Don't Miss

Tron (TRX) network set to release its second game Coin War

Most blockchain projects and cryptocurrencies are making several developments behind the scenes. Tron is on the move and at the moment hardly a day or two passes without an announcement that the TRX enthusiasts can lick their lips about. Perhaps, all the steps by Tron are only to make the coin stronger and even the best among its competitors.

New Game on the Cards

After launching their first game, Magic Academy, earlier this month, we’re now about to see a new game on Tron. Coin war is about to get launched on the Tron entertainment system. The new game by the FCC team is all about the financial prediction scenario.

The first game Magic Academy has redefined the manner in which players interact with other players, their games, and game’s developers. Players buy, sell, or trade any game they wish with freedom. The new game, Coin War, serves a useful purpose too, let’s discover what’s that right below.

What Tron Enthusiasts Should Expect

Undoubtedly, Tron has entered the world of blockchain gaming, and players now have every reason to smile day after another. Coin war that is about to be launched will help predict the price changes in the mainstream cryptocurrencies as well as the future trends in major global stock market indexes for a certain period.

Basically, it makes the rigorous predication entertaining as it will be easier to accomplish even the most stringent things in entertainment and make the prediction behavior valuable. Getting the most critical encouragement in any game is essential to moving forward, and hence, that is precisely what Coin War has in store.

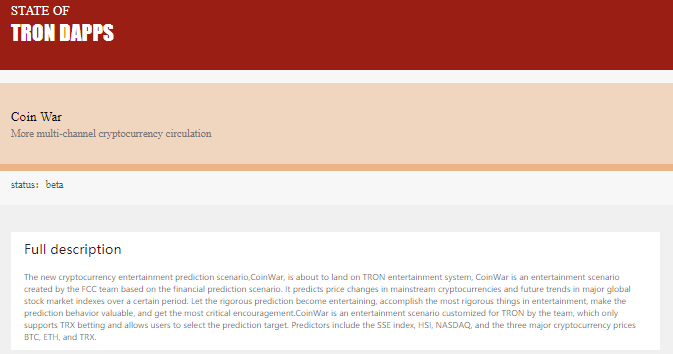

The screenshot of Coin War DApp listed on Tron DApps directory. | Source: tron.app

FCC team has customized this entertainment scenario for Tron that it supports only TRX betting and will allow the users to select the prediction target easily. The predictors here include the SSE index, NASDAQ, HIS, as well as three major cryptocurrency prices ETH, BTC, and TRX. We think at least a couple other cryptocurrencies like Ripple’s XRP and Litecoin might get added to it after the game make it to the public (it’s in beta as of now).

Will Coin War be huge for Tron (TRX)?

The gaming industry is without denial a multi-billion industry which is slowly but steadily getting disrupted by the blockchain technology. The DApps. At the forefront of this disruption is Tron with all technical capabilities which allow it for development of even more complex online games in a decentralized environment.

With the rate at which Tron is making developments, it may be just a matter of time before it overtakes the competitors. Massive usage of Tron (TRX) can only be predicted, and perhaps that may drive up the value of Tron. However, for now, we wait for the launch of Coin War and watch other news as they unfold.

For real-time trade alerts and a daily breakdown of the crypto markets, sign up for Elite membership!

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Image courtesy of Myriams-Fotos/Pixabay

Don't Miss

A Guide to Exploring the Singaporean ETF market

Singapore’s Exchange Traded Fund (ETF) market has grown, offering investors diverse investment opportunities and access to different asset classes. As the market evolves, investors must navigate these uncharted waters with a clear understanding of Singapore’s ETF landscape. This article explores the trends, challenges and strategies for navigating the Singapore ETF market. To start investing in ETFs, you can visit Saxo Capital Markets PTE.

The Singaporean ETF Market: Exponential Growth

The Singapore ETF market has seen significant growth in recent years, with an increasing number of ETFs covering a wide range of asset classes and holders. different investment topics.

One of the notable trends in the Singapore ETF market is the growing diversity of available options. Investors can now choose from ETFs that track domestic and international stock indexes, bonds, commodities, and specialist sectors or themes. This diverse range of ETFs allows investors to create comprehensive portfolios tailored to their investment goals.

The growth of the ETF market in Singapore is also due to growing investor demand for low-cost, transparent, and accessible investment vehicles. ETFs offer benefits such as intraday liquidity, real-time pricing, and the ability to trade on exchanges. These characteristics have made ETFs attractive to retail and institutional investors who want exposure to different asset classes.

Regulatory Landscape and Investor Protection

The Monetary Authority of Singapore (MAS) is the…

Don't Miss

Property Loans for Foreigners in Singapore That You Must Know About

Intending to invest in a residential or commercial property in Singapore?

When it comes to foreigners applying for a loan in Singapore, things can be pretty hard regardless of the reason whether you need the property for personal or business purposes.

In Singapore, buying a property is challenging, whether you are a foreigner or a native, and sometimes applying for a loan is the only way for you to afford it.

HOW MUCH CAN YOU BORROW FOR A PROPERTY LOAN IN SINGAPORE?

As for the Foreigner Loans, in Singapore, there is an exact amount of money you can borrow to finance the purchase of a property.

In this sense, Singapore has the Loan to Value Ratio (LTV).

The LTV ratio is what determines the exact amount of money you can borrow for a property loan, which changes depending on where you try to obtain the loan:

- If you are applying for a bank loan, you can borrow a maximum of 75% of the value of the property you want to purchase. That means if you are looking for a property that costs $500.000, the maximum amount of money a bank lender can give you like a loan in Singapore is going to be $375.000.

- When you are applying for a loan with a Housing…

Don't Miss

CoinField Launches Sologenic Initial Exchange Offering

CoinField has started its Sologenic IEO, which is the first project to utilize the XRP Ledger for tokenizing stocks and ETFs. The sale will last for one week and will officially end on February 25, 2020, before SOLO trading begins on the platform. Sologenic’s native token SOLO is being offered at 0.25 USDT during the IEO.

Earlier this month, Sologenic released the very first decentralized wallet app for SOLO, XRP, and tokenized assets to support the Sologenic ecosystem. The app is available for mobile and desktop via the Apple Store and Google Play. The desktop version is available for Windows and Mac.

“By connecting the traditional financial markets with crypto, Sologenic will bring a significant volume to the crypto markets. The role of the Sologenic ecosystem is to facilitate the trading of a wide range of asset classes such as stocks, ETFs, and precious metals using blockchain technology. Sologenic is an ecosystem where users can tokenize, trade, and spend these digital assets using SOLO cards in real-time. The ultimate goal is to make Sologenic as decentralized as possible, where CoinField’s role will be only limited to KYC and fiat ON & OFF ramping,” said CoinField’s CEO…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange