Crypto Queen

Tax refunds are down this year, but not for Louisa.

Tax refunds are down, in fact they have dropped by 8.4 percent, down to a 2019 average of $1,865 from $2,035 last year. This drop has some workers who usually get a refund paying out of pocket in addition to what’s already withheld from their paychecks.

But not all working people are taking a hit. An acquaintance who’s a UX developer at a design firm, and also operates a side hustle trading crypto under an LLC, told me she found a way to hang on to the money the Trump tax plan would otherwise pilfer from her earnings. Through a membership with a financial research platform, Louisa (not her real name) has been able to tuck the money away where it’s counted as a business loss, and she still has access to it for later.

Stumbling across a tax trap door

Louisa dabbles in crypto, although she doesn’t describe herself as an expert. She uses a financial research platform called the Pareto Network, which connects investors on a peer-to-peer basis. There are other platforms like this, but Pareto turns out to have a uniquely beneficial glitch.

It caters to entry level dabblers like Louisa, while also providing more advanced tools for higher volume investors. One of these tools is a subscription giving members unique access to more exclusive trading intel. And that’s where she found a trap door that would keep her money safe from Trump’s tax plan.

How the trap door works

In an effort to up her crypto trading game, Louisa signed up for the premium level subscription. To qualify, Louisa first had to build up a score on her Pareto investor’s profile. This was simply a matter of purchasing PARETO Rewards, the platform’s native points system, similar to airline miles. For now the company doesn’t sell rewards directly, but they’re available from resellers such as Netcoins, and various wholesale markets such as KuCoin and CredoEx, which trade digital assets. Once she had enough of these rewards points, she qualified for the subscription and its premium features.

The subscription itself, she found out, is a business expense because it is for financial research. So all the money she spent ‘buying’ her membership by accumulating rewards counts toward her business losses for the year because she just paid for access to the financial research platform.

Scaling this for a bigger investors to protect income as losses

These kind of digital rewards points are not yet regulated at a federal level as their own kind of asset, so the IRS tentatively considers them property, like a car. But while a car depreciates, these rewards stand to accrue value, because unlike airline points there are a limited number of PARETO Rewards. She told me she spent about $1,200 on PARETO Rewards over the second half of last year. It’s a modest sum, but it was enough to cover the 8.4% drop in her tax return.

And she’s essentially saving the money for later to sell at a profit. According to Pareto Network, there’s no limit to the level of access you can purchase. You could put aside $10,000 this way and it would all be tax deductible, as long as you actually access the Pareto Network with them at least once. It’s still yours, in points form, and you can liquidate it after tax season potentially for a net gain. Louisa kept her taxes, and made a little extra pocket money to boot. It’s a loophole, and it’s legal.

Keeping your income while keeping in good standing

Putting it another way, Louisa simply discovered an asset that’s also a loss—something that’s not really supposed to exist. But it does, and whether by accident or by design, Pareto has pulled a fast one on the IRS. So for now the joke’s on them, and investors using the Pareto Network are sitting pretty in good standing with the law.

As long as the investor’s subscription package is a relevant expense for your business, even unincorporated sole proprietorships that exist in your mind, you can swing this to shelter your income. The new tax plan is costing Americans a lot. But there are still ways to keep our earnings safe, and this is one of the most interesting I’ve heard about in a while.

Disclaimer: We do not provide tax, legal or accounting advice and this information is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Altcoins

XNO Token of Xeno NFT Hub listed on Bithumb Korea Exchange

Hong Kong, Hong Kong, 25th January, 2021, // ChainWire //

Xeno Holdings Limited (xno.live ), a blockchain solutions company based in Hong Kong, has announced the listing of its ecosystem utility token XNO on the ‘Bithumb Korea’ cryptocurrency exchange on January 21st 2021.

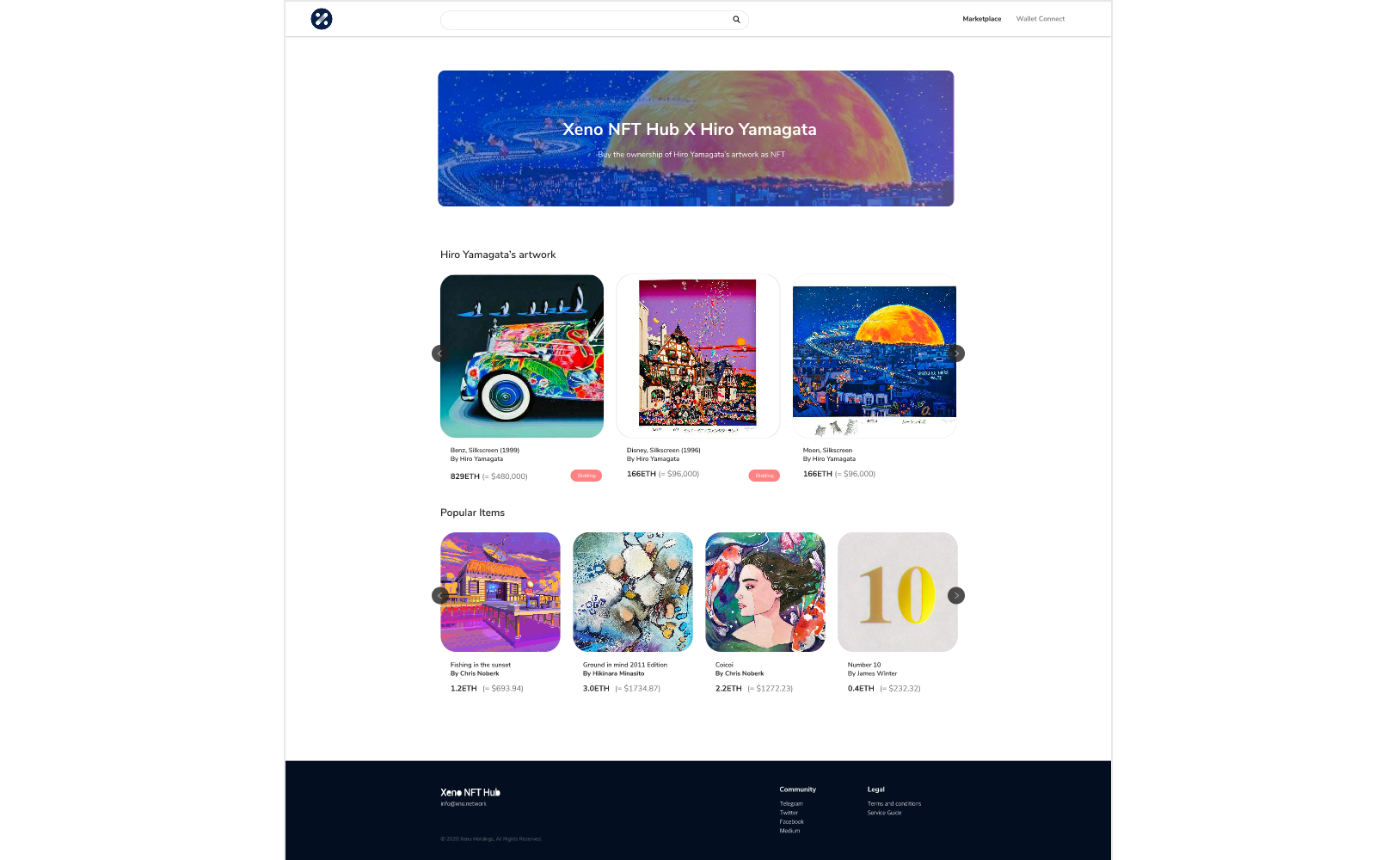

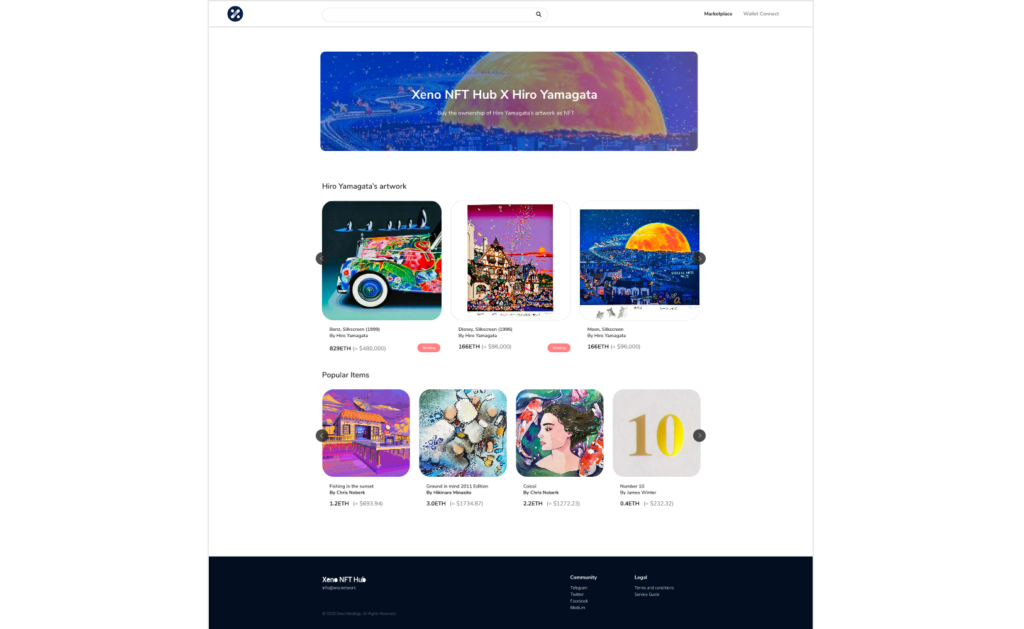

Xeno NFT Hub (market.xno.live ), developed by Xeno Holdings, enables easy minting of digital items into NFTs while also providing a marketplace where anyone can securely trade NFTs.

The Xeno NFT Hub project team includes former members of the technology project Yosemite X based in San Francisco and professionals such as Gabby Dizon who is a games industry expert and NFT space influencer based in Southeast Asia.

NFT(Non-Fungible Token) technology has recently gained huge focus in the blockchain arena and beyond, making waves in the online gaming sector, the art world, and the digital copyrights industry in recent years. The strongest feature of NFTs is that “NFTs are unique digital assets that cannot be replaced or forged”. Unlike fungible tokens such as Bitcoin or Ether, NFTs are not interchangeable for other tokens of the same type but instead each NFT has a unique value and specific information that cannot be replaced. This fact makes NFTs the perfect solution to record and prove ownership of digital and real-world items like works of art, game items, limited-edition collectibles, and more. One of the ways to have a successful…

Altcoins

XENO starts VIP NFT trading service and collaborates with contemporary artist Hiro Yamagata

Hong Kong, Hong Kong, 24th December, 2020, // ChainWire //

The XENO NFT Hub (https://xno.live) will provide a crypto-powered digital items and collectables trading platform allowing users to create, buy, and sell NFTs. Additionally it will support auction based listings, governance and voting mechanisms, trade history tracking, user rating and other advanced features.

As a first step towards its fully comprehensive service, XENO NFT Hub launched a recent VIP service to select users and early adopters in December 2020 with plans for a full Public Beta to open in June 2021.

“NFTs are extremely flexible in their usage, from digital event tickets to artwork, and while NFTs have a very wide spectrum of uses and categories XENO will initially focus its partnership efforts and its own item curation on three primary areas: gaming, sports & entertainment, and collectibles.”, said XENO NFT Hub president Anthony Di Franco.

He also added “This does not mean we will prohibit other types of NFTs from our ecosystem However, it simply means that XENO’s efforts as a company will be targeted into these verticals initially as a cohesive business approach.”

Development and Procurement Lead, Gabby Dizon explained, “Despite our initial focus, we found ourselves with a unique opportunity to host some of the works of Mr. Hiro Yamagata. We are collaborating with Japanese artist Hiro Yamagata to enshrine some of his artwork into NFTs.”

Mr. Yamagata has…

Altcoins

My Crypto Heroes Announces Issuance of MCH Governance Token

Tokyo, Japan, 24th November, 2020, // ChainWire //

My Crypto Heroes is happy to announce the issuance of MCH Coin as an incentive to players in the My Crypto Heroes ecosystem, aiming to allow them to craft a “User-oriented world”. The MCH coin is available on Uniswap with a newly created pool with ETH.

My Crypto Heroes is a blockchain-based game for PC and Mobile. It allows users to collect historic heroes and raise them for battle in a Crypto World. Officially released on November 30th, 2018, MCH has recorded the most transactions and daily active users than any other blockchain game in the world.

What is MCH Coin?

MCH Coin is being issued as an ERC-20 Standard Governance Token. The issuance began on November 9th, 2020, with 50 million tokens issued.

Of the funds issued, 40% are allocated to a pay for on-going development and as rewards for advisors and early investors. 10% are allocated to marketing and the growth of the ecosystem, and 50% are allocated to the community. The Distribution Ratio of the MCH Coin is subject to change via a governance decision.

The MCH coin will be used as a voting right as part of the ecosystem’s governance, with 1 coin being 1 vote. It will also be used for in-game utilities and payments. Additional information can be found here:

https://medium.com/mycryptoheroes/new-ecosystem-with-mchcoin-en-a6a82494894f

During December 2020 the first…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange