Don't Miss

Recap: Founder of Tron (TRX)’s acquired BitTorrent creating finer Bitcoin

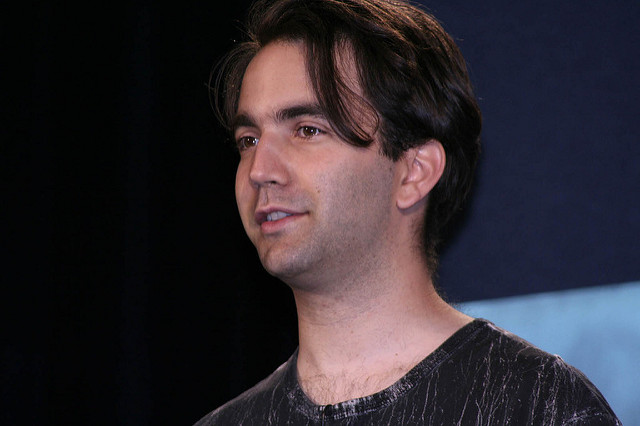

The founder of the peer-to-peer file sharing service provider that was sold to Tron (TRX) recently, BitTorrent, Bram Cohen is attached to an up and coming cryptocurrency by the name Chia.

The rumored-crypto is taunted to overthrow Bitcoin as the preferred virtual currency in the crypto market. Unlike Bitcoin, Chia does not necessitate massive amounts of power and electricity and has managed to raise more than 3 million US dollars so far without the assistance of an initial coin offering or ICO.

The funds are intended to be used in assisting the startup to develop its blockchain and digital currency that is powered by Proof of Capacity (also referred to as Proof of Space) and Proof of Time protocols.

Most blockchain technologies have Proof of Work in place of Chia’s Proof of Time. According to reports from reliable sources in BitTorrent, the management plans to launch this much-awaited product in Q1 2019.

According to one of the Chia spokespersons,

“This might be the first fully compliant public offering for a crypto company.”

Cohen is quoted as saying:

“The idea behind the Chia network is to make a better Bitcoin and to fix the centralization issues that have been in existence.”

Currently, as per the rough estimate, a transaction done using Bitcoin’s network wastes as much power as it takes to electrify an American household for one week.

BitTorrent creator and legendary coder Bram Cohen sees this as an opportunity. The two key issues Bram sees in Bitcoin’s process is the environmental impact it has and the unreliability that ascends from the few Bitcoin miners that exist with the inexpensive access to power employing outsized influence.

Brief History of BitTorrent

BitTorrent is a P2P file sharing protocol and program that has managed to use the internet to revolutionize the entertainment industry. In 2001, Bram Cohen co-founded the world largest file-sharing network and company BitTorrent Inc which owns BitTorrent software and uTorrent. And then, as we all know, the p2p firm was sold to one of the most promising crypto companies, Tron Foundation, a few months ago.

Born in 1975 in a Jewish household in New York, Bram spent his early years in Manhattan’s Upper West Side, where he acquired basic computer coding skills from his father at the age of six.

Fast forward in 2001, Bram who was working at the time at MojoNation, a thriving dot.com company, quit his job to start working on BitTorrent. His first coding of BitTorrent’s client implementation framework was in Python language, and the peer-to-peer file sharing company quickly gained popularity for its ability to share and host large movie and music files through the internet.

Chia Network

The Chia Platform is an American company based in San Francisco which seeks to improve the infrastructure of digital money. As a company, Chia is in the process of designing a blockchain platform that is based on proofs of time and space in line with its mission to make virtual money more decentralized, more secure, and more eco-friendly.

According to information from Chia network, the platform aims to create a functional and eco-friendly alternative to Bitcoin and at present, is hosting a competition that seeks to advance Chia’s VDF also known as verifiable delay function that will assist facilitate new dawn of Bitcoin’s decentralized consensus.

Unlike Bitcoin’s and Ethereum’s mining procedure that relies on the proofs of work that consume a lot of power and leave the mining procedure be quite centralized, Chia’s “mining or farming” procedure will rely on proof of time and space in building and verifying blockchains that issue virtual currencies.

Participants taking part in the 3-month contest are tasked to develop implementations of Chia’s verifiable delay function (VDF) algorithm that was released this week. The intention behind the competition is to set benchmarks for the network’s security as well as its algorithm. The winner is positioned to go home with USD 100,000 worth of Bitcoin.

Bram is throwing some nice money into blockchain out of what he got by selling BitTorrent to Tron; everyone should be happy. Maybe few might not be that pleased with Cohen’s decision of utilizing the money he made from Tron CEO to come and compete with them, and on top, with an intent to create an even better cryptocurrency than the market king, Bitcoin. What this the reason why he left BitTorrent quickly right after its acquisition by Tron? What do you think?

For the global insights every crypto trader must have, apply for Elite membership!

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Image courtesy of Flickr

Don't Miss

A Guide to Exploring the Singaporean ETF market

Singapore’s Exchange Traded Fund (ETF) market has grown, offering investors diverse investment opportunities and access to different asset classes. As the market evolves, investors must navigate these uncharted waters with a clear understanding of Singapore’s ETF landscape. This article explores the trends, challenges and strategies for navigating the Singapore ETF market. To start investing in ETFs, you can visit Saxo Capital Markets PTE.

The Singaporean ETF Market: Exponential Growth

The Singapore ETF market has seen significant growth in recent years, with an increasing number of ETFs covering a wide range of asset classes and holders. different investment topics.

One of the notable trends in the Singapore ETF market is the growing diversity of available options. Investors can now choose from ETFs that track domestic and international stock indexes, bonds, commodities, and specialist sectors or themes. This diverse range of ETFs allows investors to create comprehensive portfolios tailored to their investment goals.

The growth of the ETF market in Singapore is also due to growing investor demand for low-cost, transparent, and accessible investment vehicles. ETFs offer benefits such as intraday liquidity, real-time pricing, and the ability to trade on exchanges. These characteristics have made ETFs attractive to retail and institutional investors who want exposure to different asset classes.

Regulatory Landscape and Investor Protection

The Monetary Authority of Singapore (MAS) is the…

Don't Miss

Property Loans for Foreigners in Singapore That You Must Know About

Intending to invest in a residential or commercial property in Singapore?

When it comes to foreigners applying for a loan in Singapore, things can be pretty hard regardless of the reason whether you need the property for personal or business purposes.

In Singapore, buying a property is challenging, whether you are a foreigner or a native, and sometimes applying for a loan is the only way for you to afford it.

HOW MUCH CAN YOU BORROW FOR A PROPERTY LOAN IN SINGAPORE?

As for the Foreigner Loans, in Singapore, there is an exact amount of money you can borrow to finance the purchase of a property.

In this sense, Singapore has the Loan to Value Ratio (LTV).

The LTV ratio is what determines the exact amount of money you can borrow for a property loan, which changes depending on where you try to obtain the loan:

- If you are applying for a bank loan, you can borrow a maximum of 75% of the value of the property you want to purchase. That means if you are looking for a property that costs $500.000, the maximum amount of money a bank lender can give you like a loan in Singapore is going to be $375.000.

- When you are applying for a loan with a Housing…

Don't Miss

CoinField Launches Sologenic Initial Exchange Offering

CoinField has started its Sologenic IEO, which is the first project to utilize the XRP Ledger for tokenizing stocks and ETFs. The sale will last for one week and will officially end on February 25, 2020, before SOLO trading begins on the platform. Sologenic’s native token SOLO is being offered at 0.25 USDT during the IEO.

Earlier this month, Sologenic released the very first decentralized wallet app for SOLO, XRP, and tokenized assets to support the Sologenic ecosystem. The app is available for mobile and desktop via the Apple Store and Google Play. The desktop version is available for Windows and Mac.

“By connecting the traditional financial markets with crypto, Sologenic will bring a significant volume to the crypto markets. The role of the Sologenic ecosystem is to facilitate the trading of a wide range of asset classes such as stocks, ETFs, and precious metals using blockchain technology. Sologenic is an ecosystem where users can tokenize, trade, and spend these digital assets using SOLO cards in real-time. The ultimate goal is to make Sologenic as decentralized as possible, where CoinField’s role will be only limited to KYC and fiat ON & OFF ramping,” said CoinField’s CEO…

-

Blogs7 years ago

Blogs7 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs7 years ago

Blogs7 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs7 years ago

Blogs7 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs7 years ago

Blogs7 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss7 years ago

Don't Miss7 years agoRipple’s five new partnerships are mouthwatering

-

Blogs7 years ago

Blogs7 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs7 years ago

Blogs7 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs7 years ago

Blogs7 years agoIs Litecoin (LTC) Changing Its Game Plan By Going For Mass Adoption?