Bitcoin

Moonlite: Smart Crypto Mining through Cost-Effective & Sustainable Green Energy

It’s no secret, cryptocurrency is huge. In fact, it’s worth close to $400 billion & counting. And, has indeed come a very long way since the pioneer of crypto, Bitcoin, saw its first light in 2009.

Today, there are more than 1,500 different coins & tokens that we can choose from, trading on 190 exchanges across the globe. And, worldwide, more and more corporations, institutions and regulators are joining the mainstream movement towards digital currencies.

However, there are also many challenges. And, not the least being the high electricity consumption costs associated with crypto mining. But, Moonlite has secured one of the last green energy contracts available in the new crypto mining mecca of Iceland.

Please continue reading to see how Moonlite is well on track for opening its highly profitable crypto mining center in Iceland later this year. And, how you can become part of the success story by holding tokens in its new-generation, industrial-scale crypto-mining operation.

The high power costs of crypto mining is a dealbreaker

In an article titled “Bitcoin mining consumes more electricity a year than Ireland”, The Guardian reported during November that the bitcoin network consumes 30.14TWh a year; which, not only exceeds the usage of Ireland but also that of 19 other European countries, it says.

The article further explains how the bitcoin miners are responsible for verifying transactions made with the cryptocurrency, also to protect the system against fraud, as Bitcoin is a decentralized network where “no centralized authority” exists to confirm ledger entries.

During the process of validating network transactions, miners use specialized computers to solve computing problems which demand high electricity usage, The Guardian writes. And, miners receive compensation for their services by means of a “reward”, paid in bitcoins.

“Each individual bitcoin transaction uses almost 300KWh of electricity – enough to boil around 36,000 kettles full of water”, the article continues. And, by comparison, the Visa credit card company’s data centers, which process 200 million transactions daily, only use 2% of the electricity that the bitcoin network does, even while Bitcoin processes fewer than 350,000 transactions per day, it says.

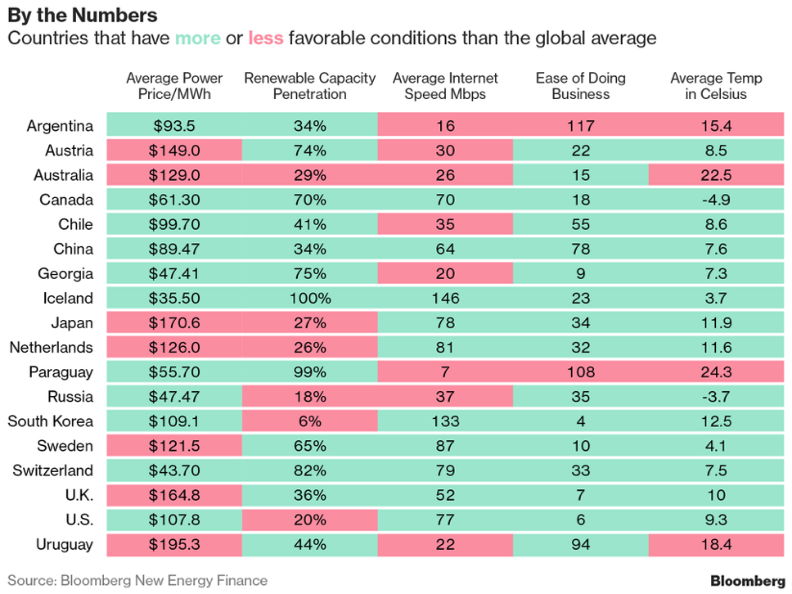

With reference to the above table from the Bloomberg Technology website, the electricity costs in countries like the US, Japan, UK and South Korea vary between $107-$170 MWh.

As noted earlier, bitcoin transactions consume 300KWh or 0.3 MWh each. This means that the electricity cost per transaction equates to between $32 and $51 for the countries mentioned.

When the cost of power represents such a high input expense to crypto mining enterprises, it can be appreciated that the profitability of such operations is under extreme pressure.

This barrier to entry is a major factor that prevents new miners from entering the market and it forces non-profitable, existing entities to cease their activities.

The solution – affordable and sustainable green energy

In its February article titled “How Iceland became the bitcoin miners’ paradise”, The Guardian explains that it’s all about “location, location, and volcanoes”.

It continues to explain how the island’s magma-fueled power plants harness the power of geothermal energy –from the volcanoes- to generate a cheap and abundant form of renewable energy.

The abundance of the natural source in Iceland is driving down the cost of power on the island. This, in turn, is ideal for the miners of cryptocurrencies, who are able to make higher profits as they run their computers 24/7, 365 days a year, the article says.

Iceland is also extremely water-rich, a resource which is stored naturally in ice caps and underground. Through nature’s spontaneous melting processes, it creates a constant and regular flow of water which is harnessed by hydroelectric power stations on the island. Hydro provides the majority of Iceland’s electricity needs, the country’s National Energy Authority says.

And, another stakeholder, the National Power Company of Iceland is further busy with the development of a network of wind turbines on the island in a project which they dubbed “Energy from the fresh air”. There are a number of areas in Iceland that show great potential for the successful utilization of wind energy, the company says.

Also, the country’s location at the northernmost tip of the Mid-Atlantic Ridge provides a further benefit in that the cool “Arctic air reduces the need to invest in expensive air-conditioning for the server rooms – crucial, since the specialised chips used to mine most cryptocurrencies produce huge amounts of heat when running at their maximum efficiency”, writes The Guardian.

Moonlite turns green energy into profits

Moonlite is proud to announce that it is one of the last commercial enterprises to be awarded an energy contract in the Keflavik area of Iceland, which will ensure the uninterrupted and large-scale supply of naturally produced, low-cost electricity to its operations.

https://www.youtube.com/watch?v=18GSJmu1T3k

Iceland’s authorities, energy, and utility companies receive countless inquiries and applications from around the world, submitted by crypto mining operators and data centers wishing to establish themselves on the island.

However, although entry requirements are stringent and a large percentage of the applicants fail to comply thereto, the energy-supply infrastructure for large-scale commercial contracts in the area has reached its capacity and Moonlite is one of the last enterprises to be awarded such a contract.

It will take many years for the energy infrastructure –notably the electricity links from Reykjavik to Keflavik- to catch up and in the meantime, Moonlite will enjoy a low-competition environment which will greatly enhance its overall profitability.

Moonlite has successfully secured and locked in all the necessary contracts & guarantees for operations in the Keflavik area–also the purchase of real estate- and its progress is well on track to commence business later this year.

More information on the Data Centre Construction and Total Contributions to Date is available on the Moonlite website.

With its focus on industrial-scale crypto mining –predominantly Bitcoin, Bitcoin Cash, DASH & Litecoin- Moonlite is destined to be the largest miner in Iceland, as the key competitors are increasingly following the data-center business model, thereby renting out their facilities and not focusing directly on mining per se.

The Moonlite Project employs the latest technology –see Mission Statement– world-class people and an unprecedented Value Offering To All Investors to ensure a superior return on investment.

A key factor for highly profitable crypto mining operations is access to cheap electricity resources. Moonlite has contractually secured such supply –as described earlier- and will enjoy the benefits of Iceland’s plentiful natural resources in that regard.

Electricity costs in Iceland do not even equal 25% of the energy bills in some of the other leading crypto countries’ e.g. Japan. Please refer to the electricity tariff table further above for a detailed comparison between the various countries.

The Moonlite Project is therefore perfectly geared for highly profitable operations. More information on Moonlite’s Anticipated Investment Returns is available on pg. 27 of the whitepaper. And, a full Investor Pack may be obtained by means of the website.

MNL Token & ICO

Moonlite presents investors with an opportunity to hold a token in a new-generation, highly lucrative, industrial-scale crypto-mining operation that is focused on efficiency by employing low cost and clean energy sources, also artificial intelligence and custom algorithms.

The MNL token is issued by means of Ethereum Smart Contract and entitles investors to share in 35% of Moonlite profits.

Moonlite’s Initial Coin Offering (ICO) is currently underway and ends on 22 March 2018. Investors may participate in the ICO on the Get Tokens page of the Moonlite website.

Full MNL token Facts are also available on the website. And, on pages 19-21 of the Moonlite whitepaper. Participants may further sign up for the Bounty program on the website.

MNL tokens will be available for trading on open cryptocurrency exchanges after the ICO.

Management, Roadmap & Milestones

Moonlite follows a policy of employing only the best operational teams to oversee and maintain the effective operations of its data centers. The Simplified Team Structure is outlined on pages 13-14 of the whitepaper.

And, “We are very selective of who we invite to be part of our team, and only engage with the best talent”, Moonlite say. Therefore, the enterprise has the most skilled, experienced and qualified management team & board of advisers.

Further information is available under Our Team & Advisors on the website, also on pages 22-24 of the Moonlite whitepaper.

The Moonlite journey started in 2017 and is fully mapped out up to and until the opening of the Data Center on 1 August 2018. The Milestones can be viewed on the website. Further information on the Operational Plan can also be viewed on pages 15-17 of the Moonlite whitepaper.

Conclusion

Cryptocurrencies and crypto mining are here to stay and busy picking up vast global momentum as we speak.

As is the case with any nascent industry, there are always countless early-movers wishing to take advantage of an imminent rise. And, crypto is no different. Many crypto miners have tried but eventually gave up due to prohibitive costs such as electricity.

This has vastly widened the scope and availability of great market opportunities for serious participants, such as Moonlite, who are in it for the long haul.

Through careful and brilliant strategic planning –such as basing its operations in Iceland- Moonlite is sure to leverage the potential of highly profitable crypto activities for the benefits of its investors in many years to come.

The reasons listed under Why Choose The Moonlite Project on page 26 of the whitepaper is a sure testament to the outlook for Moonlite and its investors for ongoing success in the cryptocurrency industry.

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Image courtesy of Alessio Maffeis via Flickr

Bitcoin

Bitcoin Price Dumps Below $41,000 Amid Uncertainty

Bitcoin price dumped hard on Monday, briefly slipping below $41,000, erasing gains recorded in the previous week. The premier cryptocurrency seems to have exhausted its recent rally propelled by industry vulnerabilities. At the time of writing, the world’s largest cryptocurrency was trading slightly lower at $41,385. Bitcoin’s total market cap has dipped by 2% over the past day, while the total volume of BTC tokens traded over the same period climbed by 58%.

Fundamentals

Bitcoin price has been facing retracements and a rollercoaster over the past few days after recently rocketing to a 20-month peak. On-chain data has suggested that many investors used the opportunity to take some profits, leading to a decline in the asset’s price.

Bitcoin’s price slump is mirrored in the wider crypto market, with the global crypto market cap decreasing by 1.85% over the past 24 hours to $1.55 trillion. The total crypto market volume has increased by 32% over the same period. The Crypto Fear and Greed Index has plunged from a level of extreme greed to a greed level of 70, suggesting a decline in risk appetite.

Ethereum, the largest altcoin by market capitalization, is currently trading at $2,167, down almost 3% for the day. Meme coins have been hit hard by the market slump, with Dogecoin and Shiba Inu down by more than 4% over the last day.

Last week on Thursday, cryptocurrency experts took notice of…

Bitcoin

Bitcoin Price is in Consolidation Mode Despite Market Optimism Post-Fed Decision

Bitcoin price edged lower on Thursday despite optimism in wider markets on the back of the Fed’s interest rate decision. The flagship cryptocurrency has been consolidating above the critical level of $42,000 after briefly topping $44,000, its highest level in 20 months. Bitcoin was trading 0.71% lower at $42,569 at press time. BTC’s total market cap has increased by more than 3% over the last day to $832 billion, while the total volume of the asset traded over the same period jumped by 22%.

Economic Outlook

Bitcoin price has been trading sideways over the past few days, suggesting a pause in its recent rally towards $45,000. The premier cryptocurrency has decreased by 4% in the past week but remains 15.22% higher in the month to date. The digital asset has staged a significant recovery this year after a torrid 2022 in which a string of scandals, including the collapse of FTX, led to a market meltdown, undermining the credibility of the sector.

The crypto market has been buoyed by the Fed’s latest interest rate decision. The US Federal Reserve on Wednesday held its key interest rate unchanged for the third consecutive time, in line with market expectations. With the easing of the inflation rate, members of the Federal Open Market Committee (FOMC) voted to keep the benchmark overnight borrowing rate in a targeted range between 5.25%-5.5%.

Additionally, the central bank indicated that three rate…

Bitcoin

Bitcoin Price Blasts $44K in Spectacular Surge as Spot Bitcoin ETF Approval Looms Large

Bitcoin price has been hovering above the $43,000 psychological level over the past two days amid anticipation about the potential approval of a spot bitcoin ETF. The flagship cryptocurrency has climbed more than 16% in the past week and nearly 170% in the year to date. Bitcoin’s total market cap has increased by nearly 5% over the past 24 hours to $858.9 billion, while the total volume of the token traded rose by 43%. The Bitcoin price was trading at $43,914 at press time.

Fundamentals

Bitcoin price has posted significant gains over the past few days, climbing to its highest level since April 2022, before the crash of a stablecoin that started a litany of company failures, pummeling crypto prices. The world’s largest cryptocurrency briefly topped the crucial level of $44,000 on Wednesday amid rising momentum despite being massively overbought.

According to analysts, with no spot bitcoin ETF approvals yet and the halving event five to six months away, the market is riding on FOMO. Capital has been flowing in the Bitcoin market amid enthusiasm that the launches of spot ETF will bring in billions of dollars of new investment into the crypto sector.

Investors have already started providing capital as seed money for ETF products. Notably, a recent report by CoinDesk showed that the world’s largest fund manager, BlackRock, received $100,000 in capital from a seed investor for its spot bitcoin exchange-traded fund…

-

Blogs7 years ago

Blogs7 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs7 years ago

Blogs7 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs7 years ago

Blogs7 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs7 years ago

Blogs7 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss7 years ago

Don't Miss7 years agoRipple’s five new partnerships are mouthwatering

-

Blogs7 years ago

Blogs7 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs7 years ago

Blogs7 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs7 years ago

Blogs7 years agoIs Litecoin (LTC) Changing Its Game Plan By Going For Mass Adoption?