Don't Miss

Sentinel Protocol – Protecting Against Crypto Fraud

Sentinel Protocol is an interactive security threat intelligence platform that combines collective and artificial intelligence (AI) to protect users against hacks and scams.

Within the cryptocurrency sector, reports of scams, hacks, and security threats have literally become the order of the day. Cybercriminals are constantly innovating new ways to breach security walls and this, in turn, stands in the way of mainstream adoption. One of the most highly touted benefits of blockchain technology, decentralization, has also turned into its greatest enemy.

Sentinel Protocol has found a way to turn this weakness into an advantage by creating a decentralized collective intelligence framework. Crypto users acting individually are not able to create a viable solution to this problem. But through this framework, users are able to harness the power of mutual self-interest to address the challenge effectively.

Security Features of the Platform

The Sentinels

At the core of the Sentinel Protocol ecosystem are security professionals known as The Sentinels. These include developers, white hat hackers, security vendors, and professionals. In exchange for their collective intelligence contributions and threat protection innovations, they earn rewards from the platform.

In many cases, ethical white hackers only receive social recognition for their assistance and contributions. But the prospects of getting financial incentives for their efforts offer greater motivation and has created a vibrant community.

The Sentinel Portal

This is an interactive intelligence platform on the ecosystem where The Sentinels validate reported incidents and hacks. Community members also have the opportunity to share news on security issues, insights and tips, and get Sentinel Points in return. Users who are not security experts make manual reports on the system which are later validated by the experts and added to the intelligence platform.

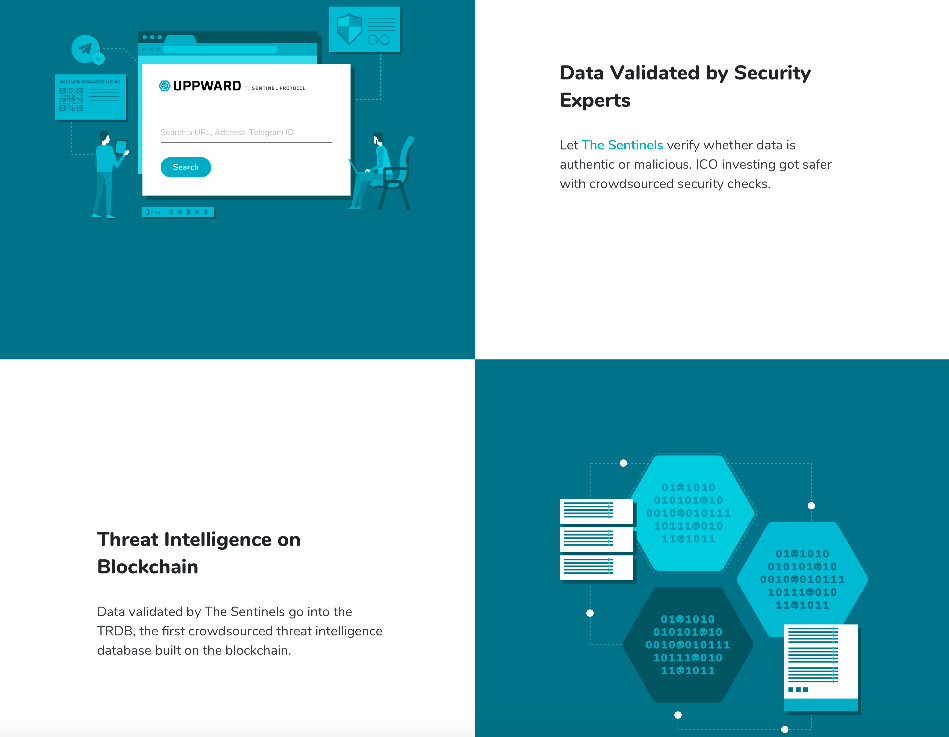

Threat Reputation Database (TRDB)

The TRDB is a blockchain-based reputation system on the Sentinel Protocol. First, by virtue of its decentralization, it eliminates the threat posed by keeping threat data in one central location. As such, the database is not vulnerable to abuse or manipulation.

Secondly, the TRDB addresses the absence of shared knowledge among crypto security vendors. Presently, most existing security vendors compile their own data and store it within walled gardens since there is no incentive for collaboration. But on this framework, it is not a winner takes all game. The more information collected on existing threats, the higher the chances of cyber-crime prevention. Vendors and security experts within this ecosystem are encouraged to make contributions to the database.

As such, the TRDB is able to effectively collect data on hackers’ wallet addresses, phishing addresses, malware hashes and malicious URLs among others. And even though general users can participate, only security experts update the records to eliminate systemic errors. Through this database, any digital assets acquired through malicious acts are tracked to receiving addresses and sub-addresses. All platforms integrated with Sentinel Protocol are alerted, cutting off any chances of the scammer using the seized assets.

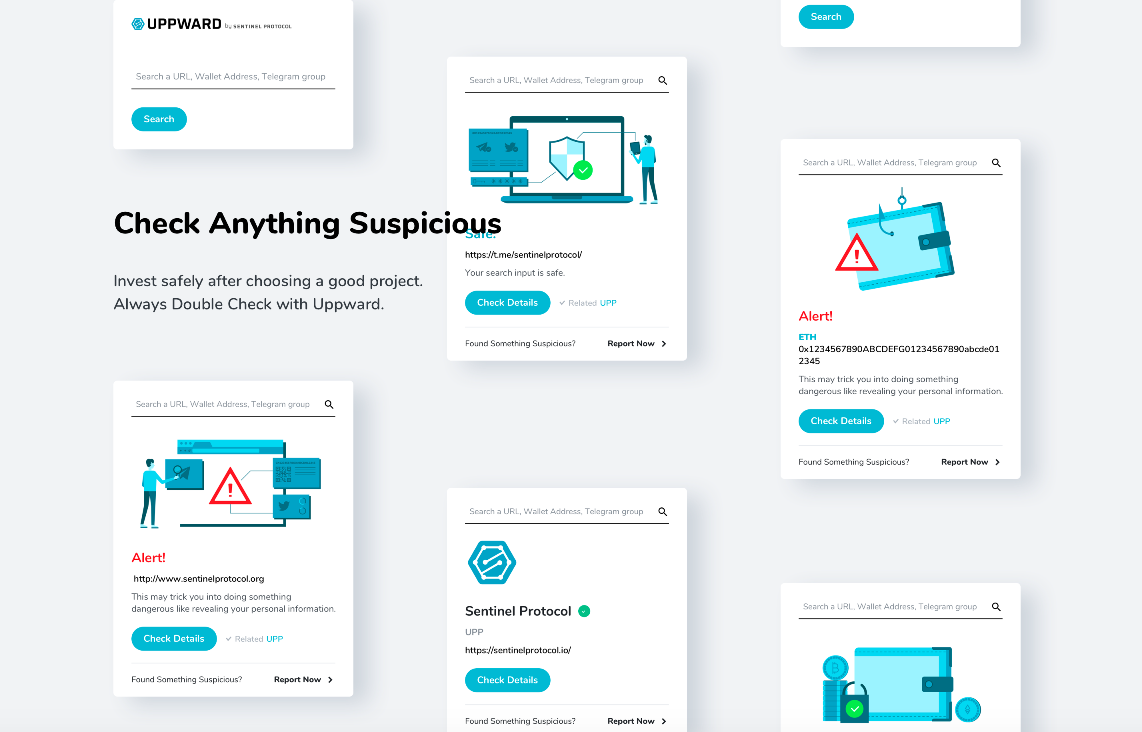

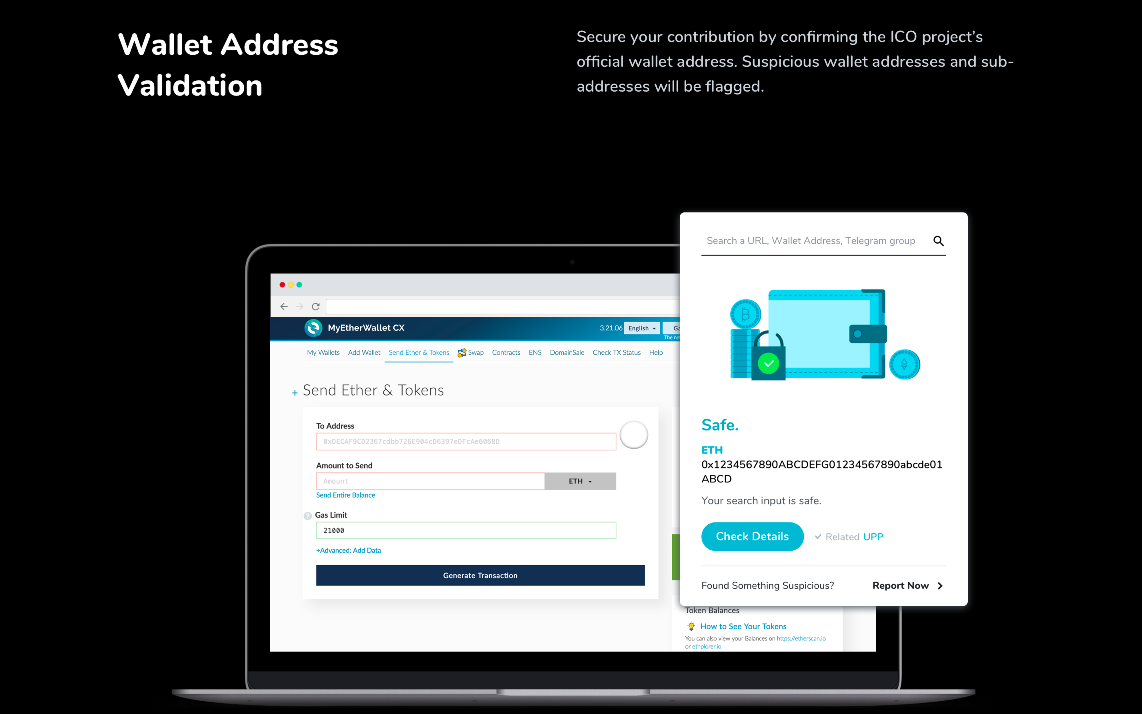

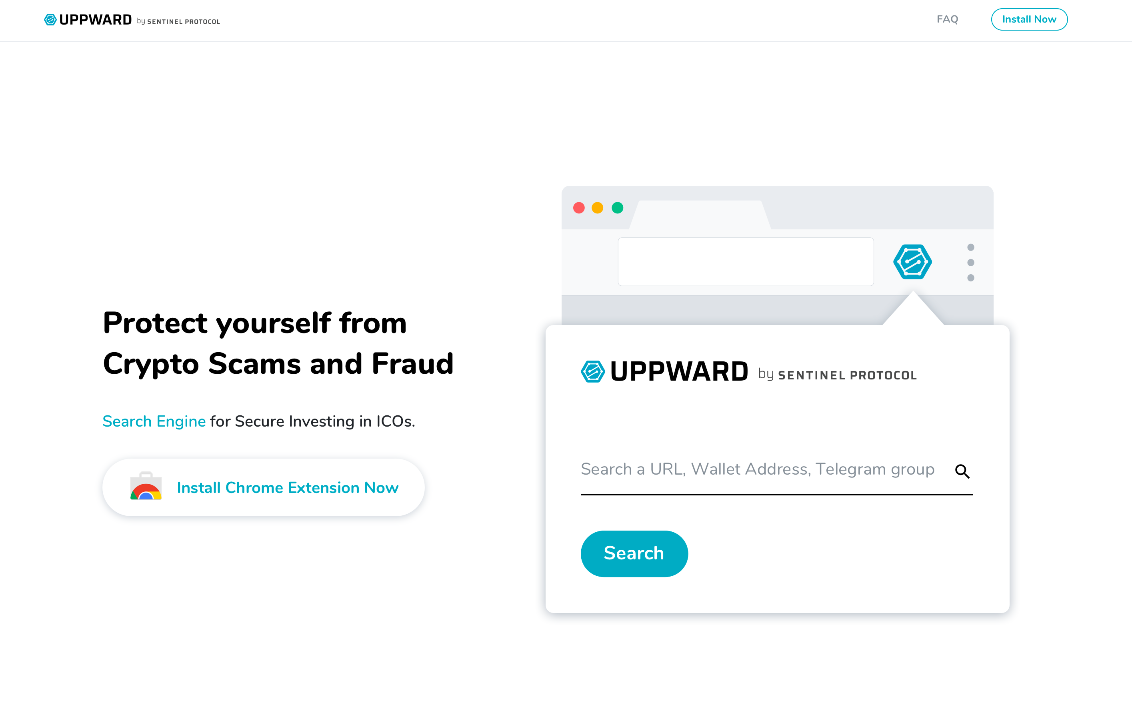

Uppward Chrome Extension

Fake ICO websites have become one of the most common approaches used by malicious actors. For this reason, the Sentinel Protocol has created a security system that investors can use to avert this risk. Uppward Chrome Extension allows platform users to confirm the authenticity of ICO websites, wallet addresses and social media accounts used by ICO projects. By using this protective feature, ICO investors ensure that their contributions go to the right project addresses.

Machine Learning Security Technology

Sentinel Protocol makes use of machine learning to keep track of behavior changes. For starters, it collects existing data and creates model behavior of all normal activities. If at any time this system detects a change in the norm, then it reports the probability of a threat based on the suspicious activity. This could be related to changes in computer usage or transaction patterns among other things. When this happens, the system blocks the execution of the suspicious process and shares the data with the reputation system for further investigation.

Distributed Malware Analysis Sandbox (D-Sandbox)

This feature of the platform makes it possible to run unverified code and programs in a secure environment where they do not pose any risk to the host. Platform users submit threats to this sandbox for analysis by the collective intelligence system.

As hacking and fraud become prevalent in the crypto industry, there is a growing need for a security framework that can cultivate investor and stakeholder trust. Sentinel Protocol provides precisely that, making it possible to reduce hacking and scam incidents significantly. Through its collective intelligence system, threat reputation database and data verification model, the platform makes it a lot safer to interact with blockchains.

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your thorough research before investing in any cryptocurrency and read our full disclaimer.

Don't Miss

A Guide to Exploring the Singaporean ETF market

Singapore’s Exchange Traded Fund (ETF) market has grown, offering investors diverse investment opportunities and access to different asset classes. As the market evolves, investors must navigate these uncharted waters with a clear understanding of Singapore’s ETF landscape. This article explores the trends, challenges and strategies for navigating the Singapore ETF market. To start investing in ETFs, you can visit Saxo Capital Markets PTE.

The Singaporean ETF Market: Exponential Growth

The Singapore ETF market has seen significant growth in recent years, with an increasing number of ETFs covering a wide range of asset classes and holders. different investment topics.

One of the notable trends in the Singapore ETF market is the growing diversity of available options. Investors can now choose from ETFs that track domestic and international stock indexes, bonds, commodities, and specialist sectors or themes. This diverse range of ETFs allows investors to create comprehensive portfolios tailored to their investment goals.

The growth of the ETF market in Singapore is also due to growing investor demand for low-cost, transparent, and accessible investment vehicles. ETFs offer benefits such as intraday liquidity, real-time pricing, and the ability to trade on exchanges. These characteristics have made ETFs attractive to retail and institutional investors who want exposure to different asset classes.

Regulatory Landscape and Investor Protection

The Monetary Authority of Singapore (MAS) is the…

Don't Miss

Property Loans for Foreigners in Singapore That You Must Know About

Intending to invest in a residential or commercial property in Singapore?

When it comes to foreigners applying for a loan in Singapore, things can be pretty hard regardless of the reason whether you need the property for personal or business purposes.

In Singapore, buying a property is challenging, whether you are a foreigner or a native, and sometimes applying for a loan is the only way for you to afford it.

HOW MUCH CAN YOU BORROW FOR A PROPERTY LOAN IN SINGAPORE?

As for the Foreigner Loans, in Singapore, there is an exact amount of money you can borrow to finance the purchase of a property.

In this sense, Singapore has the Loan to Value Ratio (LTV).

The LTV ratio is what determines the exact amount of money you can borrow for a property loan, which changes depending on where you try to obtain the loan:

- If you are applying for a bank loan, you can borrow a maximum of 75% of the value of the property you want to purchase. That means if you are looking for a property that costs $500.000, the maximum amount of money a bank lender can give you like a loan in Singapore is going to be $375.000.

- When you are applying for a loan with a Housing…

Don't Miss

CoinField Launches Sologenic Initial Exchange Offering

CoinField has started its Sologenic IEO, which is the first project to utilize the XRP Ledger for tokenizing stocks and ETFs. The sale will last for one week and will officially end on February 25, 2020, before SOLO trading begins on the platform. Sologenic’s native token SOLO is being offered at 0.25 USDT during the IEO.

Earlier this month, Sologenic released the very first decentralized wallet app for SOLO, XRP, and tokenized assets to support the Sologenic ecosystem. The app is available for mobile and desktop via the Apple Store and Google Play. The desktop version is available for Windows and Mac.

“By connecting the traditional financial markets with crypto, Sologenic will bring a significant volume to the crypto markets. The role of the Sologenic ecosystem is to facilitate the trading of a wide range of asset classes such as stocks, ETFs, and precious metals using blockchain technology. Sologenic is an ecosystem where users can tokenize, trade, and spend these digital assets using SOLO cards in real-time. The ultimate goal is to make Sologenic as decentralized as possible, where CoinField’s role will be only limited to KYC and fiat ON & OFF ramping,” said CoinField’s CEO…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange