Currency Market

Crypto on plastic: Mastercard supports new multi-currency crypto card announced by Wirex

Breaking into new ground, Wirex is one the first of its kind, a cryptocurrency platform, that has been granted a Mastercard principal membership. The organizations together will release a brand new multi-currency card through their membership scheme. The London based crypto payment processor Wirex, which is regulated by the UK’s Financial Conduct Authority has also gained a license to issue crypto cards around Europe, taking crypto to new heights.

Thanks to the Wirex card’s multi-currency nature, it will be supported by Mastercard and will be linked to a variety, 19 to be precise, crypto, and fiat currency accounts within the Wirex app. Although an official release date has not been issued yet, the excitement of such a card shows true movement toward generalizing the use of cryptocurrency for all, making it more accessible on a wider scale.

The card is a bid in the attempt to encourage the use of cryptocurrency to be used for everyday payments. Wirex is also upgrading its existing rewards program enticing users to pay using crypto by offering a certain percentage back. For example, one of their rewards saw users get 1.5% back on each in-store transaction using Bitcoin. To make it more worth the users while, from now on, there will be a greater incentive in the form of 2% back on online and in-store purchases using Bitcoin, as well as up to 6% rewards on customers who are native to Wirex Token balance on an annual scheme.

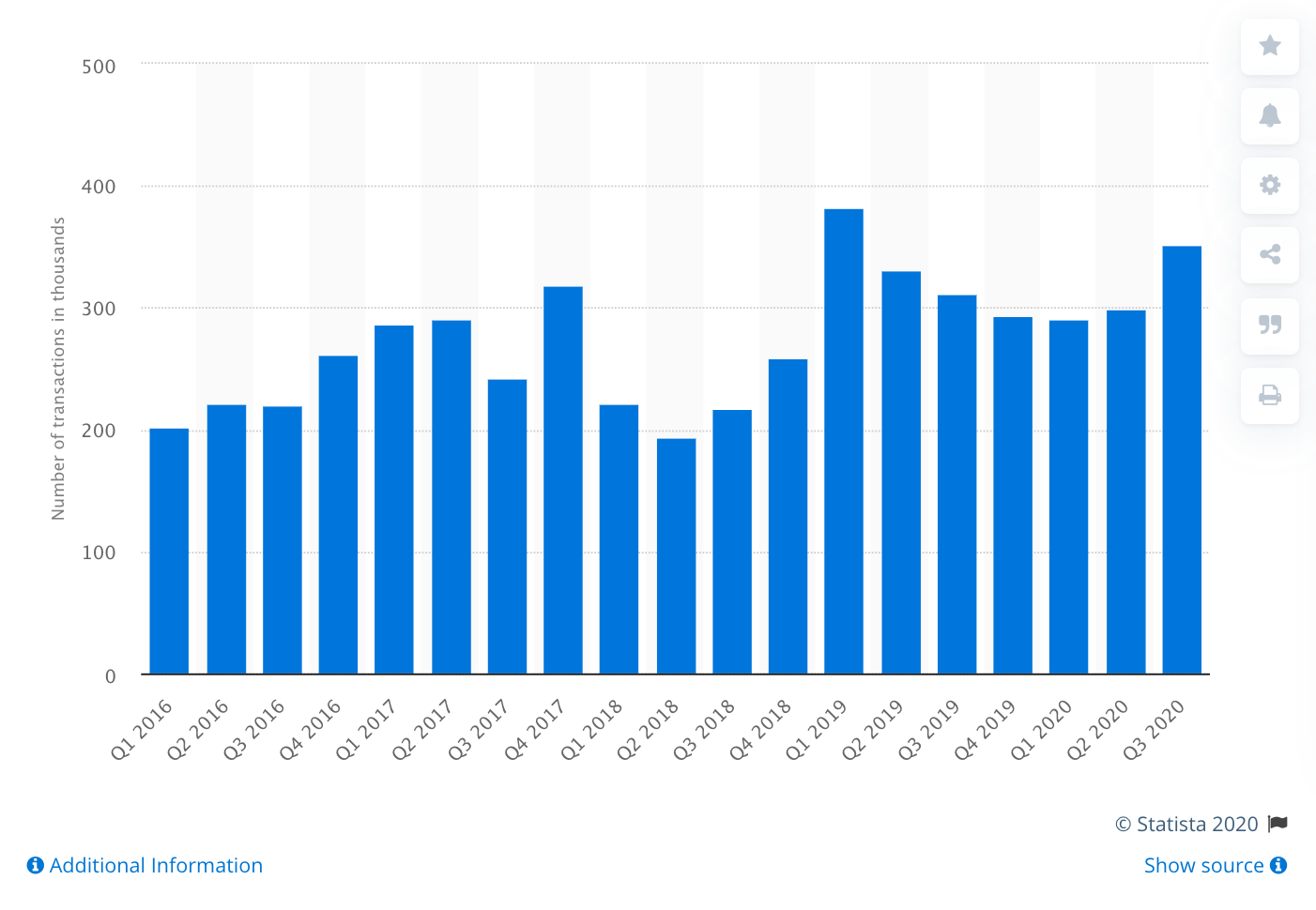

(Graph showing the number of daily Bitcoin transactions. Source: Statista)

On the back of MasterCard offering the new multi-currency crypto card, Wirex is also bringing to market several other features. These include building on a partnership with payment solution company LHV. These new features, which now live in the European Economic Area include support for five new currencies which include, the Croatian Kuna, Polish Zloty, Czech Koruna Hungarian Forint, and Romanian leu. Supporting an array of currencies such as the ones stated above, the company is not only broadening their audience and reach but also helping to encourage the wider use of cryptocurrencies.

One of the biggest driving forces behind including a range of currencies, both crypto and fiat are due to its popularity. Earlier, the platform hit over three million users, all of whom are active. Observing this proved to show a heightened adoption among mainstream users of crypto and those too who are not solid crypto users. This proves that even those who are not hardcore crypto users are beginning to take an interest.

The services provided by Wirex will allow users in 130 countries to spend cryptocurrencies and fiat currencies using an existing dedicated Visa card and or your smartphone. Making life much easier and flexible for them. The multi-currency card shows strong signs of deepening the integration between the two worlds, plastic, and crypto. Both Mastercard and Visa show big promise moving forward in these areas and continue to establish a working relationship with prominent, game-changing firms.

One of the first physical crypto cards was Coinbase’s card which was released in the US market, again supported by Mastercard and Visa payment networks. So Wirex will be the first of its kind to hit the European market and one which has both the collaboration and flexibility to be used for fiat or crypto.

MasterCard and Visa both seem to show an understanding of where to place emphasis and so are both working hard to try and get their networks working in the best way to support the future. With this in mind, MasterCard has actively sought out crypto exchanges and payment service providers to enlist in its very own and recently expanded cryptocurrency card program. Visa has also taken a keen interest as the organization is beginning to understand that crypto is gaining vast amounts of traction and if they do not begin to adopt and support it, they could miss out on huge potential.

There’s a lot to be said with how far cryptocurrencies have come and how many we now have available in comparison to when Bitcoin was first launched. The introduction of a multi-currency card also proved to us how both currencies can work in harmony together and that there is enough room in the market for both of them to be adopted by consumers, giving them the ability to pay and use them both equally.

Currency Market

Smart MFG Tech Announces its First Liquidity Mining Rewards Program on LINKSWAP

Manufacturing Industry 4.0 company Smart MFG Tech has announced that it is launching its MFG Liquidity Mining Rewards on LINKSWAP today. LINKSWAP is a decentralized, community-governed Decentralized Exchange (DEX) and an AMM platform, which was created by YF Link (YFL). The team at YF Link says it aims to address “the pain points of second-generation AMMs” by offering such features as Reduced Impermanent Loss, RugLock, SlipLock that are not offered by other platforms.

Smart MFG Tech has said that the first integration of the MFG liquidity mining rewards will use the LINKSWAP LP (Liquidity Provider) Rewards service. It will allow LPs to deposit their LP token(s) (UNI-V2) to the participating rewards pool (ETH|MFG) and earn MFG rewards seamlessly. Smart MFG said it will continue to work with the YF Link team to provide support for other pairs and expand services.

LINKSWAP’s Rewards is a liquidity mining service that enables LPs to earn rewards for providing liquidity in a participating pool. YF Link has implemented a custom frontend solution for Smart MFG LP rewards pool on LINKSWAP. This will allow LPs to add liquidity to Smart MFG’s existing ETH|MFG pool on UniSwap v2 and deposit their LP token(s) (UNI-V2) to their LINKSWAP rewards pool (ETH|MFG).

Smart MFG explained how the rewards can be earned:

“LPs get a share of the transaction fees on Uniswap v2. This is calculated by how much liquidity is provided relative to the percentage…

Currency Market

Building Your Nest Egg Brick By Brick: Are Micro-Investments Here to Stay?

No matter what our goals are, sometimes just getting started can be the most difficult part of building our savings up. When it comes to investing, many of us are wary of parting with our money to generate more financial security in the future. But what if you can build significant savings without even noticing?

That’s the aim of the micro-investing apps that have come to dominate online stores across Android and iOS. Today, more fintech startups are working on delivering refined solutions that encourage minuscule investments at a more frequent rate.

Micro-Investing apps will look to make saving more accessible to young people – many of whom in the UK have little-to-no money tucked away for a rainy day.

However, the prevalence of money-saving technology and the disruptive chaos of the COVID-19 pandemic appears to have prompted a widespread increase in households saving more of their disposable income:

With micro-investing platforms playing a role in bringing UK household savings back up to five-year highs, is it fair to say that little-by-little investing is here to stay? Let’s take a look at how micro-investment platforms could revolutionise how we manage our finances:

What is Micro-Investing

Micro-investing, or sparse change investing, is a relatively new development in fintech. It effectively enables users to put away small amounts of money towards their long, or short, term goals. The idea…

Currency Market

Decentralized Insurance Platform Bridge Mutual to Launch BMI Token on Polkastarter

Bridge Mutual, a decentralized platform that allows users to insure stablecoins, has announced that its native BMI token will be launched on Polkastarter tomorrow, January 30. The Polkadot’s decentralized exchange will host an Initial DEX Offering (IDO) for Bridge Mutual.

“Even the most sophisticated digital asset investors are at risk of losing their funds through various malicious and negligent activities in the blockchain ecosystem. With Bridge Mutual, we believe it doesn’t have to be this way. Using Bridge, people can control the risk exposure of their digital asset investments, just as they do with real-world assets. The Bridge Mutual platform allows people to offer and purchase coverage in a decentralized p2p way. We’re excited kickstart the launch of the BMI ecosystem with a launch on Polkastarter and creating a better way of protecting digital assets for users all over the globe,” Bridge Mutual CEO Mike Miglio said in a statement.

Bridge Mutual allows users to buy and sell insurance for smart contracts, stablecoins and crypto exchanges, peer-to-peer. Users can purchase insurance via the Bridge Mutual app and then file a claim if their digital assets are lost after a hack. “When users lock stablecoins in Bridge Mutual’s coverage pools, those funds are reinvested into popular (and safe) yield generating platforms that return yields to coverage providers. When a claim is approved, stablecoins from the coverage pool goes…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange