Don't Miss

Image Protect: Global Coin Report White Paper Review

Our analysts took a look at the Image Protect White Paper. Here’s what they found.

White Paper available here.

Company website here.

Right now, companies are being set up to tackle every area of the global industry using blocking technology. Many of these companies are conducting initial coin offerings (ICOs) in order to raise the capital required to fund the development of the project in question.

Here at Global Coin Report, we have set our team of analysts the task of reviewing what we see as some of the most promising white papers associated with these projects in an attempt to offer our readers some degree of insight into whether or not participating in the various ICOs is warranted.

The latest company on which our team set its sights on is Image Protect and, specifically, this white paper outlining the company’s efforts in the blockchain space.

Industry Problem

The white paper kicks off with what problem Image Protect is trying to solve and, more specifically, how the company intends to go about it.

It is estimated that there are over a trillion images on the Internet. According to a study done by Getty Images and the Stock Artists Alliance, 70% of all visual media used on the Internet today was not authorized by the copyright owner. As a result, content owners have lost out on billions of dollars of potential revenues.

Making the situation worse is the fact that there’s very little that content owners can do on their own. Roughly 80% of unauthorized uses are non-commercial and not pursuable for monetary value because they are personal blogs, forums, ad-supported blogs, or there is no identifiable owner. The only action is to send DMCA takedown notices to the ISP or hosting company to remove the infringing content from the websites.

Further adding insult to injury is the fact that commercial infringements are expensive to pursue. According to Penn Law, the average cost to litigate a copyright infringement case through trial ranges from $384,000 to $2,000,000. Additionally, to pursue a lawsuit in federal court, the image must be registered through the US copyright office. According to a survey done by PPA, only 4% of professional photographers register their copyrights.

So, for photographers, both professional and amateur, what is the best way to protect their work and also monetize their images? The answer lies with blockchain technology.

Blockchain can be used to securely record ownership transactions that are impossible to repudiate later or manipulate. A public, decentralized ledger like the blockchain is ideal for cataloging and storing original photographs and images away from any central authority. Even if the copyright service ceases to exist, there will still be a verifiable copy of the original work on the blockchain.

Key Blockchain Benefits

- Lock-in Attribution – Create a permanent and unbreakable link between you and your creative work. That link – the record of ownership – can be forever verified and tracked.

- Securely Share – Securely share your digital content with friends, family or fans. Transferring work is made as easy as sending an email.

- Gain Visibility – Trace where and how your work spreads on the Internet.

- Certificate of Authenticity – Each registered piece comes with a COA, a built-in unique cryptographic ID, and the complete ownership history. The COA can be verified anytime and printed out.

- License your work – Transfer, consign or loan your digital creations without losing attribution.

Image Protect

Image Protect is a revolutionary content rights platform, utilizing blockchain technology to manage, protect and monetize digital media for content producers of all levels, publishers, and advertisers. Its proprietary embeddable in-image advertising format, IPShare, lies at the heart of the mission.

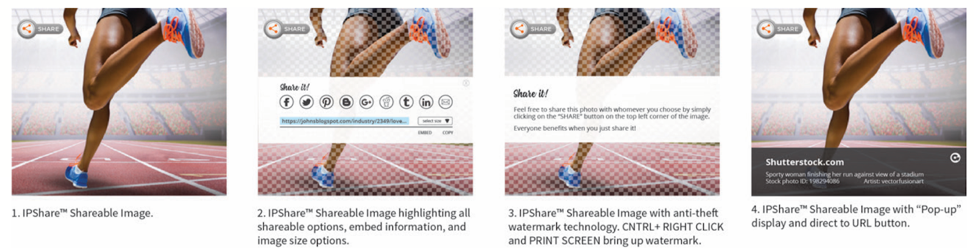

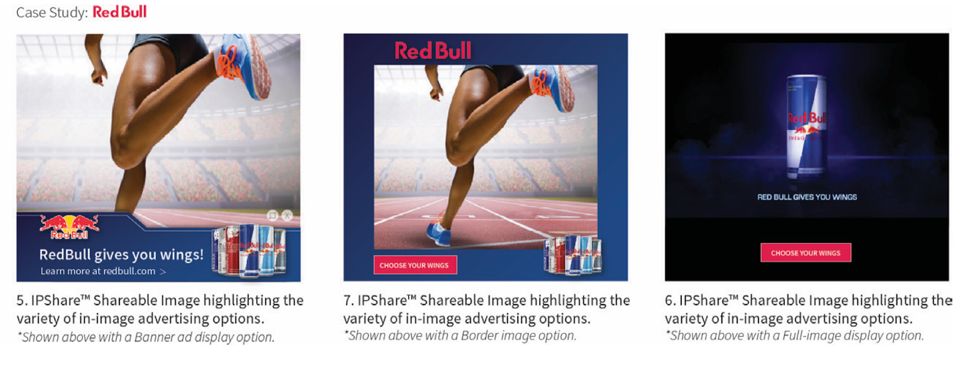

IPShare

IPShare will significantly change the current copyright and licensing landscape by locking in attribution, securely sharing content, gaining visibility, social engagement, ownership authentication, easy-to-use licensing, and revenue growth from online advertising. With IPShare, Image Protect provides content owners not only with copyright protection but an added way to monetize their work with ad revenues. This is truly revolutionary and gives content owners the opportunity to capitalize on the $229 billion digital ad market, which is expected to grow to $340 billion by 2020.

Here’s why IPShare is better than anything the competition offers. Instead of sending the standard DMCA takedown notice to an ISP or hosting company for removal of the original image, Image Protect now asks the website owner to replace the current image with the same image that has been converted to the IPShare embeddable format. It’s as simple as copying and pasting the image into the user’s website dashboard across all web templates, i.e., WordPress, Blogger, SquareSpace, Wix, etc. The image is instantly transformed into an online billboard, containing in-image advertising, hot links, social sharing and dynamic messaging.

Proven Model

450,000 members with over 35,000,000 digital assets are already using Image Protect. In 2017, Image Protect processed 59M images and found 23M new websites using client images. Typically, 1% of all sites are commercial infringements. Image Protect averages $1000.00 in post-licensing fees per case. This equates to a total overall value of $230MM in pursuable license fees. Additionally, in 2017, 8MM non-commercial websites (personal blogs, forums, ad-supported blogs, etc.) were submittable for IPShare replacement. The total projected value from CPM and CPC ad revenue is $200MM per year.

Ecosystem

Image Protect is building a global decentralized copyright registry for digital content that authenticates users and links intellectual property to make the management of digital content universally accessible. The online registry will generate a unique ecosystem for rights owners, creating a new efficient marketplace for licensing and monetization. The smart-contract formalizes existing licensing rights for digital assets, making them easy for a creator or photo buyer to use, transfer or modify.

The blockchain is used to securely record ownership transactions and legal evidence for infringement case that is impossible to later repudiate or manipulate. Secure smart-contracts create transparency into usage and provenance of registered content. Image recognition and internet search technology provide visibility into media usage by crawling the web, applying machine learning to identify similar or identical media, and subsequently reporting their existence and location to the registered owners.

Image Protect’s powerful dashboard allows members to monitor content usage, check earnings, review analytics, activate content, find new websites, and focus on media buys. The proprietary image recognition technology, along with a cloud-sourced team, analyzes every image in the network. Image Protect technology breaks down the pixels within the image itself, identifying objects and themes according to the latest open RTB standards. Image Protect’s cutting-edge keyword technology helps advertisers target their campaigns to highly relevant content & images.

The result is better performance & ensures consumers are more interested in the campaigns they see. This new technology generates additional revenue while providing a targeted, first-person advertising opportunity across all types of online content.

Key services:

- IPTrackTM Global Internet Image Monitoring

- Standard DMCA Takedowns

- IPShareTM Image Replacement

- Post Usage Licensing

- Simplified Copyright Registration with the US Copyright Office.

- Real-time Image Data Analytics

Real-time Image Analytics

Using Big Data processing through millions of IP objects, with hundreds of different attributes, Image Protect provides full-scale analysis for its registered users. Image Protect also tracks IPShareTM impressions, click-through traffic, social media shares, and related geographic and demographic data.

Trusted by over 450k global media agencies and photographers:

Management Team

One of the most important things to look at in any project is the people behind it. Here, we are very impressed with the Image Protect team.

It starts off with CEO Lawrence Adams. He is an Advisor to Public Companies and the founder of Seaside Advisors LLC, an advisory company designed to assist public companies in all facets of the capital markets. For a project to be successful, it takes someone with experience in raising large amounts of capital and being able to execute the business plan.

Matthew Goldman is Image Protect’s co-founder and Chief Strategy Officer. Before Co-founding Image Protect, Matthew held the position as Senior Director of Global Media partnerships at Corbis Images, a Bill Gates privately held media licensing company. He’s also held several key executive and advisory roles with innovative start-ups within the Silicon Beach environment.

Another co-founder is Jonathan Thomas. He has brokered large-scale licensing and distribution deals with media giants including Getty Images and Corbis, as well as many other global media partners. His vast experience with building media brands and knowledge of the digital media landscape gives him complete insight into the valuable emergence of online copyright enforcement.

Advisors

Advisors are critical because they provide a wealth of experience and expertise in moving projects forward. Advisors include Ben Arnon, a veteran in the media space. He has held various positions at Universal Pictures, Universal Music Group, Yahoo! and Wildfire, which was acquired by Google in 2012 for $350 million.

Bryan Lemster is President of Halcyon Innovation, LLC., a web and mobile development firm. For the last twelve years, Bryan has engaged in large-scale development projects including social networks, Blockchain/cryptocurrency projects and mobile application development including the iPhone and Android platforms.

Vinícius Teranova is an Angel Investor and Founder of Terranova Capital, a blockchain investment group. He has over six years of Growth Marketing expertise, helping small and middle businesses to achieve sustainable growth. He has been a cryptocurrency enthusiast since 2013 and is an influencer within Brazil’s emerging cryptocurrency market. Vinicius has spoken at some of the most significant cryptocurrency events in Rio de Janeiro and currently holds over 50 successful ICO investments.

Eyo Ekpo is an entrepreneur and management consultant professional, specializing in corporate finance, planning, and strategy. Since his involvement in the blockchain space in November 2016, he has harnessed these skills and established himself as an angel investor and advisor for numerous projects globally.

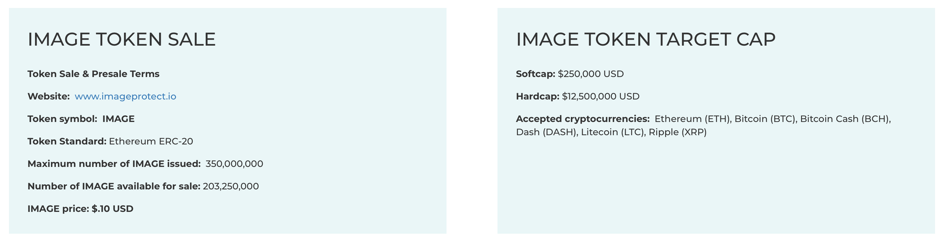

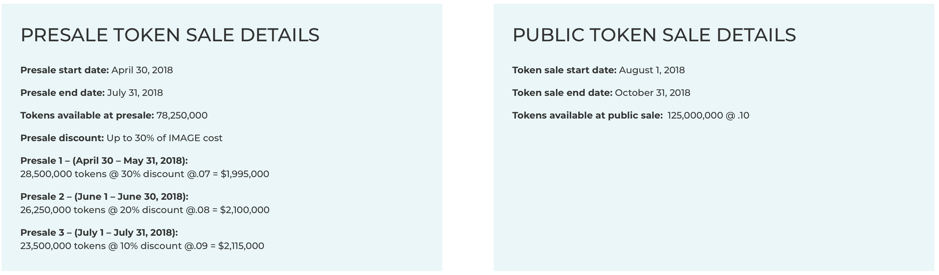

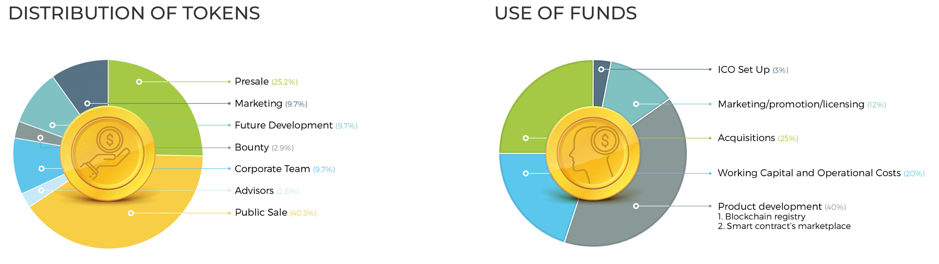

IMAGE Token Sale

In association with the offering, the company will issue a nontransferable token that can be redeemed for the Security Token once the Security token is passed through the Securities and Exchange Commission. Image Protect is conducting a pre-sale for its IMAGE token starting on April 30th and ending on July 31st. The token details are as follows:

Why Invest

IMAGE tokens receive 10% of revenue generated from infringement settlements, smart-licensing and recurring online ad revenue from impressions, click-through traffic, and shares. This allows a token owner to earn income for years to come.

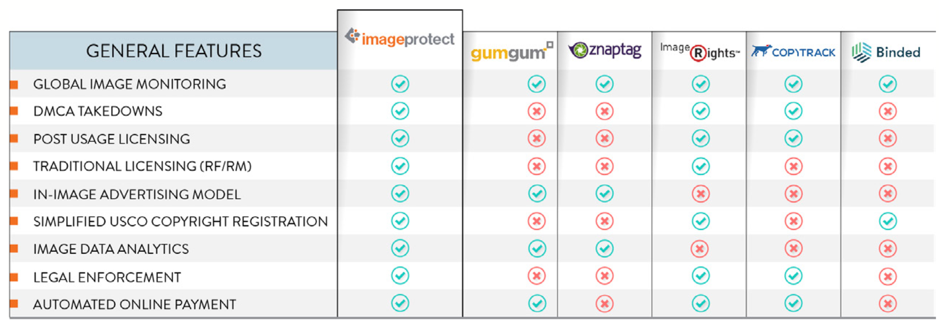

All transactions within the system are made only in IMAGE and Image Protect always serves as an intermediary in these payments. Each transaction has a commission in IMAGE paid to Image Protect. Furthermore, none of the other blockchain companies offer the same number of services as Image Protect; thus, Image Protect is the go-to choice for digital asset holders and expands the IMAGE ecosystem.

Conclusion

So, finally, let’s put forward a conclusion in line with the introduction to this piece and answer our initial question – is this one worth a look for potential ICO (token sale) participants?

In a word, yes.

Image Protect has put forward an incredibly strong white paper here and it looks as though the company really understands what it is trying to do as far as creating a solution to an existing problem is concerned. Not only that, but this is a company that is an established entity within its space in the US and globally.

This is a rare situation for a company that is conducting an ICO and we think this really sets it apart from many of its peers (and when we say peers, we mean in terms of those companies currently conducting these sorts of token sales) from a potential investor/participatory perspective.

Finally, the digital image space is ripe for blockchain disruption. The management at Image Protect has developed the technology and strategy that is a win-win for the company, copyright owners, and IMAGE token holders. Of all the projects that we have looked at, Image Protect is one of the most disruptive technologies we have seen. Image Protect CEO Lawrence Adams said:

“This is a win-win for all parties. The rights holder captures revenue converted from the Advertising model. We capture revenue otherwise considered lost. And the website/blog owner enjoys the use of the image without penalties or fees.”

For more information, check out the Image Protect website and white paper.

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Don't Miss

A Guide to Exploring the Singaporean ETF market

Singapore’s Exchange Traded Fund (ETF) market has grown, offering investors diverse investment opportunities and access to different asset classes. As the market evolves, investors must navigate these uncharted waters with a clear understanding of Singapore’s ETF landscape. This article explores the trends, challenges and strategies for navigating the Singapore ETF market. To start investing in ETFs, you can visit Saxo Capital Markets PTE.

The Singaporean ETF Market: Exponential Growth

The Singapore ETF market has seen significant growth in recent years, with an increasing number of ETFs covering a wide range of asset classes and holders. different investment topics.

One of the notable trends in the Singapore ETF market is the growing diversity of available options. Investors can now choose from ETFs that track domestic and international stock indexes, bonds, commodities, and specialist sectors or themes. This diverse range of ETFs allows investors to create comprehensive portfolios tailored to their investment goals.

The growth of the ETF market in Singapore is also due to growing investor demand for low-cost, transparent, and accessible investment vehicles. ETFs offer benefits such as intraday liquidity, real-time pricing, and the ability to trade on exchanges. These characteristics have made ETFs attractive to retail and institutional investors who want exposure to different asset classes.

Regulatory Landscape and Investor Protection

The Monetary Authority of Singapore (MAS) is the…

Don't Miss

Property Loans for Foreigners in Singapore That You Must Know About

Intending to invest in a residential or commercial property in Singapore?

When it comes to foreigners applying for a loan in Singapore, things can be pretty hard regardless of the reason whether you need the property for personal or business purposes.

In Singapore, buying a property is challenging, whether you are a foreigner or a native, and sometimes applying for a loan is the only way for you to afford it.

HOW MUCH CAN YOU BORROW FOR A PROPERTY LOAN IN SINGAPORE?

As for the Foreigner Loans, in Singapore, there is an exact amount of money you can borrow to finance the purchase of a property.

In this sense, Singapore has the Loan to Value Ratio (LTV).

The LTV ratio is what determines the exact amount of money you can borrow for a property loan, which changes depending on where you try to obtain the loan:

- If you are applying for a bank loan, you can borrow a maximum of 75% of the value of the property you want to purchase. That means if you are looking for a property that costs $500.000, the maximum amount of money a bank lender can give you like a loan in Singapore is going to be $375.000.

- When you are applying for a loan with a Housing…

Don't Miss

CoinField Launches Sologenic Initial Exchange Offering

CoinField has started its Sologenic IEO, which is the first project to utilize the XRP Ledger for tokenizing stocks and ETFs. The sale will last for one week and will officially end on February 25, 2020, before SOLO trading begins on the platform. Sologenic’s native token SOLO is being offered at 0.25 USDT during the IEO.

Earlier this month, Sologenic released the very first decentralized wallet app for SOLO, XRP, and tokenized assets to support the Sologenic ecosystem. The app is available for mobile and desktop via the Apple Store and Google Play. The desktop version is available for Windows and Mac.

“By connecting the traditional financial markets with crypto, Sologenic will bring a significant volume to the crypto markets. The role of the Sologenic ecosystem is to facilitate the trading of a wide range of asset classes such as stocks, ETFs, and precious metals using blockchain technology. Sologenic is an ecosystem where users can tokenize, trade, and spend these digital assets using SOLO cards in real-time. The ultimate goal is to make Sologenic as decentralized as possible, where CoinField’s role will be only limited to KYC and fiat ON & OFF ramping,” said CoinField’s CEO…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange