Don't Miss

BUFF Wants to Monetize Gamers’ Playing Time

The blockchain revolution has reached most of the economic sectors, and gamers didn’t want to stay aloof from it. BUFF, a young startup founded in 2017, wants to leverage the disruptive technology for a loyalty platform for gamers. The team intends to launch a new token that will represent a standard currency across various gaming brands. Thus, gamers will do what they enjoy the most while earning tokens as rewards. The BUFF coin will fuel a decentralized ecosystem for gamers, who will be able to obtain it by playing any of thousands of games, from Cash Royal to Dota2 and from FIFA series to League of Legends.

The BUFF Ecosystem

Gaming is one of the largest industries out there as the market has evolved at a fast pace since its early days in the 90s. Now it represents a $116 billion industry with a third of the world population acting as users. The market is demonstrating a ten percent annual growth. There are countless gaming brands covering different themes and categories, and BUFF aims to create a standard coin to be used and earned by playing any of those games.

The BUFF platform will act as a loyalty system. In other words, BUFF wants to be for the gaming industry what Star Alliance is currently for the airline industry. The latter is a loyalty system or alliance that connects 27 full members and 40 affiliates, among which one can find Lufthansa, Air Canada, and Hilton Hotels & Resorts.

The BUFF’s ecosystem will revolve around four main groups:

- Gamers– this is by far the largest group. Gamers will be able to earn BUFF coins and redeem these for digital items.

- Game asset traders– they will have access to a trading platform where they can find entities that interested in buying large volumes of digital items.

- Game developers/publishers– they will use the BUFF platform as a way to promote their new games and increase the in-app purchases.

- Legacy sponsors– they will have the opportunity to promote their brands within BUFF’s ecosystem.

The BUFF ecosystem will help game publishers better connect with gamers and create communities. The platform will benefit both gamers and publishers as it provides a transparent and secure method of interaction based on the blockchain technology.

For gamers, this will be a great way to monetize their playing time. They can join the BUFF ecosystem through their smartphone or desktop app and just enjoy playing. The application will monitor the gamers’ activities within every game. Based on the achievements, gamers will see new BUFF coins added to their platform accounts. They can redeem their coins by purchasing digital items or even by unlocking new levels in their games. It’s much more convenient to spend your pre-earned tokens to unlock new levels rather than spend your hard-worked money.

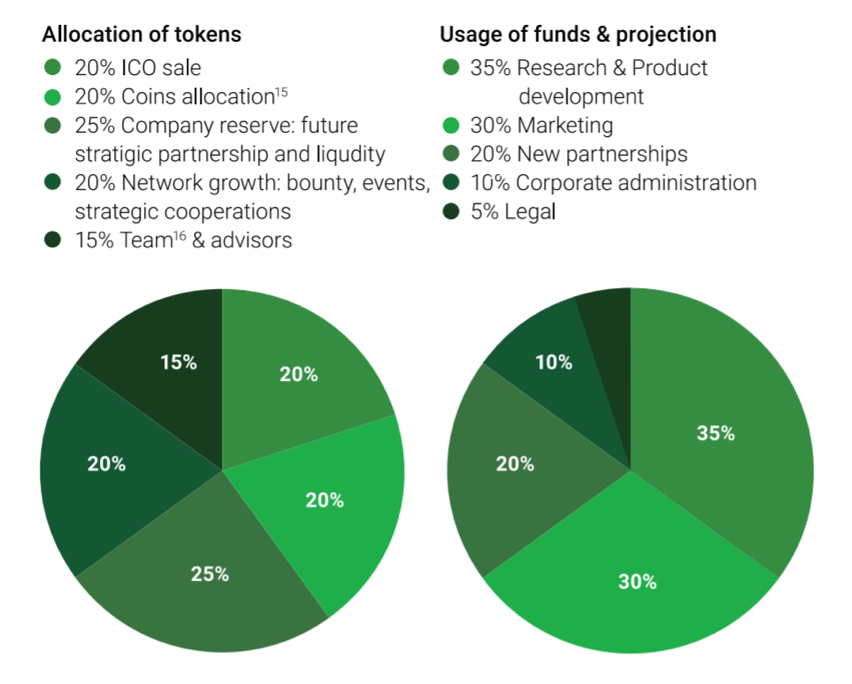

BUFF Token Sale

To build its platform and create the largest gaming ecosystem and community, the BUFF team plans to conduct an initial coin offering (ICO) to raise $30 million. The soft cap target is $6 million.

During the token sale event, the team will distribute its BUFF coin, which is an ERC20 token, suggesting that it is based on Ethereum and operates with smart contracts. The total supply of tokens is 300 million, with 20% of it being reserved for the ICO event.

There has been a private sale of BUFF coins, which started in April 2018. The public ICO is planned for August 2018, and the token will be launched in September 2018.

Those who want to invest in BUFF tokens should know that the first days of the public sale come with generous bonuses. Thus, if you choose to invest in the first day of the ICO, you can get a 10% discount. Also, a 7% bonus will be available on the second day, and a 5% bonus can be claimed on the third day. Once the fourth day starts, investors will have to pay the full price set for the ICO event.

However, even in the later days, you can still enjoy great bonuses when you invest higher amounts of crypto funds. Thus, you can get a 10% bonus if you investat least 25 ETH, a 15% bonus if you depositno less than 50 ETH, and a 20% bonus if you investmore than 100 ETH.

Investors can buy BUFF coins with Bitcoin, Ethereum, euro, and UK pound. Note that investors should pass through KYC and AML processes before making the transactions.

BUFF’s Prospects

Given that gaming is one of the largest industries, it seems that BUFF has already guaranteed its success, as it will integrate with most of the major gaming brands, including the top 10 most played games that have reached 1.4 billion users. However, much will depend on the team’s approach and the implementation of the steps stipulated in the roadmap. BUFF has recently partnered with Overwolf, a leading gaming developer of apps, including overlay apps. It has over 200 applications in its free App Store. The firm now runs a large gaming community that comprises 15 million monthly active users. Thus, BUFF is already in the right direction, as its loyalty system already integrates into Overwolf’s ecosystem.

After the ICO ends, a beta version of the platform will go live for six months. Then, in 2019, gamers can access all the features of the platform, which will also add more game brands. In 2020, the BUFF team plans to reach gaming consoles like PlayStation and Xbox.

The BUFF token price will depend on the supply/demand ratio after it gets launched. Investors will be able to convert BUFF to other tokens on crypto exchanges. For more information, check out the BUFF website and white paper.

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Image courtesy of Pexels

Don't Miss

A Guide to Exploring the Singaporean ETF market

Singapore’s Exchange Traded Fund (ETF) market has grown, offering investors diverse investment opportunities and access to different asset classes. As the market evolves, investors must navigate these uncharted waters with a clear understanding of Singapore’s ETF landscape. This article explores the trends, challenges and strategies for navigating the Singapore ETF market. To start investing in ETFs, you can visit Saxo Capital Markets PTE.

The Singaporean ETF Market: Exponential Growth

The Singapore ETF market has seen significant growth in recent years, with an increasing number of ETFs covering a wide range of asset classes and holders. different investment topics.

One of the notable trends in the Singapore ETF market is the growing diversity of available options. Investors can now choose from ETFs that track domestic and international stock indexes, bonds, commodities, and specialist sectors or themes. This diverse range of ETFs allows investors to create comprehensive portfolios tailored to their investment goals.

The growth of the ETF market in Singapore is also due to growing investor demand for low-cost, transparent, and accessible investment vehicles. ETFs offer benefits such as intraday liquidity, real-time pricing, and the ability to trade on exchanges. These characteristics have made ETFs attractive to retail and institutional investors who want exposure to different asset classes.

Regulatory Landscape and Investor Protection

The Monetary Authority of Singapore (MAS) is the…

Don't Miss

Property Loans for Foreigners in Singapore That You Must Know About

Intending to invest in a residential or commercial property in Singapore?

When it comes to foreigners applying for a loan in Singapore, things can be pretty hard regardless of the reason whether you need the property for personal or business purposes.

In Singapore, buying a property is challenging, whether you are a foreigner or a native, and sometimes applying for a loan is the only way for you to afford it.

HOW MUCH CAN YOU BORROW FOR A PROPERTY LOAN IN SINGAPORE?

As for the Foreigner Loans, in Singapore, there is an exact amount of money you can borrow to finance the purchase of a property.

In this sense, Singapore has the Loan to Value Ratio (LTV).

The LTV ratio is what determines the exact amount of money you can borrow for a property loan, which changes depending on where you try to obtain the loan:

- If you are applying for a bank loan, you can borrow a maximum of 75% of the value of the property you want to purchase. That means if you are looking for a property that costs $500.000, the maximum amount of money a bank lender can give you like a loan in Singapore is going to be $375.000.

- When you are applying for a loan with a Housing…

Don't Miss

CoinField Launches Sologenic Initial Exchange Offering

CoinField has started its Sologenic IEO, which is the first project to utilize the XRP Ledger for tokenizing stocks and ETFs. The sale will last for one week and will officially end on February 25, 2020, before SOLO trading begins on the platform. Sologenic’s native token SOLO is being offered at 0.25 USDT during the IEO.

Earlier this month, Sologenic released the very first decentralized wallet app for SOLO, XRP, and tokenized assets to support the Sologenic ecosystem. The app is available for mobile and desktop via the Apple Store and Google Play. The desktop version is available for Windows and Mac.

“By connecting the traditional financial markets with crypto, Sologenic will bring a significant volume to the crypto markets. The role of the Sologenic ecosystem is to facilitate the trading of a wide range of asset classes such as stocks, ETFs, and precious metals using blockchain technology. Sologenic is an ecosystem where users can tokenize, trade, and spend these digital assets using SOLO cards in real-time. The ultimate goal is to make Sologenic as decentralized as possible, where CoinField’s role will be only limited to KYC and fiat ON & OFF ramping,” said CoinField’s CEO…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange