Yet this latest one is so epic because of the amount of money bleeding out. But is there a light at the end of the tunnel? Could bitcoin’s plummeting price hold the key to mass adoption?

Let’s take a look at the various factors getting in the way of mass adoption and how a lower price–along with removing these other obstacles–could be the trigger to crypto’s recovery.

1. Volatility

This time last year, Bitcoin was approaching its all-time high of almost $20,000. Now it’s flirting with $3,000 with some analysts calling for a low of $1,500. That’s a staggering drop by anyone’s standards.

While there’s every possibility that the price will skyrocket back up again, such fluctuations are not for the faint-hearted. They’re also not suitable for use as a currency.

Plenty of stablecoins are in the market which may eventually leave Bitcoin behind as an everyday exchange of value. But they won’t make Bitcoin redundant. In fact, its plummeting price could be the catalyst that brings in the real money.

No professional investor is going to buy when the price is inflated by speculation. When there’s blood on the streets and institutional investors start to buy, the low price will mark a milestone for mass adoption.

2. Usability

Even if you go for a generally recognized easy-to-use exchange like Coinbase, it’s still no walk in the park. In a society that’s used to contactless payments or paying with a smartphone, walking around a store waiting for a transaction confirmation is taking a backward step.

We’re getting better at it, with cryptocurrencies like Dash claiming industry firsts and allowing instant payment confirmations. But there’s still a long way to go. 42-character addresses have to be replaced by names. Clunky hardware wallets that need lengthy configuration are going to get thrown out.

Unfathomable interfaces of decentralized exchanges will need to be tailored to a lay market. They’ll have to go mobile–without 5,000 hoops to jump through before customers can log in.

3. Scalability

How to scale blockchains for mass adoption has been the question on everybody’s lips especially since 2017 saw CryptoKitties crash Ethereum and the Bitcoin blockchain get so backed up that transaction times went through the roof.

The Lightning Network is making good progress despite the downward turn in price.

Ethereum too is working hard on scaling solutions like SNARKs and the plasma protocol. Plasma will essentially allow hundreds of thousands of transactions to happen off-chain enabling mass adoption and speed without clogging up the network.

A few companies are working on incorporating plasma into their technology stack. Digitex Futures, for example, as a hybrid exchange, will use the speed of centralized servers for matching orders and plasma technology to offer decentralized account balances.

4. Regulation

Many people argue that regulation will stifle innovation. But the big banks and institutional investors simply won’t get on board until they know they’re operating within the lines of the law. Goldman Sachs and JPMorgan have had their fair share of working against market interests, yet crypto still somehow needs their seal of approval.

More exchanges that offer both derivative and spot trading are going to start appearing. In fact, the launch of ICE Markets’ Bakkt in January 2019 is causing a stir throughout the community.

As a regulated ecosystem for global assets with a US-based Bitcoin futures exchange, Bakkt is likely to bring in the big players. This means the stocks and bonds sitting in paper contracts will migrate to the blockchain and the market cap will leap to incomprehensible heights.

When valuable industries such as futures move to the blockchain, we’ve already seen how profitable that can be. CME saw its daily volume increase by 93 percent in Q2 2018 after introducing futures.

Bakkt will also open the door for smaller futures exchanges like Digitex to allow retail traders to make living trading derivatives on crypto.

5. Security

We’re talking about cybersecurity here, not the ongoing debate about security versus utility token. The US SEC and UK FCA are stepping up their efforts to prevent ICO scams. Custodians and exchanges continue their game of whack a mole with the hackers. But until the security of funds becomes, well, more secure, users won’t want to risk losing all their funds to an exchange hack.

2019 will see crypto insurance providers coming to the market, although the process is a complex one. Understanding the risk associated with being a cryptocurrency custodian or with futures trading on a volatile market like crypto isn’t easy.

The Barriers to Mass Adoption Are Being Worked on

When institutions are comfortable being in the space when providers can offer some kind of insurance, regulation gets it right, and bitcoin price gets low enough, the sea change will surely begin.

All these barriers to mass adoption are being worked on regardless of the lowering prices. The bear market is allowing developers to push out the products that will lead to mass adoption of crypto. It’s just a question of when.

For the latest cryptocurrency news, join our Telegram!

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Image courtesy of Pexels

Altcoins

XNO Token of Xeno NFT Hub listed on Bithumb Korea Exchange

Hong Kong, Hong Kong, 25th January, 2021, // ChainWire //

Xeno Holdings Limited (xno.live ), a blockchain solutions company based in Hong Kong, has announced the listing of its ecosystem utility token XNO on the ‘Bithumb Korea’ cryptocurrency exchange on January 21st 2021.

Xeno NFT Hub (market.xno.live ), developed by Xeno Holdings, enables easy minting of digital items into NFTs while also providing a marketplace where anyone can securely trade NFTs.

The Xeno NFT Hub project team includes former members of the technology project Yosemite X based in San Francisco and professionals such as Gabby Dizon who is a games industry expert and NFT space influencer based in Southeast Asia.

NFT(Non-Fungible Token) technology has recently gained huge focus in the blockchain arena and beyond, making waves in the online gaming sector, the art world, and the digital copyrights industry in recent years. The strongest feature of NFTs is that “NFTs are unique digital assets that cannot be replaced or forged”. Unlike fungible tokens such as Bitcoin or Ether, NFTs are not interchangeable for other tokens of the same type but instead each NFT has a unique value and specific information that cannot be replaced. This fact makes NFTs the perfect solution to record and prove ownership of digital and real-world items like works of art, game items, limited-edition collectibles, and more. One of the ways to have a successful…

Altcoins

XENO starts VIP NFT trading service and collaborates with contemporary artist Hiro Yamagata

Hong Kong, Hong Kong, 24th December, 2020, // ChainWire //

The XENO NFT Hub (https://xno.live) will provide a crypto-powered digital items and collectables trading platform allowing users to create, buy, and sell NFTs. Additionally it will support auction based listings, governance and voting mechanisms, trade history tracking, user rating and other advanced features.

As a first step towards its fully comprehensive service, XENO NFT Hub launched a recent VIP service to select users and early adopters in December 2020 with plans for a full Public Beta to open in June 2021.

“NFTs are extremely flexible in their usage, from digital event tickets to artwork, and while NFTs have a very wide spectrum of uses and categories XENO will initially focus its partnership efforts and its own item curation on three primary areas: gaming, sports & entertainment, and collectibles.”, said XENO NFT Hub president Anthony Di Franco.

He also added “This does not mean we will prohibit other types of NFTs from our ecosystem However, it simply means that XENO’s efforts as a company will be targeted into these verticals initially as a cohesive business approach.”

Development and Procurement Lead, Gabby Dizon explained, “Despite our initial focus, we found ourselves with a unique opportunity to host some of the works of Mr. Hiro Yamagata. We are collaborating with Japanese artist Hiro Yamagata to enshrine some of his artwork into NFTs.”

Mr. Yamagata has…

Altcoins

My Crypto Heroes Announces Issuance of MCH Governance Token

Tokyo, Japan, 24th November, 2020, // ChainWire //

My Crypto Heroes is happy to announce the issuance of MCH Coin as an incentive to players in the My Crypto Heroes ecosystem, aiming to allow them to craft a “User-oriented world”. The MCH coin is available on Uniswap with a newly created pool with ETH.

My Crypto Heroes is a blockchain-based game for PC and Mobile. It allows users to collect historic heroes and raise them for battle in a Crypto World. Officially released on November 30th, 2018, MCH has recorded the most transactions and daily active users than any other blockchain game in the world.

What is MCH Coin?

MCH Coin is being issued as an ERC-20 Standard Governance Token. The issuance began on November 9th, 2020, with 50 million tokens issued.

Of the funds issued, 40% are allocated to a pay for on-going development and as rewards for advisors and early investors. 10% are allocated to marketing and the growth of the ecosystem, and 50% are allocated to the community. The Distribution Ratio of the MCH Coin is subject to change via a governance decision.

The MCH coin will be used as a voting right as part of the ecosystem’s governance, with 1 coin being 1 vote. It will also be used for in-game utilities and payments. Additional information can be found here:

https://medium.com/mycryptoheroes/new-ecosystem-with-mchcoin-en-a6a82494894f

During December 2020 the first…

-

Blogs7 years ago

Blogs7 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs7 years ago

Blogs7 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs7 years ago

Blogs7 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs7 years ago

Blogs7 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss7 years ago

Don't Miss7 years agoRipple’s five new partnerships are mouthwatering

-

Blogs7 years ago

Blogs7 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs7 years ago

Blogs7 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs7 years ago

Blogs7 years agoIs Litecoin (LTC) Changing Its Game Plan By Going For Mass Adoption?