Don't Miss

Nebulas Releases “Nebulas Rank Yellow Paper” to Help Users Accurately Assess Blockchain Data

At the end of June, Nebulas Research made its Nebulas Rank Yellow Paper public. The document discusses a value ranking mechanism that is used to assess the importance and relevance degree of blockchain members and elements. The algorithm represents an important research achievement for implementing search index ranking and value assessment in a distributed ledger technology (DLT) infrastructure. Nebulas Rank is the first multi-dimensional value ranking instruments created for DLTs. The tool can measure the value of apps and information by taking into account liquidity and propagation of application-based addresses and smart contracts.

What is Nebulas Rank?

Nebulas Rank is one of the key elements of the Nebulas Framework, along with Nebulas Force, Developer Incentive Protocol, Proof of Devotion (PoD) Consensus Algorithm, and the search engine tool for decentralized apps (Dapps). Nebulas aims to combine these elements to build a next-generation blockchain platform. In fact, the Global Public Chain Technology Assessment Index provided by the CCID Research Institute ranks Nebulas as the sixth best blockchain project. The ranking was published in mid-June 2018 by China’s Ministry of Industry and Information Technology.

Nebulas Rank is a revolutionary product that aims to sort out the huge data flow through blockchains. The algorithm’s principle is somewhat similar to Google’s PageRank, and it measures various parameters, such as speed, liquidity, width and depth of a blockchain capital to come up with a fair ranking for the users. Thus, developers can easily discover and measure value in the DLT ecosystem. Nebulas Rank allows the assessment of each user, decentralized application, and smart contract. The obtained data can then be applied in recommendation, advertising, and other areas.

The value assessment with Nebulas Rank is carried out based on three major dimensions:

- Liquidity– it refers to the frequency and scale of blockchain transactions. More transactions along with larger transaction scale generate a higher liquidity figure.

- Propagation– the second dimension refers to the scope and depth of asset liquidity. The propagation property, which includes the scope, speed, and depth of data transmission, is a significant index demonstrating the quality of the network and its expansion potential.

- Interoperability– the interaction between Dapps, users, and smart contracts constitutes the third dimension of the ranking system proposed by Nebulas.

What Does the Nebulas Rank Yellow Paper Discuss?

The Yellow Paper touches upon Nebulas Rank algorithm separately from Nebulas’ other elements. Nebulas Rank was first introduced last year in the technical white paper, but the Yellow Paper comes with more details on how the mechanism works and how the information and transactions within a blockchain system are valued.

The Yellow Paper represents a milestone that follows the recent launch of the Nebulas Mainnet, referred to as 1.0 Eagle Nebula. The paper shows the team’s readiness to become a major player in the blockchain space by providing DLT-based value discovery solutions.

The Nebulas Rank Yellow Paper has been developed by Nebulas Research’s team of talents, which has relied on in-depth research and practical experimentation. The team comprises experts from various areas, such as blockchain, computer science, and cryptography among others. We speak about doctors from leading universities like Huazhong University of Science and Technology or Tsinghua University.

The publication of the Yellow Paper suggests that Nebula Rank has officially entered the implementation phase after it was successfully tested. Now the work on Eagle Nebula 2.0 has started.

The Nebulas Rank Yellow Paper, published on June 30, was also announced by Nebulas via a medium blog post.

According to the announcement, the Yellow Paper discusses a dual taxonomy of Nebulas Rank algorithm: Core Nebulas Rank and Extended Nebulas Rank. The first one revolves around two factors, which are “the median value of assets of a factor account over a certain period of time” and “measures of the degree of access of the account within a certain period of time.” The second one provides various calculation techniques for the value scales of different apps in a DLT ecosystem.

The document also discusses the manipulation-resistance of Core Nebula Rank. The value measurement algorithm is using specific methods to detect manipulation attacks from entities who want to mislead the system to obtain benefits.

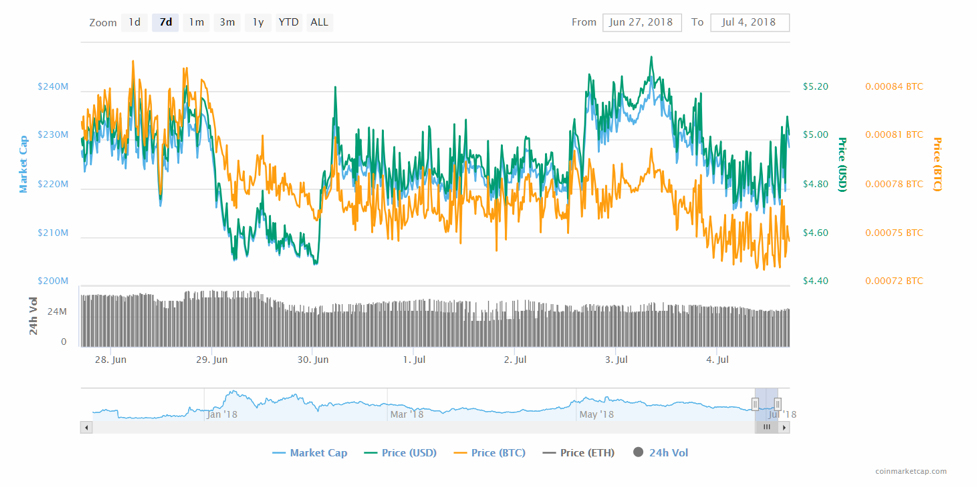

source: coinmarketcap.com

Nebulas token price positively reacted to the news on the Yellow Page publication. On June 30, the NAS token rose from $4.50 to $5.22 and is currently fluctuating at around $5.00.

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Image courtesy of Nebulas

Don't Miss

A Guide to Exploring the Singaporean ETF market

Singapore’s Exchange Traded Fund (ETF) market has grown, offering investors diverse investment opportunities and access to different asset classes. As the market evolves, investors must navigate these uncharted waters with a clear understanding of Singapore’s ETF landscape. This article explores the trends, challenges and strategies for navigating the Singapore ETF market. To start investing in ETFs, you can visit Saxo Capital Markets PTE.

The Singaporean ETF Market: Exponential Growth

The Singapore ETF market has seen significant growth in recent years, with an increasing number of ETFs covering a wide range of asset classes and holders. different investment topics.

One of the notable trends in the Singapore ETF market is the growing diversity of available options. Investors can now choose from ETFs that track domestic and international stock indexes, bonds, commodities, and specialist sectors or themes. This diverse range of ETFs allows investors to create comprehensive portfolios tailored to their investment goals.

The growth of the ETF market in Singapore is also due to growing investor demand for low-cost, transparent, and accessible investment vehicles. ETFs offer benefits such as intraday liquidity, real-time pricing, and the ability to trade on exchanges. These characteristics have made ETFs attractive to retail and institutional investors who want exposure to different asset classes.

Regulatory Landscape and Investor Protection

The Monetary Authority of Singapore (MAS) is the…

Don't Miss

Property Loans for Foreigners in Singapore That You Must Know About

Intending to invest in a residential or commercial property in Singapore?

When it comes to foreigners applying for a loan in Singapore, things can be pretty hard regardless of the reason whether you need the property for personal or business purposes.

In Singapore, buying a property is challenging, whether you are a foreigner or a native, and sometimes applying for a loan is the only way for you to afford it.

HOW MUCH CAN YOU BORROW FOR A PROPERTY LOAN IN SINGAPORE?

As for the Foreigner Loans, in Singapore, there is an exact amount of money you can borrow to finance the purchase of a property.

In this sense, Singapore has the Loan to Value Ratio (LTV).

The LTV ratio is what determines the exact amount of money you can borrow for a property loan, which changes depending on where you try to obtain the loan:

- If you are applying for a bank loan, you can borrow a maximum of 75% of the value of the property you want to purchase. That means if you are looking for a property that costs $500.000, the maximum amount of money a bank lender can give you like a loan in Singapore is going to be $375.000.

- When you are applying for a loan with a Housing…

Don't Miss

CoinField Launches Sologenic Initial Exchange Offering

CoinField has started its Sologenic IEO, which is the first project to utilize the XRP Ledger for tokenizing stocks and ETFs. The sale will last for one week and will officially end on February 25, 2020, before SOLO trading begins on the platform. Sologenic’s native token SOLO is being offered at 0.25 USDT during the IEO.

Earlier this month, Sologenic released the very first decentralized wallet app for SOLO, XRP, and tokenized assets to support the Sologenic ecosystem. The app is available for mobile and desktop via the Apple Store and Google Play. The desktop version is available for Windows and Mac.

“By connecting the traditional financial markets with crypto, Sologenic will bring a significant volume to the crypto markets. The role of the Sologenic ecosystem is to facilitate the trading of a wide range of asset classes such as stocks, ETFs, and precious metals using blockchain technology. Sologenic is an ecosystem where users can tokenize, trade, and spend these digital assets using SOLO cards in real-time. The ultimate goal is to make Sologenic as decentralized as possible, where CoinField’s role will be only limited to KYC and fiat ON & OFF ramping,” said CoinField’s CEO…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange