Don't Miss

SEC Compliant TopiaCoin Completes SAFT, Opening Blockchain Security to Accredited Investors

TopiaCoin began making noise earlier this year when it unveiled development of a military-grade security layer for blockchains, pioneering total data security amidst a wave of data scandals hitting major companies — from Facebook to Equifax. Since the team has delivered on its earliest roadmap commitments and has opened its doors to private investors.

What’s more, the security token is one of the few projects that is prioritizing security and legitimacy by protecting its investors by completing a Simple Agreements for Future Tokens (SAFT), becoming fully SEC compliant.

Let’s take a quick look at what TopiaCoin is doing to pioneer data security for blockchains, and what the SAFT agreement means for investors.

A Security Layer for Protecting Peer-to-Peer Transactions and dApps

The team behind TopiaCoin’s revolutionary security layer have a history of developing security solutions for some of today’s most sensitive and high-level clients — including the US military.

Janine Terrano, the CEO of Topia Technology, is a seasoned executive with a demonstrated history of leading cybersecurity experts to protect and maintain network security.

Janine Terrano is now bringing her expertise, along with other notable industry leaders (including Stan Larimer, founder of the BitShares and EOS blockchains) to build the TopiaCoin network and Secure Data File Sharing (SDFS).

Terrano explains, “The TopiaCoin ICO is the first step towards a truly game-changing moment in data security to address the crisis large companies, governments, and individuals face today.”

Protecting Users’ and Developers’ Data

TopiaCoin’s SDFS network uses patented technology that shreds and encrypts data that is associated with the blockchain. It’s the very first secure network to offer targeted data security between two distinct peers.

Although many blockchain based solutions offer decentralization and encryption as a basis for data security, only Topia offers a data security layer that secures specific data transactions between two persons.

For example, Topia’s network empowers peers to protect specific transactions between you and another person, be it a legal document, medical records, or other sensitive information.

The SDFS network empowers users to:

- Send and receive sensitive information in a secure, immutable, decentralized way

- Establish private workspaces that can be used to share information with multiple peers

- Send and receive secure messages — without a centralized network

“Today, there is no real data security for blockchain-based applications and there is a huge need in the marketplace for a security layer,” says Stan Larimer, founder of BitShares and Advisor to TopiaCoin.

Larimer goes on to say, “TopiaCoin will be the first to market with military-grade security and this will bring great value to the blockchain and BitShares community.”

Protecting Investors with SAFT and Regulatory Compliance

Last year’s ICO craze (which raised over $4b in funding for cryptocurrency projects) has sparked widespread scrutiny in projects that have swindled investors and caused alarm for the crypto space — prompting SEC probes into the space like never before.

TopiaCoin recognized this early on — and has taken great efforts to protect its investors by maintaining total SEC compliance and working with law firm Wilson Sonsini Goodrich & Rosati, to complete its Simple Agreements for Future Tokens (SAFT).

A SAFT agreement is a legally binding agreement between a cryptocurrency company and its investors. Here’s how it works:

- Investors buy the rights to tokens that will be released

- The tokens are issued to investors when the company’s service is launched

- When the project is complete, investors receive tokens

- In many cases, these tokens become much more valuable as they are used to transact for services on the blockchain

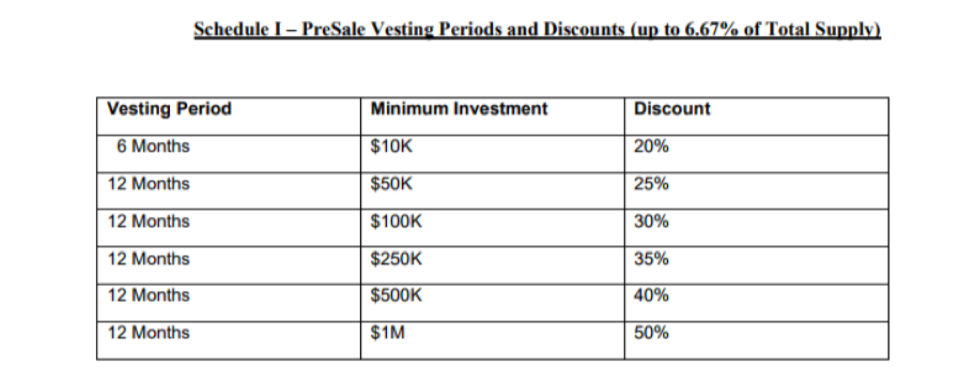

The SAFT agreement legally opens the door to accredited investors— opening a special opportunity for those interested in getting involved in the project early at pre-ICO prices.

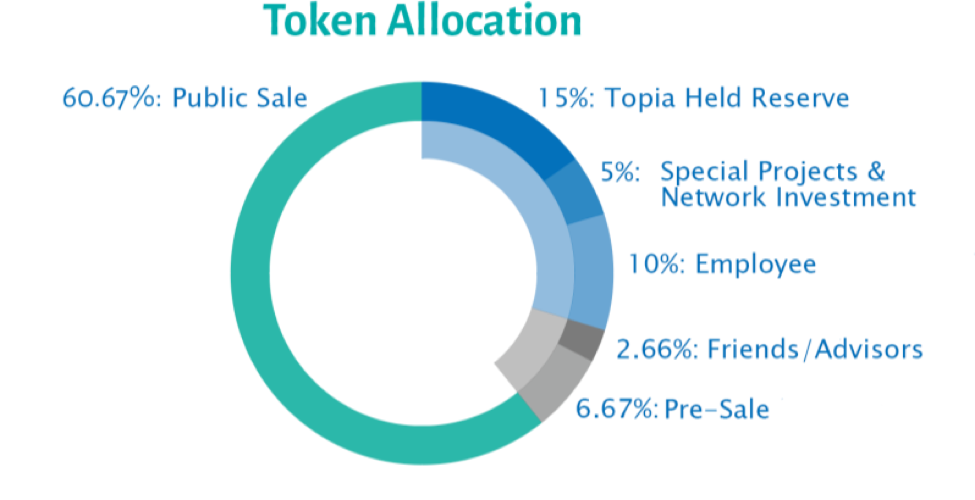

TopiaCoin’s Token Sale

For those interested in getting involved with TopiaCoin, there is currently a private presale which will be followed by a public token sale.

Here are some of the details:

- 300 million total supply

- 210 million available for the public sale (60.67%)

- 67% reserved for pre-sale

- Presale discounts and contribution bonuses are available

- Token prices may increase during the public sale

As always, do your own diligence and research before investing. If you want to learn more about TopiaCoin, check out the following links below.

Accredited investors can apply using the SAFT agreement here: https://topiacoin.io/SAFT.pdf

View the token sale document here: https://topiacoin.io/Economics.pdf

TopiaCoin’s website: https://topiacoin.io/

Whitepaper: https://topiacoin.io/SDFS.pdf

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Don't Miss

A Guide to Exploring the Singaporean ETF market

Singapore’s Exchange Traded Fund (ETF) market has grown, offering investors diverse investment opportunities and access to different asset classes. As the market evolves, investors must navigate these uncharted waters with a clear understanding of Singapore’s ETF landscape. This article explores the trends, challenges and strategies for navigating the Singapore ETF market. To start investing in ETFs, you can visit Saxo Capital Markets PTE.

The Singaporean ETF Market: Exponential Growth

The Singapore ETF market has seen significant growth in recent years, with an increasing number of ETFs covering a wide range of asset classes and holders. different investment topics.

One of the notable trends in the Singapore ETF market is the growing diversity of available options. Investors can now choose from ETFs that track domestic and international stock indexes, bonds, commodities, and specialist sectors or themes. This diverse range of ETFs allows investors to create comprehensive portfolios tailored to their investment goals.

The growth of the ETF market in Singapore is also due to growing investor demand for low-cost, transparent, and accessible investment vehicles. ETFs offer benefits such as intraday liquidity, real-time pricing, and the ability to trade on exchanges. These characteristics have made ETFs attractive to retail and institutional investors who want exposure to different asset classes.

Regulatory Landscape and Investor Protection

The Monetary Authority of Singapore (MAS) is the…

Don't Miss

Property Loans for Foreigners in Singapore That You Must Know About

Intending to invest in a residential or commercial property in Singapore?

When it comes to foreigners applying for a loan in Singapore, things can be pretty hard regardless of the reason whether you need the property for personal or business purposes.

In Singapore, buying a property is challenging, whether you are a foreigner or a native, and sometimes applying for a loan is the only way for you to afford it.

HOW MUCH CAN YOU BORROW FOR A PROPERTY LOAN IN SINGAPORE?

As for the Foreigner Loans, in Singapore, there is an exact amount of money you can borrow to finance the purchase of a property.

In this sense, Singapore has the Loan to Value Ratio (LTV).

The LTV ratio is what determines the exact amount of money you can borrow for a property loan, which changes depending on where you try to obtain the loan:

- If you are applying for a bank loan, you can borrow a maximum of 75% of the value of the property you want to purchase. That means if you are looking for a property that costs $500.000, the maximum amount of money a bank lender can give you like a loan in Singapore is going to be $375.000.

- When you are applying for a loan with a Housing…

Don't Miss

CoinField Launches Sologenic Initial Exchange Offering

CoinField has started its Sologenic IEO, which is the first project to utilize the XRP Ledger for tokenizing stocks and ETFs. The sale will last for one week and will officially end on February 25, 2020, before SOLO trading begins on the platform. Sologenic’s native token SOLO is being offered at 0.25 USDT during the IEO.

Earlier this month, Sologenic released the very first decentralized wallet app for SOLO, XRP, and tokenized assets to support the Sologenic ecosystem. The app is available for mobile and desktop via the Apple Store and Google Play. The desktop version is available for Windows and Mac.

“By connecting the traditional financial markets with crypto, Sologenic will bring a significant volume to the crypto markets. The role of the Sologenic ecosystem is to facilitate the trading of a wide range of asset classes such as stocks, ETFs, and precious metals using blockchain technology. Sologenic is an ecosystem where users can tokenize, trade, and spend these digital assets using SOLO cards in real-time. The ultimate goal is to make Sologenic as decentralized as possible, where CoinField’s role will be only limited to KYC and fiat ON & OFF ramping,” said CoinField’s CEO…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange