Featured news

Five Strategies for Lowering Your Crypto Taxes

Getting taxes done isn’t always the highest item on everyone’s to do list. This is especially true if you have accumulated significant gains from investing in cryptocurrencies. What many investors often don’t consider are the opportunities to actually reduce their tax liabilities from their crypto investing. This article discusses five strategies that you can use to help minimize your crypto tax liability.

Depending on what country you live in, your cryptocurrency will be subject to different tax rules. The questions below address implications within the United States, but similar issues arise around the world. As always, check with a local tax professional to assess your own particular tax situation.

1. Tax loss harvesting

Tax loss harvesting is a common strategy in the world of investing where you sell your assets that will realize a capital loss. All you need to do is look at your investments and see which ones you bought for more than they are currently worth. By selling at a loss, you can potentially dramatically lower your net capital gains and thus reduce your taxable income. Given the market we are currently in, there are abundant opportunities to harvest losses and save on your tax bill. Cryptocurrency tax calculators have built specific tax loss harvesting tools that you can use automatically detect which coins present the most powerful tax loss harvesting opportunities.

2. Invest for longer than one year

The IRS treats all cryptocurrencies as property for tax purposes—not currency. Just like other forms of property, you incur capital gains when you sell or dispose of your property for more than you acquired it for. The government taxes these capital gains differently depending on how long you held the investment. Because the government wants to incentivize long-term investing, the capital gains tax rate is less for investments that are held for more than a year and more for investments that are held for less than a year. This means that if you bought Bitcoin, held it for a month, and then sold it, your capital gains tax rate would be higher than if you waited to sell it a year later.

Holding your cryptocurrency investments for longer than one year can help cut down on your capital gains taxes.

3. Give away your cryptocurrency

No, this is not a suggestion to donate all of your hard earned cryptocurrency gains to charity. However, if you gift your cryptocurrency to a family member or a friend, you can partially address your problem with cryptocurrency taxes. In 2018, the IRS allowed U.S. citizens to offer a gift of up to $15,000 without documented proof of the transaction. This is also not a taxable event, so the gift does not trigger a capital gain.

This is a particularly interesting alternative considering that when the recipient of your gift decides it’s time to cash out, that value that’s taxed is based on the market value on that given day. Something to think about as you ponder what to do with your crypto gains.

4. Buy cryptocurrency with your IRA or 401-K

Using an IRA or 401-K to defer tax payments is a popular way to reduce tax liabilities. The same is present in the crypto markets. By using your retirement account to purchase cryptocurrencies, you can defer paying tax (or even avoid paying it at all): all the income and gains generated by the retirement account will return into the account with tax deferred or (in the case of a Roth IRA), with no tax applied at all. This means your crypto investment can grow without being hindered by the need to take money out in order to pay a tax bill.

5. Keep accurate records

To ensure that you are paying the correct amount of taxes on your crypto capital gains and capital losses, you should keep detailed records for every crypto transaction that you participate in over the year. Information like the date of acquisition, the dollar value, the date sold, and the proceeds from the sale are all need to report crypto on your taxes. If you haven’t been keeping a detailed record of your crypto transactions, it could save you a significant amount of time to use a crypto taxes calculator that automatically calculates your cost basis and capital gains liability for you. This is one of the best ways to ensure you are minimizing your crypto taxes.

These are five tips you can use to help reduce your overall tax liability for the year. Remember that the tax year cut-off is Dec. 31st, so any tax loss harvesting needs to happen before the end of the year!

Crypto

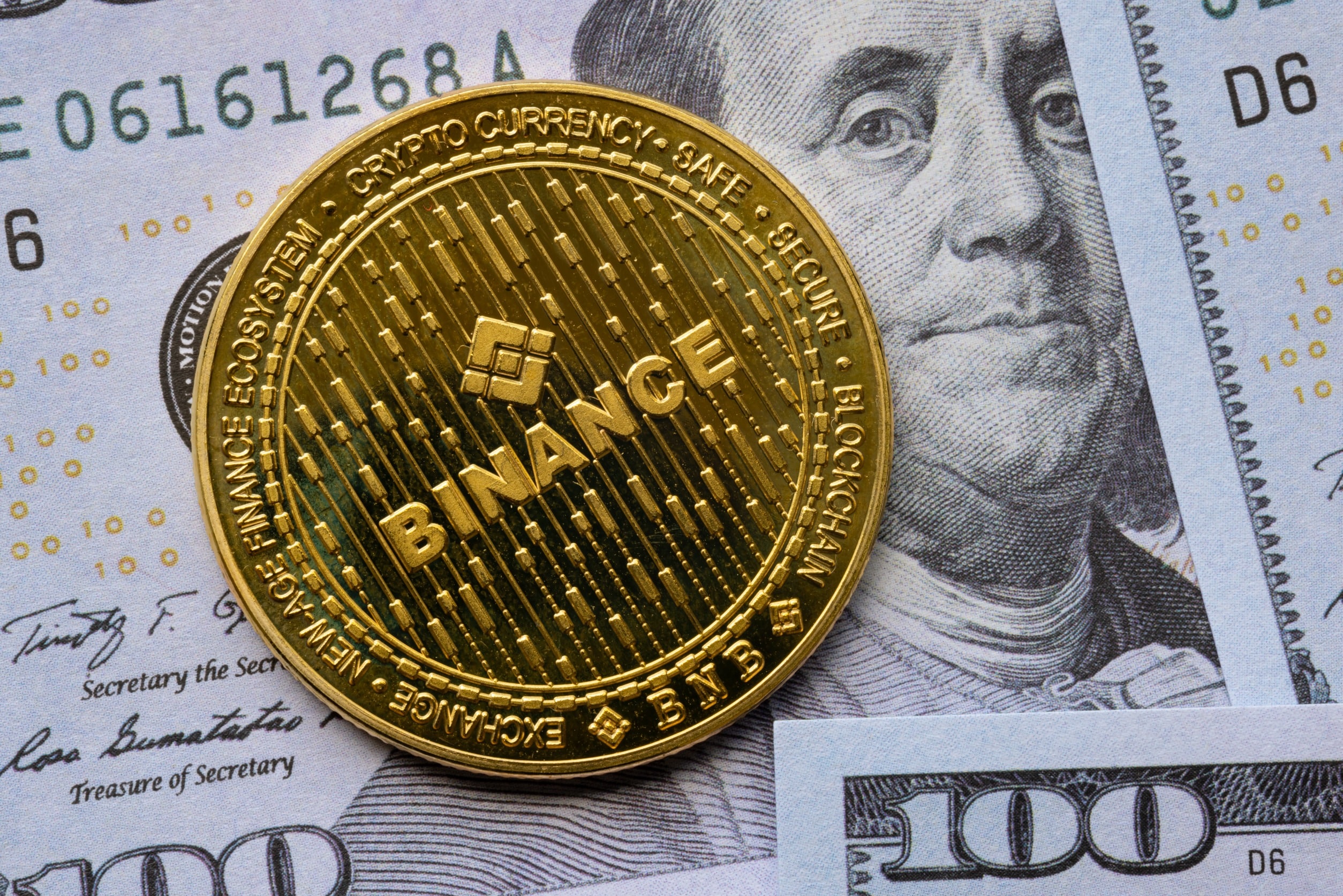

BNB Price Surges Past $300, Faces Crucial $339 Hurdle: What’s Next?

BNB price has noted significant gains over the past few days, surging past the psychological resistance of $300. The native cryptocurrency of the Binance Exchange has surpassed Solana to regain its position as the fourth-largest cryptocurrency by market cap. The digital currency has been rallying lately with a 7-day profit of more than 15%. Additionally, BNB has clocked a phenomenal gain of 38% in the month to date.

Binance Coin Outlook

BNB price has been on a strong bull run for the past week, breaking out of its consolidation. Even so, the asset has experienced a correction in its uptrend over the past 24 hours but remains above the crucial level of $300. BNB’s total market cap has decreased by 4% over the past day to $48 billion, while the total volume of the asset traded over the same period dipped by about 15%.

Over the past year, Binance Coin has had to cope with Fear, Uncertainty, and Doubt (FUD) on the back of the regulatory troubles of its underlying exchange. Earlier, the BNB price touched a low of $223.50, a few days after its former CEO, Changpeng Zhao, pleaded guilty to money laundering charges. However, the cryptocurrency has managed to rebound 46% in value since then.

The recent price rally has been associated with various positive developments in the Binance ecosystem, including the Introduction of the Isolated Margin Auto-Transfer Mode. This feature enables…

Altcoins

Solana Price Surges Beyond $100, Dethroning Ripple and BNB To Secure Fourth Place

Solana price performance in recent times has been remarkable, surpassing Ripple and Binance Coin to become the fourth-largest cryptocurrency by market cap. The SOL price breached the critical level of $100 for the first time since April 2022 over the weekend to imbue optimism among investors. However, the altcoin has corrected by 7%, suggesting that the market is overheated. At the time of writing, the ‘Ethereum killer’ was trading slightly lower at $111.60.

SOL Outlook

Solana price has made a significant recovery over the past few weeks, climbing above the psychological level of $100. The altcoin has been one of the best-performing assets this year, extending its year-to-date gains to more than 1,025%, with more gains recorded in the past month alone. However, even with such growth, analysts have noted that Solana has a bleak chance of topping its ATH of $260.

The reason behind this is the increase in supply relative to its value. In November 2021, when the Solana price hit its all-time high of $260, its total market capitalization was around $78 billion. Despite the value of the crypto asset being less than half of what it was at the top, its market cap is currently hovering near $50 billion.

This has been brought about by the increase in the Solana supply by more than 100 million SOL over the past two years. According to some analysts, for the altcoin to retest $260, its…

Altcoins

Solana Price Skyrockets to 20-Month Peak Amidst Memecoin Frenzy

Solana price has noted significant gains over the past few weeks, climbing to its highest level since April 2022. The ‘Ethereum Killer’ almost topped the crucial level of $100 on Friday, before pulling back slightly. The asset’s recent surge has catapulted Solana’s total market cap to $39.6 billion, ranking 5th after and above BNB and XRP, respectively. Solana has jumped by more than 22% in the past week and more than 80% in the month to date. At the time of writing, SOL price was trading 0.90% lower at $93.10.

Catalysts Behind SOL’s Rally

Solana price has been on a strong bull run over the past few days, rocketing to its highest level in 20 months as the network benefits from the substantial activity and strong interest in memecoins. The SOL token, the native digital asset of the high-performance blockchain platform Solana, has shown some serious strength over the past few weeks, outperforming all the altcoins in the market.

The recent surge in the Solana price has been linked to heightened on-chain activities on the Solana blockchain. Notably, the ongoing hype for the blockchain’s speedy transactions, cheap fees, and a lottery of meme coin issuances has buoyed SOL’s on-chain activity. Metrics have revealed that Solana has been the strongest draw among on-chain traders, with trading volumes and network fees outperforming Ethereum- the largest altcoin by market cap.

Cited figures provided by DeFi aggregator DeFiLlama…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoIs Litecoin (LTC) Changing Its Game Plan By Going For Mass Adoption?