Altcoins

BlocPal Is The Most Advanced Way to Pay

How time flies! Next year will bring with it a birthday cake and 10 candles when cryptocurrency celebrates its first decade on the planet.

And what an exciting & eventful period it’s been since the pioneer of digital money –Bitcoin- saw the first light of day in 2009.

Both crypto and its original understudy –blockchain- have become some of the hottest buzzwords over the past years. And each in their own right as the world came to realize increasingly that the technologies represent revolutionary solutions & opportunities for the Digital Age that we live in.

We further saw global exuberance, euphoria, skyrocketing crypto values and also, of course, extreme market volatility as mankind celebrated the coming of the new era with gusto. While at the same time regulators and governments around the globe had to come to grips with the choice of the people and introduce digital currency & blockchain into their frameworks.

Although the process is ongoing and likely to take a long time given the vast disruptive effect, it’s busy gaining massive momentum within the key economies. For instance, as Fortune magazine writes, in the U.S. State of Arizona, residents can already pay their taxes by means of certain cryptocurrencies.

While today there are more than 1,800 different digital currencies available in a market worth hundreds of billions of dollars. And after being around for almost ten years, it’s now time for crypto to start embracing the real business end of the deal.

“But why are we not seeing digital currencies used more on a daily basis?” I hear you ask. Exactly! There are several issues still hampering the easy everyday use of crypto.

Enter BlocPal, the most advanced way to pay, simplified!

Please continue reading to see what the current industry problems are and how BlocPal has arrived to revolutionize crypto payments. Also how you can become part of its success story now already as a proud owner of the BPX Coin.

Problem – cryptos are hard to spend & costly

Digital currency ticks all the boxes for being the greatest payment solution ever seen. Especially in our globalized & integrated world and during this, the Digital Age, where borderless convenience & immediacy has become the norm.

Yet, even though the crypto industry has achieved breathtaking growth & extraordinary technological advancement in a relatively short period of time, there are still several issues that prevent the massive and ever-increasing global community of keen cryptocurrency owners from using it as a regular payment method.

In an article titled, “Here’s why crypto isn’t accepted for more everyday transactions”, the popular financial and business news publication, Business Insider, wrote that by the end of 2016 there were already 11,291 retailers globally which accept crypto payments from customers. And for the year 2017 alone, that amount grew by more than 30% it says.

“At the same time, users have also warmed up to the idea: a recent survey found that 40% of people familiar with the digital currency would be open to using it in everyday transactions”, Business Insider continues.

The publication further lists the “main obstacles to using cryptocurrency for everyday transactions”, of which slow transaction times and high transaction fees are two of the major ones.

In terms of the former, “The average confirmation for Bitcoin takes about 20 minutes per transaction right now – but during past stretches of activity (such as in Jan 2018), it got as high as 41 hours”, Business Insider wrote at the time. And while processing times have improved further, even now -in the second half of 2018- it can still take several minutes for a simple crypto payment authorization to go through.

While, in terms of fees, months ago Bitcoin transactions cost $40 each, although it has reduced significantly since then, Business Insider wrote. But even at a cost of between US$5-10 per transaction in current times, crypto is still considered far too expensive for everyday payments.

But there is still great optimism while people around the globe are working relentlessly on crypto payment solutions, Business Insider continued.

“Crypto e-payments companies are constantly introducing new technologies and features that could potentially decrease transaction costs and provide instant settlements for retailers, while also eliminating the issue of fraudulent chargebacks. Making ground on these issues would make crypto significantly more appealing to the masses as a form of payment”, Business Insider concluded.

However, while echoing the optimism expressed in the preceding paragraph, it must be noted that the e-wallets that come as part-and-parcel of many cryptocurrencies today are still far too simplistic to holistically cover the payment needs of crypto users and merchants alike.

For instance, existing e-wallets are commonly not geared for 24/7 support, instant & guaranteed settlement, know-your-client (KYC) regulatory requirements and auto-invoice generation, to name but a few shortcomings.

BlocPal is the ideal crypto payment solution for everyday life

BlocPal’s all-in-one decentralized blockchain payment platform represents the only wallet that users & merchants will ever need!

https://www.dropbox.com/s/jk84fd1p6t97qgy/v2%20full.mp4?dl=0

BlocPal focuses on providing the exact tools needed by crypto users and merchants today to ensure quick, borderless, secure, seamless & low-cost payments on the go.

Users can enjoy all the features & benefits of BlocPal that were specifically designed to make their spending enjoyable and hassle-free:

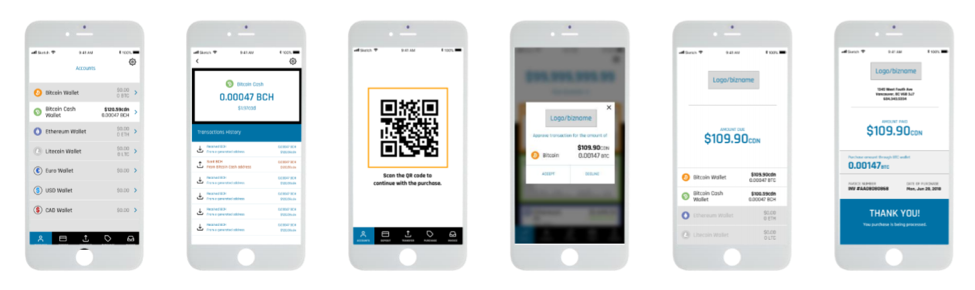

- Double-Secure BlocPal Wallet – the one-stop solution that provides seamless multi-cryptocurrency & fiat interchangeability for payments and deposits.

- Low Fees.

- Easy QR Code Scanner – instant approval at merchant terminals & automatic proof-of-payment receipt.

- Royalty Rewards – receive free BPX coins per transaction, also airdrops.

- And much more!

While Merchants will also benefit from BlocPal like never before:

- BlocPal integrates seamlessly with both physical and online businesses. Sign up within minutes and hit the ground running with easy API integration and plug-ins for popular ecommerce software.

- Receive your money in seconds –not minutes or hours – transactions are approved instantaneously.

- Transaction fees below 1% – beats credit/debit cards and other e-wallets hands-down.

- Multiple cryptocurrencies are already accepted – and growing.

- Rewards program for both merchants & their customers.

- No Chargebacks.

- Convert your crypto to fiat and BlocPal puts it automatically in your bank.

- Know-your-client (KYC) features.

- Anti-money-laundering (AML) procedures.

- And much more!

And Enterprise customers, business owners & entrepreneurs will also love BlocPal because, in addition to all the benefits & features listed earlier, the platform further provides revolutionary solutions in terms of:

- Developer APIs.

- White label / branded services.

- Custom blockchain solutions.

- Robust back-office systems.

- Equity financing/crowdfunding.

- Securities compliance.

- Corporate governance.

Extensive information in terms of the features, benefits and revolutionary technology associated with BlocPal’s all-in-one decentralized blockchain payment platform is available on the Website and in the Investor Presentation pack.

The BPX Coin – A Securities Token Adhering to Securities Law

BlocPal is currently inviting investors to participate in its success story through ownership of the BLOC token, commonly referred to as the BPX Coin.

BPX Coin owners will receive 33% of BlocPal’s net profits in royalties.

Information for investors is available under Frequently Asked Questions, while disclosure in terms of the Use of Initial Proceeds and Distribution of Tokens is made on the Website and in the Investor Presentation pack.

BLOC holders will be able to trade BPX amongst themselves upon completion of all funding rounds and regulatory sign-off. Based on BlocPal’s projected outlook, it is possible that the value of the BPX Coin will increase over time.

Please contact BlocPal on the Website for further information.

Management, Milestones & Roadmap

BlocPal International Inc. is a private company incorporated under the laws of Canada.

The enterprise is under the capable management of a group of highly qualified, skilled & experienced industry veterans who have successfully processed $25 billion in transactions—and counting!

The exciting journey of BlocPal started in 2017 and although several milestones have already been achieved, many more are planned for the future.

More information on the Leadership Team and the BlocPal Roadmap can be viewed on the website and Investor Presentation pack.

Conclusion

Digital currency has come a long and exciting way since its inception almost ten years ago. And it’s now time for it to embrace the next level of functionality.

BlocPal’s all-in-one decentralized blockchain payment platform has arrived to make every-day crypto transactions the easy & preferred choice for merchants, enterprises, and consumers on the go.

References

BlocPal – Investor Presentation

CoinMarketCap – Cryptocurrencies by Market Capitalization

Fortune magazine – Arizona Senate Votes to Accept Tax Payments in Bitcoin

Business Insider – Here’s why crypto isn’t accepted for more everyday transactions

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your thorough research before investing in any cryptocurrency and read our full disclaimer.

Image courtesy of Pexels

Altcoins

Solana Price Surges Beyond $100, Dethroning Ripple and BNB To Secure Fourth Place

Solana price performance in recent times has been remarkable, surpassing Ripple and Binance Coin to become the fourth-largest cryptocurrency by market cap. The SOL price breached the critical level of $100 for the first time since April 2022 over the weekend to imbue optimism among investors. However, the altcoin has corrected by 7%, suggesting that the market is overheated. At the time of writing, the ‘Ethereum killer’ was trading slightly lower at $111.60.

SOL Outlook

Solana price has made a significant recovery over the past few weeks, climbing above the psychological level of $100. The altcoin has been one of the best-performing assets this year, extending its year-to-date gains to more than 1,025%, with more gains recorded in the past month alone. However, even with such growth, analysts have noted that Solana has a bleak chance of topping its ATH of $260.

The reason behind this is the increase in supply relative to its value. In November 2021, when the Solana price hit its all-time high of $260, its total market capitalization was around $78 billion. Despite the value of the crypto asset being less than half of what it was at the top, its market cap is currently hovering near $50 billion.

This has been brought about by the increase in the Solana supply by more than 100 million SOL over the past two years. According to some analysts, for the altcoin to retest $260, its…

Altcoins

Solana Price Skyrockets to 20-Month Peak Amidst Memecoin Frenzy

Solana price has noted significant gains over the past few weeks, climbing to its highest level since April 2022. The ‘Ethereum Killer’ almost topped the crucial level of $100 on Friday, before pulling back slightly. The asset’s recent surge has catapulted Solana’s total market cap to $39.6 billion, ranking 5th after and above BNB and XRP, respectively. Solana has jumped by more than 22% in the past week and more than 80% in the month to date. At the time of writing, SOL price was trading 0.90% lower at $93.10.

Catalysts Behind SOL’s Rally

Solana price has been on a strong bull run over the past few days, rocketing to its highest level in 20 months as the network benefits from the substantial activity and strong interest in memecoins. The SOL token, the native digital asset of the high-performance blockchain platform Solana, has shown some serious strength over the past few weeks, outperforming all the altcoins in the market.

The recent surge in the Solana price has been linked to heightened on-chain activities on the Solana blockchain. Notably, the ongoing hype for the blockchain’s speedy transactions, cheap fees, and a lottery of meme coin issuances has buoyed SOL’s on-chain activity. Metrics have revealed that Solana has been the strongest draw among on-chain traders, with trading volumes and network fees outperforming Ethereum- the largest altcoin by market cap.

Cited figures provided by DeFi aggregator DeFiLlama…

Altcoins

Solana Price Breaches $60 Amid a Symphony of Bullish Indicators

Solana price has jumped more than 8% over the past week, breaching the important level of $60. At the time of writing, Solana was trading 3% higher at $61.07. The asset’s total market cap has climbed to $25.9 billion over the past week, ranking it the 6th largest cryptocurrency after XRP. The total volume of SOL traded over the last day has declined by 8%.

SOL’s Bullish Cues

Solana’s price has been among the best-performing cryptocurrencies this year amid continuous growth. The “Ethereum killer” has consistently impressed investors throughout the year on the back of a resurgence in bullishness, which saw SOL’s price climb more than 513% in the year to date. Institutional investors have also shared the bullish sentiment, making Solana their most preferred altcoin.

In the week ending November 24, Solana recorded inflows worth nearly $3.5 million, significantly more than the other altcoins’ inflows combined. The asset’s monthly inflows were higher at $40.2 million, lower than Ethereum’s $99.6 million inflows in the same period. Other altcoins, including Litecoin and Ethereum, noted significant outflows, making Solana nearly half of the home for DeFi. This implies that when it comes to institutions, Solana is currently the best-performing altcoin with the potential of a long-term rally much higher than other digital assets.

Notably, the Solana DeFi ecosystem accomplished a significant milestone earlier this week. Its Total Value Locked (TVL) hit a new yearly peak of over $655 million,…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange