Don't Miss

Neluns is the next step in the financial ecosystems evolution

According to the latest official announcement from the Neluns team they plan to run an ICO in 3 phases: Pre-Sale, Pre-ICO, and ICO. In the mission statement, Neluns declares its ultimate goal to build the next generation financial ecosystem hinging on a bank and insurance company functionality. The bank side of the system will support operations with crypto and fiat currencies and will have a built-in currency exchange module. The system is likely to create the most favorable conditions for the further evolution and increased maturity of the cryptocurrency market.

Ecosystem Key features

The Neluns ecosystem includes:

- Neluns Bank is the next generation bank supporting most of the core retail bank features for fiat money and cryptocurrencies.

- Neluns Exchange is built on the cutting edge technology facilitating the improved accessibility of the secure and fast cryptocurrency trade operations.

- Neluns Insurance company ensures all the transactions and trades within the ecosystem.

Users have access to the following functionality within the Neluns ecosystem:

- Trade cryptocurrencies with a few clicks

- Exchange cryptocurrencies

- Fast deposits and withdrawal to/from the system from around the globe

- Option to open an IBAN Account that supports multicurrency (private or corporate)

- Issue debit and credit cards from major card issuers Visa, MC, Amex

- Promptly send and receive international money transfers

- Earn more interest on your money in the Neluns savings accounts in fiat or cryptocurrencies

- Receive loans from Neluns in fiat and cryptocurrencies

- P2P (Peer-to-peer) Landing Platform allows earning interest on lending to other users

- Draw profits from the NLS tokens trading on the cryptocurrency exchanges

- Trades insurance is available and can be enabled for select or all transactions

- Get dividends

- Lowered risk levels and extra profits are open for the active market participants

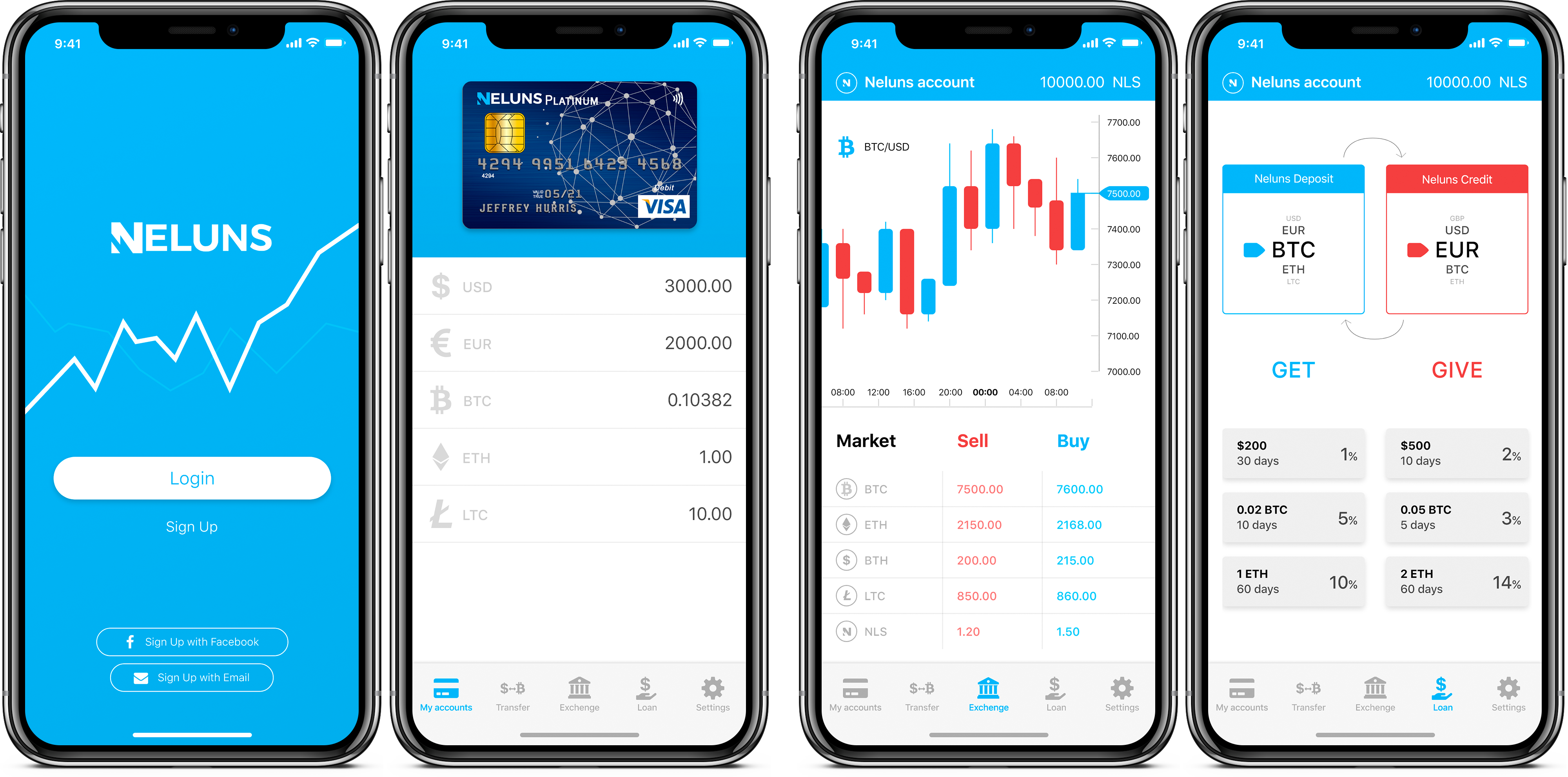

Neluns Bank offers a broad range of services to private and corporate customers. The transactions are executed in fiat and crypto money. Once a multicurrency account is open users are able to carry out transactions in USD, EUR, GBR and cryptocurrencies. There’s an option to issue a bank card for the multicurrency account.

There are 4 types of bank cards and respective software products available: Lite, Silver, Gold, and Platinum.

Making purchases, sending payments, trading cryptocurrencies and fund withdrawals are available from any ATM around the globe 24×7.

Users can obtain loans in fiat or crypto money from the system as well as earn interest on the savings account in the system. All savings accounts are FDIC (The Federal Deposit Insurance Corporation) insured. The P2P fiat and cryptocurrency lending platform will be developed and it will serve as a base of Neluns Bank. Users will be able to extend and obtain loans to/from other users.

Neluns Exchange is based on the bank guarantee principles allowing us to create the new high quality cryptocurrency exchange. These principles combined with the cutting edge technology are the pillars of the system supporting easy fund withdrawals, cybersecurity threats protection, high availability and peak loads resistance. The system is expected to offer both best user experience for cryptocurrency traders and great deals on savings account interest rates.

There will be apps created for iOS and Android to make sure that the bank and exchange operations are available on the go from mobile devices. 24×7 technical support service will be launched to address any challenges users face.

The project will be run in accordance with respective government regulations and all applicable legal frameworks to minimize the risks and facilitate the successful project execution. Neluns Bank is in the process of obtaining a banking business license. Neluns Bank will adhere to all respective licensing, regulatory and supervisory requirements that are applicable for the regulated banks. Neluns Exchange will be regulated as per CFTC (U.S Commodity Futures Trading Commission) and SEC (U.S Securities and Exchange Commission) licensing requirements.

Main ICO Facts

NLS token is ERC20 token (public Ethereum blockchain). It is a security token with 50% dividends payout based on the Neluns ecosystem performance (the bank, the exchange, the insurance company).

Dividends are paid out on a quarterly basis.

Dividends payout formula is based on the number of tokens one holds vs. the total number of tokens.

NLS token holders who use the Neluns ecosystem products enjoy additional advantages. The more tokens are held the greater bonuses and privileges are provided.

- NLS Token supply – 200M

- Token price – $1

In 15 days after the first round of ICO starts Form D (an official notification of ICO start) will be submitted to SEC (U.S Securities and Exchange Commission).

ICO stages (rounds)

Pre-Sale

Hard Cap – $2.000.000

Soft Cap – $500.000

1 stage (round), pre-sale, stage (round) length 14 days, from 08-01-2018 to 08-15-2018.

bonus 30%

extra-bonus 40% investment of more than 1 ETH in one transaction

extra-bonus 50% investment of more than 10 ETH in one transaction

Pre-ICO

Hard Cap – $10.000.000

Soft Cap – $2.000.000

2 stage (round), pre-ICO, stage (round) length 21 days, from 08-15-2018 to 09-05-2018.

bonus 20%

extra-bonus 30% investment of more than 1 ETH in one transaction

extra-bonus 35% investment of more than 10 ETH in one transaction

ICO

Hard Cap – $112.000.000

Soft Cap – $10.000.000

3 stage (round), ICO, stage (round) length 31 days, from 09-05-2018 to 10-05-2018

bonus 10%

extra-bonus 20% investment of more than 1 ETH in one transaction

extra-bonus 25% investment of more than 10 ETH in one transaction

Projects Website: https://neluns.io/

White Paper: https://neluns.io/static/ver165/whitepaper/whitepaper.pdf

E-mail: [email protected]

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Don't Miss

A Guide to Exploring the Singaporean ETF market

Singapore’s Exchange Traded Fund (ETF) market has grown, offering investors diverse investment opportunities and access to different asset classes. As the market evolves, investors must navigate these uncharted waters with a clear understanding of Singapore’s ETF landscape. This article explores the trends, challenges and strategies for navigating the Singapore ETF market. To start investing in ETFs, you can visit Saxo Capital Markets PTE.

The Singaporean ETF Market: Exponential Growth

The Singapore ETF market has seen significant growth in recent years, with an increasing number of ETFs covering a wide range of asset classes and holders. different investment topics.

One of the notable trends in the Singapore ETF market is the growing diversity of available options. Investors can now choose from ETFs that track domestic and international stock indexes, bonds, commodities, and specialist sectors or themes. This diverse range of ETFs allows investors to create comprehensive portfolios tailored to their investment goals.

The growth of the ETF market in Singapore is also due to growing investor demand for low-cost, transparent, and accessible investment vehicles. ETFs offer benefits such as intraday liquidity, real-time pricing, and the ability to trade on exchanges. These characteristics have made ETFs attractive to retail and institutional investors who want exposure to different asset classes.

Regulatory Landscape and Investor Protection

The Monetary Authority of Singapore (MAS) is the…

Don't Miss

Property Loans for Foreigners in Singapore That You Must Know About

Intending to invest in a residential or commercial property in Singapore?

When it comes to foreigners applying for a loan in Singapore, things can be pretty hard regardless of the reason whether you need the property for personal or business purposes.

In Singapore, buying a property is challenging, whether you are a foreigner or a native, and sometimes applying for a loan is the only way for you to afford it.

HOW MUCH CAN YOU BORROW FOR A PROPERTY LOAN IN SINGAPORE?

As for the Foreigner Loans, in Singapore, there is an exact amount of money you can borrow to finance the purchase of a property.

In this sense, Singapore has the Loan to Value Ratio (LTV).

The LTV ratio is what determines the exact amount of money you can borrow for a property loan, which changes depending on where you try to obtain the loan:

- If you are applying for a bank loan, you can borrow a maximum of 75% of the value of the property you want to purchase. That means if you are looking for a property that costs $500.000, the maximum amount of money a bank lender can give you like a loan in Singapore is going to be $375.000.

- When you are applying for a loan with a Housing…

Don't Miss

CoinField Launches Sologenic Initial Exchange Offering

CoinField has started its Sologenic IEO, which is the first project to utilize the XRP Ledger for tokenizing stocks and ETFs. The sale will last for one week and will officially end on February 25, 2020, before SOLO trading begins on the platform. Sologenic’s native token SOLO is being offered at 0.25 USDT during the IEO.

Earlier this month, Sologenic released the very first decentralized wallet app for SOLO, XRP, and tokenized assets to support the Sologenic ecosystem. The app is available for mobile and desktop via the Apple Store and Google Play. The desktop version is available for Windows and Mac.

“By connecting the traditional financial markets with crypto, Sologenic will bring a significant volume to the crypto markets. The role of the Sologenic ecosystem is to facilitate the trading of a wide range of asset classes such as stocks, ETFs, and precious metals using blockchain technology. Sologenic is an ecosystem where users can tokenize, trade, and spend these digital assets using SOLO cards in real-time. The ultimate goal is to make Sologenic as decentralized as possible, where CoinField’s role will be only limited to KYC and fiat ON & OFF ramping,” said CoinField’s CEO…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange