Don't Miss

Ponder: A Trusted Referral Network on The Blockchain

Without a doubt, blockchain technology is the most significant disruptor we’ve seen since the creation of the Internet. Ten years from now, we’ll look back and imagine how we ever existed without blockchain technology, the same as we do now with the Internet.

The importance of the blockchain is that it reduces the reliance on a third-party to verify transactions. Relying on another party requires trust and trust is not something we should grant lightly. Matter of fact, for most people, confidence lies only through referrals.

One platform that is at the center of all of this is Ponder. Ponder uses blockchain and gamification techniques to both generate trust among the participants and to make the process more enjoyable. By taking a mobile-first and a ‘referrer-first’ approach, Ponder helps attract more people to make referrals.

Ponder App

The first segment Ponder targets is online dating. According to a 2013 Pew Internet Survey, 54% of Americans think someone has misrepresented themselves on an online dating platform. In their survey three years later, Pew found 45% of respondents agreed that online dating was more dangerous than other ways of meeting, and for women, that figure rises to 54%, with 42% of female online daters experiencing harassment. Less than one in four eventually end up in a relationship.

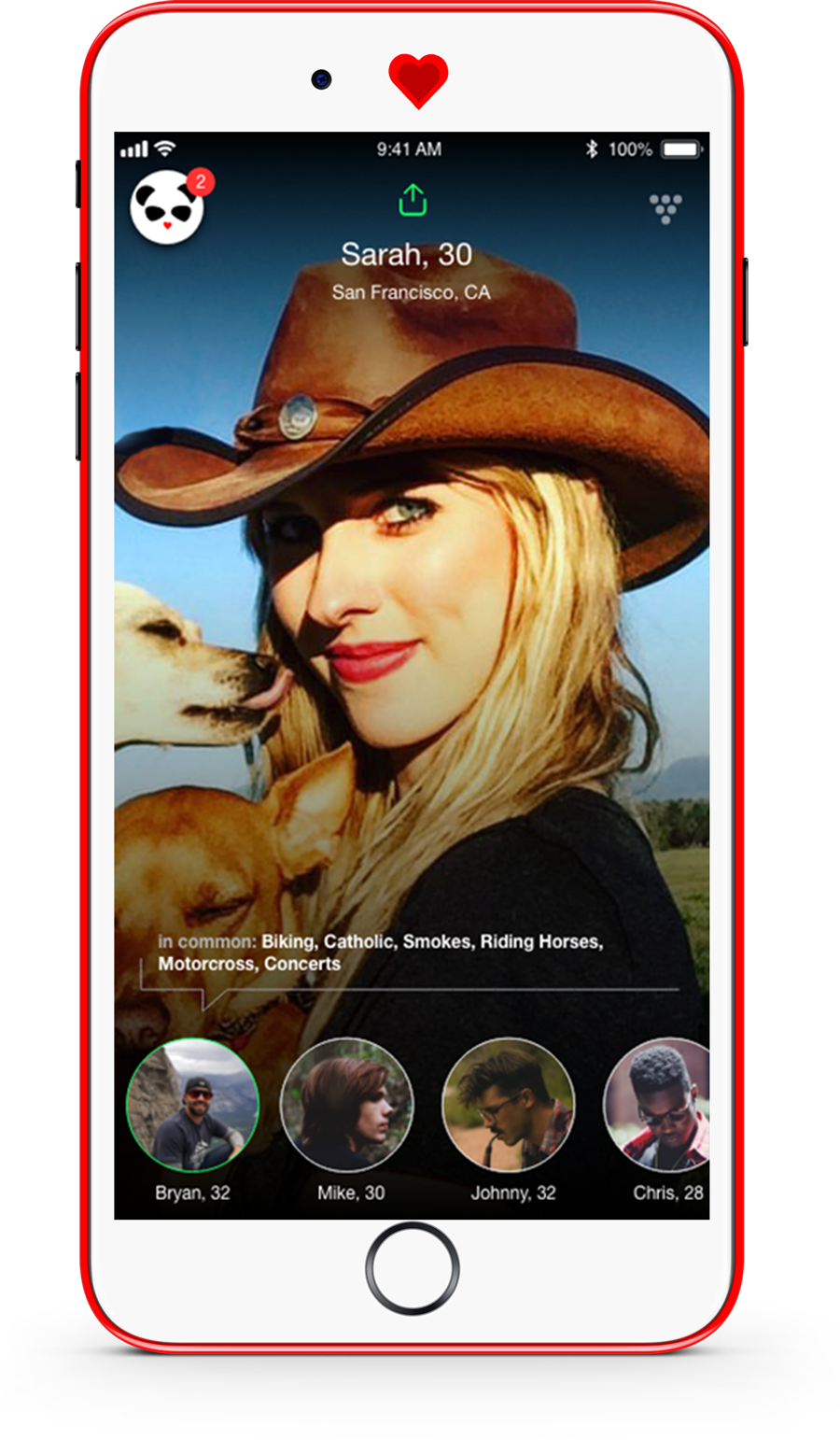

The Ponder App is already in beta and is a game for playing matchmaker where you can earn real money by making successful matches. The more great matches you make, the more money you win. For singles, Ponder gets you hand-picked matches selected by humans, not algorithms.

The Ponder App already has over 70k registered users in the US. With the app, users earn $10 if the couple that they recommend to each other become a match. If the couple marries, the matchmaker receives $1000.

Besides dating, job referrals have a higher success rate with the referral system. With Ponder, users play the game of matchmaker, matching up companies and prospective candidates from the users’ social network. Each time the company and the candidate both ‘like’ the recommendation, a match is made, and the referrer is paid. If the candidate goes on to work for the firm, then a larger bonus is paid. The referrer’s skill as a matchmaker is tracked through their match rate. Higher match rates lead to higher bonuses and access to the best referral opportunities.

Perhaps, thou, the most significant opportunity for Ponder is in trusted business referrals. Creating trust-based communities on the blockchain can help generate more business or product referrals and therefore convert more customers.

Ponder Gold Tokenomics

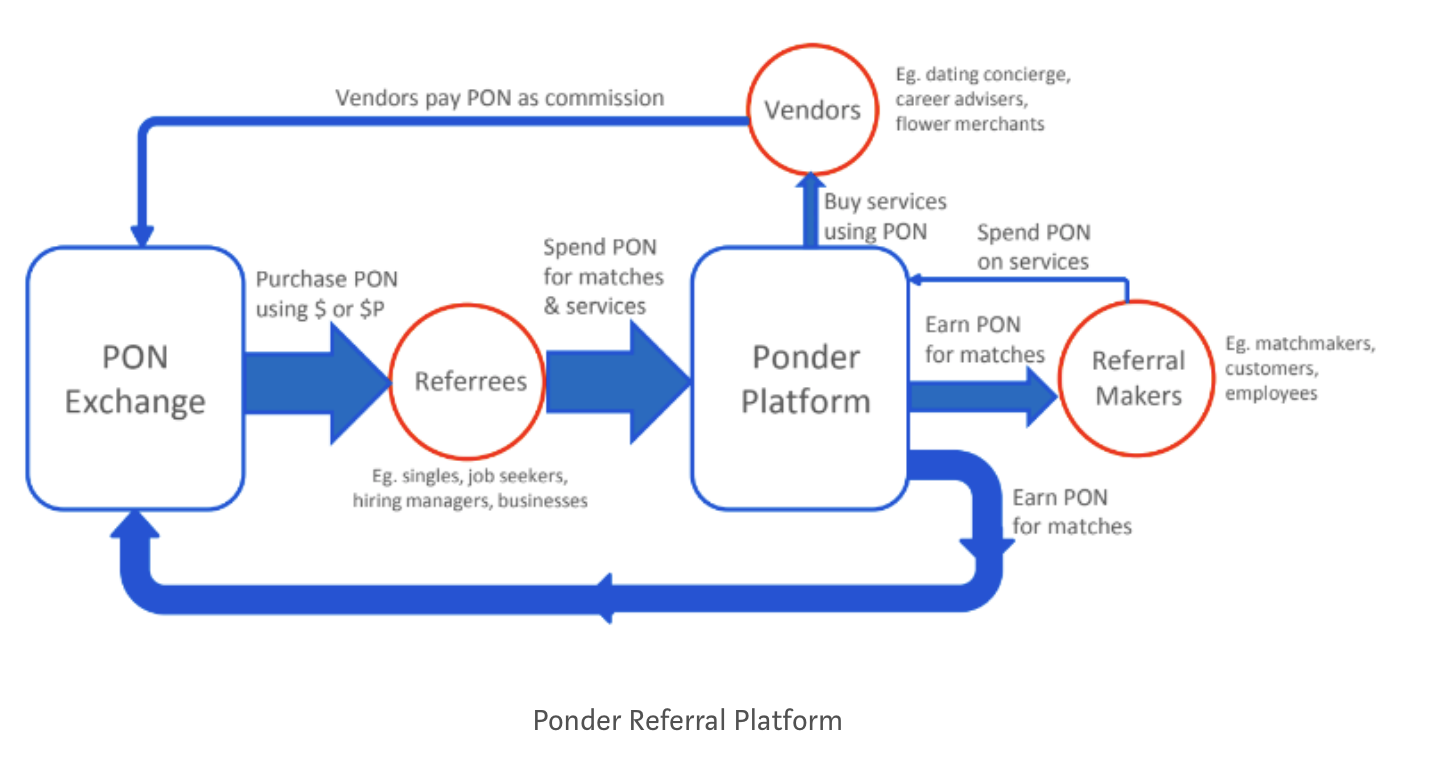

The folks at Ponder have realized that the same protocol they are using will be the basis for a “referrals on the blockchain” kind of system, using the PON token and technical mechanism. The PON token will be at the core of all referrals or matchmaking. The referrer makes PON for the successful match, and the referees pay PON for being successfully matched. With each match, a portion of the PON goes back to Ponder, which can then be resold on Ponder’s in-app exchange.

However, PON will also be used by an ecosystem of partners. Firstly, PON will be used by third party developers that create other referral verticals (investor/investee, landlord/tenant, teacher/student). Each vertical can set their own rules about reward sharing and entry fee. Ponder’s referral platform will take care of the rest and ensures those rules are not broken. For any third-party developers that build these applications on the platform, the PON token will have to be the unit of currency used.

Secondly, PON will be used by a community of vendors that will accept PON as payment for their services and will use PON for access to the platform. For example, with the dating product, Ponder has completed a deal with a concierge service where singles can use PON for the service to reserve restaurants and buy movie tickets. Those vendors would pay tokens for premium access to the Ponder platform.

Ponder Gold Token Sale

Ponder is currently conducting a private sale and the public sale starts on July 1st. Both the private and public sales are for non-US residents only. Only those on the Whitelist can buy PON, and continue until July 31st.

The hard cap of the sale has been reduced to $12 million as Ponder is also conducting a $6 million equity raise. Ponder has gotten a lot of attention in the investment community. Several notable venture capital firms and major international media companies have shown interest in participating.

With the reduction in the hard cap, the price of the token has also been reduced from $.20 to $.10. Ponder even has removed the 40% of PON tokens reserved for in-app purchases. Instead, Ponder will create a purchase-only exchange on the platform where users can buy tokens directly from the app.

Conclusion

Referrals are by far the best way to get new customers, employees, and for finding that perfect match. We believe Ponder is one of the most significant game-changing platforms to hit the blockchain space this year. With a strong team lead by CEO Manshu Agarwal and Chairman Michael Egan, PON could be one of the top token success stories in the crypto world. For more information, check out the Ponder website, Medium, and Telegram.

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Image courtesy of Ponder

Don't Miss

A Guide to Exploring the Singaporean ETF market

Singapore’s Exchange Traded Fund (ETF) market has grown, offering investors diverse investment opportunities and access to different asset classes. As the market evolves, investors must navigate these uncharted waters with a clear understanding of Singapore’s ETF landscape. This article explores the trends, challenges and strategies for navigating the Singapore ETF market. To start investing in ETFs, you can visit Saxo Capital Markets PTE.

The Singaporean ETF Market: Exponential Growth

The Singapore ETF market has seen significant growth in recent years, with an increasing number of ETFs covering a wide range of asset classes and holders. different investment topics.

One of the notable trends in the Singapore ETF market is the growing diversity of available options. Investors can now choose from ETFs that track domestic and international stock indexes, bonds, commodities, and specialist sectors or themes. This diverse range of ETFs allows investors to create comprehensive portfolios tailored to their investment goals.

The growth of the ETF market in Singapore is also due to growing investor demand for low-cost, transparent, and accessible investment vehicles. ETFs offer benefits such as intraday liquidity, real-time pricing, and the ability to trade on exchanges. These characteristics have made ETFs attractive to retail and institutional investors who want exposure to different asset classes.

Regulatory Landscape and Investor Protection

The Monetary Authority of Singapore (MAS) is the…

Don't Miss

Property Loans for Foreigners in Singapore That You Must Know About

Intending to invest in a residential or commercial property in Singapore?

When it comes to foreigners applying for a loan in Singapore, things can be pretty hard regardless of the reason whether you need the property for personal or business purposes.

In Singapore, buying a property is challenging, whether you are a foreigner or a native, and sometimes applying for a loan is the only way for you to afford it.

HOW MUCH CAN YOU BORROW FOR A PROPERTY LOAN IN SINGAPORE?

As for the Foreigner Loans, in Singapore, there is an exact amount of money you can borrow to finance the purchase of a property.

In this sense, Singapore has the Loan to Value Ratio (LTV).

The LTV ratio is what determines the exact amount of money you can borrow for a property loan, which changes depending on where you try to obtain the loan:

- If you are applying for a bank loan, you can borrow a maximum of 75% of the value of the property you want to purchase. That means if you are looking for a property that costs $500.000, the maximum amount of money a bank lender can give you like a loan in Singapore is going to be $375.000.

- When you are applying for a loan with a Housing…

Don't Miss

CoinField Launches Sologenic Initial Exchange Offering

CoinField has started its Sologenic IEO, which is the first project to utilize the XRP Ledger for tokenizing stocks and ETFs. The sale will last for one week and will officially end on February 25, 2020, before SOLO trading begins on the platform. Sologenic’s native token SOLO is being offered at 0.25 USDT during the IEO.

Earlier this month, Sologenic released the very first decentralized wallet app for SOLO, XRP, and tokenized assets to support the Sologenic ecosystem. The app is available for mobile and desktop via the Apple Store and Google Play. The desktop version is available for Windows and Mac.

“By connecting the traditional financial markets with crypto, Sologenic will bring a significant volume to the crypto markets. The role of the Sologenic ecosystem is to facilitate the trading of a wide range of asset classes such as stocks, ETFs, and precious metals using blockchain technology. Sologenic is an ecosystem where users can tokenize, trade, and spend these digital assets using SOLO cards in real-time. The ultimate goal is to make Sologenic as decentralized as possible, where CoinField’s role will be only limited to KYC and fiat ON & OFF ramping,” said CoinField’s CEO…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange