Don't Miss

Bexplus Trader Expert Sharing: Which Investment in Bitcoin can Make Profits?

At this time last year, Bitcoin was reaching its all-time high price. However, the whole year past, its price declined by 80% since then. BTC speculators or investors don’t seem to be getting tired of its “disruptive” price falling. And a lot of people that missed out on the late 2017 and early 2018 price hike, jump in the crypto world, expecting to make quite a fortune when it hits its former levels. But the story just goes the opposite way. So is it possible to profit from BTC investment? In the following part, we will explore 3 types of profitable BTC investment.

Measure 3 Common Types of BTC Investment

- Invest in BTC Spot and Wait for Appreciation

Bitcoin spot trade might be the first transaction type that most investors will opt for when they just entered the cryptocurrency area. Investors can directly buy BTC with fiat currencies. The only way to earn money with BTC spot is waiting for its price rising. Unless you are a BTC believer and willing to wait for its appreciation in several years, you should turn to another type of investment.

- Exchange BTC to USDT and Earn the Spread

USDT is the cryptocurrency version of US dollar and also considered as a stable cryptocurrency. Generally speaking, when the BTC, as well as other cryptocurrencies, drop, USDT may perform the opposite way and rises a little. Therefore, when the BTC market is going to get down, investors will exchange BTC to USDT to earn the spread.

- Make Two-way Profits with BTC Futures Contracts

Different from the former two types of investment, BTC futures trading enables investors to make a profit from both BTC price up and down. What you should do is to predict the BTC trend will be upward or downward in the near future. Besides, it provides X times leverage, which means even though you actually hold a small amount of BTC, you can also open a larger position. No matter at which price you start the investing, as long as you choose the right direction, you can have a chance to make great profits.

Which Investment in Bitcoin is Profitable Based on the Current Trend?

Since BTC keeps a repeated and slight falling without any big break out, it’s obvious to notice that the former two investment are not smart options. But with BTC futures trading, as long as there is price fluctuation, there is an opportunity to profit from it.

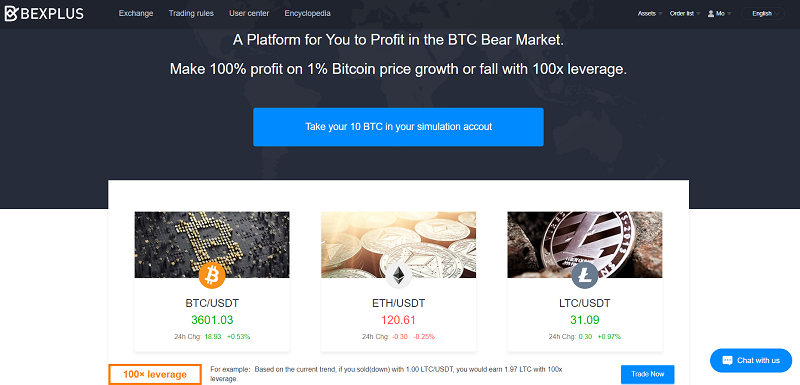

Bexplus is a popular cryptocurrency futures exchange which provides Bitcoin, Ethereum and Litecoin perpetual contract with 100x leverage. Established in late 2017, Bexplus has completed tens of millions of US dollar fundraising and financing, which guarantees the solid foundation as well as long-term development of Bexplus exchange platform. It also supports 15 languages and covers 26 countries and regions worldwide.

BTC, ETH and LTC perpetual contract which means you can open or close an order anytime you want. You can decide to long (assuming price up) or short (assuming price down) BTC, ETH or LTC based on your own analysis. For example, with 100x leverage added, you can use 1 BTC to enter a 100 BTC trade. If the price goes up or down 1%, you can get 100% profit. Furthermore, you can set stop-profit and stop-loss to control the risks.

Whether Bitcoin will take off in 2019 or not, you can choose to invest BTC futures contract and get profits. If you haven’t yet traded futures before, you can try it in the trading simulator in Bexplus.

Deposit Activity to Earn 50% BTC Free Bonus

To deposit BTC in the Bexplus account, you can earn 50% BTC bonus, which can also be used to trade futures contract and withdrawn. The more deposit, the more bonus you will get!

More: https://www.bexplus.com/en/cash_back

Invite Friends to Join and Earn 30% Commission

Invite friends to register and trade in Bexplus, you can share 30% transaction fee of your invitees as commission. Also, both you and our invitees can enjoy 10% OFF service charge.

More: https://www.bexplus.com/en/account/activity_show

Register with invitation code PCDfB to enjoy 10% OFF charge fee.

Follow Bexplus on:

Website: www.bexplus.com

Facebook: https://www.facebook.com/Bexplusglobal/

Telegram: https://t.me/bexplusexchange

For Business cooperation: [email protected]

Don't Miss

A Guide to Exploring the Singaporean ETF market

Singapore’s Exchange Traded Fund (ETF) market has grown, offering investors diverse investment opportunities and access to different asset classes. As the market evolves, investors must navigate these uncharted waters with a clear understanding of Singapore’s ETF landscape. This article explores the trends, challenges and strategies for navigating the Singapore ETF market. To start investing in ETFs, you can visit Saxo Capital Markets PTE.

The Singaporean ETF Market: Exponential Growth

The Singapore ETF market has seen significant growth in recent years, with an increasing number of ETFs covering a wide range of asset classes and holders. different investment topics.

One of the notable trends in the Singapore ETF market is the growing diversity of available options. Investors can now choose from ETFs that track domestic and international stock indexes, bonds, commodities, and specialist sectors or themes. This diverse range of ETFs allows investors to create comprehensive portfolios tailored to their investment goals.

The growth of the ETF market in Singapore is also due to growing investor demand for low-cost, transparent, and accessible investment vehicles. ETFs offer benefits such as intraday liquidity, real-time pricing, and the ability to trade on exchanges. These characteristics have made ETFs attractive to retail and institutional investors who want exposure to different asset classes.

Regulatory Landscape and Investor Protection

The Monetary Authority of Singapore (MAS) is the…

Don't Miss

Property Loans for Foreigners in Singapore That You Must Know About

Intending to invest in a residential or commercial property in Singapore?

When it comes to foreigners applying for a loan in Singapore, things can be pretty hard regardless of the reason whether you need the property for personal or business purposes.

In Singapore, buying a property is challenging, whether you are a foreigner or a native, and sometimes applying for a loan is the only way for you to afford it.

HOW MUCH CAN YOU BORROW FOR A PROPERTY LOAN IN SINGAPORE?

As for the Foreigner Loans, in Singapore, there is an exact amount of money you can borrow to finance the purchase of a property.

In this sense, Singapore has the Loan to Value Ratio (LTV).

The LTV ratio is what determines the exact amount of money you can borrow for a property loan, which changes depending on where you try to obtain the loan:

- If you are applying for a bank loan, you can borrow a maximum of 75% of the value of the property you want to purchase. That means if you are looking for a property that costs $500.000, the maximum amount of money a bank lender can give you like a loan in Singapore is going to be $375.000.

- When you are applying for a loan with a Housing…

Don't Miss

CoinField Launches Sologenic Initial Exchange Offering

CoinField has started its Sologenic IEO, which is the first project to utilize the XRP Ledger for tokenizing stocks and ETFs. The sale will last for one week and will officially end on February 25, 2020, before SOLO trading begins on the platform. Sologenic’s native token SOLO is being offered at 0.25 USDT during the IEO.

Earlier this month, Sologenic released the very first decentralized wallet app for SOLO, XRP, and tokenized assets to support the Sologenic ecosystem. The app is available for mobile and desktop via the Apple Store and Google Play. The desktop version is available for Windows and Mac.

“By connecting the traditional financial markets with crypto, Sologenic will bring a significant volume to the crypto markets. The role of the Sologenic ecosystem is to facilitate the trading of a wide range of asset classes such as stocks, ETFs, and precious metals using blockchain technology. Sologenic is an ecosystem where users can tokenize, trade, and spend these digital assets using SOLO cards in real-time. The ultimate goal is to make Sologenic as decentralized as possible, where CoinField’s role will be only limited to KYC and fiat ON & OFF ramping,” said CoinField’s CEO…

-

Blogs6 years ago

Blogs6 years agoBitcoin Cash (BCH) and Ripple (XRP) Headed to Expansion with Revolut

-

Blogs6 years ago

Blogs6 years agoAnother Bank Joins Ripple! The first ever bank in Oman to be a part of RippleNet

-

Blogs6 years ago

Blogs6 years agoStandard Chartered Plans on Extending the Use of Ripple (XRP) Network

-

Blogs6 years ago

Blogs6 years agoElectroneum (ETN) New Mining App Set For Mass Adoption

-

Don't Miss6 years ago

Don't Miss6 years agoRipple’s five new partnerships are mouthwatering

-

Blogs6 years ago

Blogs6 years agoCryptocurrency is paving new avenues for content creators to explore

-

Blogs6 years ago

Blogs6 years agoEthereum Classic (ETC) Is Aiming To Align With Ethereum (ETH)

-

Blogs6 years ago

Blogs6 years agoLitecoin (LTC) Becomes Compatible with Blocknet while Getting Listed on Gemini Exchange